- Home

- »

- Advanced Interior Materials

- »

-

U.S. Steel Rebar Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Steel Rebar Market Size, Share & Trends Report]()

U.S. Steel Rebar Market Size, Share & Trends Analysis Report By Application (Construction, Infrastructure, Industrial), By Region (Northeast, Midwest, West), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-720-4

- Number of Pages: 65

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

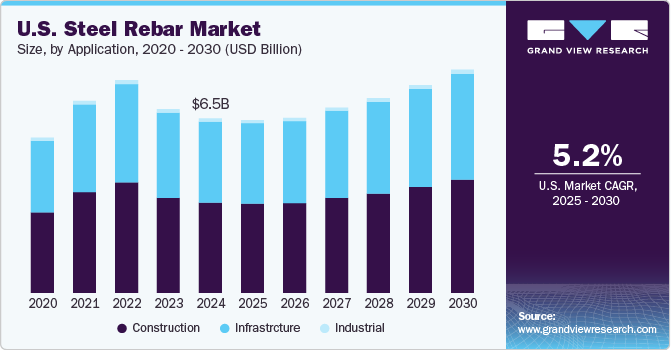

The U.S. steel rebar market size was valued at USD 5.75 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2022 to 2030. The market growth is anticipated to be driven by the increasing investments in residential development projects across the U.S. Increasing demand for affordable houses has pushed state and local governments to invest in affordable housing in the country. For instance, in May 2022, Colorado announced it would invest USD 150 million in housing development. The investment is expected to support the construction of new houses, condos, and apartments, thus, aiding market growth over the coming years.

The expansion of the construction industry in the U.S. is expected to positively influence steel rebar demand. For instance, according to the U.S. Census Bureau, total construction spending amounted to USD 1,626.44 billion in 2021, which was up by 8.5% from 2020. The growth is slightly stagnant as of the first five months of 2022.

Also, aging infrastructure has forced the government to invest in the modernization of the existing infrastructure. For instance, in November 2021, the U.S. president signed USD 1.2 trillion Infrastructure Investment and Jobs Act. The act focuses on rebuilding the country by investing in infrastructures such as bridges, roads, airports, communication, and water supply.

Increasing demand from the construction and infrastructure industries has forced manufacturers to expand their manufacturing capacity. For instance, in April 2022, Nucor Corporation announced they would invest USD 350 million in the construction of a new rebar mill in North Carolina. The plant is expected to have an annual production capacity of 430,000 tons and is expected to begin by 2024.

The availability of substitutes such as glass fiber reinforced polymer, plastic fiber, and stainless steel concrete reinforcements is a key market restraint for the steel rebar industry. However, the product is the first choice for new construction owing to its lower cost as compared to its counterparts.

Application Insights

Construction held the largest revenue share of over 51.0% of the market in 2021. Expanding investments in residential and commercial buildings are projected to fuel market growth in the country during the forecast period. For instance, in March 2022, new home construction increased by 22% as compared to March 2021.

The infrastructure segment is anticipated to register the fastest growth rate of 5.8% in terms of revenue across the forecast period. Rising investments by state governments toward infrastructural developments are expected to boost the consumption of steel rebars. For instance, in March 2022, the Michigan governor signed USD 4.7 billion for infrastructure development. The investment is anticipated to help the state with fixing bridges, roads, dams, and water supply.

Industrial is another vital application segment of the market. The product is used in the construction of industrial facilities such as processing plants, mining structures, factories, warehouses, and others. Rising investment in the construction of new industrial facilities is expected to propel the demand for rebar in the country over the coming years.

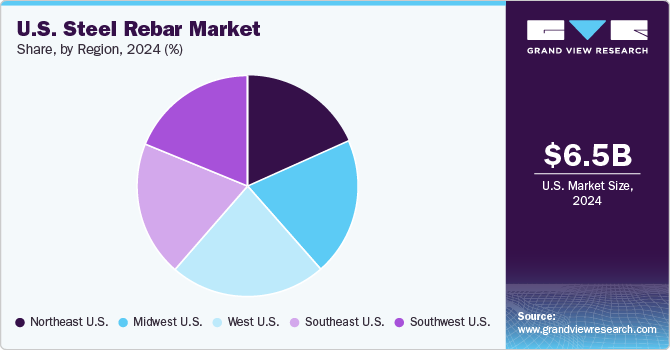

Regional Insights

The western U.S. accounted for more than 23% of the revenue share in 2021. The increasing demand for residential buildings is driving the market growth in the West region. For instance, according to state authorities, in June 2021, new housing permits issued in California were 9,676 units, which was up by 5% as compared to the previous year.

The Northeast U.S. is likely to expand by 6.1% in terms of revenue across the forecast period. The demand is being driven by the new infrastructure investment in the region. In February 2022, Massachusetts' Governor announced that USD 1 billion would be invested over five years to construct and renovate bridges.

The Midwest is one of the key regions of the market. Increasing investment in the industrial segment is expected to drive the demand for rebar in the region. For instance, in March 2022, Stellantis announced they would invest USD 2.5 billion in a new electric vehicle plant in Indiana in partnership with Samsung SDI.

Key Companies & Market Share Insights

The increase in steel rebar demand in the U.S. is driving key manufacturers to adopt merger and acquisition strategies. For instance, in January 2022, Knight’s Companies acquired Sovereign Steel, a rebar fabricator. This acquisition is expected to assist the former in diversifying its portfolio and participating in the company's upcoming infrastructure projects. Some of the prominent players in the U.S. steel rebar market include:

-

Acerinox S.A

-

ArcelorMittal

-

CMC Steel

-

EVRAZ U.S., Inc

-

Gerdau S.A

-

Liberty Steel USA

-

Nucor

-

OutoKumpu

-

Schnitzer Steel Industries, Inc

-

Steel Dynamics, Inc

U.S. Steel Rebar Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.07 billion

Revenue forecast in 2030

USD 9.28 billion

Growth Rate

CAGR of 5.5% from 2022 to 2030

Market size volume in 2022

7,496.0 kilotons

Volume forecast in 2030

10,182.8 kilotons

Growth Rate

CAGR of 3.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

Northeast, Midwest, West, Southeast, Southwest

Country scope

U.S.

Key companies profiled

Gerdau S.A, CMC Steel, Steel Dynamics, Inc., Schnitzer Steel Industries, Inc., Acerinox S.A, OutoKumpu, Liberty Steel USA

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. Steel Rebar Market Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global U.S. steel rebar market report based on application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

U.S.

-

Northeast

-

Midwest

-

West

-

Southeast

-

Southwest

-

-

Frequently Asked Questions About This Report

b. The U.S. steel rebar market was estimated at USD 5.75 billion in 2021 and is expected to reach USD 6.07 billion in 2022.

b. The U.S. steel rebar market is expected to grow at a compound annual growth rate of 5.5% from 2022 to 2030 to reach USD 9.28 billion by 2030.

b. Construction was the key application segment of the market with a revenue share of above 51% of the market in 2021.

b. Some of the key players operating in the U.S. steel rebar market are Gerdau S.A, CMC Steel, Steel Dynamics, Inc., Acerinox S.A, Outokumpu, and among others.

b. Growing investment in residential and commercial building construction is the key growth driver for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."