- Home

- »

- Medical Devices

- »

-

U.S. Sterilization Services Market Size & Share Report, 2025GVR Report cover

![U.S. Sterilization Services Market Report]()

U.S. Sterilization Services Market Analysis Report By Technique (Steam, E-beam & Gamma Radiation, EtO), By Type, By Delivery Mode (Onsite, Offsite), By End Use, And Segment Forecasts 2018 - 2025

- Report ID: GVR-2-68038-560-1

- Number of Pages: 65

- Format: Electronic (PDF)

- Historical Range: 2012 - 2015

- Industry: Healthcare

Report Overview

The U.S. sterilization services market size to be valued at USD 2.72 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2018 to 2025. The rise in prevalence of chronic diseases and various initiatives taken by the government to ensure the adoption of essential sterilization standards in hospitals and research centers is expected to drive the market over the forecast period. Currently, stringent medical safety and infection control norms are increasing public awareness, resulting in shorter hospital stays and reduced healthcare costs.

With the increasing demand for food supply and the introduction of exotic fruits and vegetables, stricter norms have been introduced to ensure the safety and quality of such products. Techniques such as low-temperature and gamma irradiation are used for sterilization processes in the food industry, which is slated to spur market growth.

The U.S. government has been focusing on reducing healthcare costs and this is expected to encourage the FDA to make approval procedures of generic pharmaceuticals speedier and easier. Faster approvals mean a greater need for new sterility testing methods, compelling innovative market players to spend more on similar solutions, thereby driving the market. With the growing demand for drugs, companies are launching newer drugs with better efficacy and different routes of administration, dosage, or for a new indication. These launches require thorough sterility testing and this is anticipated to boost the market.

Regional and service portfolio expansions and mergers and acquisitions are key strategic undertakings adopted by key players in the industry. In November 2015, Steris acquired Synergy Health, marking a significant milestone in its business activities. The expansion was intended to achieve enhanced customer satisfaction and expand its customer base. In April 2014, Steris announced its intent to acquire Integrated Medical Systems for USD 165 million. It was to pay an additional USD 10 million for real estate. The acquisition was expected to confer tax benefits to the company.

U.S. Sterilization Services Market Trends

The growing demand for sterilization services from hospitals, the pharmaceutical industry, and medical equipment makers is one of the key drivers for the market's expansion.Furthermore, the increased emphasis on infection prevention in the food business, as well as the rapid development in surgical procedures, are driving the market growth.

The significant rise of the sterilization industry globally is expected to be accelerated by the considerable increase in medical equipment and the rapidly expanding demand for electronic-beam sterilization.

Global sterilization services have benefited from technological breakthroughs that have improved the dependability, effectiveness, and monitoring and evaluation abilities of different sterilization devices.The usage of innovative materials and technologies has sparked the creation of new sterilizing processes, which act as an opportunity for all the market players to expand.

However, the key component used for sterilization is ethylene oxide which has many side-effects and is anticipated to limit the expansion of the market. The numerous challenges and complications associated with the sterilization of modern medical tools may also pose a hindrance to the growth of the sterilizing services industry. But,plasma sterilization has developed as an effective sterilization approach instead of outdated techniques.

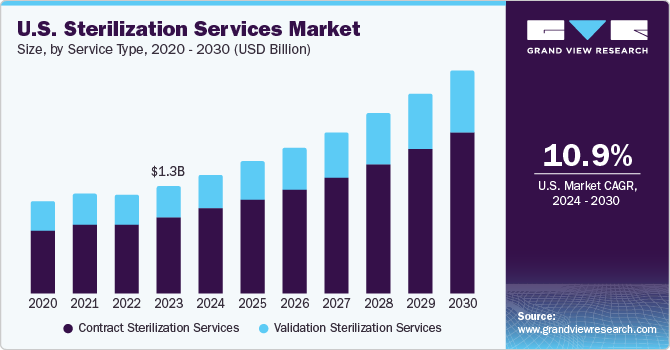

Type Insights

Based on type, the market is segmented into contract and validation services. The contract segment captured the largest market share in 2017 and is expected to continue its dominance through the forecast period. Contract services include in-house and off-site sterilization of medical devices, pharmaceuticals, and packaged units. Most of the in-house sterilization in hospitals is executed in the sterile processing department. Contract services are preferred by hospitals and manufacturers as they significantly reduce cost and resource burden and allow them to focus on their core activities.

Validation services require significant investments in terms of consumables. The presence of a large number of market players is expected to hurt the prices of these services as it reduces profit margins. However, validation of sterilization is a mandatory step in every healthcare center, which is expected to offset the adverse impact of the restraint.

Technique Insights

An increasing number of surgical procedures and rising geriatric population have driven the adoption of a variety of sterilization services. Market players have been making significant investments in research and development of novel techniques. Heat sterilization is the most widely used and reliable method of sterilization. It works best when used in a hydrated form rather than a dry state. Low-temperature sterilization technique is compatible with most delicate medical equipment and is extremely easy to control and monitor.

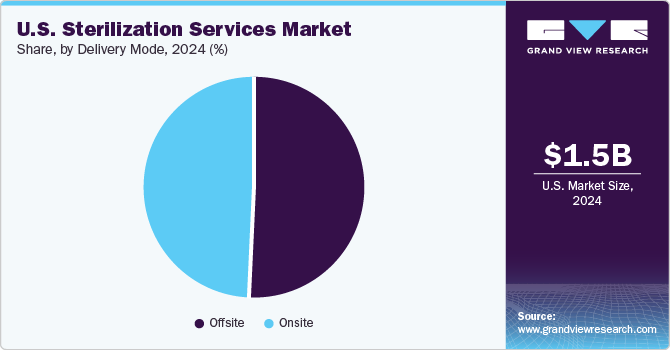

Delivery Mode Insights

Based on delivery mode, the market is segmented into off-site and on-site. The off-site segment is expected to witness the fastest growth rate during the forecast period. An increasing number of service providers and the rising trend of outsourcing sterilization services are factors anticipated to fuel segment growth.

On-site sterilization services require significant space, equipment, and manpower and so these departments are best for manufacturers with high output. Currently, heat and EtO are widely-used techniques in on-site settings. However, most novel materials used in medical devices are prone to deterioration by heat, limiting the use of such techniques in these settings.

End-use Insights

By end-use, the market is segmented into hospitals, pharmaceuticals, medical device companies, clinical laboratories/research centers, and others, which includes food and beverage companies. The hospital segment dominated the U.S. sterilization services market in 2016 and is expected to retain its position throughout the forecast period.

Increasing prevalence of hospital-acquired infections, the surge in the number of surgical procedures performed, and constantly expanding patient pool are prime factors driving this segment.

Key Companies & Market Share Insights

Currently, the global industry is consolidated in nature with only a few top companies capturing the major share. Some of the leading players are STERIS Corporation; Getinge Group; and Advanced Sterilization Products Services, Inc. Other prominent companies include 3M, Belimed, Cantel Medical, MATACHANA GROUP, Sterigenics International LLC, and TSO3.

Recent Developments

-

In March 2023, Getinge acquired Ultra Clean Systems Inc., a leading US manufacturer of ultrasonic cleaning technologies used in hospitals and surgery centers to decontaminate surgical instruments.

-

In February 2021, TERIS plc announced the completion of the previously disclosed purchase of Cantel Medical, a leading supplier of infection-control products and services to customers in the endoscope, oral, dialysis, and biomedical sectors. The acquisition will expand and complement STERIS' product offerings, international presence, and customer base.

U.S. Sterilization Services Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.1 billion

Revenue forecast in 2025

USD 2.7 billion

Growth rate

CAGR of 5.1% from 2017 to 2025

Base year for estimation

2016

Historical data

2012 - 2015

Forecast period

2017 - 2025

Quantitative units

Revenue in USD million and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Type, technique, delivery mode, end-use

Country scope

U.S.

Key companies profiled

Steris PLC; 3M; Advanced Sterilization Products Services; Cantel; J&J; Stryker; E-beam; Cretex; Sotera Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sterilization Services Market SegmentationThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2012 to 2025. For this study, Grand View Research has segmented the U.S. sterilization services market report based on type, technique, delivery mode, and end use:

-

Technique Outlook (Revenue, USD Million, 2012 - 2025)

-

Steam

-

EtO

-

E-beam radiation

-

Gamma radiation

-

Others

-

-

Type Outlook (Revenue, USD Million, 2012 - 2025)

-

Contract services

-

Validation services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2012 - 2025)

-

Onsite

-

Offsite

-

-

End-use Outlook (Revenue, USD Million, 2012 - 2025)

-

Hospitals

-

Pharmaceutical companies

-

Medical device companies

-

Clinical laboratories

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."