- Home

- »

- Clinical Diagnostics

- »

-

U.S. Tissue Diagnostics Market Size Report, 2021-2028GVR Report cover

![U.S. Tissue Diagnostics Market Size, Share & Trends Report]()

U.S. Tissue Diagnostics Market Size, Share & Trends Analysis Report By Technology & Product (IHC, Primary & Special Staining), By Application (Breast Cancer, NSCLC), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-270-9

- Number of Pages: 157

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Healthcare

Report Overview

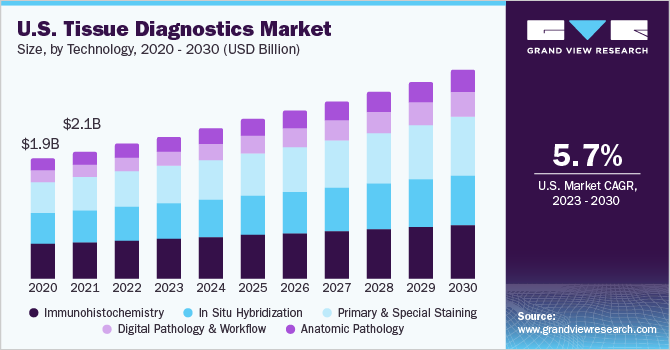

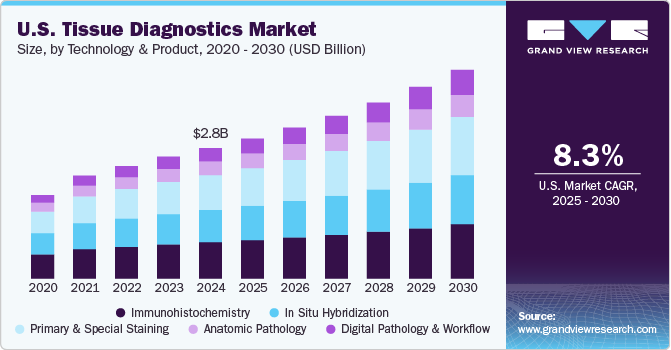

The U.S. tissue diagnostics market size was valued at USD 2.07 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 3.91% from 2021 to 2028. The market is collectively driven by emerging solutions pertaining to digital tissue diagnostics, advancements in imaging techniques & increasing affordability of diagnostics, and growth of personalized therapeutics & diagnostics. The use of digital slides has significantly increased in recent years, owing to its associated benefits including flexible magnification and remote access to slides. The growing emphasis on precision medicine is supported by several organizations & companies in the U.S., which is expected to contribute to the market growth. Moreover, the development in genome sequencing techniques and diagnostic tools can be attributed to the growth of personalized medicine over the years.

Companies are supporting the development of precision medicine with novel oncology solutions. For instance, in May 2020, QIAGEN launched new oncology solutions, such as the QCI Interpret One software solution for genomic profiling of tumors. The advancements in imaging techniques are expected to positively influence the market growth. According to Breastcancer.org, breast cancer is the most common type of cancer diagnosed among American women. In 2021, it is estimated that around 30% of the new cases of cancer in women would be breast cancers.

However, significant efforts are being made to curb the spread of the disease, which has emphasized the importance of innovation in the field of pathology. In addition, researchers are focusing on studying the morphological bases of the COVID-19 disease, which is expected to boost the market growth. For instance, in December 2020, researchers reported the occurrence of histological changes in frontal lobes and olfactory bulbs of the brain, which may be owing to COVID-19 related anosmia.

With technological improvements in imaging techniques, the sensitivity of detection and diagnosis of breast cancer has also improved. Technological expansion in breast tissue analysis includes procedures for evaluating gene expression, cellular biochemistry, and molecular biology using digital methods, tomosynthesis, CAD, and other methods. The global COVID-19 pandemic has affected several aspects in pathology laboratories, such as specimen workflow, biosafety protocols, laboratory staffing, laboratory finances, and resident training.

The specimens for histology were collected and processed by standard procedures involving embedding in paraffin, and later staining with hematoxylin and eosin. However, the presence of a non-value-based reimbursement policy and high costs associated with the usage of tissue diagnosis is anticipated to act as a restraint for the market. Several factors are contributing to the high cost of clinical research in the U.S. including administrative staff costs, clinical procedure costs, and site monitoring costs.

Technology & Product Insights

The Immunohistochemistry (IHC) segment dominated the market in 2020 accounting for a revenue share of 28.02%. The IHC technology is widely used for clinical research & development of cancer diagnostics and therapeutics; which is attributed to the high share of the segment. IHC is one of the most important tools/technologies used for examining tissues/specimens for early diagnosis of disease, prognosis, and prediction of therapy response in cancer patients.

It is widely preferred over traditional special enzyme staining methods as the conventional methods only identify a limited number of enzymes, tissue structures, and proteins. Whereas IHC tests are specific and helpful in highlighting the distinction between different types of cancer. It is considered the most profitable sub-segment under tissue diagnostics. Slide staining systems have been the key contributors to the revenue generated by the IHC segment.

A major trend is the adoption of automated systems for staining IHC samples. The use of automated staining systems avoids any errors that may occur during manual work. For instance, the MY-2300 Immuno-Histo Stainer developed by IHC World, LLC functions automatically and has stable, accurate, and reliable performance. As the system is easily operated, it enhances working efficiency and helps in handling multiple specimens simultaneously.

On the contrary, digital pathology and workflow are set to grow at a rapid pace during the forecast period due to the increasing adoption of digital pathology technologies in big as well as small laboratories. Digital software that is being developed by leading market participants is primarily used with scanners offered by the same company. The development of software that can be used with scanners from different companies is expected to propel the adoption of digital pathology technology in small-scale labs.

Application Insights

The breast cancer application segment accounted for the highest revenue share of over 49% in 2020. Tissue diagnostics are crucial in evaluating breast cancer in patients. The most commonly used tissue biopsy tests for breast cancer include fine-needle aspiration biopsy, core needle biopsy, and surgical biopsy. Companies have developed companion diagnostics to prevent the poor prognosis of breast cancer variants that have limited treatment options. For instance, in November 2020, the U.S. FDA approved Agilent Technologies, Inc.’s PD-L1 IHC 22C3 pharmDx that helps in the identification of triple-negative breast cancer in patients, which can be treated with KEYTRUDA (pembrolizumab).

Whereas tissue diagnostics is set to gain immense traction across gastric cancer and Non-Small Cell Lung Cancer (NSCLC) applications. The gastric cancer application segment is expected to grow at a CAGR of 4.03% from 2021 to 2028. Innovations in the detection of cancers in samples/specimens are expected to drive the segment growth. Biopsy techniques have gained immense traction in the diagnosis of stomach ulcers. Researchers & companies are focusing on developing companion diagnostic tests for the identification of gastric cancer.

For instance, in April 2020, VENTANA HER2 Dual ISH DNA Probe Cocktail assay was introduced by Roche, which helps detect the HER2 biomarker in gastric cancer and breast cancer. Hence, despite decreasing incidence & mortality rate due to gastric cancer, researchers & companies are engaging in identifying biomarkers for efficient diagnosis. In current clinical practices, tissue diagnostics is the gold standard for diagnosing NSCLC.

Negative results in liquid biopsy tests do not necessarily rule out the presence of an oncogenic alteration; hence, it is essential to carry out tissue-based analysis for further confirmation. In addition, companies operating in the market are engaged in developing specific tests and tools for the detection of NSCLC, which is expected to drive the market. For instance, in January 2020, QIAGEN N.V. and Amgen developed a tissue-based thera screen test for the identification of NSCLC patients with KRAS G12C mutation.

Key Companies & Market Share Insights

Industry participants are focusing on novel product development collaborations with other participants to sustain market competition and gain a competitive edge. For instance, in January 2021, F. Hoffmann-La Roche Ltd. launched the CE-IVD digital automated algorithms for pathology, uPath HER2 Dual ISH image analysis and uPath HER2 (4B5) image analysis for diagnosis of breast cancer. These algorithms facilitate the quick determination of whether the tumors are positive for HER2 biomarkers.

In August 2020, Thermo Fisher Scientific, Inc. signed an agreement with (HTI) Hengrui Therapeutics, Inc., a U.S. subsidiary of a Chinese pharmaceutical company, for developing a Companion Diagnostic (CDx) for identifying NSCLC by using Oncomine Precision Assay. The assay helps in the detection of around 50 cancer-related biomarkers from FFPE tumor tissues or liquid biopsy specimens. Some key participants operating in the U.S. tissue diagnostics market include:

-

Merck KGaA

-

Thermo Fisher Scientific, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Abbott Laboratories

-

Siemens Healthineers AG

-

Danaher

-

bioMérieux SA

-

QIAGEN

-

Becton, Dickinson & Company (BD)

-

Agilent Technologies, Inc.

-

General Electric Company (GE Healthcare)

-

BioGenex

-

Cell Signaling Technology, Inc.

-

Bio SB

-

DiaGenic ASA

-

Sakura Finetek Japan Co., Ltd.

-

Abcam plc

-

Enzo Life Sciences, Inc.

-

VITRO SA (Master Diagnóstica)

-

TissueGnostics GmbH

U.S. Tissue Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2,194.5 million

Revenue forecast in 2028

USD 2,815.4 million

Growth rate

CAGR of 3.91% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology & product, application

Country scope

U.S.

Key companies profiled

Merck KGaA; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Siemens Healthineers AG; Danaher; bioMérieux SA; QIAGEN; Becton, Dickinson & Company (BD); Agilent Technologies, Inc.; General Electric Company (GE Healthcare); BioGenex; Cell Signaling Technology, Inc.; Bio SB; DiaGenic ASA; Sakura Finetek Japan CO., LTD; Abcam plc; Enzo Life Sciences, Inc.; VITRO SA (Master Diagnóstica); TissueGnostics GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. tissue diagnostics market report on the basis of technology & product and application:

-

Technology & Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Immunohistochemistry

-

Instruments

-

Slide Staining Systems

-

Tissue Microarrays

-

Tissue Processing Systems

-

Slide Scanners

-

Other Products

-

-

Consumables

-

Reagents

-

Antibodies

-

Kits

-

-

-

In situ Hybridization

-

Instruments

-

Consumables

-

Software

-

-

Primary & Special Staining

-

H&E Staining

-

Special Staining

-

-

Digital Pathology & Workflow

-

Whole Slide Imaging

-

Image Analysis Informatics

-

Information Management System Storage & Communication

-

-

Anatomic Pathology

-

Instruments

-

Microtomes & Cryostat Microtomes

-

Tissue Processors

-

Automatic Strainers

-

Other Products

-

-

Consumables

-

Reagents & Antibodies

-

Probes & Kits

-

Others

-

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Breast Cancer

-

Non-Small Cell Lung Cancer (NSCLC)

-

Prostate Cancer

-

Gastric Cancer

-

Other Cancers

-

Frequently Asked Questions About This Report

b. The U.S. tissue diagnostics market size was estimated at USD 2,072.0 million in 2020 and is expected to reach USD 2,194.5 million in 2021.

b. The U.S. tissue diagnostics market is expected to grow at a compound annual growth rate of 3.91% from 2021 to 2028 to reach USD 2,815.4 million by 2028.

b. The Immunohistochemistry (IHC) segment dominated the U.S. tissue diagnostics market in 2020 accounting for a revenue share of 28.02%.

b. Some key players operating in the U.S. tissue diagnostics market include Merck KGaA; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Siemens Healthineers AG; Danaher; bioMérieux SA; QIAGEN; and Becton, Dickinson & Company (BD).

b. The U.S. tissue diagnostics market is driven by emerging solutions pertaining to digital tissue diagnostics, advancements in imaging techniques & increasing affordability of diagnostics, and growth of personalized therapeutics and diagnostics.

b. The breast cancer application segment accounted for the highest revenue share of over 49% in 2020 in the U.S. tissue diagnostics market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."