- Home

- »

- Medical Devices

- »

-

U.S. Varicose Vein Treatment Devices Market, Industry Report, 2026GVR Report cover

![U.S. Varicose Vein Treatment Devices Market Size, Share & Trends Report]()

U.S. Varicose Vein Treatment Devices Market Size, Share & Trends Analysis Report By Type (Endovenous Ablation (Laser Ablation, Radiofrequency Ablation), Sclerotherapy, Surgical Ligation & Stripping), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-4-68038-116-0

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

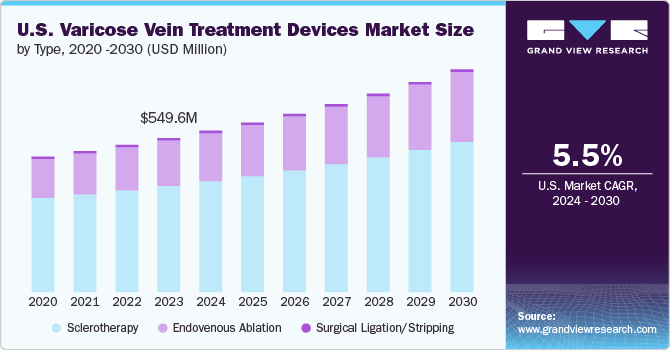

The U.S. varicose vein treatment devices market size was valued at USD 461.5 million in 2018 and is expected to expand at a CAGR of 5.5% over the forecast period. The rise in investments by the manufacturers to introduce innovative products in the market is likely to boost the growth. An increase in the prevalence of varicose veins coupled with the growing geriatric population is anticipated to further fuel the growth in the U.S.

Minimally invasive varicose vein surgeries result in reduced patient discomfort, postoperative pain, and bruising. Unlike surgical stripping, patients who have undergone occlusion procedures can immediately resume their daily routine activities. Minimally invasive procedures are increasingly being performed at physician offices and ambulatory centers, instead of hospital settings. This increases patient comfort and convenience and reduces patient anxiety of undergoing surgery in hospital settings.

Varicose vein treatment surgeries are evolving to become noninvasive or minimally invasive in nature. Reduced risk of infections and scarring associated with invasive surgeries is anticipated to drive the preference for non-invasive surgeries. Noninvasive methods reduce the duration of hospital stay, thereby saving time as well as cost. As a result, there is a rise in preference for treatment options, such as foam sclerotherapy, endovenous laser, and radiofrequency ablation over conventional surgeries.

Venous ablation techniques can be performed without a groin incision, eliminating the risk of wound infection, especially in obese patients. These techniques are less time consuming and efficient for short- as well as long-term treatment of varicose veins. Post-operative pain is very limited with higher wavelengths and with radial fiber in case of ablation procedures.

Aging may considerably affect the structure and functions of the veins. One out of every two people above 50 years is affected by varicose veins. An investigational study indicated that about 42% of men and 58% of women belonging to the age group of 66 to 96 years suffer from varicose veins.

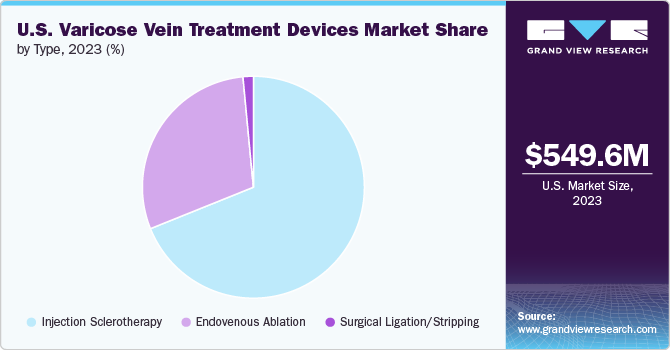

Type Insights

Based on type, the U.S. varicose vein treatment devices market is categorized into endovenous ablation, sclerotherapy, and surgical ligation and stripping. The endovenous ablation segment is further categorized into laser ablation and radiofrequency ablation. Sclerotherapy segment accounted for the largest market share in 2018, due to easier accessibility, efficiency to treat varicose veins, and favorable reimbursement scenario. Sclerotherapy procedure eliminates the need for prolonged hospital stay and patients often leave with minimal bruising and scarring.

Various organizations undertake initiatives for raising awareness and the treatment rate of vein diseases. Numerous market players are investing in the development of innovative and effective products. Commercialization of various products in the recent years is anticipated to further boost the growth. VenaSeal closure system by Medtronic is the latest addition to the varicose vein treatment options. According to the clinical performance data for VenaSeal, it is anticipated to be the most effective treatment options in the forthcoming years.

Rising demand for the treatment of vein diseases is owing to the significant presence of aesthetically conscious population base in the country. Patients are willing to undergo cosmetic surgeries due to safety and evident results. The demonstration of safety and efficacy of laser treatments has reduced the apprehension regarding cosmetic procedures. This factor is projected to further fuel the demand for the treatment devices in the forthcoming years.

U.S. Varicose Vein Treatment Devices Market Share Insights

Some of the key players operating in the market are Medtronic plc; AngioDynamics, Inc.; Syneron Medical Ltd.; Lumenis Ltd.; Biolitec AG; Eufoton srl; Energist Group; Quanta Systems S.p.A.; and Teleflex, Inc. The companies engage in regional expansion, new product development, and product portfolio expansion to strengthen their market presence. Some of the market players opt to purchase the products directly from the manufacturers and sell them as distributors.

In terms of regional footprint, Medtronic and Teleflex, Inc. were some of the leading companies in 2018. Medtronic is present in more than 160 countries, whereas, Teleflex, Inc. operates in about 150 countries. Teleflex, Inc. expanded through various mergers and acquisitions in recent years. For instance, in February 2017, the company acquired Vascular Solutions, Inc. The acquisition propelled the Teleflex vascular and interventional access product portfolios. Furthermore, recently, in April 2017, Teleflex acquired Pyng Medical through a merger, after which the company runs as a subsidiary of Teleflex Canada. Through this acquisition, the company expanded its regional reach, making it a strong player in the market.

U.S. Varicose Vein Treatment Devices Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 522.3 million

Revenue forecast in 2026

USD 706.3 million

Growth Rate

CAGR of 5.5% from 2019 to 2026

Base year for estimation

2018

Historical data

2015 – 2017

Forecast period

2019 – 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Medtronic plc; AngioDynamics, Inc.; Syneron Medical Ltd.; Lumenis Ltd.; Biolitec AG; Eufoton srl; Energist Group; Quanta Systems S.p.A.; Teleflex, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the U.S. varicose vein treatment devices market report based on type:

-

Type Outlook (Revenue, USD Million, 2015 - 2026)

-

Endovenous Ablation

-

Laser Ablation

-

Radiofrequency Ablation

-

-

Sclerotherapy

-

Surgical Ligation & Stripping

-

Frequently Asked Questions About This Report

b. The U.S. varicose vein treatment devices market size was estimated at USD 491.7 million in 2019 and is expected to reach USD 522.3 million in 2020.

b. The U.S. varicose vein treatment devices market is expected to grow at a compound annual growth rate of 5.5% from 2019 to 2026 to reach USD 706.3 million by 2026.

b. Sclerotherapy dominated the type segment of the U.S. varicose vein treatment devices market in 2019. This is attributable to the easier accessibility, efficiency to treat varicose veins, and favorable reimbursement scenario.

b. Some key players operating in the U.S. varicose vein treatment devices market are Medtronic plc; AngioDynamics, Inc.; Syneron Medical Ltd.; Lumenis Ltd.; Biolitec AG; Eufoton srl; Energist Group; Quanta Systems S.p.A.; and Teleflex, Inc.

b. Key factors that are driving the market growth include the growth in investments by the manufacturers to introduce innovative products and an increase in the prevalence of varicose veins coupled with the growing geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."