- Home

- »

- Animal Health

- »

-

U.S. Veterinary Oncology Market Size Report, 2030GVR Report cover

![U.S. Veterinary Oncology Market Size, Share & Trends Report]()

U.S. Veterinary Oncology Market Size, Share & Trends Analysis Report By Therapy (Surgery, Radiology, Chemotherapy, Immunotherapy), By Animal Type (Canine, Feline), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-370-4

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The U.S. veterinary oncology market size was valued at USD 87.96 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. The major contributors to the market growth are the increasing prevalence of cancer cases, the growing number of pet owners, technological advancements in per cancer therapeutics, and ongoing clinical trials related to veterinary oncology. Moreover, pet owners are willing to spend more on pet health, which is also among the major factors driving the demand for pet cancer therapies. The COVID-19 pandemic has changed pet owners’ relationships with their companions. It acted as a catalyst for rapid business and economic changes.

As various governments across the world urged individuals to stay at home during the pandemic, many people found comfort and companionship through pets. The pet expenditure has witnessed an increase during the coronavirus breakdown. At the animal shelters in the country, adoption rates soared as much as 40% in 2020 as compared to 2019. Growing R&D in veterinary oncology to provide the best treatments to pets with cancer is a major boon for the market. An increase in investments related to pet cancer therapeutics by organizations is expected to fuel the market growth. The corporations are engaging in strategies, such as licensing, R&D collaborations, and business development, to enhance their product pipeline in veterinary oncology.

For instance, in 2020, Boehringer Ingelheim spent USD 412 million on their R&D activities. Furthermore, ongoing clinical trials in this field support the market growth. In March 2020, The University of Illinois Cancer Care Clinic and Comparative Oncology Research Laboratory publicized two clinical trials for canine cancer. Other supportive drugs are still in pipeline and are expected to offer lucrative opportunities in the coming years. Veterinary medicine has evolved numerously in recent years and advancements in technology permit to provide medical attention to pets as it is available for humans.

Technological upgradation in the veterinary sector to provide an effective treatment to companion animals drives the market growth. In addition, the presence of major players in the country further contributes to its growth. Participants in the country are actively involved in product expansion strategies to gain a competitive advantage. For instance, in January 2021, CureLab Oncology started CureLab Veterinary, a subsidiary with exclusive rights to use CureLab Oncology patents for the treatment of canines, felines, and horses worldwide. The first target market for the subsidiary’s patented DNA therapeutics is canines and felines. The company also has seven R&D sites in the U.S.

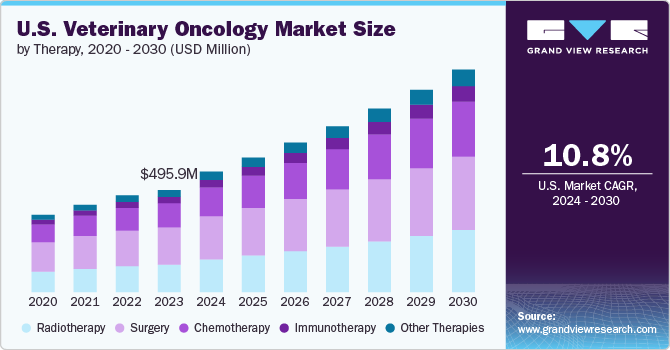

Therapy Insights

The radiology segment accounted for the maximum share of more than 25% of the global revenue in 2022. Radiology is often carried out with surgery to help excise tumors. An increasing number of government initiatives for the establishment of new veterinary radiation centers in the U.S. are propelling the growth of this segment. For instance, in November 2020, at Roanoke, Virginia, Virginia Tech’s Animal Cancer Care and Research Center started a radiation therapy facility for pets that has a Varian LINAC accelerator installed. The LINAC also consists of Rapid Arc technology.

It can rotate 360 degrees while delivering the radiation to treat different types of tumors in companion animals. The establishment of such new state-of-the-art radiology centers focused on treatment for pet cancer is expected to help boost the segment growth. The immunotherapy segment, on the other hand, is expected to register the fastest growth rate of over 8% in the coming years on account of an increase in the number of veterinary centers focused on carrying out clinical trials in immunotherapy. For instance, The University of Pennsylvania in collaboration with Penn Vet Cancer Center is involved in carrying out immunotherapy clinical trials.

Animal Type Insights

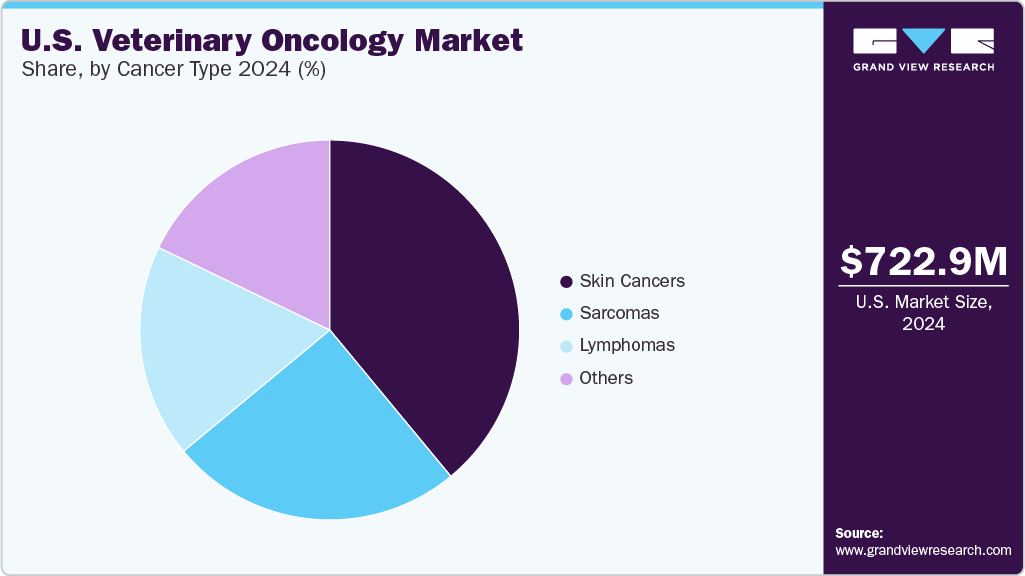

The canine segment held the largest revenue share of over 55% in 2022 and is also anticipated to grow the fastest in the coming years. The rising prevalence of canine cancer boosts the demand for an effective treatment modality. Increasing R&D initiatives and a growing number of clinical trials support the segment’s dominance. For instance, in November 2019, The UC Davis School of veterinary medicine became part of the Vaccination Against Canine Cancer Study (VACCS) trial, the largest clinical trial to evaluate a new vaccine strategy for the treatment and prevention of cancer in dogs. An increase in clinical trial activities specific to canine cancer therapeutics is expected to propel the segment growth in the coming years.

For instance, in March 2020, The Comparative Oncology Research Laboratory and the University of Illinois Cancer Care Clinic publicized 2 clinical trials for canines with cancer. Other supportive drugs are still in the pipeline and, if approved, can significantly drive the market. Cats are the second most popular choice by pet owners in the U.S. Increased concerns regarding their health and hygiene are driving the growth of the feline segment. According to the published article in NCBI in 2019, squamous cell carcinoma is the most common malignant oral tumor in the feline population. The growing number of cats diagnosed with cancer is expected to boost the demand for veterinary oncology products in the U.S.

Key Companies & Market Share Insights

The market is highly competitive as players operating in the industry are focusing on research collaborations, product developments, geographic expansions, and investments in innovative technologies. For instance, in May 2020, PetCure Oncology and Sugar Land Veterinary Specialists publicized a novel radiation oncology service, expanding their network in Houston. In January 2021, the U.S. FDA conditionally approved verdinexor tablets by Karyopharm Therapeutics Inc. to treat lymphoma in canines. This is the first oral treatment to treat dogs with lymphoma. Some of the prominent players in the U.S. veterinary oncology market include:

-

Boehringer Ingelheim International GmbH

-

Elanco

-

Zoetis

-

PetCure Oncology

-

Accuray Inc.

-

Varian Medical System, Inc.

-

Morphogenesis, Inc.

-

Karyopharm Therapeutics, Inc.

-

Regeneus Ltd.

-

One Health

U.S. Veterinary Oncology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 94.93 million

Revenue forecast in 2030

USD 143.22 million

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, animal type

Country scope

U.S.

Key companies profiled

Boehringer Ingelheim International GmbH; Elanco; Zoetis; PetCure Oncology; Accuray Incorporated; Varian Medical System, Inc; Morphogenesis, Inc.; Karyopharm Therapeutics, Inc.; Regeneus Ltd.; One Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. veterinary oncology market report on the basis of therapy and animal type:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Radiology

-

Stereotactic Radiation Therapy

-

Gamma Knife

-

LINAC

-

PBRT

-

CyberKnife

-

-

Brachytherapy

-

Others

-

-

Chemotherapy

-

Immunotherapy

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Lymphoma

-

Mast Cell Cancer

-

Mammary & Squamous Cell Cancer

-

Others

-

-

Feline

-

Mammary & Squamous Cell Cancer

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The radiology segment dominated the U.S. veterinary oncology market and accounted for the largest revenue share of more than 25% in 2022.

b. The U.S. veterinary oncology size was estimated at USD 87.96 million in 2022 and is expected to reach USD 94.93 million in 2023.

b. The U.S. veterinary oncology market is expected to grow at a compound annual growth rate of 6% from 2023 to 2030 to reach USD 143.22 million by 2030.

b. The canine segment dominated the U.S. veterinary oncology market and accounted for the largest revenue share of around 55% in 2022.

b. Some key players operating in the U.S. veterinary oncology market include Boehringer Ingelheim International GmbH, Elanco, Zoetis, PetCure Oncology, Accuray Incorporated, Varian Medical System, Inc., Morphogenesis, Inc., Karyopharm Therapeutics, Inc., Regeneus Ltd., One Health., and OHC

b. Key factors that are driving the U.S. veterinary oncology market growth include the increasing adoption of different cancer therapeutics to curb cancer cases in pets, a growing pet population with the rising number of companion pet ownership, and willingness to spend on pets by pet proprietors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."