- Home

- »

- Electronic & Electrical

- »

-

U.S. Wine Cooler Market Size & Share Report, 2021-2028GVR Report cover

![U.S. Wine Cooler Market Size, Share & Trends Report]()

U.S. Wine Cooler Market Size, Share & Trends Analysis Report By Product (Countertop, Free-standing), By Application (Commercial, Residential), By Distribution Channel, By Price Range, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-443-5

- Number of Pages: 74

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

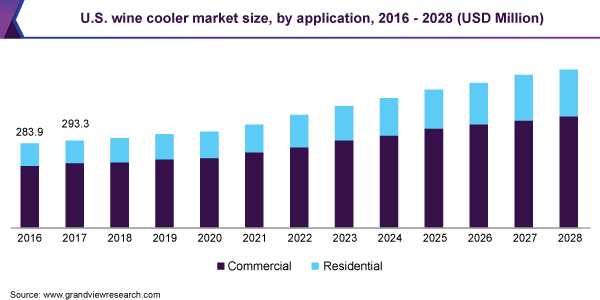

The U.S. wine cooler market size was valued at USD 326.5 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2021 to 2028. The growth in product adoption can be attributed to the increasing consumption of wine in American households. Consumers can be seen buying these and storing the bottles at home, making wine coolers a basic necessity. Product launches have also been driving the growth of the market. For instance, Vinotemp, a Henderson, Nevada-based company building premium wine storage, launched Garage 300-Bottle Dual-Zone Wine Cooler in April 2021. It features enhanced insulation on both the cabinet and the door, added to resist the effects of changing temperatures. Consumers can monitor and set their temperature zones via a central control panel, as well as turn Vinotemp’s BioBlu LED lighting on and off.

The adoption of home appliances with multi-functional features is an upcoming trend in the residential sector. Moreover, along with alcohol, the consumption of non-alcoholic wines amongst millennials has been on the rise over the past few decades. One of the greatest functions of a wine cooler, which is driving its rapid deployment in the residential and commercial sectors, is its ability to protect wine collection from any natural elements that could potentially be damaging.

There has been significant growth in online shopping across all age groups in the U.S., with the most common users of online channels being younger, urban, and affluent consumers. This is also likely to support market growth.

Moreover, with recent stay-at-home orders and safer-at-home advisories across the country, consumers are becoming increasingly reliant on their household appliances. Several brick-and-mortar stores have taken a major hit owing to strict lockdowns and the need for maintaining social distancing in severely affected cities across the U.S. Thus, e-commerce has emerged as the preferred distribution channel since the COVID-19 outbreak.

Furthermore, according to the Wine Intelligence U.S. COVID-19 Impact Report, published in May 2020, the majority of respondents stated that the origin of wine they purchased was the same during the first half of 2020, but there was a notable shift in purchase preferences toward domestic wines and away from imports. Around 18% of respondents reported buying more wine from California and other U.S. regions during the pandemic-induced lockdown, while 20% reported that they were buying less wine from France, Italy, and Spain.

Application Insights

The commercial segment dominated the market in 2020 with a revenue share of more than 73% and will grow at a steady CAGR from 2021 to 2028. The growing number of hospitality and entertainment centers including hotels, restaurants, resorts, pubs, bars, and food cafes is attributed to the highest share of the segment.

There are several claims about the benefits of drinking wine; such as it helps lower blood sugar levels, lose weight, reduce chances of catching a cold, and improve memory. These factors result in increased consumption of wine, which, in turn, drives the product demand. The growing number of millennials are reaching the legal drinking age. An increase in the number of food joints serving wine and other beverages has further increased the product demand.

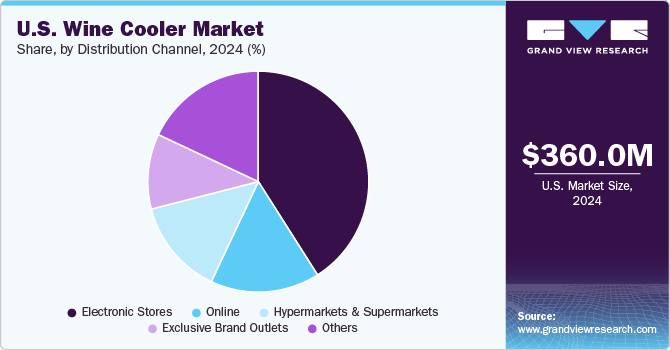

Distribution Channel Insights

The specialty stores/homecare shops distribution channel segment accounted for the largest revenue share of 38.1% in 2020 and is expected to grow at a significant CAGR during the forecast period. The segment growth is majorly driven by the quality of products and the overall consumer experience offered by these stores. The online segment is estimated to register the fastest CAGR from 2021 to 2028. Factors attributing to the growth of the online segment include social media influence and increased penetration of smartphones & e-commerce sites.

The supermarket/hypermarket segment is also projected to have significant growth over the coming years. Kroger Co., Costco Wholesale Corp., are the key hypermarket chains that offer a variety of items ranging from appliances, beauty products, clothing, to furniture and electronics. The majority of the people in the country prefer to shop in supermarkets/hypermarkets owing to discounted rates and better consumer experience offered by these stores. According to the National Grocers Association, there were more than 40,000 hypermarkets and over 41,800 supermarkets in the U.S. in 2019.

Price Range Insights

Based on the price range, the above USD 1,500 segment accounted for the highest revenue share of 45.3% in 2020. The segment is anticipated to expand further at a considerable CAGR over the forecast period. Wine coolers that are priced more than USD 1,500 are typically used at commercial spaces, such as hotels, restaurants, bars, pubs, cafes, and resorts, as they can store a large number of bottles at a time.

The price category of USD 500 to 1,500 holds a decent range of wine coolers. Freestanding wine chillers with a high capacity as well as built-in units with moderate capacity are available in this price category. The less than USD 500 price range segment is projected to grow at the fastest CAGR during the forecast years. Rising demand for wine fridges from the residential sector is driving the growth of this segment.

Product Insights

The free-standing segment accounted for the largest revenue share of over 52% in 2020 and is projected to ascend at a steady CAGR from 2021 to 2028. Free-standing equipment is more affordable and offers various benefits over its counterparts. In addition, unlike regular refrigerators, a wine cooler helps store a collection of wines at a suitable temperature maintaining its precise taste and, thus, driving the segment growth.

Countertop equipment is an ideal solution for homes with less floor space as they take up less space and can enhance a kitchen’s overall aesthetics. Some of the best-reviewed countertop wine chillers are NutriChef, Antarctic Star, Ivation, NewAir, and Koolatron. NutriChef’s 12-Bottle Thermoelectric Wine Cooler has the perfect blend of style and functionality, including a reinforced glass door, an LED lighting system, and an interior that helps in maximizing storage space.

Built-in wine coolers serve as an excellent option for those who want their wine fridges to complement and blend with their existing home décor. Its compact design is ideally suitable for small kitchens, apartments, recreational vehicles, and other smaller spaces. NewAir’s AWR-290DB and AWR-190SB are popular examples of built-in wine chillers.

Key Companies & Market Share Insights

The market is highly fragmented and is characterized by the presence of several well-established as well as some small- and medium-scale companies. The impact of established players on the market is quite high as a majority of them have vast distribution networks across the country. Recent developments & innovations carried out by companies through various R&D activities and investments have significantly contributed to the market growth.

For instance, Cuisinart launched its e-commerce website, which retails approximately 200 products and 1,500 replacement parts from the company’s portfolio. In January 2020, Allavino introduced Tru-Vino Temperature Control technology, and in September 2018, Newair launched Dual Zone Wine and Beverage Refrigerator. The refrigerator offers two cooling zones, one for carbonated drinks and one for wines. Some of the key companies in the U.S. wine cooler market are:

-

Haier Group Corp.

-

LG Electronics, Inc.

-

Whirlpool Corp.

-

Koolatron

-

Newair

-

Samsung Electronics Co. Ltd.

-

EdgeStar

-

hOmeLabs (hOme)

-

Allavino

-

EuroCave

-

Wine Enthusiast

-

BSH Home Appliances Group

-

Electrolux AB

-

Whynter LLC

-

The Avanti Products

-

NutriChef Kitchen, LLC

-

Vinotemp

-

Cuisinart

-

Liebherr Group

-

Danby Appliances

-

SMEG S.p.A.

-

Phiestina

U.S. Wine Cooler Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 350.4 million

Revenue forecast in 2028

USD 536.2 million

Growth rate

CAGR of 6.4% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, price range

Country scope

U.S.

Key companies profiled

Haier Group Corp.; LG Electronics, Inc.; Whirlpool Corp.; Koolatron; Newair; Samsung Electronics Co. Ltd.; EdgeStar; hOmeLabs (hOme); Allavino; EuroCave; Wine Enthusiast; BSH Home Appliances Group; Electrolux AB; Whynter LLC; The Avanti Products; NutriChef Kitchen, LLC; Vinotemp; Cuisinart; Liebherr Group; Danby Appliances; SMEG S.p.A.; Phiestina

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. wine cooler market report on the basis of product, application, distribution channel, and price range:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Free-standing

-

Countertop

-

Built-in

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Supermarket/Hypermarket

-

Specialty Stores/Homecare Shops

-

Company-owned Outlets

-

Online

-

-

Price Range Outlook (Revenue, USD Million, 2016 - 2028)

-

Less than USD 500

-

Above USD 500 to 1,500

-

Above USD 1500

-

Frequently Asked Questions About This Report

b. The U.S. wine cooler market size was estimated at USD 326.5 million in 2020 and is expected to reach USD 350.4 million in 2021.

b. The U.S. wine cooler market is expected to grow at a compound annual growth rate of 6.4% from 2021 to 2028 to reach USD 536.2 million by 2028.

b. The commercial segment dominated the U.S. wine cooler market in 2020 with a revenue share of more than 73% and will grow at a steady CAGR from 2021 to 2028.

b. Some of the key players operating in the U.S. wine cooler market include Haier Group Corporation, LG Electronics Inc., Whirlpool Corporation, and Samsung Electronics Co. Ltd., along with several small and midsized players, such as Koolatron, Newair, EdgeStar, hOmeLabs, and EuroCave.

b. The growth in the adoption of wine coolers can be attributed to the increasing consumption of wine in American households. Product launches have also been driving the growth of the U.S. wine cooler market.

b. The specialty stores/homecare shops distribution channel segment accounted for the largest revenue share of 38.1% in 2020 and is expected to grow at a significant CAGR during the forecast period in the U.S. wine cooler market.

b. Based on the price range, the above USD 1,500 segment accounted for the highest revenue share of 45.3% in 2020 in the U.S. wine cooler market.

b. The free-standing segment accounted for the largest revenue share of over 52% in 2020 and is projected to ascend at a steady CAGR from 2021 to 2028 in the U.S. wine cooler market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."