- Home

- »

- Medical Devices

- »

-

U.S. Wound Irrigation System Market Size Report, 2020-2027GVR Report cover

![U.S. Wound Irrigation System Market Size, Share & Trends Report]()

U.S. Wound Irrigation System Market Size, Share & Trends Analysis Report By Product (Manual, Battery-operated), By End-use (Hospitals, Wound Care Centers), By Application (Chronic, Surgical Wounds), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-827-5

- Number of Pages: 56

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

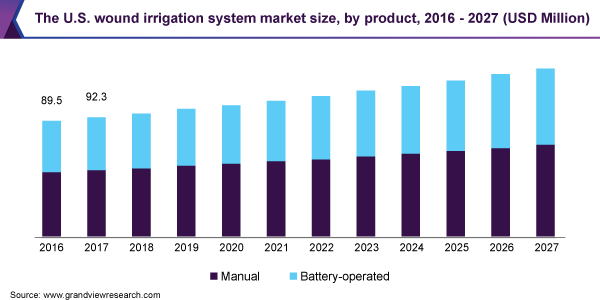

The U.S. wound irrigation system market size was valued at USD 98.3 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2020 to 2027. The demand for the wound irrigation system is on a rise owing to the technological advancements, increasing prevalence of chronic diseases, rising number of surgical procedures, and rising geriatric population across the country. A wound irrigation system is used to keep wounds hydrated, remove deeper debris, and assist in a visual examination. The introduction of technologically advanced products is the major factor expected to drive the market. For instance, in February 2017, Centurion Medical Products Corporation launched its wound irrigation system IRIG-8 for acute wound management in the emergency room.

This equipment rapidly delivers irrigation solutions in high volumes to acute wounds with constant pressure. Similarly, in 2017, Bionix, Inc. launched the Igloo wound irrigation system, which allows effective removal of necrotic tissue and bacteria with continuous and high volume irrigation. This initiative was part of a product portfolio expansion strategy to have a dominant share in the market. Unhealthy & sedentary lifestyles and increasing smoking and alcohol consumption leading to the rise in the prevalence of non-communicable diseases are factors likely to boost market growth during the forecast period. For instance, according to the National Diabetes Statistic Report 2017, published by the CDC, more than 100.0 million people in the U.S. were diabetic or had prediabetes conditions. Cancer is a global healthcare burden as it is one of the leading causes of death.

According to the WHO, it is the leading cause of death globally and almost one in six deaths occur due to cancer. In addition, more than 70% of cancer-related deaths typically occur in middle- and low-income countries. The number of surgeries being performed is increasing owing to the rising prevalence of chronic conditions. As a result, wound care products are being increasingly used to prevent Surgical Site Infections (SSIs).

Most surgical wounds after major surgeries are relatively large and deep, producing exudate that requires regular management. Wound irrigation helps manage large wounds, which significantly reduces the risk of infection. Thus, the rising incidence of chronic diseases is expected to increase the demand for wound care products, thereby supporting the market growth. A growing number of surgeries is one of the key factors expected to drive market growth during the forecast period.

During surgeries, wound irrigation system is used to clean wounds as it assists in better visualization of deeper wounds. According to the Healthcare Cost and Utilization Project, in 2014, around 9,942,000 surgeries were performed in the U.S. within Ambulatory Care Settings (ASCs). Similarly, according to the Health Research Educational Trust 2018, around 15.0 million surgeries are performed every year in the U.S. and nearly 2.0% to 5.0% of patients develop an SSI.

A wound irrigation system allows a steady flow of solutions across the open wound surface, which provides better hydration of deep SSIs. This system also allows the precise removal of cellular debris and surface pathogens from wound exudates. Thus, a rising number of surgical procedures is anticipated to boost the market growth over the forecast period.

Product Insights

The manual product segment dominated the market with a share of over 55% in 2019. The product has thumb-controlled pressure, which provides an appropriate stream directly to the desired site. Such systems are majorly used for deep surgical wound healing and hard-to-heal wounds. Thus, increasing cases of SSIs and diabetic foot ulcers is anticipated to drive the demand for manual wound irrigation systems.

The battery-operated product segment is expected to witness the fastest growth during the forecast period. Such systems allow rapid and efficient removal of necrotic tissues, foreign materials, and bacteria. These products are easy to use and reduce the risk of cross-contamination; thus are widely used for chronic wounds and burn cases.

Application Insights

The chronic wounds segment held the largest market share of 33.2% in 2019 and is anticipated to witness the fastest growth rate over the forecast period. The increasing cases of chronic diseases, especially diabetes, and rising geriatric population are the major factors driving the segment growth.

The segment is further subdivided into diabetic foot ulcers, pressure ulcers, venous leg ulcers, and others. The surgical wounds segment is anticipated to witness significant growth over the forecast period. The rising number of SSI is one of the major driving factors for segment growth. Surgical wounds majorly occur due to SSIs.

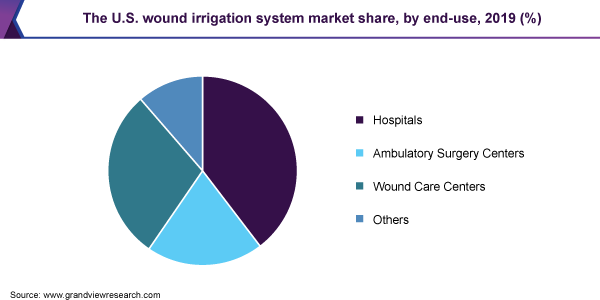

End-use Insights

The hospital segment held the largest market share of 39.80% in 2019. The segment will expand further at a steady CAGR owing to the rising number of surgical procedures as wound irrigation systems are majorly used to clean deeper wounds before surgery for better view and assessment of the wound. Moreover, the increasing cases of diabetic foot ulcers and venous leg ulcers are projected to boost the demand for such systems.

The wound care centers segment is anticipated to witness the fastest growth over the forecast period. Wound care centers are specifically dedicated institutions for wound treatment. Generally, patients are recommended a wound care center if the wound has not started healing in 2 weeks and if it has not completely healed in 6 weeks. The presence of several wound care centers equipped with advanced tools and technologies is anticipated to drive the market growth in the U.S.

Key Companies & Market Share Insights

Major companies in the market are focusing on R&D to develop technologically advanced products to gain a competitive edge. For instance, in February 2017, Company Centurion Medical Products, launched wound irrigation system IRIG-8 for acute wound management in the emergency room. This system rapidly delivers irrigation solutions in high-volumes to acute wounds with desirable effective and constant pressure.

Companies are also engaging in partnerships, mergers, and acquisitions, to strengthen their product portfolio, manufacturing capacities, and provide competitive differentiation. For example, in February 2018, Medline Industries acquired Centurion Medical Products and following that full set of product portfolio related to vascular access products along with complementary minor procedures, such as tray offerings and infection prevention products, which will be marketed under Medline Industries. Some of the prominent players in the U.S. wound irrigation system market include:

-

Westmed, Inc.

-

Bionix, Inc.

-

C.R. Bard, Inc.

-

CooperSurgical, Inc.

-

Stryker Corporation

-

BSN Medical

-

Centurion Medical Products (Medline Industries Inc.)

-

Zimmer Biomet

The U.S. Wound Irrigation System Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 101.61 million

Revenue forecast in 2027

USD 129.8 million

Growth Rate

CAGR of 3.6% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

The U.S.

Key companies profiled

Westmed, Inc.; Bionix, Inc.; C.R. Bard, Inc.; CooperSurgical, Inc.; Stryker Corp.; BSN Medical; Centurion Medical Products (Medline Industries, Inc.); and Zimmer Biomet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. wound irrigation system market report on the basis of product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Manual Wound Irrigation System

-

Battery-operated Wound Irrigation System

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Burn Wounds

-

Chronic Wounds

-

Diabetic Foot Ulcer

-

Venous Leg Ulcer

-

Pressure Ulcer

-

-

Surgical Wounds

-

Traumatic Wounds

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Ambulatory Surgery Centers (ASCs)

-

Wound Care Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. wound irrigation system market size was estimated at USD 98.36 million in 2019 and is expected to reach USD 101.61 million in 2020.

b. The U.S. wound irrigation system market is expected to grow at a compound annual growth rate of 3.6% from 2020 to 2027 to reach USD 129.86 million by 2027.

b. The manual system dominated the U.S. wound irrigation system market with a share of 55.60% in 2019. This is attributable to the increasing number of surgical site infections and diabetic foot ulcers.

b. Some key players operating in the U.S. wound irrigation system market include Westmed, Inc., Bionix, Inc., C.R. Bard, Inc., CooperSurgical, Inc., Stryker Corporation, BSN Medical, Centurion Medical Products (Medline Industries, Inc.), Zimmer Biomet.

b. Key factors that are driving the market growth include technological advancement, increasing prevalence of chronic diseases, rising number of surgical procedures, and rising geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."