- Home

- »

- Beauty & Personal Care

- »

-

Global Vegan Cosmetics Market Size Report, 2030GVR Report cover

![Vegan Cosmetics Market Size, Share & Trend Report]()

Vegan Cosmetics Market Size, Share & Trend Analysis Report by Product (Skin Care, Hair Care, Color Cosmetics), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, E-Commerce), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-501-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

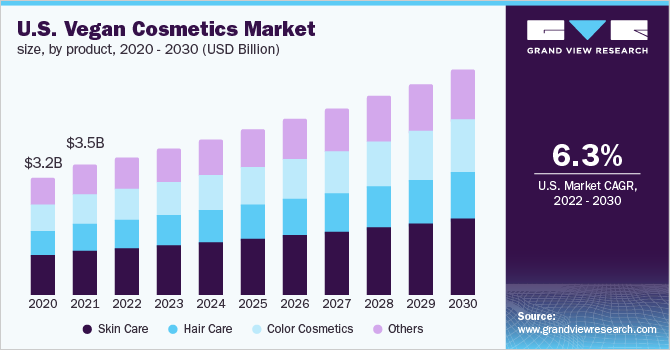

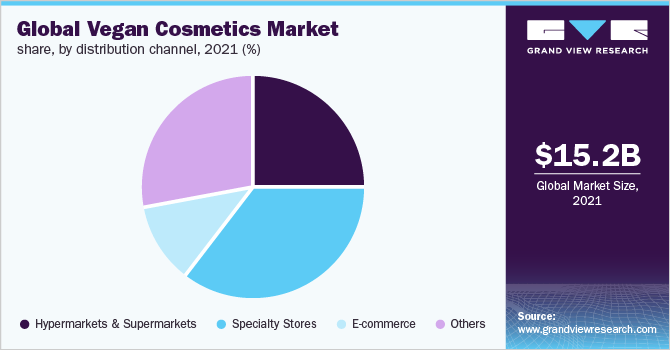

The global vegan cosmetics market size was valued at USD 15.17 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2030. One of the primary factors driving market expansion is the rise of vegan consumerism all across the globe where consumers are against animal cruelty and are seeking cosmetics that do not contain any animal ingredients. Therefore, there is a shift in the cosmetics market mainly propelled by ethically conscious consumers opting for vegan products.

Vegan cosmetics are those products that do not include any animal ingredients such as beeswax, collagen, and others and are used for beautifying, maintaining hygiene, or changing or enhancing the appearance of consumers. Its major types include skin care, hair care, and color cosmetics products among various others. These products are easily accessible to consumers in the market through various distribution channels including specialty stores, supermarkets, hypermarkets, e-commerce, and others.

Moreover, the rising trend of veganism has encouraged manufacturers to invest in research & development, to launch new products and their variants to cater to consumers looking for vegan products. For instance, in Feb 2021, G&M, an Australian beauty products manufacturer launched vegan cosmetics to tap into the growing market for the same, especially among millennial consumers.

Additionally, vegan cosmetics such as skin care, color cosmetics, hair care, and others are becoming an integral part of grooming among consumers, especially among Gen Z. This is owing to the rising consumer awareness regarding the benefits associated with the use of vegan cosmetics as they are chemical-free and environmentally friendly. This in turn is expected to boost the growth of the market during the forecast years.

The recent COVID-19 outbreak has severely impacted the growth of the industry. The pandemic disrupted production as well as sales of vegan cosmetics both through online and offline channels due to social distancing and stay-home policies. Demand for new orders from retailers had come to a standstill as major markets were under lockdown, which drastically altered the supply chains globally.

Furthermore, according to The Vegan Society, the number of consumers adopting veganism has risen by 350% in the U.K. as compared to a decade ago. Moreover, in the year 2018, Vegan cosmetics sales increased by 38% in the U.K. According to Vegan Avenue, many companies have divulged an increase in demand for such products. For instance, in the year 2019, Superdrug, one of the leading health & beauty retailers in the U.K. reported a 750% increase in demand for vegan cosmetics.

Product Insights

The skin care segment accounted for about 34.01% market share in the market in the year 2021. Nowadays, conscious consumers are inclined towards using vegan skin care products. This is owing to the rising consumer awareness regarding the benefits associated with the use of the product to their skin as they are usually made by using plant-based ingredients, thus having less chance of itchiness, irritation, acne, and other problems on the skin.

The hair care segment is anticipated to expand at the fastest CAGR of 6.8%from 2022 to 2030. Vegan hair care has a wide range of products such as shampoo, hair oil, hair conditioner, hair mask, and others and is available in different forms to cater to the customer requirements which in turn is driving the demand for hair care products in the market.

Additionally, the color cosmetics segment is expected to be the second fastest growing segment in the vegan cosmetics market registering a CAGR of 6.3% during the forecast period. E.L.F cosmetics, KVD Vegan Beauty, and Bite Beauty are some of the key brands offering vegan color cosmetics in the market which in turn is propelling the growth in terms of value sales.

Distribution Channel Insights

The specialty stores segment made the largest contribution of over 35.7% in 2021. These stores have been focusing on offering various products including vegan cosmetics to cater to customers and offer them a facility to choose from numerous brands before making a purchase. Moreover, these stores also offer discounts and vouchers on such products which in turn has increased footfall in these stores.

Additionally, supermarkets & hypermarkets hold approximately 24.8% market share. Supermarkets and hypermarkets are generally spanning over a large area and display a wide variety of beauty products under a single roof. Moreover, these stores are especially located near residential areas for convenience and easy accessibility of products including vegan cosmetics. Thus, contributing to fueling the growth of the market.

The e-commerce channel is projected to register a CAGR of 8.8% from 2022 to 2030. Rising internet penetration amongst consumers and target marketing fueling the growth of this segment. In addition, the growth of online platforms across the globe majorly since the pandemic has contributed to driving the sales of the product. For instance, Blanka, an e-commerce platform where manufacturers can brand their line of vegan cosmetics is contributing to the market growth. Moreover, recently, Boohoo, a fashion e-commerce retailer has launched almost 50 vegan cosmetics products on its site.

Regional Insights

Europe made the largest contribution of over 36.81% market share in 2021. The inclination of consumers towards veganism is expected to propel the demand for vegan cosmetics, especially in countries such as the U.K., France, and Germany. Additionally, in 2020, around 82% of all vegan products introduced in the U.K. fall under the beauty category. Moreover, according to The Vegan Society, in 2021, 97% of British shoppers were found to be looking for more vegan certified beauty products and toiletries.

North America is expected to witness a CAGR of 6.5% from 2022 to 2030. This is attributable to the presence of various suppliers and brands of vegan cosmetics such as Bawse Lady, NYX Professional, ILIA, and others in the region, especially in the U.S. is contributing to the growth.

Asia-Pacific is expected to be the fastest-growing regional segment witnessing a CAGR of 7.4% from 2022 to 2030. Rising awareness regarding the mistreatment of animals has resulted in the rise in the demand for vegan cosmetics in countries such as India, Australia, and others. Moreover, veganism after the pandemic is trending in many countries such as India, Australia, and Japan. This in turn is likely to offer immense opportunities for growth in this region during the forecast period.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offering in the market.

-

In January 2022, Colorbar, one of the leading manufacturers in the market, unveiled a vegan nail lacquer with 128 different shades to expand its range of vegan products in the Indian market

-

In March 2021, Hourglass, one of the manufacturers of vegan beauty products has a partnership with the consumer good giant ‘Unilever’ to develop and launch carmine free vegan lipstick in the market

-

In April 2019, the beauty brand ‘Kat Von D Beauty’ launched its 100% vegan mascara made from the blend of sunflower and olive oil in the market

Some of the key players operating in the vegan cosmetics market include:

-

Zuzu Luxe

-

Ecco Bella

-

Bare Blossom

-

Emma Jean Cosmetics

-

Modern Mineral Makeup

-

Urban Decay

-

Arbonne, Pacifica

-

Nature’s Gate

-

Beauty Without Cruelty

-

Billy Jealousy

-

MuLondon Organic

Vegan Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 16.02 billion

Revenue forecast in 2030

USD 26.16 billion

Growth Rate

CAGR of 6.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Zuzu Luxe; Ecco Bella; Bare Blossom; Emma Jean Cosmetics; Modern Mineral Makeup; Arbonne; Pacifica; Nature’s Gate; Beauty Without Cruelty; Billy Jealousy; MuLondon Organic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vegan cosmetics market based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Skin Care

-

Hair Care

-

Color Cosmetics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vegan cosmetics market size was estimated at USD 15.17 billion in 2021 and is expected to reach USD 16.02 billion in 2022.

b. The global vegan cosmetics market is expected to grow at a compound annual growth rate of 6.3% from 2022 to 2030 to reach USD 26.16 billion by 2030.

b. Europe dominated the vegan cosmetics market with a share of 36.8% in 2021. The inclination of consumers towards veganism is expected to propel the demand for vegan cosmetics, especially in countries like the UK, France, and Germany. Additionally, In the Year 2020, around 82% of all the vegan products introduced in the UK fall under the beauty category.

b. Some key players operating in the vegan cosmetics market include Zuzu Luxe, Ecco Bella, Bare Blossom, Emma Jean Cosmetics, Modern Mineral Makeup, Arbonne, Pacifica, Nature’s Gate, Beauty Without Cruelty, Billy Jealousy, and MuLondon Organic.

b. One of the primary factors driving market expansion is the rise of vegan consumerism all across the globe where consumers are against animal cruelty and are seeking cosmetics that do not contain any animal ingredients. Therefore, there is a shift in the cosmetics market mainly propelled by ethically conscious consumers opting for vegan cosmetics

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."