- Home

- »

- Animal Health

- »

-

Veterinary Dietary Supplements Market Report, 2021-2028GVR Report cover

![Veterinary Dietary Supplements Market Size, Share & Trends Report]()

Veterinary Dietary Supplements Market Size, Share & Trends Analysis Report By Animal Type (Livestock, Companion), By Application, By Type, By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-480-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global veterinary dietary supplements market size was valued at USD 1.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2021 to 2028. Growing need to treat, mitigate, or prevent diseases in livestock and companion animals and the rising pet population and humanization are some of the key drivers contributing to market growth. According to 2020 report by FONA International Inc., millennials and Gen-Z generations are driving the humanization and premiumization trends in the pet food market, including veterinary dietary supplements.

The COVID-19 pandemic has propelled the demand for quality veterinary supplements due to growing pet health concerns. Veterinary dietary supplements that support immune health have gained traction during 2020. Pet owners are also becoming more interested in novel products and ingredients such as CBD supplements and are seeking more specificity in product claims. This presents opportunities for veterinary dietary supplement manufacturers to launch products with functional ingredients that are proven to be safe and backed by adequate research.

More and more pet parents are treating pets as members of the family. This trend in pet humanization has increased pet expenditure while leading to demand safe and nutritional products to support pet health. Many companies are expanding their portfolio with new products or expanding their regional reach to increase market share. In July 2020, Nutramax, launched Cosequin ASU pellets thus extending its joint health veterinary dietary supplements portfolio for horses. On the other hand, as per the 2020 statement by the chief executive of Blackmores, an Australian health supplements company, the company has plans to strengthen its position in pet vitamins and supplements markets. The company has also identified a new customer segment in the form of modern career women in China and has plans to enter the Indian market.

The need to ensure that pets achieve a healthier lifestyle is leading to premiumization of pet products including pet food and supplements. Market players can deliver on transparency and build trust by leveraging branded health ingredients and supplements that provide a clear point of reference to consumers when browsing shelves. As consumer preference shifts away from generic claims, market players have begun to list specific ingredients along with their proven health benefits.

The demand for condition-specific veterinary dietary supplements to support joint health, liver health, immune system, and digestive health is also expected to increase over time owing to growing awareness among pet owners and the availability of products. According to a 2018 study published in the Irish Veterinary Journal, horse owners/caregivers frequently use nutritional supplements to balance the diet, alleviate a health issue, provide additional nutrients for performance, modify behavior, and prevent health issues from occurring in horses. The study analyzed the results of a survey wherein 22% of the respondents commonly fed joint health supplements to their horses and 13% fed calming supplements.

Veterinary Dietary Supplements market: over 40.0% rise in demand for online pet supplement due to the COVID-19

Pandemic Impact

Post COVID Outlook

The earlier projections depicting 4.5% YoY growth was countered by the pandemic resulting in the positive growth of 20% and an increase by USD ~262 Million revenue in the earlier and recent estimations

Puppy adoption rate increased by 50 to 100% in 2020 which is expected to positively impact the market over the forecast period.

In spite of disruption due to Covid-19 pandemic pet food industry witnessed tremendous growth from 2019 to 2020. According to Kerry, there was more than 150 new product development (NPD) activities in North America in 2020.

According to IDEXX, U.S. clinic visits increased by 6% in Q4 2020 which is expected to increase the revenue growth over the forecast period.

A massive shift to e-commerce has been observed due to the lockdown which is expected to propel the e-commerce segment growth over the forecast period.

In livestock, supplements are mostly used to address nutritional deficiencies. These may arise due to genetic conditions, medical conditions, or poor nutritional value of available feed. The growing need to secure animal health, product quality, and increase profitability is estimated to drive the demand for livestock supplements. For example, ruminating animals, such as dairy cows, often struggle with consuming adequate food to maintain an adequate supply of energy. Some farms may thus elect to use molasses for their herds as an energy supplement. Market players provide a variety of supplements to satisfy various nutritional needs of livestock animals. Virbac, for instance, provides a lineup of feed supplements to support udder health, fertility, growth rate, and overall health in cattle.

Animal Type Insights

The companion animals segment dominated the market and held the largest revenue share of over 60.0% in 2020. This can be attributed to growing initiatives by market players, pet population, and humanization. The segment is also expected to witness the highest CAGR of 8.3% from 2021 to 2028. Ark Naturals Company, based in the U.S. specializes in nutraceuticals for companion animals and uses human-grade raw materials to formulate its veterinary dietary supplements.

The livestock animals segment is also expected to grow significantly over the forecast period. Supplements are added to livestock feed to improve the performance or nutrient balance of the total ratio. It can be administered free choice with other parts of the ration if available separately, diluted with other feeds, or further diluted and mixed to produce a complete feed. The need to increase profitability while protecting the health of livestock assets is anticipated to drive the segment.

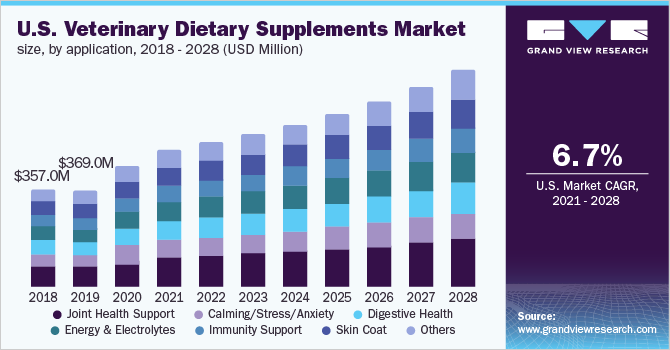

Application Insights

The joint health support segment dominated the market and accounted for the largest revenue share of 22.0% in 2020. The key factors contributing to the large share include the increasing prevalence of chronic joint disorders in companion as well as livestock animals and awareness about the availability of a variety of joint health supplements that help prevent or slow joint health disorders. As per a June 2020 study published in the Journal of the American Veterinary Medical Association, the use of joint health supplements may help to prevent or slow the progression of osteoarthritis in cats and dogs. Omega-3 Fatty Acids, green-lipped mussel, and glucosamine and chondroitin sulfate are commonly used dietary components associated with improvement in clinical signs of osteoarthritis in companion animals.

The calming/stress/anxiety segment is anticipated to witness the highest CAGR of over 8.5% over the forecast period. This is due to increasing awareness among pet parents regarding their pet’s emotional and behavioral well-being. According to Virbac, some common triggers of nervousness, anxiety, or stress in companion animals include unfamiliar people or pets, loud noises, changes in the environment, and car rides. Virbac’s Anxitane product, is an amino acid-based chewable supplement that helps pets keep calm and relaxed.

Type Insights

The multivitamins and minerals segment dominated the market and accounted for the largest revenue share of 27.5% in 2020. This can be attributed to the rising use of these veterinary dietary supplements in both companions as well as livestock animals to ensure balanced diets and promote daily bodily functions. A review article was published in Advances in Animal and Veterinary Sciences in 2019 on the Effect of multivitamin and amino acid supplements on Average Daily Gain (AVD) in crossbred Holstein calves. The results indicated a significant increase in ADG thus presenting an alternative growth rate management method in calves with poor growth performance.

The CBD segment is estimated to register notable growth of 11.0% in the next few years. This is owing to growing awareness and interest in the emotional, behavioral, and health benefits regarding use of Cannabidiol (CBD) in veterinary dietary supplements, in particular for companion animals. In February 2020, Veritas Farms launched CBD Pet Calming Chews as part of its new product line of pet CBD products- Veritas Pets.

Dosage Form Insights

The gummies and chewables segment dominated the market and accounted for the largest revenue share of 45.3% in 2020. The powders segment is expected to witness the fastest CAGR of 8.6% over the forecast period. This is owing to growing initiatives by market players in the pet food, treats, and supplements market to investigate and improve palatability in animals. Palatability studies are primarily based on the acceptance that is the choice to consume or not consume a particular dosage form and preference between dosage forms. According to a 2018 study published in the Open Journal of Veterinary Medicine appealing taste, mouthfeels, and smell were found to increase voluntary uptake of oral chewables in dogs.

In October 2020, RestoraPet launched bacon-flavored allergy, itch, and immune chews for canines. The company’s products contain the key ingredient- Vitalitrol, a super antioxidant that promotes mobility, vitality, and overall wellness and is based on over 10 years of research. Nature's Best CBD, on the other hand, launched CBD-infused, gluten-free, and vegan gummy supplement in November 2020.

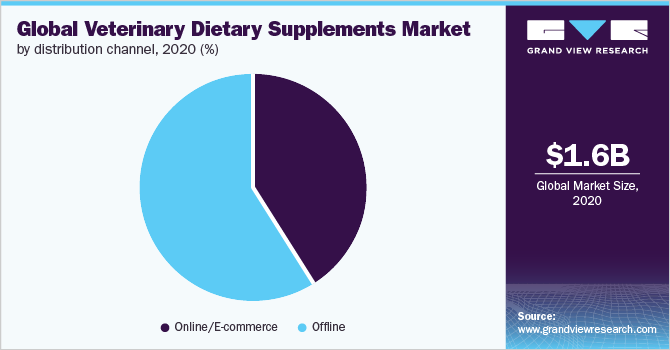

Distribution Channel Insights

The offline channel segment dominated the market and accounted for the largest revenue share of 58.9% in 2020. This is owing to a large number of pet owners and livestock farm operators opting for brick-and-mortar purchasing as the channel of choice. However, e-commerce and other online channels had been gaining traction for the past few years. Many offline stores even began offering customers a choice between ordering online and purchasing offline to increase sales.

The COVID-19 pandemic has catalyzed the adoption of online/ e-commerce channels and the segment is expected to register a high CAGR of 9.2% over the forecast period. This is expected to lead to further fragmentation of an already intensely competitive market. In March 2021, for example, Happy Go Healthy launched its line of premium dog supplements- Brilliant Bites onAmazon.com and Walmart.com.

Regional Insights

North America dominated the veterinary dietary supplements market and accounted for the largest revenue share of over 33.0% in 2020. The key factors responsible for the large share of the market in the region include the presence of key players and the increasing trend of pet humanization and premiumization of pet products. In October 2018, Nutramax, a leading company that develops products for humans and companion animals including dietary supplements, expanded operations at its Lancaster facility with a USD 20.0 million investment.

In Asia Pacific, the market is expected to grow at an exponential rate of 9.5% over the forecast period. The rising pet population and growing awareness about pet health are the factors expected to drive the market in the region. Market players are involved in regional expansion or the launch of new products for veterinary consumption in the region. Wai Yuen Tong Medicine Co., Ltd. for instance, launched a range of branded herbal supplements for pets in August 2020, thus diversifying into the pet supplements market.

Key Companies & Market Share Insights

The market is fragmented with many large and small players. These players implement various strategic initiatives to achieve their growth objectives and increase market share. Product launches, partnerships, expansion of local and regional footprint, and mergers and acquisitions are some of the initiatives deployed by key companies. For instance, in September 2020, Beaphar launched a lineup of natural calming products for companion animals such as spot-on, tablets, treats, collars, and home spray. The products help promote a calming effect in cats and dogs without causing drowsiness. The ingredients include natural plant extracts such as Limetree blossom, Rosemary, Hop flowers, and Melissa.

The market is also undergoing consolidation to some extent. Wind Point Partners, for example, is a private equity investment firm that has completed 300+ acquisitions in the last 30 years. These include several consumer and pet products companies such as Petmate, Targeted PetCare, Pestell Nutrition among others. In March 2021, Wind Point Partners acquired FoodScience Corporation that specializes in nutritional research and pet supplements. Some of the prominent players in the veterinary dietary supplements market include:

-

Boehringer Ingelheim

-

Virbac

-

Ark Naturals Company

-

Beaphar

-

FoodScience

-

NOW Foods

-

Nutramax Laboratories, Inc.

-

Nutri-Pet Research, Inc.

-

Ceva

-

Canna Companion

-

Nestle

Veterinary Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.8 billion

Revenue forecast in 2028

USD 3.2 billion

Growth rate

CAGR of 8.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, application, type, dosage form, distribution channel, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Boehringer Ingelheim; Virbac; Ark Naturals Company; Beaphar; FoodScience; NOW Foods; Nutramax Laboratories, Inc.; Nutri-Pet Research, Inc.; Ceva; Canna Companion; Nestle

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country-level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this report, Grand View Research has segmented the global veterinary dietary supplements market report on the basis of animal type, application, product, dosage form, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Livestock Animals

-

Companion Animals

-

Cats

-

Dogs

-

Horses

-

Others (Small Animals, Birds)

-

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Joint Health Support

-

Calming/ Stress/ Anxiety

-

Digestive Health

-

Energy and Electrolytes

-

Immunity Support

-

Skin & Coat Health

-

Others (Kidney, Urinary Tract, Liver, Cardiovascular, Weight Management)

-

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Omega 3 Fatty Acids

-

Proteins & Peptides

-

CBD

-

Multivitamins & Minerals

-

Probiotics & Prebiotics

-

Others (Antioxidants)

-

-

Dosage Form Outlook (Revenue, USD Million, 2016 - 2028)

-

Tablets & Capsules

-

Gummies & Chewables

-

Powders

-

Liquids

-

Others (Injectables, Paste)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Online/ E-commerce

-

Offline

-

Pet Specialty Stores

-

Retail

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Key factors driving the veterinary dietary supplements market growth include, rising demand for condition-specific supplements to support joint health, liver health, immune system, and digestive health is also expected to increase over time owing to growing awareness among pet owners and availability of products.

b. The global veterinary dietary supplements market size was valued at USD 1.6 billion in 2020 and is estimated to reach USD 1.8 billion in 2021.

b. The global veterinary dietary supplements market is expected to grow at a compound annual growth rate of 8.2% from 2021 to 2028 to reach USD 3.2 billion by 2028.

b. Multivitamins & minerals dominated the veterinary dietary supplements market by type with a share of 27.47% in 2020. This can be attributed to the rising use of these supplements in both companions as well as livestock animals to ensure balanced diets and promote daily bodily functions.

b. Some key players operating in the veterinary dietary supplements market include Boehringer Ingelheim, Virbac, Ark Naturals Company, Beaphar, FoodScience, NOW Foods, Nutramax Laboratories, Inc., Nutri-Pet Research, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."