- Home

- »

- Animal Health

- »

-

Veterinary Medicine Market Size, Share, Growth Report 2030GVR Report cover

![Veterinary Medicine Market Size, Share & Trends Report]()

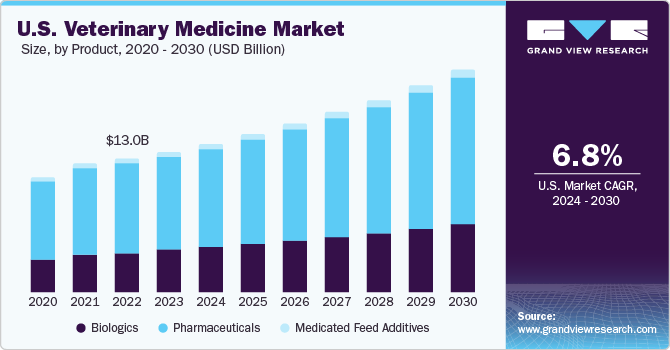

Veterinary Medicine Market Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Animal Type, By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-885-5

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Veterinary Medicine Market Size & Trends

The global veterinary medicine market size was valued at USD 46.51 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030, according to new report published by Grand View Research Inc. The market is driven by increasing demand for animal protein, incidence of diseases in animals, and product launches. Other factors fueling market growth include advancements in veterinary medicine and penetration of pet insurance. For instance, In June 2023, Bimeda Biologicals launched Stimulator 5 + PMH combination vaccine indicated against major Bovine Respiratory Diseases (BRD) in cattle, including Infectious Bovine Rhinotracheitis (IBR), Bovine Respiratory Syncytial Virus (BRSV), Bovine Viral Diarrhea, and Parainfluenza-3 (PI3).

The market witnessed a dampened growth rate during 2019-2020 due to the COVID-19 impact and impact of veterinary diseases such as African Swine Fever. However, as veterinary care services were recognized as essential services in key countries the market surged during 2021. This growth was catalyzed by increased pet adoption, veterinary visits, and pet humanization. In 2022, macroeconomic headwinds such as high input costs, inflation, etc. combined with COVID-19 impact in some key markets (e.g. China) impacted the market adversely. For instance, Elanco reported disruption in its global supply chain along with increased freight costs, less reliable transportation schedules, and shortages of components or raw materials in Q1 2022. Zoetis too reported continued supply chain challenges and the impact of foreign exchange in Q1 2022.

The overall animal health sector including veterinary medicine turned out to be resilient despite many challenges and is expected to grow significantly over the forecast period owing to strong underlying drivers.According to a report by the Australian Bureau of Agriculture and Resources Economics and Sciences, China will represent around 40% of the increase in meat demand by 2050. As per the OECD 2022-2031 agricultural outlook, global pig meat consumption is forecast to reach 129 metric tons in the next 10 years, which is expected to account for one-third of total meat consumption. This increasing consumption is expected to fuel demand for safe food sources highlighting biosecurity and prudent use of veterinary medicines. This is anticipated to propel market growth in the near future.

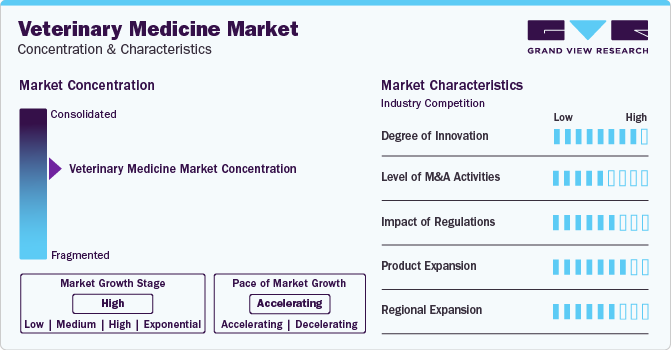

Market Concentration & Characteristics

Advancements in preventive and therapeutic treatments for animals, such as new drugs and procedures, contribute to innovation. Ongoing research and development efforts, collaboration between academia and industry, regulatory frameworks, and the evolving needs of veterinary community and animal owners influence the degree of innovation. As technology and scientific knowledge continue to advance, the veterinary medicine market is likely to see further innovations that improve the quality of care for animals

M&A activities are often initiated by market playersdriven by the desire to achieve economies of scale, improve operational efficiency, expand their geographic reach, or to gain access to new markets and strengthen market presence. In June 2023 for example, EQT, a Swedish investment firm, agreed to acquire Dechra Pharmaceuticals for about USD 5.6 billion. In September 2022, Zoetis acquired an Australian animal health company- Jurox. This expanded Zoetis’ portfolio, R&D and manufacturing capabilities in Australia, and strengthened its anesthetic lineup with addition of Alfaxan for pets

Regulations play a crucial role in shaping and influencing the veterinary medicine market. These regulations are designed to ensure the safety and efficacy of veterinary products, protect animal health and welfare, and safeguard public health. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA), oversee the approval and registration of veterinary medicines. Strict regulatory requirements ensure that products meet safety and efficacy standards before being marketed. The approval process can affect the time and cost of bringing new products to market. The impact of regulations on the market is thus medium to high

Companies are focusing on product portfolio expansion by investing in R&D and partnerships. Market players are involved in diversifying product lines. Companies are expanding their regional reach to increase market presence and share. Increasing international partnerships are expected to enable regional expansion

Product Insights

In 2023, pharmaceuticals segment accounted for the largest revenue share of 67.58% of the market. Pharmaceuticals primarily include anti-inflammatory drugs, parasiticides, anti-infectives, and others. Biologics segment is anticipated to witness the fastest market growth from 2024 to 2030. The growth of this market can be attributed to increasing animal health expenditure, availability of veterinary medicines, R&D activities, product launches by key companies, and the rising prevalence of diseases in animals. For instance, in April 2022, Boehringer Ingelheim launched a new stem cell therapy for horses-RenuTend-indicated for the treatment of tendon and suspensory ligament injuries.

As per estimates by the American Pet Products Association, Inc., pet parents spent about USD 136.8 billion on their companion animals in 2022. This number was notably higher than in 2021 wherein pet owners spent an estimated USD 123.6 billion. Of the USD 136.8 billion spent in 2022, about USD 35.9 billion was attributed to vet care and product sales comprising routine veterinary care, sales of pharmaceuticals and other products through veterinary clinics, and surgical procedures. This trend is expected to continue in the coming years, thus fueling veterinary medicines market growth.

Animal Type Insights

Production Animals segment accounted for the largest revenue share in 2023. This is owing to the high uptake of medicines in livestock sector, need for disease prevention & control, and the intensification of livestock farming, as global population continues to grow, so does the demand for animal products such as meat, milk, and dairy products. This puts pressure on the livestock industry to increase production, leading to a greater need for veterinary medicine to ensure the health and well-being of animals.

Estimated Number of U.S. Households Owning A Pet As Per 2023-2024 APPA National Pet Owners Survey Pet Type U.S. Households in Millions Birds 6.1 Cats 46.5 Dogs 65.1 Horses 2.2 Freshwater Fish 11.1 Saltwater Fish 2.2 Reptiles 6 Small Animals 6.7

The companion animal segment is expected to grow lucratively during the forecast period owing to an increase in pet ownership, humanization of pets, and expenditure of pets. Dogs and cats are the most popular pets. Growing availability of canine and feline medicines, along with a strong R&D pipeline is estimated to propel segment growth in the coming years. In June 2022, Boehringer Ingelheim for example, entered into a research partnership with CarthroniX, a biopharma company, to develop small molecule therapeutics in canine oncology.

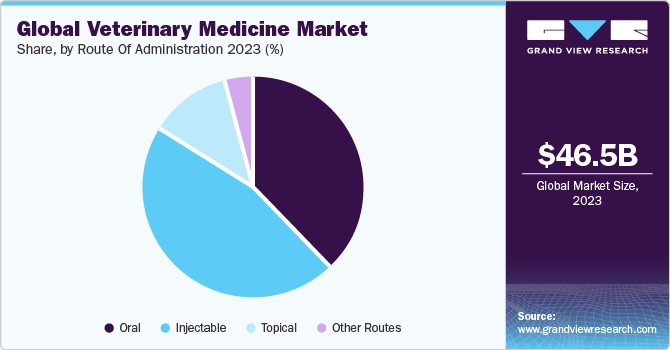

Route Of Administration Insights

Injectable segment dominated the market in 2023. The segment comprises drugs administered via intravenous, intramuscular, & sub-cutaneous route. The availability of numerous injectable medicines, high cost of injections, and benefits associated with the injectable route are some of the key factors driving the market growth. Injectable route facilitates rapid onset of action, precise dosage control, and higher bioavailability of drug contributing to its growing adoption. In May 2023, Zoetis received FDA clearance for Librela- its injectable anti-nerve growth factor (NGF) monoclonal antibody (mAb) for osteoarthritic dogs.

Other routes segment includes inhalational routes and controlled-release implants. This segment is expected to grow at the fastest CAGR from 2024 to 2030 due to increasing availability of products and growing adoption of alternative modes of delivery by livestock farmers & pet parents. REVALOR-XS by Merck & Co., Inc. for instance, is an extended release implant containing trenbolone acetate and estradiolthat improves feed efficiency and increases rate of weight gain in cattle.

Distribution Channel Insights

Veterinary Hospitals & Clinics segment accounted for the largest revenue share in 2023. These facilities play a pivotal role in providing healthcare services to animals and are well-positioned to integrate use of veterinary medicines into a broader spectrum of care, addressing both acute and chronic conditions in animals. Moreover, these facilities typically have in-house pharmacies or partnerships with external pharmacies to dispense prescribed veterinary medicines directly to animal owners. This ensures a seamless process from diagnosis to treatment.

Veterinary hospitals and clinics also build ongoing relationships with pet owners or livestock producers. This fosters trust and communication, creating an environment where clients are more likely to follow prescribed treatment plans. The continuity of care is reinforced by the ability to obtain medications directly from the same facility where the animal receives other veterinary services. E-commerce segment, on the other hand, is estimated to register the fastest CAGR over the forecast period. This is owing to convenience of ordering medicines online, wide product selection, price comparison and competitive pricing offered by e-commerce platforms.

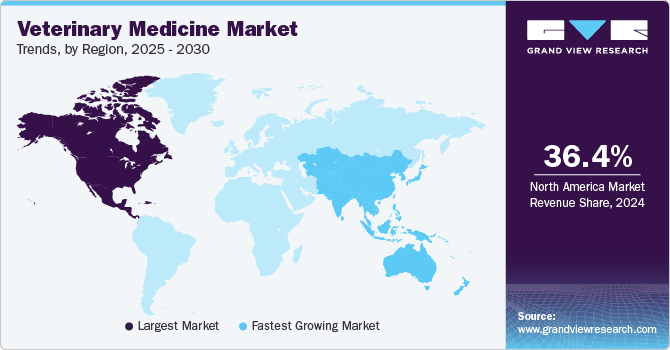

Regional Insights

North America region dominated the market with a revenue share of 32.23% in 2023. This can be attributed to the presence of key companies, high expenditure on pets, pet humanization, and rising awareness about animal disease. For instance, key market players, such as Zoetis; Merck & Co., Inc.; Elanco Animal Health; and Vetbiologics, are headquartered in the U.S. and are undertaking various strategic initiatives to increase their market share. In September 2023, Elanco launched Varenzi-CA1- its U.S. FDA conditionally approved product- to control non-regenerative anemia in felines with chronic kidney disease (CKD).

Asia Pacific is expected to witness fastest CAGR over the forecast period. As economies in Asia Pacific region continue to grow, there is a noticeable increase in the size of the middle-class population, higher disposable incomes, and growing urbanization. This is associated with lifestyle changes, including a growing preference for companion animals. Urban dwellers often seek veterinary care for their pets, contributing to demand for a variety of veterinary medicines, preventive treatments, and healthcare services. Market players have begun to capture opportunities in these emerging markets. In March 2023, for instance, Sun Pharmaceutical Industries Limited headquartered in India acquired a 60% stake in Vivaldis Health And Foods Private Limited specializing in drugs, food supplements, and over-the-counter products for pets.

Europe has some of the world's most stringent animal welfare regulations. Compliance with these regulations necessitates the use of veterinary medicines to ensure the health and welfare of animals, whether they are companion animals or part of the livestock sector. The region is also characterized by a well-developed veterinary healthcare infrastructure. Ongoing technological advancements, including the development of innovative medicines, diagnostic tools, and treatment modalities, contribute to the growth of the market as practitioners adopt new and improved methods of care.

In Latin America, the growth in the livestock sector, including cattle, poultry, and swine, necessitates the use of veterinary medicines for disease prevention, treatment, and overall herd health management. Livestock producers seek effective veterinary solutions to enhance the productivity of their animals and ensure a stable and reliable supply of meat and dairy products to meet the dietary needs of the growing population. In MEA, food security concerns play a crucial role in driving the market. Governments and stakeholders recognize the importance of a robust and sustainable livestock sector to ensure a stable food supply. Veterinary medicines are thus essential tools in maintaining the health and well-being of livestock, preventing disease outbreaks, and supporting the production of safe and abundant animal-derived food products.

Key Companies & Market Share Insights

The presence of several small and large companies leads to a competitive market. These companies offer a wide range of veterinary medicines spanning across segments and target species. Furthermore, market players are engaged in deploying various strategic initiatives, such as R&D, mergers & acquisitions, regional expansion, partnerships, & collaborations, to support their growth objectives. For instance, in July 2022, Dechra Pharmaceuticals acquired Piedmont Animal Health thus expanding its companion animal pharmaceutical product pipeline and pharmaceutical R&D capabilities.

Key Veterinary Medicine Companies:

- Zoetis Inc.

- Boehringer Ingelheim International Gmbh

- Merck & Co., Inc.

- Elanco

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Phibro Animal Health Corporation

- Virbac

- Bimeda Corporate

- Biogénesis Bagó

Recent Developments

-

In November 2023, Virbac acquired a majority stake in a leading Indian poultry vaccines company- Globion. This strengthened the company’s position as a leading animal health player in the Indian poultry vaccines market by extending Virbac India’s poultry portfolio.

-

In October 2023, Merck Animal Health made available its caninized monoclonal antibody- gilvetmab, to board-certified veterinary oncologists in the U.S. The product has received conditional licensing from the USDA’s Center for Veterinary Biologics (CVB) to treat canine melanoma & mast cell cancers.

-

In May 2023, Merck Animal Health received approval for BRAVECTO QUANTUM (fluralaner) in Australia. This makes it the only injectable parasiticide that provides dogs up to a full year of protection against fleas & ticks.

Veterinary Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.98 billion

Revenue forecast in 2030

USD 80.71 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, animal type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Netherlands; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Egypt; Israel

Key companies profiled

Zoetis Inc.; Boehringer Ingelheim International Gmbh; Merck & Co., Inc.; Elanco; Dechra Pharmaceuticals PLC; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Bimeda Corporate; Biogénesis Bagó

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary medicine market report based on product, animal type, route of administration, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

Other Biologics

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

Medicated Feed Additives

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Other Routes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

Norway

-

Denmark

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Egypt

-

Israel

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary medicine market size was estimated at USD 46.51 billion in 2023 and is expected to reach USD 49.98 billion in 2024.

b. The global veterinary medicine market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 80.71 billion by 2030.

b. By region, North America dominated the market in 2023. This can be attributed to the presence of key companies, high expenditure on pets, pet humanization, and rising awareness about animal disease.

b. Some key players operating in the veterinary medicine market include Zoetis Inc.; Boehringer Ingelheim International Gmbh; Merck & Co., Inc.; Elanco; Dechra Pharmaceuticals PLC; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Bimeda Corporate; and Biogénesis Bagó.

b. Key factors that are driving the veterinary medicine market growth include increasing demand for animal protein, incidence of diseases in animals, and product launches.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."