- Home

- »

- Animal Health

- »

-

Veterinary Reference Laboratory Market Size Report, 2018-2025GVR Report cover

![Veterinary Reference Laboratory Market Size, Share & Trends Report]()

Veterinary Reference Laboratory Market Size, Share & Trends Analysis Report By Technology (Clinical Chemistry, Hematology, Immunodiagnostics, Molecular Diagnostics), By Application, By Animal Type, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-590-8

- Number of Pages: 149

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Industry Insights

The global veterinary reference laboratory (VRL) market size was valued at USD 2.350 billion in 2016 and is expected to grow with CAGR of 9.1% during the forecast period. Increase in global prevalence of zoonotic diseases has triggered the demand for animal health diagnostics & monitoring services and is expected to drive market growth over the future period. In addition, zoonotic diseases cause a major public health problem, especially in tropical regions, as these regions lack proper healthcare infrastructure & financial resources.

Zoonotic diseases are classified into bacterial (brucellosis, tuberculosis, and anthrax), viral (yellow fever, HIV infection, rabies, and measles) and parasitic (toxoplasmosis, cysticercosis, and leishmaniasis). Threat of zoonotic infections spread through mosquitoes, ticks, & fleas or contact with animals is high. Zoonotic infections also cause diseases like rabies and Lyme. This is expected to propel the number of reference laboratories being established for the betterment of animal health over the coming years.

Increase in awareness amongst consumers about the need to invest in maintenance of health of animals, especially those in contact with humans, to prevent zoological diseases is expected to fuel the adoption of veterinary diagnostics and thereby propel the VRL market over the future period. In addition, stringent regulations for livestock health in the agricultural sector has kept the demand for laboratory testing services high during the future period.

Emergence of veterinary health information systems in developed economies that enable real-time diagnostics is expected to help researchers in the development of therapeutics. Veterinarians are widely adopting tests that measure blood count and chemistry panels. In addition, increase in use of veterinary software in laboratories is another factor propelling the industry growth.

Technology Insights

VRLs are using various technologies for the detection and monitoring of various veterinary related diseases. The clinical chemistry technology segment dominated the industry owing to its wide applications in disease diagnosis and monitoring. In addition, demand for clinical chemistry analyzers to assess general veterinary health profiles has increased over the past few years, which is contributing to the dominance of this segment.

In clinical chemistry tests, bodily fluids, such as blood & urine, are analyzed to evaluate the function & capabilities of the entire metabolism and organs. These parameters offer important information related to disease diagnosing and monitoring. This technology involves sample collection, analysis, and consultation. Instruments such as automatic analyzer, immulite automated chemiluminescent immunoassay system, osmometer, and pH meter are used in this procedure.

This segment is anticipated to witness significant growth over the coming years owing to increase in initiatives for veterinary health care and availability of cost-efficient measures for diseases diagnosis & monitoring. Product categories included in clinical chemistry analyzers are instruments and consumables. The consumables segment is expected to witness lucrative growth over the forecast period.

Increase in adoption of immunodiagnostic kits for veterinary use such as advanced diagnostic platforms and immunoassay formats are expected to drive segment growth. Growing demand for animal-derived food and companion & livestock animals is anticipated to fuel the demand for immunodiagnostics tests for veterinary health over the forecast period.

Application Insights

The clinical pathology segment accounted for the largest revenue share as of 2016 owing to wide adoption of pathology tests for routine pet health monitoring. Clinical pathology laboratories offer routine blood analysis tests of animals for referring veterinarian clientele and the veterinarians. These laboratories offer a variety of tests, such as coagulation profiles, chemistry analysis, complete blood cell count, blood gas analysis, cross-match, endocrine testing, urinalysis, and cytology studies. They also offer consultancy services by veterinary clinical pathologists.

The toxicology segment is anticipated to witness substantial growth over the coming years owing to growing demand for toxicology testing services. Stringent food safety regulations are expected to boost the adoption of these tests to maintain veterinary and human healthcare. Veterinary toxicology involves identification of poison source & circumstances of exposure, diagnosis of the type of poisoning, treatment, and application of management or educational strategies to prevent poisoning.

There is an increased requirement to study veterinary toxicology to avoid livestock loss due to contamination. Instances such as melamine contamination in swine feed and pet jerky treats across the world that caused severe illness & deaths of animals demonstrate the importance of veterinary toxicology in animal health and food safety. In addition, increase in instances of lead, mercury, arsenic, and cadmium being detected in popular pet foods is anticipated to boost the adoption of toxicology testing over the coming years.

The productivity testing segment is expected to witness lucrative growth in the following years owing to the rising demand for highly productive animals. In addition, rise in R&D investments coupled with the introduction of advanced products is expected to boost the development of novel products and contribute toward segment growth. For instance, in June 2016, IDEXX Laboratories introduced Rapid Visual Pregnancy Test, a point-of-care test for cattle, which helps identify an open cow after 28 days of breeding, and assists in improving reproductive efficiency.

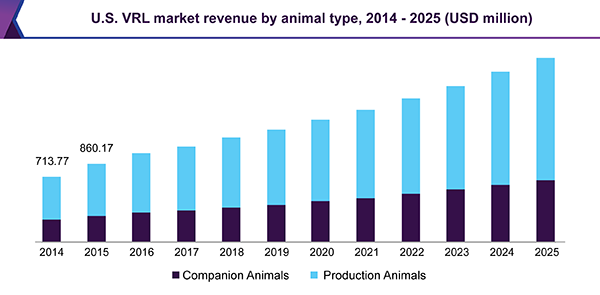

Animal Type Insights

Production animals dominate the industry in terms of share in the animal type segment in 2016, which can be attributed to high consumption of milk, meat, and other animal products. The companion animals segment is expected to grow at a lucrative rate during the forecast period owing to the increase in animal ownership, as various studies indicate that bonding with animals result in health benefits. Increased initiatives by the government for animal welfare is one of the key contributing factors.

Increase in government initiatives for maintenance of food safety and sustainability across the globe is expected to fuel the adoption of VRL for animal health. Regulatory authorities across the globe aim to achieve total food security. This is expected to boost massive food production, which results in greater demand for production animals. The regulations focus on sustainability of food products. This can be accomplished through maintenance of animal health through veterinary lab services.

The companion animal segment is expected to grow at a lucrative rate during the forecast period owing to increase in ownership of companion animals and awareness & demand for efficient animal care. An increase in animal ownership has been observed due to associated health benefits, such as reduction in blood pressure, greater psychological stability, and reduced frequency of cardiac arrhythmias & anxiety attacks, which helps improve the overall well-being of humans.

In order to maintain the well-being of companion animals, adoption of hematology and immunodiagnostic is increasing, thereby, serving as a key contributing factor to the segment growth. Moreover, prominent industry players are consistently striving to develop differentiated and highly efficacious animal products to create growth prospects for this segment.

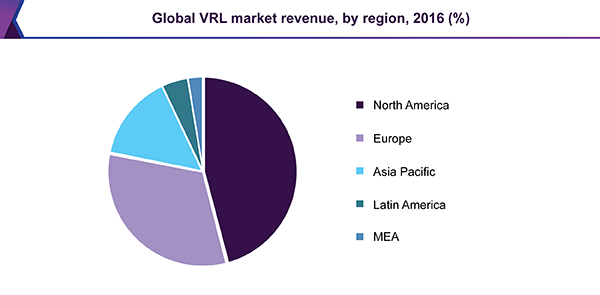

Regional Insights

The market was dominated by North America and is expected to retain its position throughout the forecast period. Presence of prominent players, advanced healthcare infrastructure, and high healthcare expenditure are some of the factors responsible for the greater share of the segment.

The global market is experiencing accelerated growth owing to factors, such as increase in the number of reported veterinary diseases & veterinary health organizations like World Small Animal Veterinary Association and rise in animal care expenditure.

The Asia Pacific is anticipated to witness lucrative growth during the forecast period owing to the presence of unmet clinical needs, increase in healthcare expenditure, and the establishment of VRLs by major global players in this region. The industry is driven by increased investment in R&D by global market players as well as consistent efforts for commercialization of veterinary diagnostics & monitoring services at relatively lower prices.

In addition, the urgent need to curb high incidence of zoonotic diseases and manage disease outbreaks, such as swine influenza and Ebola in developing countries are expected to propel the market growth. Rise in economic stability in emerging economies, such as China & India, as well as growing number of animal welfare government & private organizations are promoting the adoption of the animal health products, thereby fueling market growth.

Competitive Insights

Industry rivalry is expected to remain at a high level over the forecast period. Some of the major industry players are IDEXX Laboratories, Inc.; VCA, Inc.; GD Animal Health; Greencross Ltd.; Zoetis; Gribbles Veterinary; Phoenix Lab; Neogen Corporation; and ProtaTek International, Inc. The industry is witnessing fierce competition owing to increasing demand for VRLs.

Industry players are adopting extensive growth strategies, such as strategic alliances, product differentiation, and expansion of product portfolio in an attempt to a capture larger share of the market. Furthermore, development of high quality and sustainable products by major market players is expected to keep industry rivalry at a high level.

Key factors contributing toward industry growth are sudden disease outbreaks and emergency situations, which propels the demand for VRLs for pet health. Opportunities for emerging players are expected to remain at a moderate level as is requires high investment and compliance with stringent regulatory approval procedures.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, UK, Germany, Japan, China, India, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue growth at global, regional, & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global veterinary reference laboratory market on the basis of technology, application, animal type, and region:

-

Technology Outlook (Revenue, USD Million, 2014 - 2025)

-

Clinical Chemistry

-

Hematology

-

Immunodiagnostics

-

ELISA

-

Lateral Flow Rapid Tests

-

Others

-

-

Molecular Diagnostics

-

PCR

-

Microarrays

-

Others

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Clinical Pathology

-

Toxicology

-

Productivity Testing

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Production Animals

-

Companion Animals

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."