- Home

- »

- Animal Health

- »

-

Veterinary Services Market Size And Share Report, 2030GVR Report cover

![Veterinary Services Market Size, Share & Trends Report]()

Veterinary Services Market Size, Share & Trends Analysis Report By Service Type (Non-medical, Medical), By Animal Type (Companion, Production), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-551-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global veterinary services market size was estimated at USD 120.12 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.45% from 2023 to 2030. Some of the key factors contributing to the market growth are increasing consumption of animal-derived products, growing pet expenditure, humanization of pets, increasing initiatives by key market participants, and rising focus on sustainable animal husbandry. In April 2023, Petco, for instance, launched the “Clean Grooming Initiative” line of grooming services and products without phthalates, parabens, and chemical dyes, across its 1,350 pet care centers. With this, the company became the 1st omnichannel pet retailer in the U.S. to provide designated clean grooming services & products.

In 2020, the COVID-19 pandemic had a negative impact on the market. Veterinary service providers faced difficulties in terms of offering appropriate and adequate services while keeping their staff safe from infection. Although the government of various countries, such as the U.S., recognized veterinary medical services to be essential, other non-medical services, such as grooming and artificial insemination, faced postponement or cancellation. For instance, according to an article published by the National Library of Medicine, in June 2020, only 24% of the surveyed emergency care veterinary hospitals reported full business continuity during the pandemic. However, the pandemic also positively impacted the veterinary industry by setting new changes & trends.

Some of the noteworthy trends include a sudden increase in the ownership rates of cats & dogs, animal humanization trends, an increase in awareness among people about disease prognosis for timely treatments, and the growth of digital platforms. Therefore, despite the challenges faced by veterinary hospitals during the initial wave of the pandemic, revenue growth was reported positively by hospitals in a few developed countries after the first half of 2020 followed by 2021. For instance, according to the data published by the Veterinary Hospital Manager Association (VHMA), revenue in the U.S. veterinary industry grew in the latter half of 2020 by 4.5%, cumulatively from 2019 to 2020.

As various market stakeholders spend more and more money on ensuring food safety and meeting global demand, the livestock sector is projected to witness increased investment from both public and private players. Pet parents, too, are increasing spending on their pet’s health and services, which contributes to the market revenue. According to the American Pet Products Association (APPA), for example, overall spending in the U.S. pet industry was estimated at USD 136.8 billion in 2022. This was notably greater than the USD 123.6 billion estimated in 2021. Hence, the growing expenditure is expected to propel the adoption of veterinary services in the coming years.

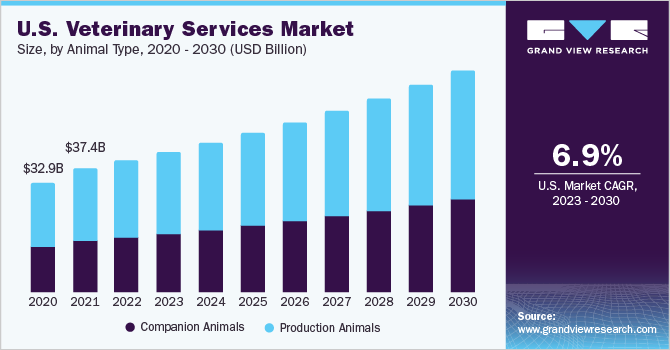

Animal Type Insights

The companion animal segment is anticipated to grow at the fastest CAGR of over 7.5% during the projected period. Companion animals, such as dogs, cats, birds, horses, and small mammals, have become an integral part of many households around the world, leading to a growing demand for companion animal veterinary services. The market is driven by factors, such as increasing pet ownership, growing awareness about pet health & nutrition, and rising pet humanization. The production animal segment dominated the market with the largest revenue share in 2022. The segment is further divided into cattle, poultry, swine, and other livestock species, such as goats, sheep, and aquaculture.

Livestock veterinary services are critical in maintaining animal health and ensuring the production of high-quality & safe food products for human consumption. The production animal veterinary services market is expected to continue to grow in the coming years, driven by factors, such as the increasing demand for animal protein and the rising focus on sustainable agriculture practices. According to the Food and Agriculture Organization (FAO) projections, by 2050, the global food demand is anticipated to increase by 70%. The increasing production and consumption of animal-derived products has thus led to increased attention to the biosecurity and safety of the food sources, with crucial diagnosis and preventative care measures.

Service Type Insights

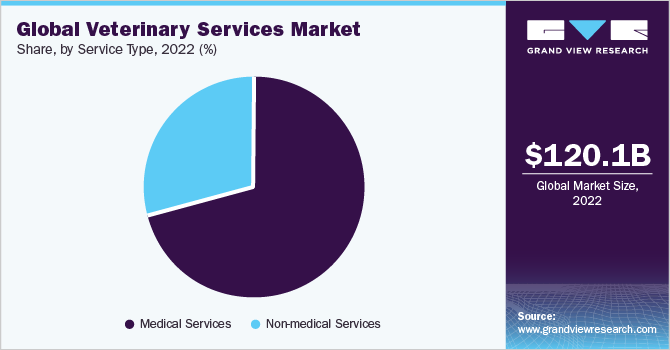

Based on the service types, the global market is bifurcated into medical and non-medical services. The non-medical services segment is anticipated to grow at the fastest CAGR of more than 7.5% over the forecast period. The segment comprises several non-medical services, such as boarding, sitting, grooming, travel, and funeral. The segment also includes livestock non-medical care industries, such as artificial insemination (AI), which are gaining more traction in recent years owing to increased government support. Furthermore, various strategic initiatives implemented by key players in the market are boosting the segment’s growth.

The medical services segment dominated the market with the largest revenue share in 2022owing to the high prevalence of zoonotic diseases and significant measures undertaken to control the outbreaks, coupled with increased access to veterinary medical services in developing nations. Since the emergence of the COVID-19 pandemic, concerns over animal-to-animal and animal-to-human disease transmission have increased the uptake of diagnostic and preventative care services among domestic animals. The WHO is involved in various cross-sectoral activities to address health threats at the human-animal-ecosystem interface. These are some of the factors contributing to the substantial share of the segment.

Regional Insights

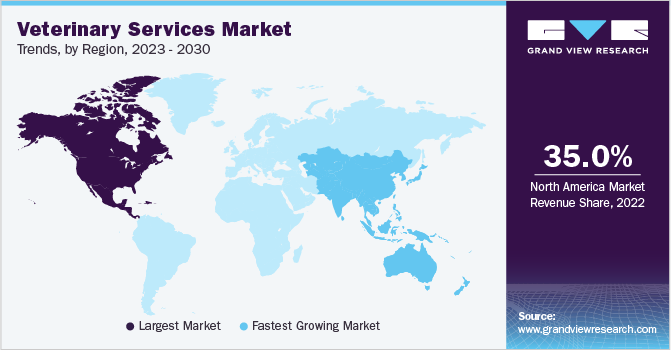

North America accounted for the highest revenue share of more than 35% in 2022. Definitive measures undertaken by various government animal welfare organizations inclined toward the overall improvement of veterinary services in the U.S. and Canada are the key drivers ofregional market growth. In the U.S., the expansion of new animal education programs, including non-traditional programs, seeking accreditation is anticipated to improve access to these services, therefore widening the scope for the adoption of veterinary services over the coming years. On the other hand, Asia Pacific is projected to be the fastest-growing regional market over the forecast years.

The exponential growth is a result of the growing pet and livestock population in the developed and emerging economies in this region. Since most Asian countries are dependent on agricultural production and exports, there is high availability of food production animals, thus the market is expected to witness significant growth. Furthermore, the increased prevalence of zoonotic diseases coupled with growing awareness about livestock disease preventative care is fueling the market growth in the region. In Japan, the proportion of veterinarians catering to pets and other small animals is increasing, thus creating a potential growth opportunity for the companion services sector. The demand for veterinarians and their services is expected to increase in developing countries like India owing to the high demand for products, such as meat and milk, because of the rising population, resulting in livestock rearing.

Key Companies & Market Share Insights

The market is competitive and largely fragmentedwith the presence of a significant number of small-and large-scale service providers. These companies are constantly involved in implementing strategic initiatives, such as collaborations, mergers & acquisitions, and service & regional expansions. For instance, in February 2023, the veterinary practice of Dr. Paulus in Saarbrücken, Germany, was merged into IVCEvidensiaDACH Group, which expanded the company’s regional presence and customer base. In June 2022, Mars Inc. announced the launch of MARS PETCARE BIOBANK to be the largest, most comprehensive real-world study of its type, which will help in disease prevention, diagnosis, and treatment. Some of the prominent players in the global veterinary services market include:

-

CVS Group Plc

-

Mars Inc.

-

National Veterinary Associates

-

Pets at Home Group PLC

-

Greencross Vets

-

Fetch! Pet Care

-

IVC Evidensia

-

A Place for Rover, Inc.

-

PetSmart LLC

-

Airpets International

Veterinary Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 128.66 billion

Revenue Forecast in 2030

USD 212.73 billion

Growth rate

CAGR of 7.45% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Animal type, service type, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

CVS Group Plc; Mars Inc.; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Services Market Report Segmentation

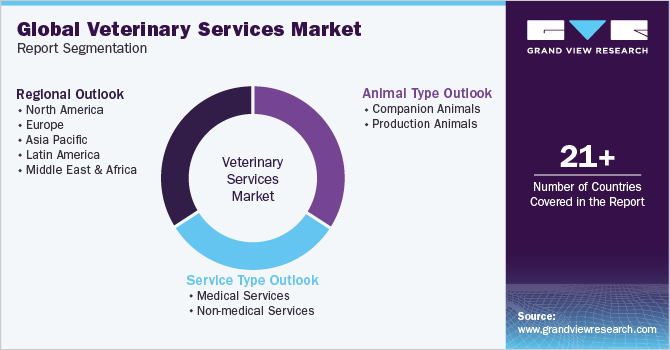

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary services market report based on animal type, service type, and region:

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Services

-

Diagnosis

-

In-vitro Diagnosis

-

In-vivo Diagnosis

-

-

Preventative Care

-

Treatment

-

Consultation

-

Surgery

-

Others

-

-

-

Non-medical Services

-

Pet Services

-

Livestock Services

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary services market size was estimated at USD 120.12 billion in 2022 and is expected to reach USD 128.66 billion in 2023.

b. The global veterinary services market is expected to grow at a compound annual growth rate (CAGR) of 7.45% from 2023 to 2030 to reach USD 212.73 billion by 2030.

b. North America accounted for the highest revenue share of more than 35% in 2022. This substantial share is owing to the presence of a large pet population with respectively high expenditure on animal healthcare services. In addition numerous measures undertaken by government & animal welfare organizations inclined towards improving veterinary services are further supporting the substantial share.

b. Some key players operating in the global veterinary services market include CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International, among others.

b. Some of the key factors propelling the market growth includes, increasing animal welfare activities, rising need to enhance food security, increasing pet populations, growing awareness about animal health coupled with growing timely diagnosis & treatments, and increasing expenditure on animal healthcare services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."