- Home

- »

- Animal Health

- »

-

Veterinary Telemetry Systems Market Size, Share Report, 2030GVR Report cover

![Veterinary Telemetry Systems Market Size, Share & Trends Report]()

Veterinary Telemetry Systems Market Size, Share & Trends Analysis Report By Animal Type (Small, Large), By Product (Wearables, Accessories), By End-use, By Mobility, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-965-2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

The global veterinary telemetry systems market size was estimated at USD 271.9 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.59% from 2022 to 2030. Increasing demand for remote patient monitoring in veterinary care, product R&D, number of veterinary surgeries, availability of refurbished equipment, rising pet expenditure, and insurance coverage are some of the key factors fueling the market growth. For instance, Invoxia, a French company, is developing a biometric health collar for dogs with an estimated product launch in the latter half of 2022. The market was notably impacted during 2020 due to the COVID-19 pandemic with a decrease in business activities, reduced sales growth, and logistical challenges.

The drop in veterinary patient visits and hospital admissions further impacted the veterinary practice business. The impact has reduced over time as governments and market stakeholders took necessary measures to ensure business continuity. As per the Ackerman Group, COVID-19 is expected to have a lesser economic impact going forward, even in case of another outbreak or a new variant. However, veterinary practices have been affected by fluctuating valuations due to macroeconomic trends, such as stubbornly high inflation, rising interest rates, a plunging stock market, the war in Ukraine, and a slowdown in veterinary revenue & visit growth. Although the macro-economic environment is foggy leading to uncertainty and driving investors to ‘safe havens’, the pet care industry is anticipated to remain less affected.

This is because it is considered one of those safe havens by investors and market participants that can thrive through all economic cycles. The macro-economic trends may also put pressure due to significant labor costs on pet company margins. Increasing technological advancements, product upgrades, and R&D activities by market players are major drivers for the industry. In France, Invoxia is developing a smart collar for dogs with connected activity, health, and GPS tracking. The parameters to be measured by the device include heart rate, respiratory rate, sleep, and activity, among others. In June 2020, AniV8, Inc. partnered with Elanco to evaluate its wearable health monitor in research settings. The company’s product helps detect and monitor osteoarthritis pain in dogs and cats.

Animal Type Insights

On the basis of animal types, the global industry has been further bifurcated into small and large animals. The small animal type segment dominated the industry in 2021 and accounted for the maximum share of more than 78.70% of the overall revenue. The segment is anticipated to expand further at the fastest CAGR during the forecast period. This is owing to most companies offering products catering to small animals comprising dogs, cats, and others. The SM100 veterinary patient monitor offered by Mano Médical, for instance, is developed specifically for cats, dogs, and other similarly-sized veterinary patients.

The device is intended for vital signs monitoring, anesthesia monitoring, ECG, blood pressure testing, and temperature monitoring, among others. The key factors contributing to the growth of the small animal segment include the increasing companion animal population, high pet expenditure, adoption of pet insurance plans, and rising pet humanization. The large animal type segment is also estimated to show notable growth in the near future, driven by product R&D for horses. The U.S.-based PonyUp Technologies Inc.’s VetCheq monitor, for instance, is a patented system that monitors horse health remotely and non-invasively. The device is fastened on the leg in a specialized wrap boot and helps monitor cardiac and respiratory function.

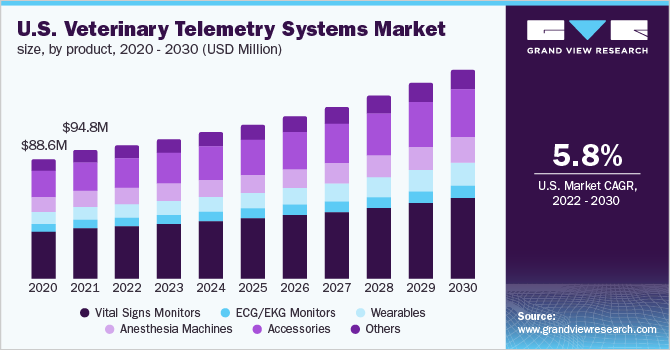

Product Insights

On the basis of products, the global industry has been further sub-segmented into vital signs monitors, ECG/EKG monitors, wearables, anesthesia machines, accessories, and others. The vital signs monitors product segment dominated the global industry and accounted for the highest share of more than 40.65% of the overall revenue in 2021. Vital signs monitors, also referred to as multi-parameter monitors and patient monitors, are the most used products for veterinary monitoring in clinics and hospitals. This is mainly because of the multiple parametric measurement functions offered by these devices.

Some monitors feature certain standard parameters while others include additional features, such as thermal recording, capnography, 2-IBP, and anesthesia monitoring. However, the high cost of premium monitors can restrain the segment growth. EDAN Instruments, Inc.’s veterinary monitor, for example, costs between USD 800 to 5,000 depending on the features. Costs can also vary based on connectivity, such as the Bluetooth-enabled PC VetGard. The wearables segment, on the other hand, is projected to expand at the fastest CAGR during the forecast years. This is owing to the entry of start-ups and research & development activities to introduce innovative pet wearable monitors to the market.

Mobility Insights

On the basis of mobility, the global industry has been further sub-segmented into portable, floor standing, and compact/tabletop. The compact or table-top telemetry systems are mainly used in hospital settings and clinics and thus, the segment accounted for the highest share of more than 34.60% of the overall revenue in 2021. LifeSense VET by Nonin, for instance, is a tabletop multi-parameter monitor designed exclusively for veterinary use. It measures EtCO2, SpO2, respiration, FiCO2, and pulse rate of intubated animals. The widescreen display offers a user-friendly touch panel for varied settings and adjustments.

On the other hand, as most of the recently launched veterinary telemetry systems are portable, the portable segment is estimated to register the fastest growth rate during the forecast period. Portable veterinary telemetry systems include hand-held monitors, wearable health trackers, fingertip devices, etc. Established companies are also releasing travel-friendly portable versions of their devices and equipment to provide more flexibility and control to the veterinarian. Veterinary Pulse Oximeter by eKuore, for example, functions as a substitute multi-parameter monitor during post-op and in low-risk settings.

Application Insights

On the basis of applications, the global industry has been further categorized into respiratory, cardiology, neurology, and others. The respiratory segment accounted for the largest share of more than 35.90% of the overall market in 2021. This is owing to the majority of telemetry systems offering some kind of respiratory parameter measurement, including respiratory rate, SpO2, CO2, etc. Respiration rate measurement is one of the core vital signs measured to track the body’s most basic functions. Respiratory monitoring can thus help identify pets with a risk of developing congestive heart failure and significant heart disease before the condition develops into an emergency.

The cardiology and neurology segments are also anticipated to grow notably in the coming years. The others segment comprising continuous glucose monitoring devices for chronic disease monitoring and other such devices is expected to expand at the fastest CAGR during the forecast period. The University of Georgia, U.S., has been offering iPro continuous glucose monitoring devices for dogs and cats since 2013. The device features a small disposable sensor and a recorder. The sensor is inserted under the animal’s skin to read blood glucose levels. The device records readings every five minutes for a period of 3 to 5 days.

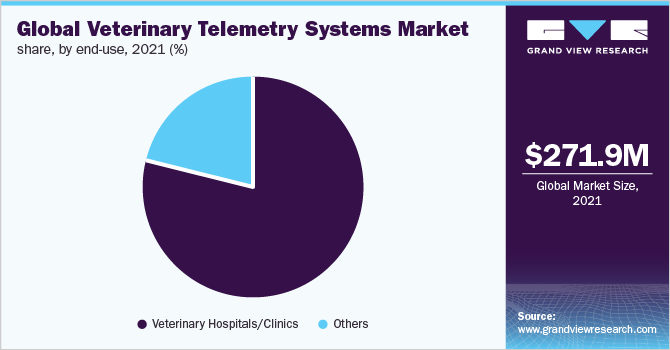

End-use Insights

The veterinary hospitals/clinics end-use segment dominated the industry in 2021 and accounted for the maximum share of more than 78.60% of the overall revenue. The others segment, which includes veterinary research institutes and others, is expected to register the fastest CAGR from 2022 to 2030. Veterinary hospitals/clinics are the primary point of consultation and care delivery for pets. These facilities are also increasingly adopting vital signs monitors and other telemetry systems to improve patient outcomes. Furthermore, as most surgeries and procedures requiring anesthesia and intubation are conducted within the hospital and/or clinic settings, the segment is projected to maintain its dominant position in the coming years.

Pemberton Veterinary Hospital in Canada, for example, monitors heart rate, blood pressure, oxygen saturation, respiratory rate, end-tidal carbon dioxide, and body temperature in anesthetized pets. Another major factor propelling the growth of this segment is that most of the key companies are targeting hospitals and clinics to market their line of veterinary monitors. Bionet, for instance, offers a range of multi-parameter monitors to companion animals or equine clinics. The benefits provided include ease of use, customizable settings, 4 years warranty, and no need for reconfiguration.

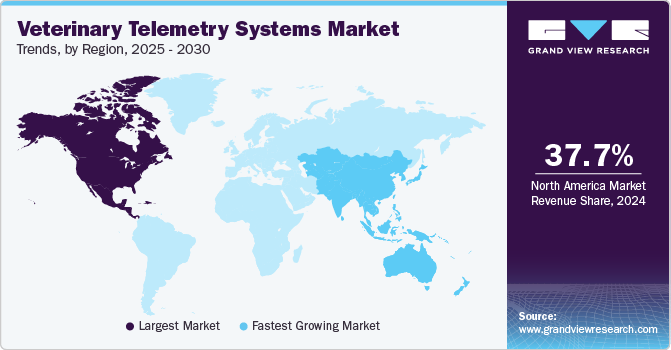

Regional Insights

On the basis of geographies, the global industry has been further divided into North America, Asia Pacific, Middle East & Africa, Latin America, and Europe. North America accounted for the largest share of more than 38.30% in 2021 of the overall revenue. This is owing to advanced veterinary healthcare infrastructure, rising adoption of pet insurance, and strategic initiatives by key players. U.S. VetMeasure, Inc., for example, is developing a smart harness called MeasureON for continuous health monitoring of companion animals in real-time. This includes monitoring vital signs, such as temperature, heart rate, and respiratory rate, through Wi-Fi and the VetMeasure app.

The Asia Pacific region, on the other hand, is projected to register the highest growth rate during the forecast years. The fast growth of this region can be attributed to the improving veterinary healthcare facilities and services, an increasing number of local companies, and the rapidly growing pet population. In addition, the presence of major industry participants in APAC countries supports the growth. For instance, Mindray, Shenzhen Comen Medical Instruments Co., Ltd., Lepu Medical Technology, and Promed Technology Co., Ltd., are headquartered in China. Bionet, another key player, is based in South Korea.

Key Companies & Market Share Insights

The industry is fragmented with the presence of numerous companies in developed and developing economies. This intensifies the industry competition and companies are involved in furthering their industry presence and position through various strategic initiatives. These include product advancements, distribution partnerships, sales & marketing activities, regional expansion, partnerships, and mergers & acquisitions. For instance, in January 2022, ICU Medical Inc. completed the acquisition of Smiths Group plc’s Smiths Medical. This expanded ICU Medical’s portfolio with key product lines, such as devices & equipment for vital signs monitoring, ventilation, and anesthesia delivery, among others. Some of the key players in the global veterinary telemetry systems market include:

-

DRE Veterinary, an Avante Health Solutions Company

-

Medtronic

-

Shenzhen Mindray Animal Medical Technology Co., Ltd.

-

Nonin

-

Masimo

-

Dextronix

-

Digicare Biomedical

-

Midmark Corp.

-

Bionet

-

Smiths Medical (ICU Medical)

Veterinary Telemetry Systems Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 285.25 million

Revenue forecast in 2030

USD 475.27 million

Growth rate

CAGR of 6.59% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, application, mobility, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; South Africa

Key companies profiled

DRE Veterinary; Medtronic; Shenzhen Mindray Animal Medical Technology Co., Ltd.; Nonin; Masimo; Dextronix; Digicare Biomedical; Midmark Corp.; Bionet; Smiths Medical (ICU Medical)

Customization scope

Free report customization (equivalent upto to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

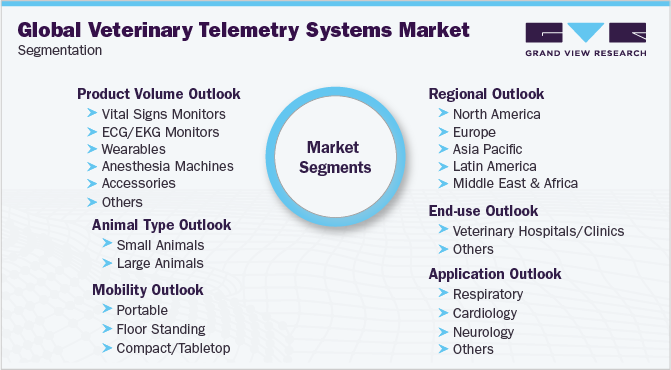

Global Veterinary Telemetry Systems Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global veterinary telemetry systems market report on the basis of animal type, product, mobility, application, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Small Animals

-

Large Animals

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Vital Signs Monitors

-

ECG/EKG Monitors

-

Wearables

-

Anesthesia Machines

-

Accessories

-

Others

-

-

Mobility Outlook (Revenue, USD Million, 2017 - 2030)

-

Portable

-

Floor Standing

-

Compact/Tabletop

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Respiratory

-

Cardiology

-

Neurology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Veterinary Hospitals/Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary telemetry systems market size was estimated at USD 271.9 million in 2021 and is expected to reach USD 285.25 million in 2022.

b. The global veterinary telemetry systems market is expected to grow at a compound annual growth rate of 6.59% from 2022 to 2030 to reach USD 475.27 million by 2030.

b. North America accounted for the largest revenue share of over 35% in 2021. This is owing to advanced veterinary healthcare infrastructure, rising adoption of pet insurance, and strategic initiatives by key players.

b. Some key players operating in the veterinary telemetry systems market include DRE Veterinary, Medtronic, Shenzhen Mindray Animal Medical Technology Co., LTD., Nonin, Masimo, Dextronix, Digicare Biomedical, Midmark Corporation, Bionet, and Smiths Medical (ICU Medical).

b. Key factors that are driving the veterinary telemetry systems market growth include increasing demand for remote patient monitoring in veterinary care, product R&D, number of veterinary surgeries, availability of refurbished equipment, rising pet expenditure, and insurance coverage.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."