- Home

- »

- Animal Health

- »

-

Veterinary X-ray Market Size, Share & Growth Report, 2030GVR Report cover

![Veterinary X-ray Market Size, Share & Trends Report]()

Veterinary X-ray Market Size, Share & Trends Analysis Report By Solutions (Equipment, Accessories, PACS), By Animal Type, By Technology, By Type (Digital, Analog), By Portability, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-724-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Veterinary X-ray Market Size & Trends

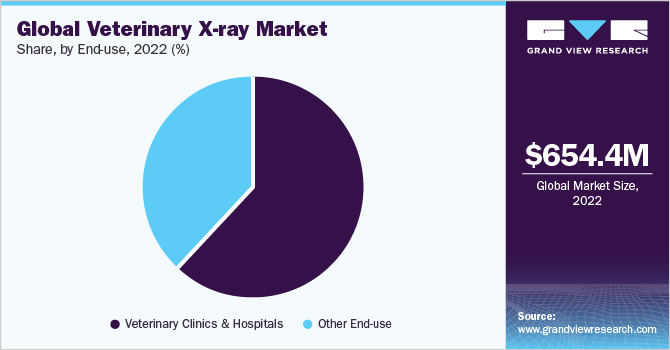

The global veterinary x-ray market size is estimated at USD 654.39 million in 2022 and is expected to grow at a lucrative compound annual growth rate (CAGR) of 6.31% over the forecast period. Demand for veterinary X-rays has increased due to a greater emphasis on animal health innovation, a greater need for diagnostics, increased pet adoption, and increased adoption of radiography in veterinary orthopedics, dentistry, and in several other indications. Furthermore, the increasing incidence of zoonotic diseases has increased the demand for effective diagnostic solutions, which is expected to drive global market growth. Moreover, technological advancements in X-ray diagnostics are further expected to boost adoption. For instance, in September 2022, SK Telecom from Korea launched an AI based diagnosis assistance X-ray service called X Caliber, capable of delivering quick analysis to the veterinarian.

The emergence of covid-19 had an impact on the entire healthcare sector, including veterinary medicine. The covid-19 was found to have slightly halted the growth of the market since several non-essential surgeries are restricted across the globe during the pandemic. Furthermore, strict restrictions on the transportation of individuals and goods led to a restricted patient influx in veterinary centers. Similarly, the shortage of skilled veterinarians, combined with suspended/postponed elective surgeries, significantly disrupted the activities of veterinary facilities, having a slightly negative impact on market providers.

Moreover, the pandemic has risen pet ownership in some countries, resulting in even more animal care delivery, which had increased the demand for veterinary diagnostic testing. For instance, the American Society for the Prevention of Cruelty to Animals (ASPCA) reported in May 2021 that one out of each five families had adopted a cat or dog since the early stages of the COVID-19 pandemic. Adoptions like these during the pandemic brought more attention to companion animal diagnosis and treatment. As a result, it is expected that it will boost the demand for the market during the forecast period.

In veterinary medicine, advanced imaging modalities such as digital radiography and X-ray rooms are quickly becoming popular to facilitate the prevention of injuries, early diagnosis, and detection. Veterinarians prefer digital radiography to evaluate complex diseases in animals. The rising popularity of pet ownership is increasing demand for effective treatment options, and thus demand for veterinary X-rays is expected to rise during the forecast period.

Similarly, radiography is one of the most common diagnostic tests covered by pet insurance. Thus, rising pet insurance adoption and increased awareness of the various diagnostic and treatment options available for pets are some of the factors driving the market growth. For instance, according to the North American Pet Health Insurance Association's (NAPHIA) statistics published in 2023 show that over 5.36 million pets were insured in North America.

Furthermore, in the veterinary radiography market, there are numerous players, and several of these players have been using pet insurance to encourage the adoption of their products. In addition, the number of new entrants has increased recently in the market. As a result, the involvement of key players in developing innovative products in collaboration with pet insurance companies is expected to boost the market growth.

Animal Type Insights

The small animal segment dominated the global veterinary x-ray market by animal type in 2022 with a share of over 71.00%. While the small animal segment is also expected to grow the fastest at a rate of about 6.56% in the coming years. The growing companion animal population, rising pet care expenditure, growing adoption for pet insurance, and technological developments in imaging modalities for small animals all contribute to this segment's growth.

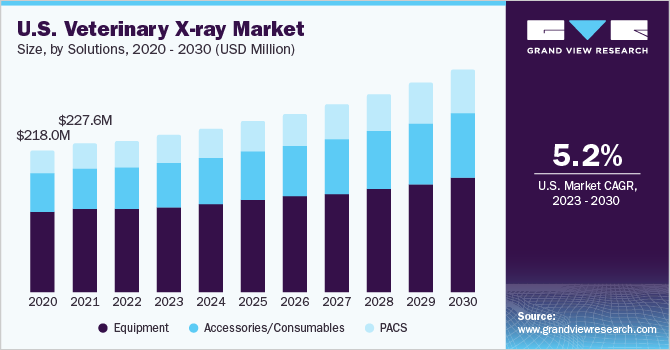

Solutions Insights

By solutions, equipment held the largest share of the market in 2022. Key factors attributing to the high share include rising demand for X-ray equipment. Since x-ray imaging equipment is a fundamental device, its adoption is expected to rise over the forecast period. Additionally, these instruments help veterinarians detect bone diseases, and fractures in animals, due to their increased sensitivity and low operating costs. Thus, the demand for equipment is expected to rise during the forecast period.

While the PACS segment is the fastest-growing segment with a CAGR of 8.30% during the forecast period. This is due to several advantages of PACS in veterinary radiography, such as more efficiently accessing, storing, and sharing images, which creates direct and cascading advantages.

Portability Insights

The fixed segment dominated the global market by portability in 2022 owing to the wide usage of this equipment by veterinarians. The Mobile segment is estimated to register the highest CAGR of over 6% in the coming years owing to the wide usage of such devices by veterinarians.

This is due to the advantages of using these devices, which include their user-friendliness, lightweight, and easy integration with digital equipment. These radiography units are useful for patients who are unable to visit radiology facilities.

Technology Insights

The computed radiography segment dominated the global veterinary x-ray market by technology in 2022 with a share of about 46.07%. The digitization of clinical data has become extremely important in veterinary science, requiring the use of advanced methodologies such as CR for animal diagnostic testing. Similarly, the use of computed radiography in small animals and the equine industry is expanding due to the numerous benefits of computed radiography. Furthermore, some benefits like CR allow for the visualization of bone detail as well as soft tissues in a single image is expected to drive the segment growth.

Digital radiography is a newer technology that is becoming more common in veterinary medicine and has numerous applications in veterinary medicine. This segment is anticipated to witness the fastest CAGR due to its advantages such as the potential to centrally store as well as quickly search patient images and also enable images to be shared quickly through the internet. This has improved radiology workflow by eliminating many manual steps, like retrieving prior studies and increasing productivity and point of care for patients on the farm.

Application Insights

The orthopedics and trauma segment dominated the global veterinary x-ray market by application in 2022 with a share of about 40.00%. The high incidences of bone fractures in small animals are a key factor contributing to segment growth. Road traffic accidents were found to be the leading cause of bone fractures among companion animals. Furthermore, the rise in the number of bone and joint injuries in animals, the high demand for accurate diagnostics, and an increase in the number of animal care facilities are also supplementing segment growth.

Respiratory and gastrointestinal are the fastest-growing segments with a rate of over 6% owing to the growing adoption of digital X-rays in the gastrointestinal tract (stomach, intestines, and colon), and respiratory tract (lungs) disease diagnosis in animals.

Type Insights

The digital segment dominated the global market by type in 2022 and is the fastest growing segment due to several advantages of digital x-ray technology over conventional x-ray techniques.

Associated advantages of using digital devices includes shorter capture time, more efficiency, as well as the production of clearer, more detailed images. Furthermore, this technology enables the production of images within a few seconds of exposure, reducing direct radiation exposure. These factors contribute to the lucrative future growth of digital radiography.

End-use Insights

Veterinary clinics & hospitals dominated the market by end-use in 2022 and are expected to expand significantly in the coming years. The high demand for X-ray equipment in animal healthcare facilities is largely driven by the need for quick, precise, and cost-effective diagnostic tools in veterinary clinics & hospitals.

Furthermore, growing collaborations between manufacturers and veterinary hospitals to provide innovative pet health solutions, as well as increased promotional activities for these facilities globally, are key factors driving the segment growth.

Regional Insights

North American region registered the highest market revenue share of about 42% in 2022 owing to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing disease burden in animals. According to the North American Pet Health Insurance Association's (NAPHIA) 2021 statistics, the overall pet population covered by insurance in the U. S. achieved 3.1 million by 2020. This indicates an increase in the number of x-ray investigations of pets in healthcare facilities, indicating an increase in the usage of x-ray equipment in the U. S.

The Asia Pacific region is anticipated to grow at the fastest CAGR of more than 8% during the forecast period. This is owing to an increase in R&D, pet humanization, growing animal healthcare expenditure, and the availability of low-cost animal health products. Similarly, growing investment by global players to expand their presence in this region, as well as increasing demand for veterinary imaging products, is expected to fuel the market growth.

Key Companies & Market Share Insights

Extensive mergers and acquisitions, expansion of product portfolio, geographic expansions, and joint research and development initiatives are among the strategies implemented by these key players. To gain a competitive advantage, manufacturers are focusing on R&D to develop innovative diagnostic technologies. To gain a larger market share, existing players are concentrating on expanding their distribution network by acquiring smaller companies, and attempting to enter into collaborative agreements with local players, to introduce new products. Some of the key players in the global veterinary x-ray market include:

-

IDEXX Laboratories, Inc.

-

Heska Corporation

-

SOUND Technologies, Inc.

-

FUJIFILM Holdings Corporation

-

Carestream Health

-

Mindray Bio-Medical Electronics Co., Ltd.

-

Midmark Corporation

-

Canon Medical Systems Corporation

-

Agfa-Gevaert Group

-

SEDECAL

Veterinary X-ray Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 687.76 million

Revenue forecast in 2030

USD 1,055.60 million

Growth rate

CAGR of 6.31% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Animal Type, solutions, technology, type, portability, application, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Netherlands; Sweden; Poland; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa;UAE; Israel

Key companies profiled

IDEXX Laboratories, Inc.; Heska Corporation; SOUND Technologies, Inc.; FUJIFILM Holdings Corporation; Carestream Health; Mindray Bio-Medical Electronics Co., Ltd.; Midmark Corporation; Canon Medical Systems Corporation; Agfa-Gevaert Group; SEDECAL

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary X-ray Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global veterinary x-ray market report based on animal type, solutions, portability, technology, type, application, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Accessories/Consumables

-

PACS

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Mobile

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct (Capture) Radiography

-

Computed Radiography

-

Film-based Radiography

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics and Trauma

-

Respiratory

-

Gastrointestinal

-

Dentistry

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Clinics & Hospitals

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Sweden

-

Poland

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Israel

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary x ray market size was estimated at USD 654.39 million in 2022 and is expected to reach USD 687.76 million in 2023.

b. The global veterinary x ray market is expected to grow at a compound annual growth rate of 6.31% from 2023 to 2030 to reach USD 1,055.60 million by 2030.

b. North America dominated the veterinary x ray market with a share of 42.09% in 2022. This is attributable to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing disease burden in animals.

b. Some key players operating in the veterinary x ray market include IDEXX Laboratories, Inc., Heska Corporation, SOUND Technologies, Inc., FUJIFILM Holdings Corporation, Carestream Health, Mindray Bio-Medical Electronics Co., Ltd., Midmark Corporation, Canon Medical Systems Corporation, Agfa-Gevaert Group, and SEDECAL

b. Key factors that are driving the veterinary x ray market growth include the increasing incidence of zoonotic diseases, increased pet adoption, and increased adoption of radiography in veterinary orthopedics, dentistry, and several other indications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."