- Home

- »

- Next Generation Technologies

- »

-

Virtual Reality (VR) Market Size And Share Report, 2030GVR Report cover

![Virtual Reality (VR) Market Size, Share & Trends Report]()

Virtual Reality (VR) Market Size, Share & Trends Analysis Report By Technology (Semi & Fully Immersive, Non-immersive), By Device (HMD, GTD), By Component (Hardware, Software), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-831-2

- Number of Pages: 300

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global virtual reality (VR) market size was estimated at USD 59.96 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.5% from 2023 to 2030. Virtual reality enables users to experience a three-dimensional environment in the real world. This immersive experience for consumers is created by VR technology through gadgets, such as VR headsets, glasses or gloves, and bodysuits. VR technology has also transformed the gaming and entertainment sectors by enabling users to engage themselves in a highly simulated environment. Furthermore, the increasing use of virtual reality (VR) in instructional training, such as for field workers, engineers, mechanics, pilots, defense personnel, and technicians in various industrial sectors, is propelling the market’s growth.

In addition, VR is widely used in various industries, such as automotive and healthcare, due to its operational benefits. For instance, virtual reality allows engineers to test a vehicle's design and construction at an early stage before beginning costly production in the automobile industry. For instance, BMW uses mixed reality (augmented & virtual reality) in development and vehicle engineering processes. Moreover, the advent of VR exposure therapy is expected to increase the trend for using advanced technologies for treating people with mental health issues. Furthermore, travel companies use VR technology to enable potential tourists to take a virtual tour of monuments, iconic destinations, parks, and more. During the COVID-19 outbreak, various industries were shut down briefly, and lockdowns were imposed to reduce the spread of the virus, which, in turn, impacted business operations across regions.

However, the increasing need for businesses to continue their business activities online resulted in an increased demand for VR. Companies moved to virtual platforms to continue their business activities, such as holding meetings and developing policies & strategies. Event organizers provided visitors with engaging and diverse experiences by holding the event on a virtual platform and offering it as a VR experience. As a result, the growing prominence of virtual events is driving market growth. The increasing use of VR applications in the architecture and planning sector is another factor expected to drive market growth. The use of virtual reality (VR) technology in architecture aids in decision-making and visualizing the effects of suggested urban designs and architectural plans.

It also enables the early detection and correction of faults, saving time and money. Moreover, several real-estate agencies have begun using VR to give virtual tours of properties, increasing the likelihood of a sale. For instance, in September 2022, PropVR launched its VR center in Mumbai, India, for real estate developers to offer VR home tours to prospective buyers. The entertainment and sports industries have gained significant benefits from VR technology. VR technology is projected to be widely adopted in location-based entertainment, gaming, theaters, and music. For instance, in September 2022, Shanghai Disney Resort introduced an immersive virtual reality (VR) experience at its Disneytown entertainment, dining, and shopping center. The increased popularity of VR in entertainment is expected to contribute to market growth.

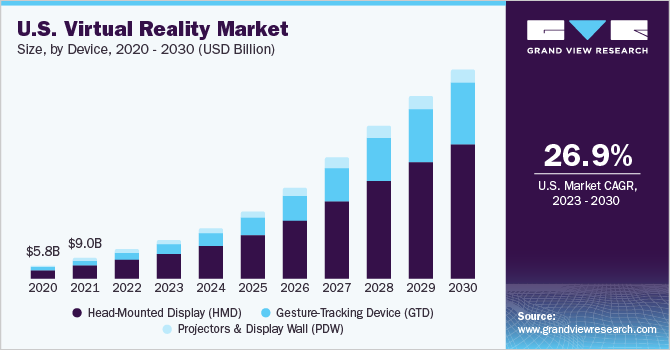

Device Insights

The Head-Mounted Display (HMD) device segment recorded the largest revenue share of 61.9% in 2022 and is anticipated to strongly lead the market till 2030. The rising use of VR headsets in consumer and commercial applications is driving its market demand. The segment’s growth is attributed to the availability of assortment and type of HMDs, such as tethered, hybrid, and wireless HMDs. The HMD devices are used to offer training in various industries, such as research, aerospace, engineering, military, and medicine, as well as to exemplify a wide range of use cases using interactive features. In addition, to offer customers a highly immersive experience, companies are regularly introducing technological advancements and entering into strategic partnerships.

The Gesture-Tracking Device (GTD) segment is anticipated to account for the fastest CAGR of 29.9% during the forecast period. This segment’s development can be accredited to a rise in demand from basic gesture tracing to visually immersive gesture tracing, as gesture tracing is an innovative and widely applied technology that enables added immersive and almost natural interaction. The various types of GTD virtual reality hardware include VR projectors, processors, sensors, large displays, and multi-screen projection systems. Moreover, various firms are also involved in improving the efficiency of sensors and processors used in VR systems to provide a significantly immersive application to users.

Technology Insights

The semi & fully immersive segment accounted for the largest revenue share of 82.7% in 2022. The segment is also estimated to account for the highest CAGR of 28.9% over the forecast period. The segment growth can be attributed to the constant rise in demand for virtual reality HMDs for educational and industrial applications. Semi & fully immersive technology reproduces the architecture of actual surroundings in a virtual platform, which is useful for complex tasks and planning. It includes the use of multifaceted emulators, high-processing personal computers, and high-resolution displays. Moreover, VR technology is in demand for educational applications as it allows students to exercise reasoning and motor activities that would not be possible to conduct in a regular classroom.

The non-immersive segment accounted for a revenue share of 17.3% in 2022. Non-immersive VR technology offers users a workstation-generated or virtual setting instead of an immersive, lifelike world experience. This technology is in trend as it is more efficient in terms of network management and is more widely available. Due to its restricted 2D interaction, the technology is limited to a few uses that include designing, gaming, medical assistance, and more. In addition, input devices, such as controllers, keyboards, mice, and displays, are required for computers and consoles for non-immersive systems to function properly, which positively impacts the market growth as investment in an entirely new system is not required.

Application Insights

The commercial segment accounted for the largest revenue share of 54.7% in 2022. The increasing use of VR headsets and VR experience rooms in the commercial sector, including real estate, vehicle showrooms, and retail stores, provides new growth potential for the market growth. Furthermore, the growing adoption of mobile devices and other handheld devices is expected to drive the usage of VR technologies in the commercial sector. Similarly, businesses are using VR to launch new products and attract buyers with a more immersive experience.

The healthcare segment is expected to register the highest CAGR of 32.2% over the forecast period. This can be attributed to the use of VR in the healthcare sector, majorly in disease awareness, operational processes, learning, and training. The demand in this segment is expected to grow as hospitals and medical colleges use VR solutions and tools to train students and doctors. Moreover, the trend of surgeries and other complex operations being conducted remotely is expected to drive the segment growth. For instance, challenging surgeries can be attempted by doctors in VR to confirm probability before operating on the actual patient.

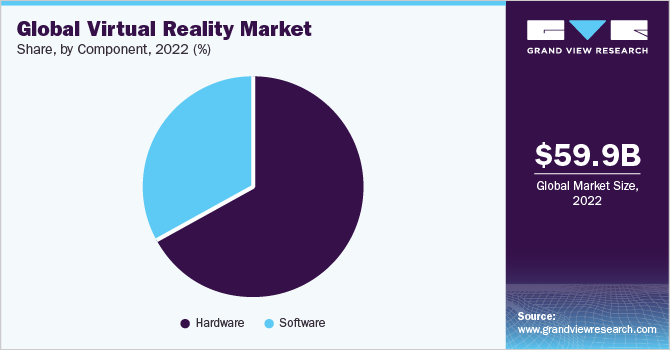

Component Insights

The hardware segment accounted for the largest revenue share of 67% in 2022. The high penetration and use of smartphones, tablets, and other advanced electronic handheld gadgets are expected to contribute to the segment’s growth as developers are introducing VR-based features in more devices. In addition, the segment includes input devices, output devices, and consoles, which users buy as accessories for VR setups. Moreover, the growing use of VR headsets in commercial applications, theme & amusement parks, and other places is anticipated to offer growth opportunities to Original Equipment Manufacturers (OEMs) to become VR equipment providers.

The software segment is anticipated to record the highest CAGR of 29.7% during the forecast period. The segment’s growth can be credited to the capability of the software to create feedback, analyze data, and handle input/output sources. VR technology is extensively used in product prototyping for its three-dimensional environment factor that enables users to impressively interact with applications and tasks. Furthermore, the segment is growing in demand as it can be used in training, simulation, developing virtual tools, VR applications, VR game development, learning experience platforms, and segment reality.

Regional Insights

Asia Pacific accounted for the largest revenue share of over 39% in 2022. The regional market growth can be attributed to countries, such as China, that are major producers and suppliers of VR-related hardware. In addition, the region is home to a large number of industries and factories that are using VR in various processes due to the trend of automation. Furthermore, the growing penetration of handheld devices with VR support in Asia Pacific is expected to drive the region’s growth.

Europe is estimated to emerge as the fastest-growing regional market with a CAGR of over 29.3% during the forecast period. This is due to the widespread deployment of VR technology in a variety of applications across several industry sectors, particularly in the gaming and automobile industries. Europe has a large gaming population, which helps drive the adoption of cutting-edge VR headsets in the region. The rapid development and sale of powerful VR hardware aimed at the gaming community in European countries have accelerated the growth of the regional market.

Key Companies & Market Share Insights

The key players use strategies, such as partnerships, acquisitions, ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Companies are also focusing on improving their product offerings to better suit the changing needs of users to stay competitive. For instance, in February 2023, Meta Platforms Inc. acquired Within Unlimited, Inc. for its VR expertise and popular virtual reality (VR) application called Supernatural.

Furthermore, key companies are expanding their portfolio by launching new products or by significantly developing existing products in their portfolio. As technological developments in the VR industry occur at a significant pace, modern products are regularly launched with new features and tools. For instance, in January 2023, HTC Corporation launched its new virtual reality & augmented reality headset named Vive XR Elite. According to the company, the product is equipped with a high-resolution display for an immersive experience. Some of the prominent players in the global virtual reality (VR) market include:

-

Alphabet Inc.

-

Barco NV

-

CyberGlove Systems, Inc.

-

Meta Platforms Inc.

-

HTC Corporation

-

Microsoft Corporation

-

Samsung Electronics Co., Ltd.

-

Sensics, Inc.

-

Sixense Enterprises, Inc. (Penumbra, Inc.)

-

Ultraleap Ltd.

Virtual Reality (VR) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 79.36 billion

Revenue forecast in 2030

USD 435.36 billion

Growth rate

CAGR of 27.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, technology, component, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Alphabet Inc.; Barco NV; CyberGlove Systems, Inc.; Meta Platforms Inc.; HTC Corp.; Microsoft Corp.; Samsung Electronics Co., Ltd.; Sensics, Inc.; Sixense Enterprises, Inc. (Penumbra, Inc.); Ultraleap Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Reality (VR) Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the virtual reality (VR) market report based on device, technology, component, application, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Head-Mounted Display (HMD)

-

Gesture-Tracking Device (GTD)

-

Projectors & Display Wall (PDW)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi & Fully Immersive

-

Non-immersive

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Consumer

-

Commercial

-

Enterprise

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global virtual reality (VR) market size was estimated at USD 59.96 billion in 2022 and is expected to reach USD 79.36 billion in 2023.

b. The global virtual reality (VR) market is expected to grow at a compound annual growth rate of 27.5% from 2023 to 2030 to reach USD 435.36 billion by 2030.

b. Asia Pacific dominated the VR market with a share of 39.9% in 2022. This is attributable to the technological advancements in Southeast Asian countries and favorable initiatives by the governments, such as funds and investments to benefit VR companies in the region.

b. Some key players operating in the virtual reality market include Barco; CyberGlove Systems, Inc.; Oculus VR, LLC; Alphabet, Inc.; HTC Corporation; Leap Motion, Inc.; Microsoft Corporation; Samsung Electronics Co. Ltd.; Sensics, Inc.; and Sixense Entertainment, Inc.

b. Key factors that are driving the virtual reality market growth include evolving solicitations in the entertainment & medical sectors, technological advancements, and growing VR penetration in the consumer electronics industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."