- Home

- »

- Consumer F&B

- »

-

Vodka Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Vodka Market Size, Share & Trends Report]()

Vodka Market Size, Share & Trends Analysis Report By Type (Flavored, Non-Flavored), By Distribution Channel (Off-Trade, On-Trade), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-924-4

- Number of Pages: 92

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Vodka Market Size & Trends

The global vodka market size was valued at USD 25.98 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The rising demand for vodka can be attributed to the growing consumption of premium vodka-based cocktails in developed economies such as the U.S. and Germany. The growing demand for vodka flavors such as cranberry, lime, and raspberry is augmenting growth. Moreover, offline trading of alcoholic beverages is further anticipated to boost market growth over the forecast period. The growing acceptance of grain-based vodkas with a delicious fruity taste is the major factor driving market growth.

Moreover, a rise in demand for natural and authentic flavors has been observed. The influence of social media and blogging sites is further supporting the growth of the global vodka market. Consumers are now more active on social networking platforms and aware of a variety of flavored vodkas and cocktails. For instance, Tito’s Vodka is marketed as “handcrafted vodka” on the company's social media account. Likewise, there are many blog posts on the internet that discuss vodka brands under different categories, such as flavored vodka and organic vodka.

The procurement of citrus cocktails at a reasonable cost is an upcoming opportunity for the market. However, the inclination of consumers toward non-alcoholic beverages is hindering market growth. At present, key players are focused on launching fruit-based vodka flavors, with minimal alcohol content. Hence, the vodka market is expected to record significant market growth during the review period. Growing investment from major players to procure superior-quality ingredients, such as blueberries and ruby red grapefruits, is propelling the market growth. The rising procurement of organic infusions across the world is driving the industry's growth. In addition, premium brands are focusing on introducing deliciously, flavored vodkas with crisp notes.

The popularity of e-commerce among consumers is also favoring the growth of vodka through online distribution channels. Direct-to-consumer (DTC) and other e-commerce channels that sell vodka have the potential for strong growth from a small base. Players engaged in direct-to-consumer approaches have employed different business models to legally sell to consumers directly. For one, distilleries are selling direct-to-consumer at a physical location or online. Third-party cocktail clubs (e.g., SaloonBox) are gaining popularity due to the “cocktail culture” trend, wherein clubs deliver expert-curated cases of spirits and cocktail ingredients; retail partners deliver the liquor, while the cocktail ingredients are shipped directly. The adoption of different models will likely favor the growth of the market.

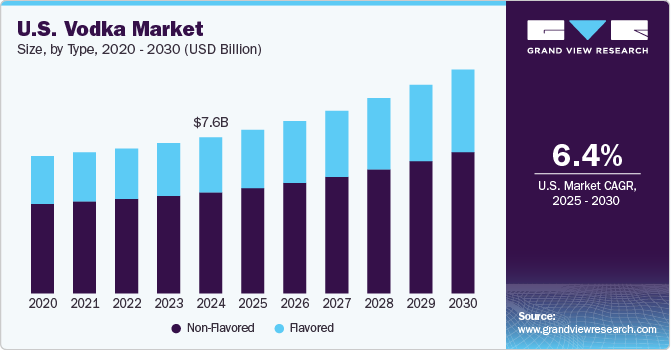

Type Insights

In terms of value, the non-flavored segment dominated the market with a share of over 65% in 2022. Non-flavored vodkas undergo many phases of distillation to enhance their overall attractiveness and functioning, setting them distinct from traditional drinks. They can often be mixed with a mix of personalized botanical infusions and quality ingredients to produce a pleasing taste. Additionally, the growth in health consciousness encourages the consumption of alcohol made with natural ingredients, has fewer calories, and is sugar-free. In order to meet the expanding customer demands worldwide, companies in the industry provide a variety of non-flavored vodkas.

The flavored segment is expected to expand at a CAGR of 6.5% over the forecast period from 2023 to 2030. The ever-growing demand for high-end flavored vodka, especially among the millennial population, is one of the major factors driving growth across the globe. As countries across the globe are seeing strong economic growth, consumer interest in high-end flavored vodka drinks has grown, fueled by a willingness to spend on desired products. Additionally, spirits companies across the globe are focusing on launching premium flavored vodka products in the market to cater to the rising demand. For instance, in March 2022, BACARDI, a leading spirit company, launched TAILS COCKTAILS, a series of cocktails-at-home products to service premium quality cocktails easily, quickly, and consistently.

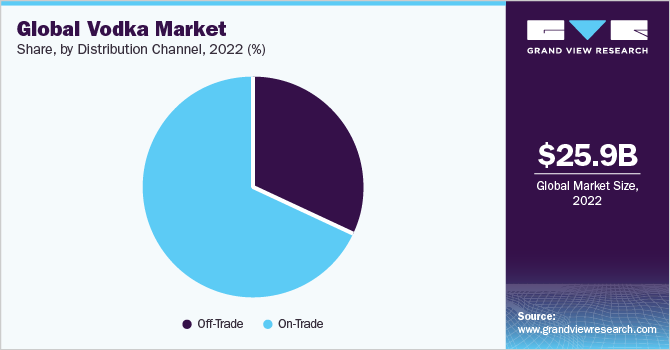

Distribution Channel Insights

On-trade segment held the largest share of over 65% in 2022. The on-trade distribution channel segment includes nightclubs, hotels, bars, quick service restaurants, and lounges. RTD, vodka mixes, and other high-quality vodka products have witnessed strong demand due to the growing number of pubs and expanding hospitality industry across the globe. Hotels, pubs, and restaurants have significantly improved the overall cocktail experiences that appeal to millennials. Millennials are exhibiting their desire for originality and authenticity in flavors by tasting regional tastes and buying from artisan distilleries. Direct-to-consumer sales are on the rise as millennials try to connect with their preferred manufacturers.

Off-trade segment is expected to register the highest CAGR of 6.4% from 2023 to 2030. The off-trade segment includes all retail outlets such as liquor specialty stores, hypermarkets, supermarkets, mini markets, convenience stores, and wine & spirit shops. Consumers prefer these outlets as they offer a variety of coupons and offers. In addition to the availability of discounts and promotional offers, these outlets offer easy access to different varieties of alcohol.

In order to reach the largest number of consumers, the majority of companies collaborate with top supermarkets like Walmart, Target, Tesco, and others to launch their products and extend consumer outreach.

Regional Insights

In 2022, North America was the largest region and accounted for the maximum share of more than 35.0% of the overall revenue. The demand and consumption of vodka in North America continue to be influenced by changes in consumer habits brought on by the pandemic. Even after the lifting of COVID-19 lockdowns and restrictions, these trends will have a long-term influence on the alcoholic beverage business, particularly the craft spirits segment. Vodka is experiencing growth because of consumers’ increased appetite for premium, authentic cocktails with distinct flavors. Vodka is among the most popular craft spirits consumed in the region. The growing consumption of vodka is expected to drive the demand for vodka in the region during the forecast period.

Asia Pacific is expected to register the fastest CAGR of 6.1% during the forecast period. In 2021, Asia Pacific countries, such as China, Japan, and India, emerged as some of the major markets for vodka. According to Tito’s International, Asia Pacific is an important region for the company as 60% of the world’s millennials, its target demographic, live in Asia. With the cocktail culture spreading across the countries of Asia Pacific, vodka is fast emerging and the preferred choice amongst liquor consumers compared to other categories.

Key Companies & Market Share Insights

Key companies undertake various strategies to gain a competitive advantage over others. For instance,

-

In September 2022, Brown‑Forman Corporation, one of the largest American-owned spirits and wine companies, announced that it was planning to distribute its own brands in Slovakia from September 2023. The move is aimed at furthering the growth of its portfolio, particularly the Jack Daniel’s Tennessee Whiskey and Finlandia Vodka families of brands

-

In August 2022, Constellation Brands launched ‘Fresca Mixed’, a new line of premium, pre-mixed cocktails in two varieties-Vodka Spritz and Tequila Paloma

-

In April 2022, Stoli Group announced the launch of a limited-edition Ukrainian-themed vodka for the World’s Central Kitchen Ukrainian Relief to raise funds for Ukrainian refugees

Some of the prominent players in the global vodka market include:

-

Brown-Forman Corporation

-

Diageo

-

Pernod Ricard

-

Belvedere Vodka

-

Bacardi Limited

-

Constellation Brands, Inc.

-

Proximo Spirits, Inc.

-

Distell Limited

-

Stoli Group

-

Iceberg Vodka Corporation

Vodka Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.96 billion

Revenue forecast in 2030

USD 40.25 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Russia; Italy; China; Japan; India; Brazil; Argentina; South Africa

Key companies profiled

Brown-Forman Corporation; Diageo; Pernod Ricard; Belvedere Vodka; Bacardi Limited; Constellation Brands, Inc.; Proximo Spirits, Inc.; Distell Limited; Stoli Group; Iceberg Vodka Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vodka Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vodka market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Flavored

-

Non-Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Off-Trade

-

On-Trade

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vodka market size was estimated at USD 25.98 billion in 2022 and is expected to reach USD 26.96 billion in 2023.

b. The global vodka market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 40.25 billion by 2030.

b. North America dominated the vodka market with a share of 35.1% in 2022. This is attributable to innovations and advancements in the manufacturing of vodka and inclination towards variety of flavored alcohols and mixed beverages.

b. Some key players operating in the vodka market include Brown-Forman; Diageo; Pernod Ricard; Belvedere; Russian Standard; Bacardi; Constellation Brands Inc.; Proximo Spirits; Distell Group; Savor Stoli; and IceBerg Vodka.

b. Key factors that are driving the vodka market growth include an increase in disposable income along with changes in preferences toward premium products and growing demand for alcoholic beverages on e-commerce portals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."