- Home

- »

- Next Generation Technologies

- »

-

Voice-based Payments Market Size & Share Report, 2030GVR Report cover

![Voice-based Payments Market Size, Share & Trends Report]()

Voice-based Payments Market Size, Share & Trends Analysis Report By Component (Software, Hardware), By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-923-4

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global voice-based payments market size was valued at USD 5.89 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030. The continued rollout of voice-based payments by financial institutions and retailers to seamlessly access personal data and understand customer behavior is expected to drive the growth of the market. Mobile payments platforms, such as Zelle, PayPal, and Venmo, have started rolling out voice-activated controls for their customers to carry out financial and banking functions. Conventional banks, such as Wells Fargo, are also adding conversational voice interfaces to their mobile banking apps to help their customers in accessing all the banking services.

The growing adoption of peer-to-peer voice-based payments worldwide is expected to drive the growth of the market during the forecast period. Several banks, such as Barclays and Royal Bank of Canada, among others, have started offering voice-enabled peer-to-peer payments to their customers. Barclays allows its customers to make voice-based payments using Siri, the virtual assistant offered as part of Apple Inc.’s operating systems. Similarly, Google Assistant allows Google Pay users to make peer-to-peer payments using voice commands.

The integration of voice-based payment systems in cars is also emerging as one of the major factors driving the growth of the market. Innovative services are being introduced aggressively to allow drivers to use voice assistants to pay for gas and make reservations in restaurants, among other applications, from within their cars. For instance, in January 2021, Amazon announced the launch of Alexa Custom Assistant, a service that allows device manufacturers and automakers to build their digital assistants. Fiat Chrysler would be the first automaker to use this service to develop a digital assistant for select vehicles.

Government bodies across the globe are continuously encouraging the companies offering digital payment solutions to enhance their offerings. For instance, the Government of India has invited proposals from fintech and start-up companies to develop innovative solutions that can potentially take digital payments to India’s marginalized areas. The proposals invited by the government include proposals for voice-based solutions facilitating digital payments using smartphones and other devices. The shortlisted ideas are expected to receive funding from the government.

However, the growing concerns over the level of security offered by voice-based payments are expected to restrain the market growth during the forecast period. The inability of voice assistants to understand different accents, especially non-American accents, is also expected to hinder the market expansion. On the other hand, the software and hardware at the point-of-sale terminals need to be upgraded if they were to support voice-activated technology. As such, the costs involved in integrating voice-based payments with Bluetooth and WiFi-enabled systems at the point-of-sale terminals equally do not bode well for the growth of the market.

The COVID-19 pandemic is expected to play a decisive role in driving the market growth during the forecast period. The popularity of contactless payment methods is growing as people worldwide are putting a strong emphasis on avoiding any potential exposure to coronavirus through contaminated surfaces. The growing preference for contactless payment solutions during the pandemic is particularly opening opportunities for rolling out voice-based payments. At the same time, several retail stores are also adopting voice-based payments as part of their efforts to ensure a safe and secure way of payment for the customers.

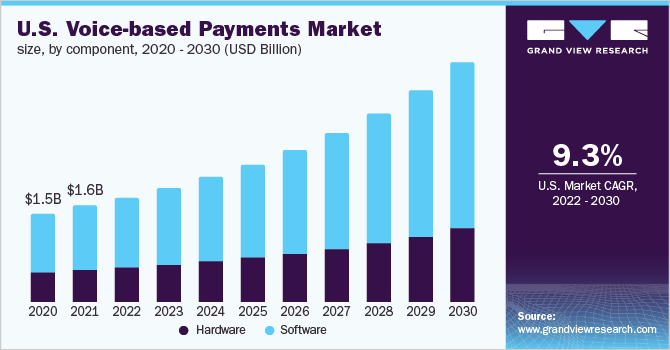

Component Insights

The software segment dominated the market in 2021 and accounted for a share of more than 66.0% of the global revenue. The growing integration of virtual assistants, such as Google Assistant, Alexa, and Siri, into the voice-based payment solutions for conventional banking is expected to drive the segment. The aggressive efforts being pursued by various voice-based payment companies to enhance their respective products also bode well for the growth of the segment. For instance, in November 2021, Google announced the launch of speech-to-text features that allow users to use voice input to add their account numbers to the app to initiate payments.

The hardware segment is anticipated to witness significant growth during the forecast period. Hardware is mainly required to convert sound signals into digital signals in voice-based payment systems. The growing popularity of voice-based payments worldwide is expected to trigger the demand for hardware that can potentially support voice-based payments, thereby driving the segment. The efforts being pursued by various companies worldwide to develop hardware with modern user interfaces and ensure a better customer experience also bodes well for the segment growth.

Enterprise Size Insights

The large enterprises segment dominated the market in 2021 and accounted for a share of more than 59.0% of the global revenue. The demand for voice-based payments is particularly rising among large enterprises as several large enterprises are trying aggressively to adopt contactless payment solutions. For instance, in April 2019, Walmart announced a partnership with Google. The partnership envisaged rolling out Walmart Voice Order, a new voice ordering capability that works across various Google Assistant-powered platforms.

The small & medium enterprises segment is expected to register the fastest growth during the forecast period. Small banks are typically trying to digitalize their services and enhance the customer experience. Small banks are particularly adopting paperless services for opening bank accounts, thereby driving the need for voice-based payments. Such enhancements being pursued by various banks to gain a competitive edge and strengthen the market position are expected to drive the segment forward.

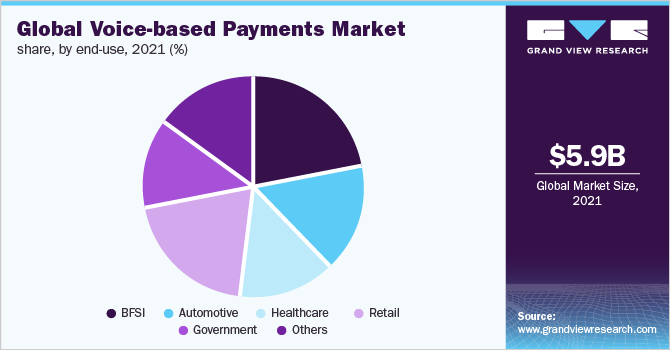

End-use Insights

The BFSI segment dominated the market in 2021 and accounted for a share of over 23.0% of the global revenue. Several banks worldwide are rolling out voice assistants as part of the efforts to streamline their operations and enhance customer experience. For instance, in August 2019, NatWest, a retail banking company, announced plans to trial voice banking with 500 of its customers. The trial envisaged allowing the bank customers to carry out a myriad of simple banking tasks using Google Assistant.

The retail segment is anticipated to expand at a promising CAGR during the forecast period. The rapid growth of voice commerce and the growing preference for touchless payments during the pandemic are among the major factors that are expected to drive the growth of the segment. Voice-based payments are being preferred over cash payments across the retail industry, owing to factors such as accessibility and convenience. According to the Federal Reserve Bank of San Francisco’s The Diary of Consumer Payment Choice study, cash use accounted for 19% of all payments in the U.S. in 2020, down by 7% points from 2019.

Regional Insights

North America dominated the voice-based payments market in 2021 and accounted for a share of over 33.0% of the global revenue. The growing preference for contactless payments across North America is expected to accentuate the regional market. MasterCard Contactless Consumer Polling revealed that 51% of the U.S. consumers use some form of contactless payment method and that these consumers have been using cashless payments on an often basis and not just in the wake of the outbreak of the pandemic.

Asia Pacific is expected to expand at the highest CAGR during the forecast period. The growth can be attributed to the growing awareness in countries, such as China, India, and Japan, about the benefits offered by voice-based payments. The aggressive efforts being pursued by various organizations across the Asia Pacific to promote the use of voice-based payments are also expected to contribute to the growth of the segment. For instance, in July 2021, the National Payments Corporation of India (NPCI) announced that it is testing voice-based payments services for feature phones in India. NPCI has already developed digital payment platforms, such as Unified Payments Interface (UPI) and Aadhaar Enabled Payment System (AePS).

Key Companies & Market Share Insights

The voice-based payments market can be described as a highly competitive market characterized by the presence of several prominent market players. Incumbents of the market are pursuing various strategies, such as strategic partnerships, new product launches, and geographic expansion, among others, as part of the efforts to enhance their offerings. For instance, in May 2021, Cerence, a provider of biometric authentication and voice-based payment services, announced that P97 Networks, a mobile commerce platform provider, has been added to the company's Cerence Pay partner ecosystem. The integration of P97 Networks' mobility services platform would allow Cerence Pay to connect drivers to safe and seamless payments via the P97 mobile commerce platform, which is available to over 30% of the retail fuel sites across the U.S. at present.

Market players are investing aggressively in research & development activities to enhance their product offerings. For instance, in May 2021, the Indian Institute of Technology Madras researchers announced that they will collaborate with the Mobile Payment Forum of India members. The collaboration is aimed to create voice-based payments for digital money transactions. Some of the prominent players in the global voice-based payments market are:

-

NCR Corporation

-

Amazon.com, Inc.

-

PayPal

-

Paysafe

-

PCI Pal

-

Vibepay

-

Cerence

-

Huawei Technologies Co., Ltd.

-

Google

-

Alibaba

Voice-based Payments Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.40 billion

Revenue forecast in 2030

USD 14.66 billion

Growth rate

CAGR of 10.9% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan, Brazil

Key companies profiled

NCR Corporation; Amazon.com, Inc.; PayPal; Paysafe; PCI Pal; Vibepay; Cerence; Huawei Technologies Co., Ltd.; Google; Alibaba

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the voice-based payments market based on component, enterprise size, end-use, and region.

- Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Hardware

-

- Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

- End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Automotive

-

Healthcare

-

Retail

-

Government

-

Others

-

- Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

-

U.S.

-

Canada

-

- Europe

-

Germany

-

U.K.

-

- Asia Pacific

-

China

-

India

-

Japan

-

- Latin America

-

Brazil

-

- Middle East & Africa

- North America

Frequently Asked Questions About This Report

b. The global voice-based payments market size was estimated at USD 5.89 billion in 2021 and is expected to reach USD 6.40 billion in 2022.

b. The global voice-based payments market is expected to grow at a compound annual growth rate of 10.9% from 2022 to 2030 to reach USD 14.66 billion by 2030.

b. North America dominated the voice-based payments market with a share of 33.37% in 2021. The growing preference for contactless payments across North America is expected to accentuate the growth of the regional market.

b. Some key players operating in the voice-based payments market include NCR Corporation; Amazon.com, Inc.; PayPal; Paysafe; PCI Pal; Vibepay; Cerence; Huawei Technologies Co., Ltd.; Google; Alibaba.

b. Key factors that are driving the voice-based payments market growth include increasing demand for contactless payments and rising demand for voice assistant-enabled devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."