- Home

- »

- Electronic Devices

- »

-

Washing Machine Market Size, Share & Growth Report, 2030GVR Report cover

![Washing Machine Market Size, Share & Trends Report]()

Washing Machine Market Size, Share & Trends Analysis Report By Product (Fully Automatic, Semi-Automatic, Dryers), By Technology (Smart Connected Machines, Conventional Machines), By Capacity, By End-use, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-237-2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Washing Machine Market Size & Trends

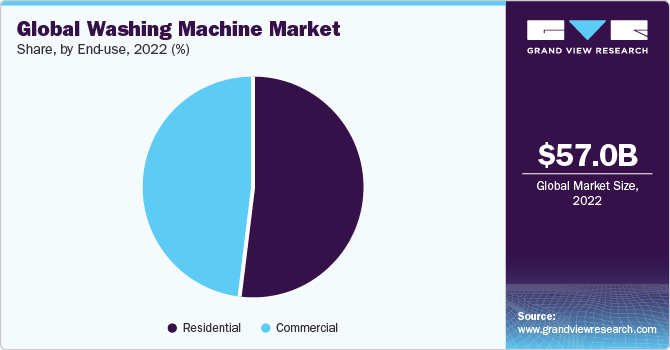

The global washing machine market size was estimated at USD 57.01 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030. The increasing demand for commercial laundry equipment is expected to provide an impetus to the industry growth. The commercial washing machine industry is undergoing a transition with the introduction of innovative solutions. The introduction of card-based laundry payment systems as an alternative to coin laundries is revolutionizing the laundry sector for increased automation.

In contrast to the traditional coin operating laundries, digital laundry payment options are reducing the frequency of coin collection and providing laundry owners with more flexible payment alternatives. The growing preference for convenience and rapidly changing consumer lifestyle are contributing to the smart connected products growth. Macroeconomic factors such as digitalization, urbanization, changing consumer buying patterns, and demand in emerging economies are augmenting the revenue growth. The introduction of next-generation washing machines utilizing technology for the efficient use of electricity and water is expected to have a positive impact on the demand for these products over the next nine years. The U.S. government is encouraging consumers and manufacturers to switch to energy-efficient appliances that use smart grids to curb high energy consumption. The need for seamlessly selecting the preferred wash cycle is expected to gain traction over the forecast period.

End-use Insights

The residential segment accounted for the largest revenue share of 51.6% in 2022. Over the past few years, urbanization has been increased significantly which has resulted in the augmented sales of white goods including washing machines, refrigerators, and air conditioners. Moreover, changing lifestyles along with the improved electricity infrastructure across rural as well as urban areas in developing countries including India, China, Indonesia, and Sri Lanka has fueled the demand for household washing machines.

The commercial segment is expected to grow at the fastest CAGR of 11.1% over the forecast period. The growth in coin laundries and online laundry services in the emerging economies of the Asia Pacific region is expected to propel the demand over the next nine years. Additionally, the growing trend of outsourcing laundry services in hospitality, hospitals, and government sectors is expected to boost the demand for commercial laundry equipment.

Regional Insights

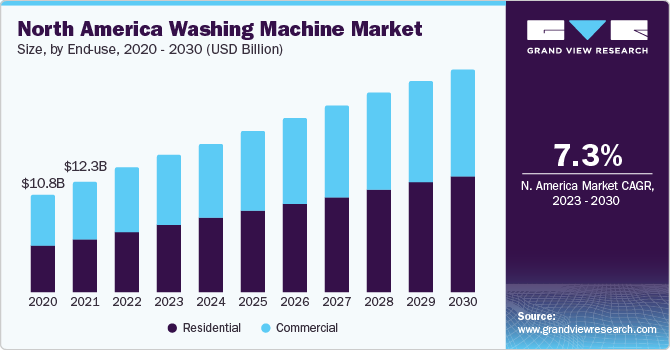

The North American region dominated the market with a revenue share of 33.9% in 2022, owing to the increasing adoption of smart and energy-efficient appliances in the region, driving the market growth. Consumers are becoming more conscious about energy savings and sustainability, thus prompting them to invest in washing machines with advanced features such as load sensing, water efficiency, and programmable settings. Additionally, the high disposable income in North America has led to a higher standard of living, contributing to the demand for convenient and time-saving home appliances.

The Asia Pacific region is expected to grow at the fastest CAGR of 12.3% during the forecast period. The rapid urbanization in the region is driving the market growth of washing machines. Increasing urbanization has led to smaller living spaces and an increased reliance on time-saving appliances, including washing machines. Due to limited space, compact and efficient washing machines are becoming increasingly popular in urban areas. Moreover, individuals and families in urban areas are busier with work and need time-saving solutions. With their automated and time-efficient features, washing machines cater to the growing demand for convenience, contributing to the expansion of the market.

Application insights

The hospitality segment accounted for the largest revenue share of 53.3% in 2022. The use of washing machines in hotels, resorts, and other establishments has increased in recent years due to the growing number of hotels in specific regions, such as Europe, North America, and the UAE. This is because the travel and tourism market has been growing rapidly in these regions, which has led to an increased demand for laundry services. According to the Hotel Data Conference Global Edition 2021, hotel occupancy in Florida was among the highest in the country in 2021, exceeding the national average of 48.1%. As a result, hotel occupancy in the U.S. has been steadily increasing since late January 2021, when it reached a new epidemic high of 58.9%. Even after accounting for temporarily closed hotels due to the pandemic, the occupancy rate was 55.7%. Furthermore, according to the AHLA's state of the hotel industry 2021 report, leisure travel is projected to rebound first, with consumers confident about national vaccination distribution and their ability to travel again in 2021.

The federal government segment is expected to grow at the fastest CAGR of 13.5% over the forecast period. The federal government's commitment to reducing greenhouse gas emissions and combating climate change has led to a heightened focus on appliance energy efficiency. Washing machines are a significant part of household energy consumption, and governments are keen to promote models that consume less energy and water. This environmental agenda has created a strong incentive for manufacturers to develop washing machines that not only meet regulatory requirements but also exceed them in terms of efficiency and eco-friendliness.

Product Insights

In the washing machine market,fully automatic segment accounted for the largest revenue share of 71.5% in 2022 and estimated to register the fastest CAGR of 10.9% over the forecast period. The growth of the segment is attributed to its high customer preference, lesser human interference, improved energy and water efficiency, and better stain removal capability as compared to semi-automatic washing machines. Fully automatic washing machines are more convenient, energy-efficient, and effective at removing stains than semi-automatic washing machines, making them a popular choice for busy households and those with limited time.

The fully automatic washing machine segment is further divided into two sub-segments: front-loading and top-loading washing machines. The front load sub-segment accounted for the largest revenue share of 68.1% in 2022 and estimated to register the fastest CAGR of 11.6% over the forecast period. However, top load sub-segment is expected to grow with a significant CAGR of 9.5%. Front-loading washing machines are typically more energy-efficient than top-loading washing machines, as they use less water and energy to wash clothes.Top-loading washing machines are typically less expensive than front-loading washing machines, and they are easier to load and unload. However, they are not as energy-efficient as front-loading washing machines, and they may not have as good of a stain removal performance.

The dryers segment is expected to witness the second highest CAGR of 10.3% over the forecast period. The introduction of the heat pump technology to address the concern of high energy consumption is providing traction to the growth of commercial dryers. Manufacturers are focusing on developing commercial products to combat the increasing on-demand laundry services growth.

Technology Insights

The conventional machine segment held the largest revenue share of 92.0% in 2022. Conventional washing machines are still popular because they are affordable, durable, easy to use, versatile, and widely available. They are typically less expensive than fully automatic washing machines and can last for many years with proper maintenance. They are also relatively easy to use and can be used to wash a variety of fabrics and items. Additionally, they are more widely available than fully automatic washing machines because they have been around for longer and are more popular with consumers.

The smart connected machine segment is expected to grow at the fastest CAGR of 12.2% over the forecast period. The preference for convenience and the rapidly changing consumer lifestyle is contributing to the segment growth. The need for managing and controlling machines through smartphones is gaining traction in the residential sector. The push by regulatory and government authorities to adopt smart devices is contributing to revenue growth. The inclination of consumers toward the adoption of connected technologies is expected to have a positive impact on the demand for these products. Companies such as Samsung Electronics Co. Ltd. and LG Electronics have shifted their focus on manufacturing smart washing machines to gain a competitive advantage.

Capacity Insights

The 6.1 to 8 kg segment accounted for the largest revenue share of 41.5% in 2022 The growth of the segment is attributed to the increasing demand for washing machines that can accommodate sufficient loads of laundry, handle more frequent laundry loads, energy-efficient, and affordable.

The above 8 kg segment is expected to grow at the fastest CAGR of 11.9%. The growth of above 8kg capacity washing machines is attributed to the increasing demand for washing machines that can accommodate larger loads of laundry due factors, such as the growing popularity of large households, the rise of online shopping, and the increasing awareness of the importance of sustainability. It allows consumers to wash more laundry in one cycle, which can save time and energy.

Key Companies & Market Share Insights

Key players in the market have adopted the strategy of mergers & acquisitions to expand their product and service portfolios.

Key Washing Machine Companies:

- Whirlpool Corporation

- SAMSUNG

- LG Electronics

- Electrolux AB

- Panasonic Life Solutions India Pvt. Ltd.

- BSH Hausgeräte GmbH

- IFB Appliances

- Maytag

- Kenmore

- General Electric

Recent Developments

-

In June 2023, IFB Industries, manufacturing of home appliances and blanking components company completed acquisition of Ramsons, a India-based industrial laundry equipment manufacturing company, which are mostly used by the hospitality sector.

-

In February 2023, Electrolux launched Professional Line 6000 washers ideal for any commercial professional laundry (hotel, healthcare, aged care or commercial laundry facility).

-

In September 2022, Samsung launched a new line of Ecobubble Fully Automatic Top Load Washing Machines that saves up to 19% water, 73% energy, and give a 20 % improvement in fabric care.

-

In September 2022, Whirlpool Corporation released a new technology called "Ozone AirRefresh” in order to wash delicate textiles without using water or detergent. This new technology is developed for Indian market and is included in the Xpert Care line of front-loading washing machines, which also provides traditional wash cycles for laundry and everyday wear.

-

In September 2022, Electrolux unveiled a new line of washing machines and tumble dryers under its premium brand AEG that automatically manage time, water, and energy usage and up to 90% of microplastic fibers generated by synthetic garments are captured by a new add-on filter.

-

In September 2022, Panasonic Life Solutions India Pvt. Ltd., a technology announced launch of a new range of smart washing machines in India in September 2022. The new top-load smart washing machines includes unique smart features as well as premium style and are powered by Panasonic's connected living platform - Miraie. The new models are available in a range of capacities ranging from 6.5 kg to 8 kg.

-

In August 2022, Maytag, a home and laundry appliance manufacturing company based in the United States, debuted the Pet Pro System, the first laundry pair designed for homes with pets. A washer with an integrated Pet Pro Filter eliminates 5 times more pet hair.

Washing Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 64.08 billion

Revenue forecast in 2030

USD 126.75 billion

Growth rate

CAGR of 10.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, capacity, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Whirlpool Corporation.; SAMSUNG; LG Electronics.; Electrolux AB.; Panasonic Life Solutions India Pvt. Ltd.; BSH Hausgeräte GmbH; IFB Appliances; Maytag.; Kenmore; General Electric

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Washing Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global washing machine market on the basis of product, technology, capacity, end-use, application, and region:

-

Product Outlook (Revenue in USD Billion, 2017 - 2030)

-

Fully automatic

-

Front load

-

Top load

-

-

Semi-automatic

-

Dryers

-

-

Technology Outlook (Revenue in USD Billion, 2017 - 2030)

-

Smart Connected Machines

-

Conventional Machines

-

-

Capacity Outlook (Revenue in USD Billion, 2017 - 2030)

-

Below 6 kg

-

6.1 to 8 kg

-

Above 8 kg

-

-

End-use Outlook (Revenue in USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

-

Application Outlook (Revenue in USD Billion, 2017 - 2030)

-

Healthcare

-

Hospitality

-

Federal Government

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global washing machine market size was estimated at USD 57.01 billion in 2022 and is expected to reach USD 64.08 billion in 2023.

b. The global washing machine market is expected to grow at a compound annual growth rate of 10.2% from 2023 to 2030 to reach USD 126.75 billion by 2030.

b. The Asia Pacific region dominated the global washing machine market with a share of 45.25% in 2022. This is attributed to several factors, including the increasing urbanization and rising disposable income in countries such as China and India.

b. Some of the key players in the global washing machine market include Whirlpool Corporation; Samsung Electronics Co. Ltd.; LG Electronics Inc.; and Electrolux AB.

b. Key factors driving the the growth in the washing machine market is the increasing demand for energy-efficient and technologically advanced appliances.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."