- Home

- »

- Medical Devices

- »

-

Wearable Breast Pump Market Size & Share Report, 2030GVR Report cover

![Wearable Breast Pump Market Size, Share & Trends Report]()

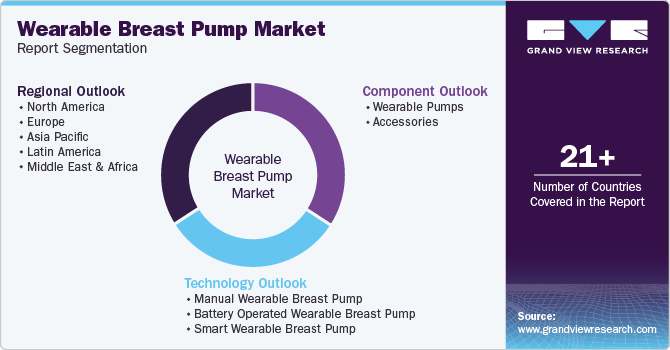

Wearable Breast Pump Market Size, Share & Trends Analysis Report By Component (Wearable Pumps, Accessories), By Technology (Battery Powered Pumps, Smart Pumps, Manual Pumps), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-669-7

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Wearable Breast Pump Market Size & Trends

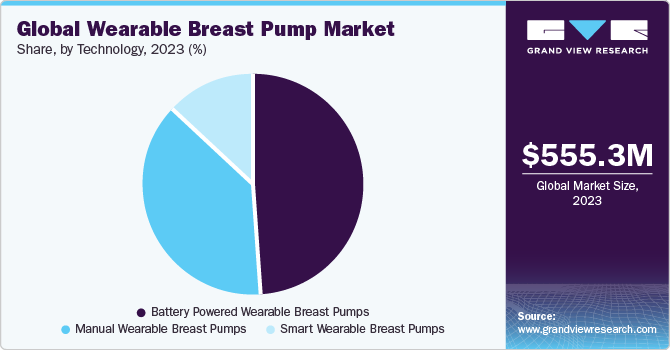

The global wearable breast pump market size was estimated at USD 555.35 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.55% from 2024 to 2030. A worldwide surge in women’s employment rate is expected to increase the demand for wearable breast pumps. For instance, as per the Center for American Progress, in December 2022, more than 993,000 mothers were working in America and the labor force participation rate for women reached 77.0%. In addition, working women have a relatively high disposable income and less time to breastfeed their babies and thus, are ideal customers for wearable breast pumps.

The growing consumer awareness about wearable breast pumps, coupled with development in healthcare infrastructure in emerging economies is expected to positively impact the market growth during the forecast period. For instance, awareness initiatives by government organizations to feed babies with expressed breastmilk using breast pumps during the COVID-19 pandemic are expected to have a positive impact on the market. Thus, increased usage of wearable breast pumps in the wake of rising precautionary measures is anticipated to drive the market. For instance, the Centers for Disease Control and Prevention (CDC) and American College of Obstetricians and Gynecology (ACOG) recommend the separation of newborns from mothers for at least a week or more, to reduce exposure of newborns to COVID-19. This is expected to drive the market at a healthy rate during the forecast period.

Governments of various countries are encouraging mothers to breastfeed babies up to the age of 6 months. Moreover, many international agencies are arranging campaigns to raise awareness about breastfeeding. Various market players, such as Medela LLC, Laura & Co., Newell Brands, and Ameda, & universities, including Washington University and Fudan University, are raising awareness among women about breastfeeding and its benefits by arranging campaigns and providing informative magazines. These factors are expected to drive the market.

Various private and public companies provide insurance coverage for wearable breast pumps. For instance, Medela offers insurance coverage for its breast pump products and related accessories. Medela also rents hospital-grade breast pumps for ample duration to mothers who cannot afford to buy a new pump. Such factors are anticipated to drive the growth of the market in the U.S. Furthermore, the Affordable Care Act mandates that a mother should be provided with an electric/manual breast pump once the baby is born. These factors are expected to support market growth over the forecast period.

The increasing number of milk banks is anticipated to boost the demand for wearable breast pumps over the forecast period. For instance, as per the European Milk Bank Association as of 2021, there are 282 milk banks in the European region, with 18 more milk banks under development. In addition, as per the National Institute of Health (NIH), there were 222 milk banks in Brazil by March 2022.

The presence of various e-commerce sites offering wearable breast pumps drives the sales of the products. Product penetration through online networks is rapidly increasing, as it allows end users to compare and select suitable products based on their brand, type, price, and point of sales. Amazon, Bodily, and Haakaa are some of the notable e-commerce websites and companies that offer significant discounts, and prompt customer service on various breast pumps & breastfeeding accessories. Thus, easy availability of different wearable breast pumps on online platforms is expected to drive market growth in the coming years.

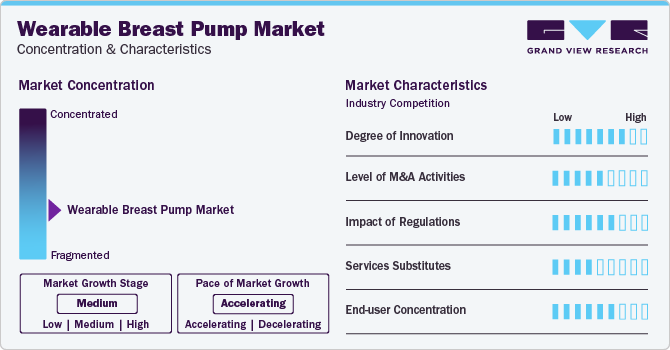

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The wearable breast pumps market is characterized by a moderate-to-high degree of growth. Key drivers include the rising awareness of breastfeeding benefits, increasing global women's employment rates, improved healthcare infrastructure in emerging economies, and government initiatives to support working mothers. Ongoing advancements in wearable breast pump technology, such as the development of battery-operated pumps and smart pump features, have made breast pumping more convenient and efficient, driving market growth.

Key strategies implemented by players in breast pump market are new product launches, expansion, acquisitions, partnerships, and other strategies. In November 2023, Pigeon officially unveiled the much-anticipated release of its second-generation GoMini Electric Wearable Breast Pumps, known as the GoMini Plus.

Degree of Innovation: The breast pump market is witnessing a substantial degree of innovation driven by rapid technological advancements and the increasing adoption of advanced products. The market is experiencing growth due to the increasing availability of more convenient and efficient wearable breast pump technology. Advancements such as battery-operated pumps and smart pump features have made breast pumping easier and more discreet, allowing mothers to pump without being tethered to a traditional pump. This has led to the popularity of wearable breast pumps, which are compact, quiet, and hands-free, making them a convenient choice for on-the-go mothers. As technology continues improving, we expect to see further innovations and enhancements in this market.

Impact of Regulations: Regulatory standards and requirements are essential in ensuring wearable breast pump safety and quality. These standards help build consumer trust in the products and ensure they are safe and effective. Manufacturers must comply with these requirements to obtain product certification or approval. This can sometimes act as a barrier to entry for new companies into the market. However, compliance with these regulatory standards can also lead to significant investments in research, development, and testing to meet the safety and performance requirements, ultimately resulting in better-quality products for consumers.

Level of M&A Activities: Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies may acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. In January 2023, International Biomedical announced the acquisition of Ameda, Inc. The company is expected to hire in Operations roles as it consolidates this acquisition and develops new growth initiatives.

Regional Expansion: The regional expansion strategy adopted by companies in the market is a smart move to capitalize on emerging opportunities and broaden their market presence. This approach involves establishing a stronger presence in key geographical areas through partnerships, acquisitions, and localized marketing strategies. By tailoring their products and services to meet regional healthcare needs, breast pump firms aim to enhance accessibility and responsiveness, ensuring a more comprehensive and effective market penetration. For instance, in January 2024, Annabella announced its seed funding of USD 8.5 million and its entrance into the U.S. breast pump market.Annabella has sold approximately 4,000 breast pumps in Israel since February 2023. This expansion demonstrates Annabella's product excellence, illustrated by its patented, FDA-cleared breast pump, which provides mothers with a product comparable to breastfeeding while emphasizing efficiency and comfort.

The seed funding is expected to be utilized to fuel next-generation product development and expand into the US market. Thus, regional expansion serves as a critical factor for industry leaders to tap into diverse markets, address specific healthcare demands, and ultimately drive sustained growth.

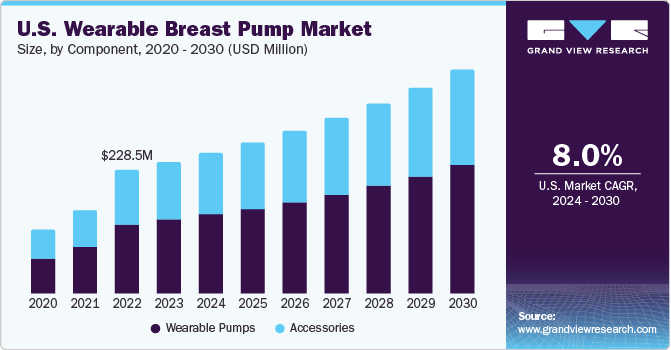

Component Insights

Based on components, the wearable breast pumps market is segmented into wearable pumps and accessories. The wearable pumps segment dominated the component segment with a market share of 57.56% in 2023. This can be accredited to the rise in population and increasing number of working women. For instance, as per the World Data Bank, the fertility rate in India will be 2.0 births per woman in 2021. Similarly, as per the data published by The World Counts, the UN estimated that about 385,000 are born each day around the globe which accounts for 140 million a year. Thereby impelling the market growth over the forecast period.

The governments of various countries encourage mothers to breastfeed babies up to the age of 6 months and international agencies help in arranging campaigns to raise awareness about breastfeeding. These factors are expected to drive the market growth during the forecast period. Furthermore, this segment is also expected to grow at the highest CAGR of 8.78% from 2024 to 2030 owing to rising online and e-commerce accessibility of wearable pumps. The increase in favorable reimbursement policies is a major factor expected to drive growth of this segment. For instance, in the U.S., Medicaid covers most wearable pumps, such as smart, battery-powered, or manual, under its insurance guidelines. Such policies are anticipated to increase the sales of these products over the forecast period.

Technology Insights

Battery powered wearable breast pump segment held the largest market in 2023. The factors driving the growth of the segment are a surge in women's employment rates, growing awareness about availability of technologically advanced breast pumps, and improving healthcare infrastructure in emerging economies.

Battery-operated breast pumps are easy to transport and can be used in small spaces and are comparatively less time-consuming and tiring. They are best suited for mothers who need to pump occasionally and do not prefer manual pumps. Moreover, the market players are consistently investing in R&D to develop smaller and lighter battery-operated wearable breast pumps, as this technology is gaining acceptance from working women. Thus, contributing to the segment growth.

The smart wearable breast pumps segment is expected to grow at the highest CAGR from 2024 to 2030. Introduction of technologically advanced products such as Elvie wearable electric breast pump, Freemie Liberty wearable breast pump, and Willow Generation 3, is anticipated to drive the segment growth. This high-tech wearable breast pump is connected to a mobile application that provides vital information such as milk volume, previous pumping sessions, and pumping time. It is best suited for women uncomfortable with cumbersome pumping devices. In addition, these pumps are preferred in working places without established designated space for expressing milk.

Moreover, there have been several product launches in smart wearable breast pumps. These factors are expected to drive the segment’s growth over the forecast period.

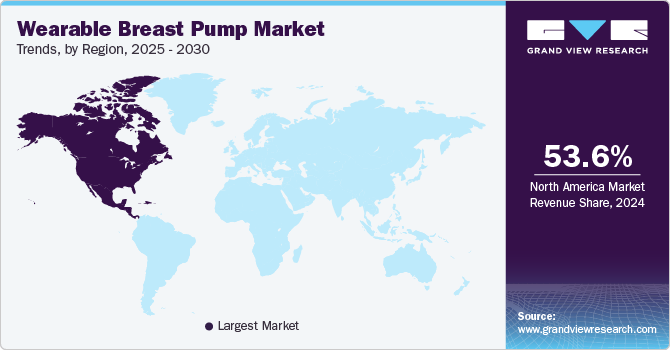

Regional Insights

North America accounted for the highest market share of over 52.0% in 2023. This dominance can be attributed to an increase in various government initiatives. For instance, various awareness campaigns by CDC, WHO, and ABM to feed babies with expressed breastmilk using breast pumps are expected to have a positive impact on the market. Moreover, CDC has been encouraging women to feed babies with breast milk. In addition, CDC has also laid guidelines & recommendations regarding the proper storage and preparation of breast milk on their website, which is anticipated to increase awareness regarding the importance of breast milk among women, thereby propelling the market growth.

The U.S. held the largest share of the North America market in 2023. Some of the factors responsible for its dominance are increasing awareness about the availability of wearable breast pumps, growing number of employed women, and high disposable income. For instance, as per a report by the U.S. BUREAU OF LABOR STATISTICS, the unemployment rate of women in the U.S. has decreased from 13.9% in 2020 to 3.3% in 2023.

However, Asia Pacific is anticipated to witness the fastest growth of 10.54% during the forecast period. This can be attributed to the well-established healthcare facilities, government support, and a decrease in infant mortality rate. For instance, according to the Workplace Gender Equality Agency, in February 2022, Australian women comprised 47.9% of total working population. Moreover, the Australian Breastfeeding Accessories Association promotes use of breast pumps and increases awareness among women, thereby propelling the market over the forecast period.

China held the largest share of the Asia Pacific market in 2023. This can be attributed to a decrease in infant mortality rate, government support, and well-established healthcare facilities. For instance, as per the data published by Macrotrends LLC the infant mortality rate in China has decreased to 8.17 in 2024 from 8.40 in 2023. Hence, above mentioned factors are anticipated to propel the market in Asia Pacific.

Wearable Breast Pump Company Insights

The markettrends are shaping industry leaders’ strategies. Heavy investments in research and development for technological innovations reflect a commitment to connected healthcare solutions. Top players are adapting to the shift towards user comfort through technological advancements, and innovative products. Technological advancements in the market have been continuous, with the emergence of smart and connected devices. These innovative wearable breast pumps enable users to monitor and manage their pumping sessions via mobile apps. The prevalence of Bluetooth connectivity, data tracking capabilities, and customizable features has been on the rise.

Key Wearable Breast Pumps Companies:

The following are the leading companies in the wearable breast pump market. These companies collectively hold the largest market share and dictate industry trends. financials, strategy maps & products of these wearable breast pump companies are analyzed to map the supply network.

- Medela AG

- Ameda, Inc.

- Willow Innovations, Inc.

- Koninklijke Philips N.V.

- Elvie (Chiaro Component Ltd)

- Freemie

- BabyBuddha Products, LLC

- Spectra

- iAPOY

- Lavie Mom

- Pigeon Corporation

Recent Developments

-

In August 2023, Lansinoh introduced the Lansinoh Wearable Pump, as part of their commitment to "Stand with the Mothers," offering support to new moms through products and resources to simplify their journey.

-

In February 2023, Madela AG and Sarah Wells partnered to launch the Allie sling bag for breastfeeding parents which was an addition to Madela’s Freestyle Hands-free Breast Pump portfolio.

-

In January 2023, Madela AG launched the Freestyle Hands-free Breast Pump these pumps offer ultra-lightweight, comfortable, and discreet collection cups that connect to portable pump motors, providing mothers with a hands-free pumping experience.

-

In January 2023, Willow Innovations, Inc. launched the first breast pump companion app, Willow 3.0 for Apple Watch. The Willow 3.0 pumps have a smartwatch companion app that allows breastfeeding parents to easily track, control, and view their pumping sessions.

Wearable Breast Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 596.37 million

Revenue forecast in 2030

USD 975.47 million

Growth rate

CAGR of 8.55% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medela AG; Ameda, Inc.; Willow Innovations, Inc; Koninklijke Philips N.V.; Elvie (Chiaro Component Ltd); Freemie; BabyBuddha Products, LLC; Spectra; iAPOY; Lavie Mom; Pigeon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Breast Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wearable breast pump market report based on component, technology, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable Pumps

-

Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Wearable Breast Pumps

-

Battery Operated Wearable Breast Pumps

-

Smart Wearable Breast Pumps

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable breast pump market size was estimated at USD 555.35 million in 2023 and is expected to reach USD 596.37 million in 2024.

b. The global wearable breast pump market is expected to grow at a compound annual growth rate of 8.55% from 2024 to 2030 to reach USD 975.47 million by 2030.

b. North America dominated the global wearable breast pump market with a share of 52.21% in 2023. This is attributable to the increasing awareness about the availability of wearable breast pumps, the growing number of employed women, and high disposable income.

b. Some of the key players operating in the global wearable breast pump market include Medela AG, Ameda. Inc., Willow Innovations, Inc., Philips, Elvie (Chiaro Technology Ltd), Freemie, BabyBuddha Products, LLC, Spectra, iAPOY, Lavie Mom

b. Key factors that are driving the wearable breast pump market's growth include a worldwide surge in women’s employment rate, growing consumer awareness about wearable breast pumps coupled with development in healthcare infrastructure in emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."