- Home

- »

- Next Generation Technologies

- »

-

Web Hosting Services Market Size & Share Report, 2030GVR Report cover

![Web Hosting Services Market Size, Share & Trends Report]()

Web Hosting Services Market Size, Share & Trends Analysis Report By Type (Shared Hosting, Dedicated Hosting), By Application, By Deployment (Public, Private, Hybrid), By End-use (Enterprise, Individual), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-480-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Web Hosting Services Market Size & Trends

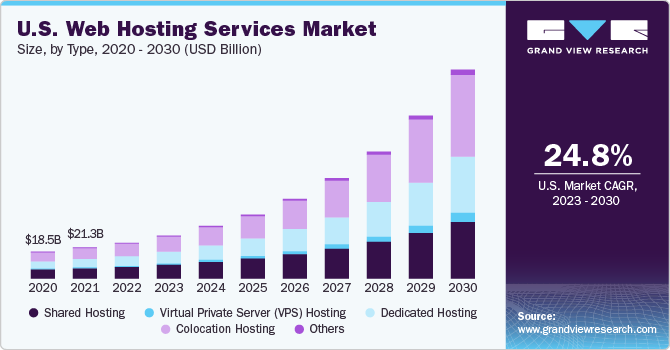

The global web hosting services market size was valued at USD 77.78 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 20.2% from 2023 to 2030. Web hosting services can be categorized into various types, such as shared, colocation, dedicated, and Virtual Private Server (VPS). The service allows enterprises and individuals to leverage a website over the internet to publish their business-related as well as personalized content. The steadily growing number of organizations across the globe are anticipated to bolster market growth over the forecast period. These organizations publish their websites over the internet to increase their online presence as well as for marketing purposes.

Over the past few years, the number of startup companies across the globe has grown at a rapid rate. Governments of various developing and developed nations provide financial and non-financial support for small business entrepreneurs to help them grow their businesses. For instance, the U.S. federal government provides various funding programs, such as Women-Owned Small Business (WOSB) Federal Contract and USDA Rural Business Enterprise Grant program, to small business owners. Such initiatives have motivated more entrepreneurs to start new businesses in the country.

Moreover, these entrepreneurs seek an omnichannel sales model to sustain their businesses in a highly competitive environment. The omnichannel sales model enables them to maximize the extent of their customer base by offering their entire product portfolios through the internet globally. Therefore, the growth of such small businesses is expected to boost market expansion in the coming years.

The growth in organizational business activities boosts the development of the market for web hosting services. As a business grows, the company’s website starts getting more traffic. It becomes difficult to handle the increased traffic if the company uses a shared server. Therefore, to satisfy the requirement of the increased traffic, the company has to switch to some other type of hosting, such as dedicated or colocation. However, the company can also choose any different kind of hosting service that it deems fit for the organization and its workload.

The low availability of funds, coupled with the growing safety and security requirements of large and small companies, has resulted in a switch to cloud-based solutions or services. The advantages of cloud hosting, including low infrastructure cost and increased uptime, have driven an inclination towards these services. Additionally, website hosting providers offer three kinds of cloud hosting services: public cloud, private cloud, and hybrid cloud. All of these cloud solutions offer varied benefits; however, hybrid cloud services are becoming the most opted option among the end-users.

The outbreak of the COVID-19 pandemic resulted in a drastic increase in internet activity globally. Most businesses have started to leverage Internet services for conducting business operations. Additionally, the outbreak has made individuals spend more time over the internet writing blogs and making fitness videos, among other activities, and posting them over the internet. Moreover, as an outcome of the pandemic, the growing inclination towards online purchasing has encouraged increased investments by end-users, leading to the development of a robust IT infrastructure and business models.

Besides, several market players are actively taking initiatives to support small businesses during this period. For instance, GoDaddy Operating Company, LLC has provided temporary free access to the company’s various tools, including marketing tools, social media designing using smartphones, and educating the users about websites and digital marketing.

Type Insights

In terms of revenue, the shared hosting segment dominated the market with a share of 35.3% in 2022. This is attributed to the high adoption rate of shared hosting servers, especially among SMEs. Most small and medium businesses prefer this hosting owing to the low website traffic that they receive. Additionally, these SMEs are present in large numbers across every region and represent more than 90% of the total number of businesses. The cost associated with shared hosting is lower than any other type; thus, a large number of SMEs, as well as individuals, are opting for this type.

As businesses grow and companies get more web traffic, they opt to shift from shared hosting to other hosting services, including VPS, dedicated, or cloud hosting. Large organizations generally opt for dedicated hosting to cater to high web traffic. Another reason for opting for dedicated hosting is the budget availability, as its cost is quite high. Due to budget constraints, small or medium-sized organizations find it challenging to choose dedicated servers for their business requirements. However, the high levels of security and uptime that dedicated hosting offers are expected to contribute to decent segment growth.

The colocation hosting segment is expected to witness the highest CAGR of 24.3% over the forecast period. The strong growth is attributed to its beneficial features that enable organizations to have better control over their infrastructure and hardware, along with providing customization of specific software and hardware requirements.

Application Insights

In terms of revenue, the public website segment dominated the web hosting services market with a share of 55.1% in 2022. This high share is attributed to the fact that most websites are accessible to everyone across the globe. Therefore, companies prefer to host their websites in a way that they can target a huge chunk of the general population to sell their products or solutions. However, companies also use intranet websites that their internal employees widely prefer. Some examples of intranet websites include Huddle, Microsoft SharePoint, Jostle, and Igloo.

The internet penetration rate and use of smartphones are increasing rapidly across the globe. This has resulted in a noticeable shift in consumer buying patterns as they prefer to buy products or services online and get them delivered to their doorsteps. Therefore, companies engaged in e-commerce businesses have started to widen their sales channel by providing products through mobile applications. It helps e-commerce companies offer customers with easy access to their online stores. As a result, the mobile application segment is anticipated to see modest growth in the coming years.

Deployment Insights

In terms of revenue, the public segment dominated the market with a share of 43.5% in 2022. This high share can be attributed to the benefits of this deployment type, such as low cost as well as high scalability that the public cloud offers. Due to these benefits, small and medium-sized businesses choose this type of service to host their websites. Moreover, the public segment primarily includes shared web hosting and public cloud hosting services.

The hybrid segment is expected to witness the highest CAGR of 22.8% over the forecast period. The high growth can be attributed to the advantages that the hybrid cloud offers, compared to the public and private clouds. These include a higher level of security and uptime compared to the public cloud. On the other hand, the cost associated with the hybrid cloud is lower than the price of a private cloud.

Additionally, companies all over the globe are increasingly inclined towards opting for hybrid cloud hosting services as it allows them to leverage the flexibility that the cloud offers. It includes connecting the on-premise private and third-party public cloud into one single and flexible infrastructure. This infrastructure allows the organization to select an optimal cloud platform for each workload and application. It also allows the switching of workloads between the public and private cloud services.

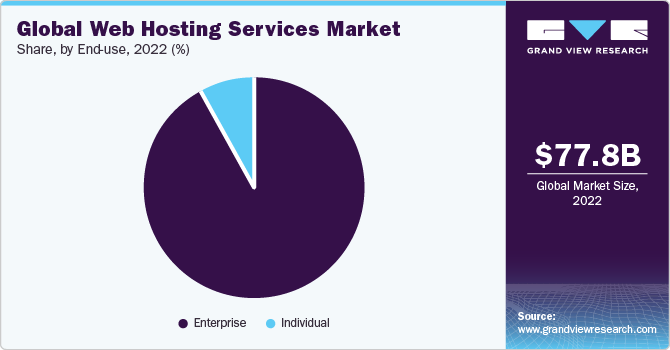

End-use Insights

In terms of revenue, the enterprise segment dominated the market with a share of 91.7% in 2022. This high share can be attributed to the increasing focus of enterprises on expanding their business presence through online channels. The significantly growing customer preference for online shopping is the primary factor creating vast opportunities for these businesses to focus on online channels. Therefore, the growing customer inclination toward online purchasing is expected to bolster the market for web-hosted services through 2030.

Large enterprises have witnessed the maximum adoption of website hosting services to manage their expansive business operations. Although fewer than SMEs, these enterprises occupy a considerable market share. Also, these businesses usually opt for a premium and highly secured web hosting plan, such as dedicated hosting, which aids in managing the organizations’ huge online traffic. Besides, most e-commerce websites also prefer dedicated hosting services to deliver enhanced security to their websites.

Regional Insights

North America dominated the market with a revenue share of 39.1% in 2022. This dominant share can be attributed to the rapid development of the U.S. market, which has the highest number of websites available online. Besides, several key market players, including Amazon Web Services, Google LLC, and GoDaddy Operating Company LLC, have a significant presence in the regional market.

Europe is anticipated to witness significant growth in the web hosting service market over the forecast period. Countries such as Germany and the U.K. are contributing to the high regional growth rate. In December 2020, the European Commission and the European External Action Service (EEAS) introduced a new EU cybersecurity strategy. The primary objective is to enhance Europe's ability to withstand cyber threats and guarantee that individuals and businesses can fully leverage secure and dependable services and digital tools.

Additionally, growing regional investments in the development of the IT infrastructure by governments of various developed and developing nations also contribute to market expansion. Furthermore, the growing digitalization and demand for online delivery websites are anticipated to spur industry expansion in the coming years.

Key Companies & Market Share Insights

Key players provide hosting services to several companies to publish their websites online. Additionally, these players are focusing on increasing their market share by adopting strategies that include investments, new product & service launches, partnerships, and mergers & acquisitions. For instance, in July 2022, GoDaddy Operating Company, LLC announced the addition of a few features to its web hosting platform. These features enable free daily backups, an additional layer of security, and many other benefits to its users.

Key Web Hosting Services Companies:

- Amazon Web Services

- Endurance International Group

- 1&1 IONOS Inc.

- Liquid Web LLC

- Google LLC

- GoDaddy Operating Company, LLC

- Hetzner Online GmbH

- Alibaba Cloud

- Equinix, Inc.

- WPEngine, Inc.

Recent Developments

-

In June 2023, HostPapa, a leading cloud service and web hosting provider for SMBs, completed the acquisition of Deluxe Corporation's web hosting and logo design businesses. The latter’s web hosting division serves small businesses and email hosting customers globally, offering white-label website hosting and logo design services. This acquisition expands HostPapa's hosting and design businesses, increasing its presence and offerings in multiple markets

-

In August 2022, WP Engine, a WordPress technology company, announced its Asia-Pacific (APAC) expansion plans by establishing a new presence in Singapore. This strategic move builds upon the company's remarkable growth and milestones in the region since the inauguration of its Brisbane office in Australia in 2017. With the launch of operations in Singapore, WP Engine has introduced new regional product offerings, further solidifying its commitment to the APAC market

-

In September 2021, MilesWeb, a web hosting company, announced expansions to its product portfolio. The company expanded its selection of managed Linux VPS hosting plans to cater to the needs of small, medium, and large websites/apps. The company offers a diverse range of web hosting solutions, ensuring they meet the requirements and satisfaction of their customers. Their VPS plans encompass basic to advanced options, providing website and app owners with multiple choices to find the most appropriate VPS hosting solution for their specific projects

-

In March 2021, DreamHost, a provider of web hosting and Managed WordPress services, introduced an extensive range of professional web services to assist small business owners in reaching their online goals. The company's offering, Pro Services, facilitates connections between website owners and industry experts in various fields, such as website design, marketing, software management, and front-end web development

Web Hosting Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 88.41 billion

Revenue forecast in 2030

USD 320.62 billion

Growth rate

CAGR of 20.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services; Endurance International Group; 1&1 IONOS Inc.; Liquid Web LLC; Google LLC; GoDaddy Operating Company, LLC; Hetzner Online GmbH; Alibaba Cloud; Equinix, Inc.; WPEngine, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Web Hosting Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global web hosting services market report on the basis of type, application, deployment, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Shared Hosting

-

Dedicated Hosting

-

Virtual Private Server (VPS) Hosting

-

Colocation Hosting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Intranet Website

-

Public Website

-

Mobile Application

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Enterprise

-

SMEs

-

Large Enterprises

-

Individual

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global web hosting services market size was estimated at USD 77.78 billion in 2022 and is expected to reach USD 88.41 billion in 2023.

b. The global web hosting services market is expected to grow at a compound annual growth rate of 20.2% from 2023 to 2030 to reach USD 320.62 billion by 2030.

b. North America dominated the web hosting services market with a share of 39.1% in 2022. This high share can be attributed to the U.S. market, which has the greatest number of websites available online. Besides, several key market players, including Amazon Web Services and Google, LLC, among others.

b. Some key players operating in the web hosting services market include Amazon Web Services, Endurance International Group, 1&1 IONOS Inc., Liquid Web, LLC, Google LLC, GoDaddy Operating Company, LLC, Hetzner Online GmbH, Alibaba Cloud, Equinix, Inc., and WPEngine, Inc. among others.

b. The growth in the organizations’ business activities boosts the growth of the market for web hosting services. As the business grows, the company websites start getting more traffic. It becomes difficult to handle the increased traffic if the company uses a shared server. Therefore, to satisfy the requirement of the increased traffic, the company has to switch to some other type of hosting, such as dedicated or colocation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."