- Home

- »

- Pharmaceuticals

- »

-

Weight Loss Supplements Market Report, 2021-2028GVR Report cover

![Weight Loss Supplements Market Size, Share & Trends Report]()

Weight Loss Supplements Market Size, Share & Trends Analysis Report By End User (18-40 Years, Under 18 Years), By Distribution Channel (Offline, Online), By Type (Powders, Pills), By Ingredient, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-394-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global weight loss supplements market size was valued at USD 33.4 billion in 2020 and is projected to expand at a compound annual growth rate (CAGR) of 16.6% from 2021 to 2028. The rising cases of obesity and related health ailments, such as Cardiovascular Diseases (CVDs), diabetes, and hypertension, are expected to drive product demand. As per the World Health Organization estimates in June 2021, approximately 2.8 million individuals die every year due to overweight or obesity. In addition, as of 2021, WHO estimates approximately 115 million individuals are suffering from obesity-related ailments in developing countries. Therefore, the growing dependency on weight loss supplements to maintain normal body weight is expected to propel market growth.

Moreover, increasing disposable income and growing concerns about maintaining a healthy lifestyle are expected to drive market growth. According to data published by William Reed Business Media Ltd. in 2016, approximately 79% of Europeans are willing to pay more for products, such as organic weight loss supplements, owing to greater interest in improving overall wellbeing. In addition, an increase in the working class and the middle-class population is anticipated to boost the product demand in the coming years. It is estimated that in India, the average household income will triple over the next two decades, and the country is expected to have the world’s fifth-largest consumer economy by 2025.

The abovementioned factors are expected to propel market growth. Government and private health organizations are designing and implementing global obesity epidemic awareness programs and events to promote the necessity of maintaining nutritional well-being and normal body weight by inculcating healthier dietary habits and pursuing an active, physical lifestyle. As per RunRepeat statistics in 2020, there are more than 184 million gym members across the globe and the number of gym members has risen by 37.1% from 2008 to 2018. In addition, the boutique fitness industry is expected to add over 2,000 new studios across the globe in the next five years.

COVID-19 weight loss supplements market impact: 12.5% decrease in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The weight loss supplements market decreased by 12.5% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 12.8% to 16.5% in the next 5 years

The pandemic significantly impacted the market growth, with temporary lockdowns and restrictions on using fitness centers and gyms

Growing obesity levels coupled with rising health consciousness will drive the market. Pursual of an active & fit lifestyle is supported with the surge of fitness centers and gyms

The pandemic led to negative lifestyle changes and unhealthy dietary changes followed by a significant decline in physical activity resulting in a rise in cases of obesity and weight gain

Adoption of sustainable and healthy living to maintain a normal weight is expected to drive the growth of the market.

However, several regional and country-level governments have laid down stringent regulatory frameworks for market players to provide sufficient evidence regarding the safety & efficacy of every ingredient used in the supplement, which is expected to restrain the market growth. The COVID-19 pandemic resulted in temporary lockdowns and closure of gyms and fitness centers resulting in individuals shifting towards negative lifestyle changes and a significant decline in physical activities. During the pandemic, market players witnessed transitions in consumer behaviors. The pandemic caused drastic environmental and social changes in the functioning of people’s lives. Due to these sudden and prominent changes, individuals negatively transformed their dietary and lifestyle habits.

As per the MDPI study conducted in September 2020 to understand body weight changes during the initial months of the pandemic, it states that 18.1% of respondents witnessed a decline in their body weight whereas, 33.6% of respondents witnessed gain in their body weight. An unhealthy diet is the leading cause of obesity and obesity-related disorders. Consumers are increasingly realizing the benefits of these supplements, which is positively impacting product growth and consumption levels. For instance, the U.S. population is becoming more health-conscious and actively pursuing a physical lifestyle. A rise in the number of fitness centers and health clubs across the country has supported the market development and growth.

Health clubs have consulting dieticians, which influences the consumption of weight loss supplements among members. Furthermore, the growing trend of gaining the perfect body physique, especially in the younger age groups, also propels growth. Public and private market players are facing strong competition and are focusing on developing & innovating new products. In addition, key players are focusing on organizing awareness campaigns to spread the need for controlling obesity and the benefits of weight loss supplements. Furthermore, key players are strengthening their e-commerce presence as well as an offline presence in retail pharmacies, drug stores, health & beauty stores, and department stores. Growing strategic alliances majorly collaborations and acquisitions among key market players operating in the weight management space are driving growth.

Type Insights

In 2020, the powders segment accounted for the highest revenue share of 32.7%. The powdered formulation makes provision of higher quantities of supplement and has a longer shelf life with the easily regulated dosages as per individual requirement, which is a driving factor for this segment. The ease of administration and dosage allows the body to digest and absorb the nutrients quickly & efficiently making them more bioavailable when compared to other formulations. Powdered formulations are perfect for individuals with hampered ingestion or clinically diagnosed dysphagia where solid oral supplement formulations, such as pills and softgels, cannot be administered.

However, the pills type segment is expected to record the fastest CAGR over the forecast years. Arise in preference for weight loss supplements in pills formulation due to the easy availability of the same in chewable tablets sustained-release pills, and sublingual pills is contributing to the segment growth. In addition, factors, such as pills being comparatively cheaper than other formulations, and their higher shelf life, and wide acceptance among patients of all age groups, are driving the demand for pill type formulation in the market.

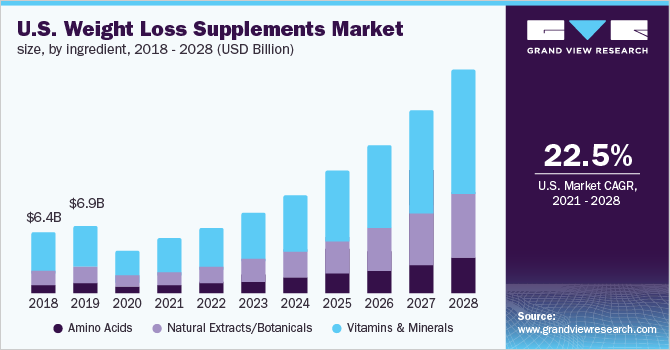

Ingredient Insights

In 2020, the vitamins and minerals segment dominated the market with a revenue share of 58.0%, owing to the widespread consumption of vitamin- and mineral-based weight loss supplements. These vitamin- and minerals-based supplements along with supporting weight management also provide nutrition and support proper functioning & metabolism of the body. Several vitamins- and mineral-based products comprise antioxidants, which prevent cell damage from structural changes as well as enhance an individual’s overall health and performance. In addition, they help in energy production and maintain healthy heart, brain, and other body functions.

On the other hand, the natural extracts and botanicals segment is anticipated to register the fastest growth rate over the forecast years. The growing demand for organic and vegan supplements across the globe due to the rising environmental concerns is expected to positively impact the segment growth. The natural extract and botanicals-based supplements are commonly composed of caffeine, green tea extract, Garcia Cambodia, licorice root, ginseng, and green coffee bean extract. In addition, the demand for traditional medicine is creating opportunities for small-size local players to enter the market with their innovative products.

Distribution Channel Insights

In 2020, the offline distribution channel segment accounted for the highest revenue share of 70.4%. The easy availability of weight loss supplements at retail pharmacies, drug stores, health & beauty stores, and department stores is contributing to the segment growth. In addition, health & beauty stores and department stores are proactively undertaking initiatives to spread awareness about maintaining good health, which is expected to positively impact the segment growth. Moreover, offline stores are continuously involved in increasing the overall customer engagement and experience at the stores. Several health & beauty stores and department stores have introduced point-of-sale terminals to accelerate the checkout process. Consumers tend to rely more on offline channels as compared to online platforms as there is a threat of purchasing substitute or counterfeit products.

However, the online distribution channel segment is expected to record the fastest CAGR over the forecast period. Online retailers offer lucrative discounts on product prices, which, in turn, drives sales through online channels. In addition, online platforms are devising and implementing numerous strategies to compete with their offline counterparts. The convenience offered by online distribution channels is positively impacting the segment growth. Furthermore, with the penetration of e-commerce, there is a gradual shift towards online distribution channels of supplements. The rise in self-directed consumers is also one of the key factors driving the segment growth.

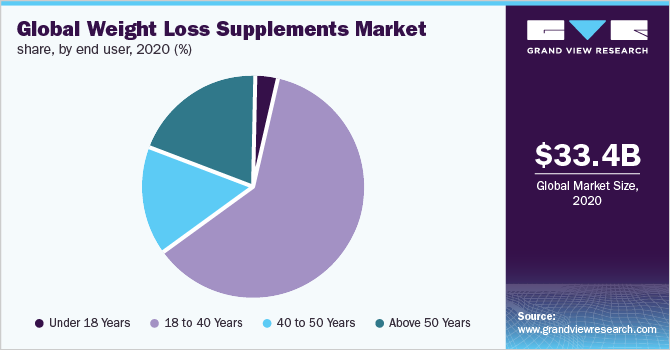

End-user Insights

In 2020, the 18 to 40 years end-user segment dominated the market with a revenue share of 61.6% owing to rapidly growing cases of obesity in this population segment. The growing need to maintain normal body weight and optimum physique is expected to drive the growth of this segment. Rising disposable income and increasing participation in physical fitness activities are expected to positively impact the growth of the segment.

The growing awareness levels of the benefits and functioning of weight loss supplements are expected to drive the segment. As per the National Institutes of Health estimates in 2021, approximately 15% of the U.S. adults have claimed to have consumed weight-loss dietary supplements in their lifetime, with higher consumption recorded in female adults compared to males. The growing demand for appetite suppressants, fat burners, and craving curbers are driving the segment growth.

However, the under 18 years end-users segment is anticipated to record the fastest CAGR over the forecast period. Rising awareness levels among the consumers under this age group about the product benefits will drive the segment. The growth in disposable income in this segment is also expected to have a positive impact on the segment growth.

Regional Insights

Asia Pacific held the largest share of 45.0% of the overall revenue due to the high prevalence of obesity, growing disposable income, and rising health consciousness among consumers. The adult and geriatric population is rapidly growing and is largely consuming appetite suppressants and weight management medications to support optimum physique and well-being. The Asia Pacific regional market is expected to grow at a steady CAGR during the forecast years owing to improving distribution strategies implemented by the key players to increase product availability. Moreover, untapped opportunities in developing countries of Asia Pacific represent the growing demand in this region. The growing patient pool in Asia Pacific is also one of the key driving factors for the market.

However, North America is anticipated to register the fastest CAGR over the forecast period owing to the alarming rise in obesity cases in the U.S. Growing sedentary lifestyle coupled with unhealthy dietary habits is leading to significant growth in the cases of obesity and related health issues. A rise in the number of fitness centers and gyms has been well accepted and adopted by the population in the form of active membership to pursue a physically fit lifestyle. The presence of several key market players in North America and easy product availability is also expected to drive the regional market. The growing demand for natural, plant-based supplements in North America is creating opportunities for key players to develop new products.

Key Companies & Market Share Insights

Key market players are constantly focusing on devising innovative product strategies to expand their existing product portfolios. In addition, these players are focusing on merger & collaboration strategies to support product research & development.For instance, in 2018, Glanbia, plc. acquiredSlimFast, weight management, and health & fitness brand. The acquisition helped the company expand its portfolio of products for weight management. The brand is planned to be operated under the company’s performance nutrition segment. Some of the key players in the global weight loss supplements market are:

-

Glanbia PLC

-

GlaxoSmithKline PLC

-

Herbalife Nutrition Ltd.

-

Abbott

-

Kellogg Company

-

Nestle

-

Kraft Heinz Company

-

Amway Corp.

-

PepsiCo

-

Ajinomoto Co. Inc.

Weight Loss Supplements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 39.8 billion

Revenue forecast in 2028

USD 116.6 billion

Growth rate

CAGR of 16.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ingredients, end user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Brazil; Mexico; South Africa; UAE; Saudi Arabia

Key companies profiled

Glanbia PLC; GlaxoSmithKline PLC; Herbalife Nutrition Ltd; Abbott; Kellogg Company; Kraft Heinz Company; Amway Corporation; Nestle; PepsiCo; Ajinomoto Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub segments from 2016 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the global weight loss supplements market report on the basis of type, ingredient, end user, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Liquid

-

Powder

-

Softgels

-

Pills

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2016 - 2028)

-

Vitamins & Minerals

-

Amino Acids

-

Natural Extracts/ Botanicals

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2028)

-

Under 18 years

-

18 to 40 years

-

40 to 50 years

-

Above 50 years

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Offline Channel

-

Online Channel

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."