- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Whey Protein Market Size, Share & Trend Analysis Report 2030GVR Report cover

![Whey Protein Market Size, Share & Trends Report]()

Whey Protein Market Size, Share & Trends Analysis Report By Type (WPI, WPC, WPH), By Application (Sports Nutrition, Dietary Supplements, Beverages), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-286-0

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global whey protein market size was valued at USD 5.33 billion in 2021 and is estimated to grow at a compound annual growth rate (CAGR) of 10.48% from 2022 to 2030. The demand for whey protein is rising as awareness about healthy lifestyles increases. Fitness and sports clubs frequently recommend protein supplements, which is drawing customers’ attention to whey protein. In addition, whey protein is used in the food industry in baked goods, dairy products, beverages, cereals, chocolates, and baby foods due to its antihypertensive and antibacterial properties. As a result, the global sales of whey protein are anticipated to increase.

The COVID-19 pandemic had a mild impact on the global industry. The industry is reaching its pre-covid levels as the trade restrictions and lockdowns end. The consumer inclination towards consuming immunity-boosting products has increased owing to rising health concerns during the pandemic. Consumers now tend to fill the protein intake gap by incorporating protein supplements in their daily diet as protein is an essential component in boosting immunity. These trends are expected to continue over the coming years and will spur product demand. Whey protein applications in various food products vary depending on the goal of its utilization.

However, it is commonly used to improve biological value, create superior textural, physical, and other food functional properties, improve sensory attributes, and formulate low-lactose and high-protein products. Furthermore, efforts to discover new applications, such as the development of edible films, will support industry growth. Biodegradable or edible films are a convenient way to extend the shelf life of foods and improve their quality while also reducing environmental pollution. This is expected to fuel the product demand over the forecast period. Cancer patients who are receiving radiation therapy or chemotherapy may have difficulty meeting their nutritional needs due to a lack of appetite.

As a result, weight loss, protein-calorie malnutrition, and muscle loss may occur. In this case, the consumption of whey protein is an excellent alternative for cancer patients. Furthermore, it also aids in digestion as these proteins are easy to digest. These properties are expected to propel the industry growth in the coming years. The skin-hydrating and hair-conditioning properties of whey protein make it a significant ingredient in the formulation of personal care products like skincare and hair care products. The expansion of e-commerce and the rising number of working women are both contributing to the positive outlook for the global beauty and personal care industry.

This is anticipated to help the product gain traction in the personal care application segment during the estimated timeframe. Food and beverage manufacturers are adding functional whey protein to their packaged foods as a result of changing consumer preferences because it can replace high-fat and expensive ingredients, such as cream cheese, milk, and butter, while also preserving the original appearance, flavor, and texture of formulations. In addition, increased competition in the packaged food sector is driving companies to add functional ingredients to their product labels, which may positively impact product demand.

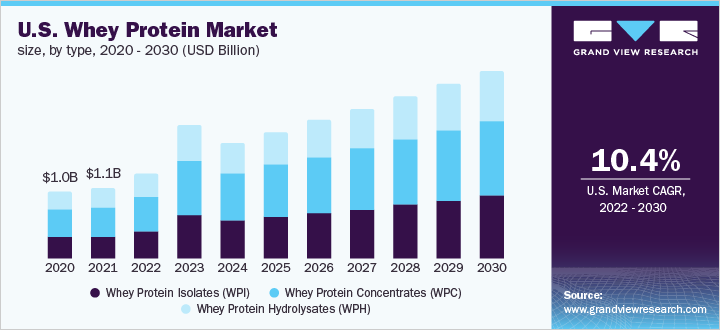

Type Insights

The Whey Protein Concentrate (WPC) segment dominated the global industry in 2021 with the largest revenue share of more than 40.00% and is expected to grow at the fastest CAGR from 2022 to 2030. WPCs are a part of whey proteins that remain soluble in the whey after casein precipitates at pH 4.6 and 20°C. These concentrates contain lipids, lactose, and minerals and are a heterogeneous mixture of different proteins. Furthermore, WPC is a low-cost alternative for blending caramel with superior flavor and processability. WPCs are employed in a variety of applications, such as the manufacturing of yogurt, beverages, and dairy desserts.

In addition, these concentrates are used to fortify infant nutrition and food products with protein. When WPC is heated and dissolved in water, it presents a gelling property that is helpful in applications in the meat and nutritional industries. These properties are anticipated to contribute to segment growth. In 2021, Whey Protein Isolate (WPI) segment held a significant share of the global revenue. Consumer preferences for incorporating proteins in regular foods, as well as rising demand for high-protein and low-fat weight management products, are expected to drive segment growth.

Furthermore, rising sales of fortified food products may boost segment growth in the coming years. Whey Protein Hydrolysate (WPH) has antimicrobial, antioxidant, and antihypertensive properties. They are used in the manufacturing of clinical nutrition, sports nutrition, and infant nutrition products. WPH is also used in the production of baked products, low-fat foods, dietetic foods, and protein-fortified beverages. Favorable regulatory support, such as from the Food and Drug Administration (FDA), for WPHs to be employed in a wide range of food applications, is expected to drive the segment in the coming years.

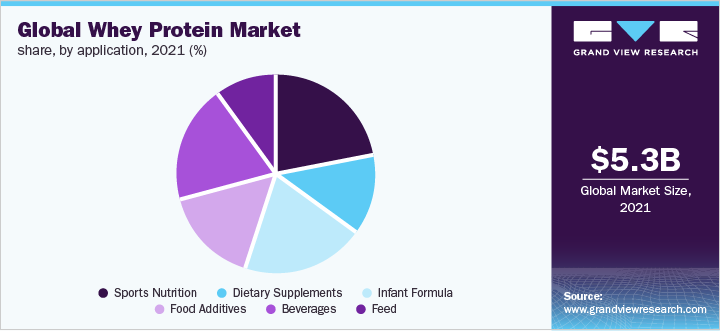

Application Insights

The sports nutrition segment dominated the global industry in 2021 and accounted for the highest revenue share of more than 21.50%. Whey proteins are widely used in a variety of food and beverage applications, such as bakery, dairy, confectionery, and energy drinks, due to their health benefits. Furthermore, there is a high product demand in food and beverage as it helps in flavor enhancement and acts as an emulsifying salt & a stabilizing agent. This is expected to drive segment growth over the forecast period. Product demand in the beverages sector is expected to remain high over the forecast period.

The increasing use of whey protein in sports nutrition and weight management products including bars, powders, and beverages, and an increasing number of fitness centers recommending protein supplements are expected to drive sales throughout the projected period. It is also used in the personal care and cosmetic industries to make a wide range of products, such as shampoos, hair dyes & colors, hair conditioners, eye care, face & body moisturizing products, and wave sets. As a result of its skin-conditioning, skin-hydrating, and hair-conditioning properties, its demand in the application is expected to grow significantly.

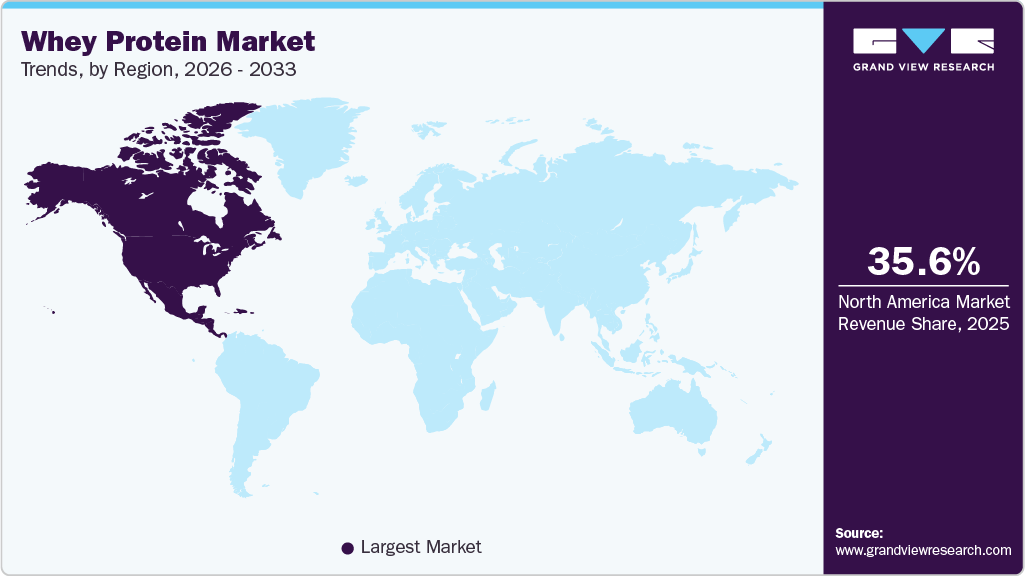

Regional Insights

North America led the global industry in 2021 and accounted for the maximum share of more than 36.30% of the global revenues. The presence of media that promotes healthy lifestyles and high disposable income levels supports the region’s growth. Furthermore, functional foods and supplements have gained traction, offering numerous health advantages in addition to basic nutrition, especially in the form of infant formula. Such factors have led to increased demand for whey protein in the region. Europe is expected to grow significantly over the forecast period owing to factors, such as the growing trend of preventive healthcare, a greater emphasis on healthy living, and a rising preference for protein supplements in Germany, France, and the U.K.

Furthermore, the growing use of protein products in both naturally derived and synthetic personal care products is expected to boost its market in the coming years. Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This is due to the rising domestic demand and exports for dairy-based protein ingredients including casein and whey. China is among the leading producers of dairy-based proteins due to the easy availability of raw materials. Furthermore, an increase in health awareness among consumers, combined with a rise in the number of fitness centers in India, is expected to drive the region’s growth in the coming years.

Key Companies & Market Share Insights

The industry players are investing in marketing and promotional strategies to spread awareness regarding the health benefits provided by the consumption of whey protein. Furthermore, companies engage in capacity expansions, strategic partnerships, product portfolio expansions, and mergers & acquisitions to gain a competitive edge. For instance, in September 2022, Dyet Nutrition, a leading nutritional supplements brand in India, launched a new product portfolio comprising whey protein concentrates in vanilla and chocolate flavors. This launch is aimed at providing high-quality supplements for bodybuilders, athletes, and people who seek overall fitness. Some of the major players in the global whey protein market include:

-

Hilmar Cheese Company, Inc.

-

Saputo Inc.

-

Glanbia plc

-

Fonterra Co-operative Group Ltd.

-

Arla Foods

-

Alpavit

-

Wheyco GmbH

-

Milk Specialties

-

Carbery Group

-

LACTALIS Ingredients

-

Olam International

-

Davisco Foods International, Inc.

-

Milkaut SA

-

Leprino Foods Company

-

Maple Island, Inc.

-

Nestle S.A.

-

Nutricia (Danone)

-

Abbott

-

Sanofi S.A.

Whey Protein Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.45 billion

Revenue forecast in 2030

USD 14.32 billion

Growth rate

CAGR of 10.48% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in thousand tons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico; U.K.; Germany; France; Italy; Russia; China; India; Japan; Australia; New Zealand; Brazil; Argentina; Colombia; Turkey; Egypt; Saudi Arabia

Key companies profiled

Hilmar Cheese Company, Inc.; Saputo Inc.; Glanbia plc; Fonterra Co-operative Group Ltd.; Arla Foods; Alpavit; Wheyco GmbH; Milk Specialties; Carbery Group; LACTALIS Ingredients; Olam International; Davisco Foods International, Inc.; Milkaut SA; Leprino Foods Company; Maple Island Inc., Nestle S.A, Nutricia (Danone), Abbott, Sanofi S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whey Protein Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global whey protein market report on the basis of type, application, and region:

-

Type Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

Whey Protein Isolates (WPI)

-

Whey Protein Concentrates (WPC)

-

Whey Protein Hydrolysates (WPH)

-

-

Application Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

Sports Nutrition

-

Dietary Supplements

-

Infant Formula

-

Food Additives

-

Beverages

-

Feed

-

-

Regional Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Turkey

-

Saudi Arabia

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global whey protein market size was estimated at USD 5.33 billion in 2021 and is expected to reach USD 6.45 billion in 2022.

b. The global whey protein market is expected to grow at a compound annual growth rate of 10.48% from 2022 to 2030 to reach USD 14.32 billion by 2030.

b. North America dominated the whey protein market with a share of 36.35% in 2021. This is attributable to the presence of health-conscious consumers who prefer including additional nutrition in their daily meals.

b. Some key players operating in the whey protein market include Hilmar Cheese Company, Inc.; Saputo Inc.; Glanbia plc; Fonterra Co-operative Group Ltd.; Arla Foods; Alpavit; Wheyco GmbH; Milk Specialties; Carbery Group; LACTALIS Ingredients; Olam International; Davisco Foods International, Inc.; Milkaut SA; Leprino Foods Company; Maple Island Inc., Nestle S.A, Nutricia (Danone), Abbott, and Sanofi S.A.

b. Key factors that are driving the whey protein market growth include growing awareness about the benefits such as improvement in body strength, presence of enriched nutrients and proteins, prevention against allergic conditions in infants, and antioxidant defense.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."