- Home

- »

- Next Generation Technologies

- »

-

Wi-Fi AS A Service Market Size, Share Analysis Report 2030GVR Report cover

![Wi-Fi as a Service Market Size, Share & Trends Report]()

Wi-Fi as a Service Market Size, Share & Trends Analysis Report By Component (Infrastructure, Software, Services), By Location Type (Indoor, Outdoor), By Organization Size (Large, SMEs), By Vertical, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-962-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global wi-fi as a service market was valued at USD 4.32 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 21.4% from 2022 to 2030. The growth is projected to be driven by the rising deployment of Wi-fi as a Service (WaaS), as it is low cost and provides greater scalability. Additionally, growing demand for widespread and high-speed network coverage and increasing adoption of air-gapped services are some of the factors fueling the growth of the industry.

The rising deployment of public Wi-Fi in several verticals such as BFSI, manufacturing, retail, manufacturing, and transportation & logistics, among others, are contributing positively to the WaaS market growth. The industry is expanding at a tremendous growth rate due to technological innovations and users’ inclination toward cloud-managed Wi-Fi services. End-user organizations are adopting Wi-Fi managed services as they have a short life cycle and are cost-efficient, which allows the scope of configuration for future updates.

Wi-Fi as a Service is a subscription-centered, cloud-based management system consisting of end-to-end Wi-Fi solutions, automatic system upgrades, access points, and a cloud-native management/control plane. It comprises infrastructure, software, and managed services. WaaS allows businesses and organizations with IT resource to provide reliable, secure, and fast wireless local area network (WLAN) access across several locations.

With WaaS, users can benefit from real-time network monitoring and a combination of historical and real-time data on Wi-Fi network usage. Wi-Fi as a service is ideal for smaller businesses, office relocations, and temporary locations, as it can be controlled through a network operating center delivering a fast and reliable data network.

WaaS provides service users with security measures about bring your own device (BYOD) technology. BYOD technology grants limited network access to a non-network device, enabling the vendor to help the user compartmentalize network access parameters, assist the user in revoking devices, and remotely wipe data from selected devices.

The managed Wi-Fi replaces vulnerable consumer-grade systems with top-notch safe and reliable hardware and efficient services allowing greater scalability, improved stability, and additional security services. Therefore, the rise in BYOD technological trend and increasing penetration of internet-connected devices in IT institutions and organizations are fueling the growth of Wi-Fi growth statistics.

COVID-19 Impact

The COVID-19 pandemic has severely impacted customer behavior & preference. The pandemic had highly affected service industries such as BFSI, manufacturing, retail, and transportation. The gradual shift from conventional business practices to online platforms resulted in the establishment of high-speed wi-fi customer service and solutions for efficient centralized management. Therefore, the IT sector played a pivotal role in supporting digital infrastructure.

The global demand for high-speed Wi-Fi services has surged owing to the work from home and online education during the pandemic. The augmented demand has made a considerable contribution to the development of wireless fidelity solutions and services leading to the growth of the industry during the pandemic.

Wi-Fi marketing is an effective way to run targeted digital ads, build customer loyalty, automate customer communications, and send emails & messages to the customers which is propelling the growth. WaaS has gained traction in BFSI as it enables always-on security protection, allows organizations to gain a competitive advantage, and reduces latency. The adoption of WaaS in the healthcare industry has increased significantly as it enables healthcare professionals for remote monitoring of patients, obtain real-time health information, and provide reminders which is useful to improve patients’ wellbeing.

Component Insights

The infrastructure segment dominated the overall market with a revenue share of almost 45% in 2021. The segment is expected to witness a CAGR of 22.6% during the forecast period. Wireless infrastructure enables the management and delivery of wireless communications through the integration of technology, software, security measures, and devices. Infrastructure is further categorized into access points, WLAN controllers, and others.

An access point serves as a connecting point between wired and wireless networks. It provides an affordable, secure, and effortless wireless LAN solution that combines flexibility and mobility with established enterprise-class features required by networking professionals. It can be connected to a hub, a wired router, or a switch through an Ethernet cable to establish a Wi-Fi signal. A WLAN infrastructure comprises access points and wireless stations combined with a distribution system to create multiple radio cells, which form a local area network with a premise such as a corporate space, school, or home.

The services segment is anticipated to witness the fastest CAGR of 20.4% throughout the forecast period. The professional services segment dominated in 2021 with a revenue share of 54%. It is expected to grow at a considerable CAGR of over 19.0% during the forecast period. Professional Wi-Fi services are the centrally managed, carrier-grade setup delivering high-performance network solutions using the internet cloud provided by managed services providers on a subscription basis.

The managed services segment is anticipated to register the fastest CAGR of over 21.0% during the forecast period. Managed Wi-Fi services provide advisory and implementation, training, maintenance, and support services among others. Managed services model allows an organization to outsource the operations, management, and delivery of processes to enable proactive network management, a lower total cost of ownership (TCO), and smart bundling. It also offers WLAN infrastructure, better time management, secure and reliable connectivity, and faster response time through a wireless LAN controller (WLC).

Location Type Insights

The indoor segment dominated with the largest revenue share of around 80% in 2021 and is expected to witness a CAGR of over 22.0% during the forecast period. Wi-Fi as a service in a closed environment owing to benefits such as low latency, higher speed, increased network capacity, and device density. The rising adoption of WaaS by small & medium enterprises across BFSI, retail & e-commerce, and healthcare, among others, is fueling the growth of the indoor segment.

The outdoor segment is anticipated to witness a considerable CAGR of 16.4% over the forecast period. The outdoor segment offers extended Wi-Fi coverage range support for outdoor deployments at public places such as transport hubs, shopping centers, and stadiums is driving the growth of the market. Initiatives taken by governments for building smart cities are propelling the adoption of outdoor WaaS. With the rising deployment of public Wi-Fi, users can travel with high-speed data connectivity, which results in improved quality of calls and provides real-time traffic information to users.

Organization Size Insights

The large enterprises are expected to dominate in 2021, gaining a market share of around 52%. It is expected to grow at the fastest CAGR of 20% throughout the forecast period. The adoption of WaaS at a substantial rate in large enterprises is propelling the growth of the segment. Large enterprises are making considerable investments in WaaS to address issues such as data security, privacy, and cloud connectivity failure.

The small & medium enterprise segment is anticipated to witness the fastest growth, growing at a CAGR of 22.7% throughout the forecast period. Small & medium organizations are adopting Wi-Fi managed services as they have a short life cycle and are cost-efficient, which allows the scope of configuration for future updates.

The SMEs benefit significantly from the opportunities WaaS offers, such as subscription-centered, cloud-based management systems consisting of end-to-end Wi-Fi solutions, automatic system upgrades, access points, and a cloud-native management/control plane. Small and medium organizations/enterprises widely adopt it to gather analytical data about customer preferences and interactions for real-time decision-making.

Vertical Insights

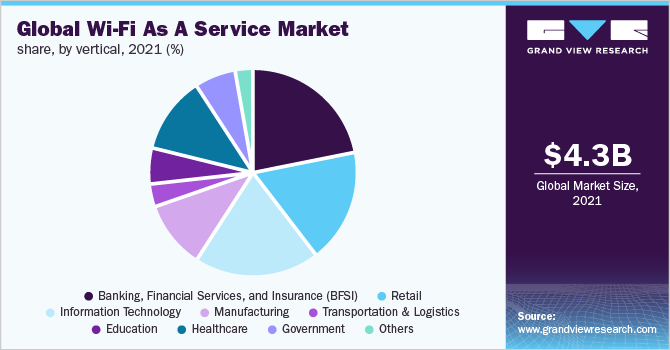

The BFSI segment dominated with the largest revenue share of around 22% in 2021. It is expected to register growth at a considerable CAGR of around 19.1% throughout the forecast period. The growth of the BFSI segment is attributed to the increasing online payment transactions and growing adoption of WaaS in the BFSI industry.

WaaS has gained traction in the BFSI sector as it enables always-on security protection, allows organizations to gain a competitive advantage, and reduces latency. Due to the ubiquity of smartphones and the ongoing expansion of internet users, tech-savvy customers demand speedy services, due to which a number of banks and financial institutions are increasingly adopting Wi-Fi as a service.

The retail segment is anticipated to witness the fastest growth, growing at a CAGR of 23.4% throughout the forecast period. Retail wireless fidelity networks help to analyze and track sales, valuable data, in-store customer behavior, customer preferences, marketing performance, and reward frequent (loyal) customers.

Mobile retail applications enable access to deals, brand promotion, and interaction on social media with customers. Also, the use of WaaS in the retail and e-commerce industry allows retailers to capture the demographics of target customers, convert browsers into buyers, create a multi-channel brand experience, and assist shoppers with navigation which is further fueling the adoption of WaaS in this industry.

Regional Insights

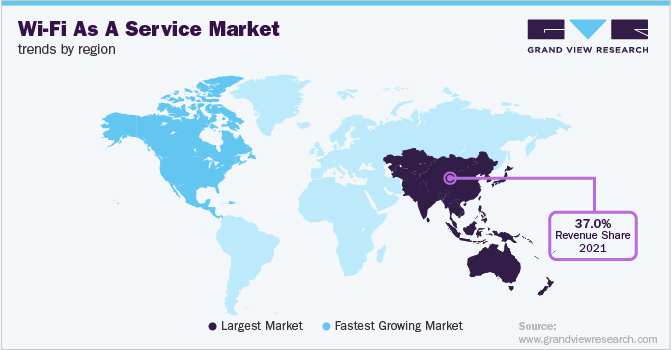

APAC led the overall market in 2021, with a market share of around 37%. The growth is attributed to the increasing penetration of smartphones, the growing proliferation of internet services, and the number of internet subscribers in the region. India and China have an extensive and distributed customer base driving the demand and creating new opportunities for WaaS. The growth is prominently due to improving internet and mobile infrastructures, and increasing requirements to reduce CAPEX and government initiatives across the region.

Furthermore, the region's untapped potential is generating new investment opportunities for technological trends and advancements such as BYOD technology, air-gapped services, and Wi-Fi marketing. Moreover, multinational companies are expanding their presence across the APAC region which results in a broad customer base and internet subscribers which provides lucrative opportunities for the market.

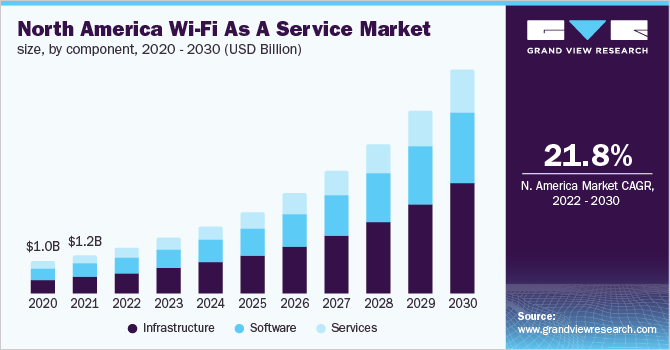

North America is expected to develop substantially by the projection period and grow at a CAGR of 21.8%. The key factor driving the WaaS in North America is the presence of significant players such as Cisco Systems, Juniper Networks Inc, Aruba, and Commscope, among others, which have propelled the industry’s growth.

The significant companies promoting the deployment of public Wi-Fi, increased investment, and early adoption of advanced technologies are contributing to the growth of Wi-Fi as a Service. Furthermore, considerable adoption of IoT and the development of smart cities are fueling the growth of the industry.

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. The key players are adopting different key strategies and developments to occupy a substantial share of the industry. For instance, Cisco Inc announced the introduction of new technologies such as catalyst 9000X series switches, private 5G as a managed service, and high-end Wi-Fi 6E access points. These new solutions aim to help organizations and businesses digitize operations and scale networks to redefine campus experience to support hybrid work. Some prominent participants in the global Wi-Fi as a service market include:

-

Cisco Systems

-

Huawei Technologies Co. Ltd

-

Commscope

-

Aruba

-

Singtel

-

Rogers Communication

-

Juniper Networks Inc

-

Dell Technologies

-

TP-Link

-

Extreme Networks

-

Fortinet

-

Arista Networks

-

D-Link Corporation

-

Cambium Networks

-

Superloop

Recent Developments

-

In March 2023, Cambium Networks launched Wi-Fi 6/6E Tri-Band outdoor solution with future-proof performance for national government and defense markets. The XE3-4TN outdoor Wi-Fi 6/6E access point (AP) provides customers with complete flexibility in supporting the unlicensed 2.4, 5, and 6 GHz Wi-Fi bands

-

In January 2023, CommScope announced that it has entered into the Wi-Fi 7 retail market with the launch of the SURFboard® G54 DOCSIS 3.1 quad-band Wi-Fi 7 cable modem. This flagship SURFboard G54 comes with significant enhancements in performance with the latest Wi-Fi 7 technology for its customers and service providers

-

In October 2022, Cisco launched Wi-Fi 6 access for small and medium enterprises. Cisco offers its customers fast speeds, high-density performance, and energy efficiency and ensures its partners have the right programs, and promotions in place by offering Managed Services

-

In August 2022, Extreme Networks, Inc. introduced Extreme AP5050, the industry’s first outdoor Wi-Fi 6E Outdoor Access Point optimized for outdoor venues, hospitals, university campuses, and others. The AP5050 offers users with enhanced wireless experiences, faster speeds, and reduced interference

Wi-Fi As A Service Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.17 billion

Revenue forecast in 2030

USD 24.36 billion

Growth rate

CAGR of 21.4% from 2022 to 2030

Base year for estimation

2021

Historic Year

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, location type, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; France; U.K.; China; India; Japan; Brazil; Mexico

Key companies profiled

Cisco Systems; Huawei Technologies Co. Ltd; Commscope; Aruba; Singtel; Rogers Communication; Juniper Networks Inc.; Dell Technologies; TP-Link; Extreme Networks; Fortinet; Arista Networks; D-Link Corporation; Cambium Networks; Superloop

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wi-Fi as a Service Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. Grand View Research has segmented the global Wi-Fi as a service market report based on component, location type, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Infrastructure

-

Access Points

-

WLAN Controllers

-

Others

-

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Location Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Banking, Financial Services, and Insurance (BFSI)

-

Retail

-

Information Technology

-

Manufacturing

-

Transportation & Logistics

-

Education

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global Wi-Fi as a service market size was estimated at USD 4.32 billion in 2021 and is expected to reach USD 5.17 billion in 2022.

b. The global Wi-Fi as a service market is expected to grow at a compound annual growth rate of 21.4% from 2022 to 2030 to reach USD 24.36 billion by 2030.

b. Asia-Pacific dominated the Wi-Fi as a service market with a share of 37% in 2021. This is attributable to the increasing penetration of smartphones, the growing proliferation of internet services, and the number of internet subscribers in the region.

b. Some key players operating in the Wi-Fi as a service market include Cisco Systems, Huawei Technologies Co. Ltd, Commscope, Aruba, Singtel, Rogers Communication, Juniper Networks Inc, Dell Technologies, TP-Link, Extreme Networks, Fortinet, Arista Networks, D-Link Corporation Cambium Networks, and Superloop, among others

b. Key factors that are driving the growth of the Wi-Fi as a service market owing to technological innovations coupled with growing users’ inclination toward cloud-managed Wi-Fi services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."