- Home

- »

- Digital Media

- »

-

Wireless In-Flight Entertainment Market Share Report, 2030GVR Report cover

![Wireless In-Flight Entertainment Market Size, Share & Trends Report]()

Wireless In-Flight Entertainment Market Size, Share & Trends Analysis Report By Aircraft Type, By Fitment Type, By Hardware, By Technology, By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-032-3

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global wireless in-flight entertainment market size was valued at USD 1,630.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 17.3% from 2023 to 2030. The market growth is attributed to consumers' increasing inclination to utilize personal electronic devices while in flight, which has complemented the rising adoption of wireless in-flight entertainment and connectivity services.

The increased proliferation of personal devices, such as laptops, smartphones, and tablets, has prompted airlines to start offering wireless in-flight connectivity & entertainment services to passengers, thereby providing them access to a wide spectrum of stored as well as streaming entertainment content and other connectivity services on their personal devices.

Furthermore, passengers’ personal devices or portable/embedded media interface devices provided by the airline can readily access these services. Both airlines and passengers can benefit from installing W-IFE systems in aircraft, and these tools can help airlines boost their revenue and increase return on investment. The combination of the In-Flight Connectivity (IFC) and In-Flight Entertainment (IFE) segments has opened up numerous opportunities under the W-IFE umbrella, including the live streaming of movies and other audio-visual content. The growing penetration of portable electronic devices and portable digital media tablets remains prominent in the BYOD era.

The aviation industry witnessed a major impact of COVID-19 pandemic. The global supply chains and logistics were suddenly affected during the initial worldwide lockdowns. Airline operators' sales for in-flight entertainment and connectivity system were affected by the drop in commercial aircraft deliveries caused by the coronavirus outbreak. This factor is anticipated to limit market expansion during the forecast period. However, a number of key players are focusing and working on implementing new strategies and tactics to overcome the pandemic's impact.

The aviation sector began to recover slowly from the pandemic in 2021, which led to an increase in aircraft deliveries. The improvement in the overall in-flight travel experience of passengers continues to drive airlines and aircraft operators to upgrade new cabin entertainment systems. This rebound in the aviation sector and aircraft deliveries is fueling the investments. For instance, in May 2022, Air France introduced their new long-haul business seat, which is expected to offer the highest level of comfort with redesigned iconic seat features.

Passengers now anticipate having access to both consistent connectivity and high-definition content owing to the growing demand for streaming services. Airlines now provide customers Wi-Fi connectivity so they can access in-flight and other entertainment content on their devices. For instance, the Emirates Group offers more than 5,00 channels of TV shows, music, movies, and games, all on demand in multiple languages, along with Wi-Fi connectivity for uninterrupted communications.

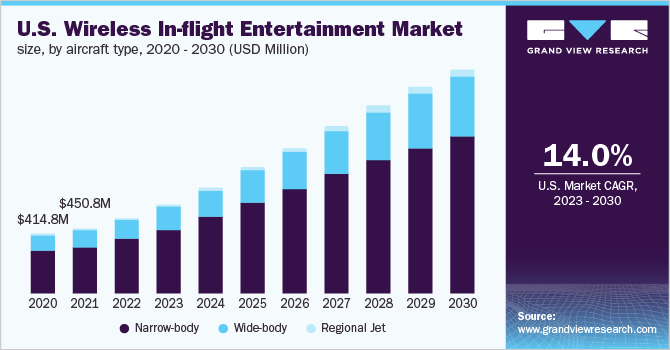

Aircraft Type Insights

The narrow-body segment accounted for the largest revenue share of more than 70% in 2022 and is likely to dominate the market over the forecast period. The strong growth of the segment is driven by the surge in demand for short-haul flights as well as the opening of new airports and travel routes. These aircraft are more appealing since they outperform their rivals in terms of ergonomics and fuel efficiency. Some of the major airlines are presently replacing their fleet of old, inefficient narrow-body aircraft with newer, more fuel-efficient ones to offer substantial growth opportunities during the forecast period.

The regional jet segment is projected to grow at the highest CAGR of 20.0% from 2023 to 2030. Airlines are modernizing and upgrading their fleets of smaller planes with portable electronic devices, entertainment systems, and Wireless In-Flight Connectivity (W-IFEC) across the globe. Airlines are also forging strategic partnerships with connectivity providers in order to improve their systems. For instance, in January 2022, Asiana Airlines Inc. partnered with Anuvu Operations LLC, a provider of high-speed connectivity and entertainment solutions, to serve as Content Service Provider (CSP) for the company.

Fitment Type Insights

The retrofit segment accounted for the largest market share of more than 80.0% in 2022 and is predicted to lead the market over the forecast period. This can be attributed to the ongoing advancement in aviation industries and revitalizing the cabin with advanced technologies to offer a better in-flight experience to passengers. Additionally, airlines have begun retrofitting wireless in-flight technology to reduce overall weight, enhance the passenger experience, and boost profit margins on each trip, which is expected to drive the growth further.

The line fit segment is anticipated to grow at the highest CAGR of about 20% over the forecast period. Connection providers and hardware suppliers are increasingly stepping into the line fit segment to assess their system offerings and provide uniform W-IFE solutions in their fleet by creating strategic alliances with aircraft manufacturers. For instance, Embraer SA, a global aerospace company, and Viasat Inc., a global communication company, partnered into an agreement of Buyer-Furnished Equipment (BFE) to offer Viasat's cutting-edge In-Flight Connectivity (IFC) technology as line-fit option on E2 aircraft of Embraer’s aircraft family.

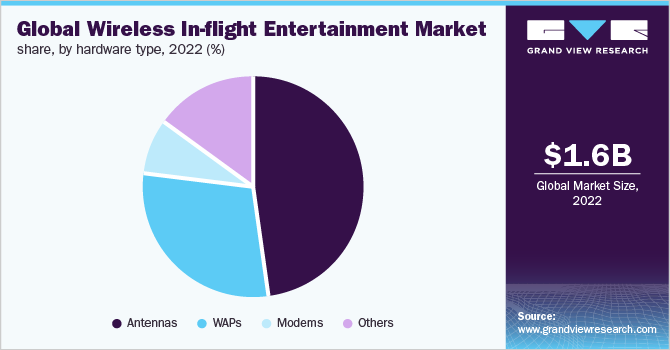

Hardware Insights

The antenna segment registered the largest revenue share of more than 45% in 2022 and is anticipated to grow at a CAGR of around 17% over the forecast period. The segment's growth can be attributed to the rising demand for antennas in the aviation sector for better connectivity. For instance, in April 2019, Viasat Inc., a global communication company, introduced its second-generation antenna. This dual-band system is expected to keep crew members as well as passengers connected, irrespective of their destination globally

The modem segment is predicted to register the fastest CAGR of around 19% from 2023 to 2030. This can be attributed to the emergence of next-generation Airborne Network (AN) and Airborne Internet (AI) systems as it uses a combination of satellite and terrestrial wireless technologies to provide coverage across the globe. Moreover, advancement in modem technology to offer uninterrupted connectivity and enhanced in-flight experience is projected to further boost the growth.

Technology Insights

The Ku-Band segment accounted for a significant revenue share of more than 30% in 2022 and is likely to dominate the market over the forecast period. The use of Ku-Band for high-speed applications such as video, computer-to-computer data communications, voice, and SCADA and mainframe workstations is expected to drive the segment growth during the forecast period. Additionally, compared to the Ka-Band frequency spectrum, Ku-Band is less vulnerable to rain fade, making it more effective for certain geographic locations, resulting in market growth during the forecast period.

The Ka-Band segment is projected to grow at the highest CAGR of 20.2% from 2023 to 2030. This can be attributed to its usage and support in several revenue streams, such as stationary and mobile equipment, including airborne and marine systems, satellite gateways, and others. Additionally, it allocates more spectrum for applications such as internet access and 5G connectivity, as it has higher bandwidth than any other bands used in the segment. Hence, the segment is expected to witness significant market growth.

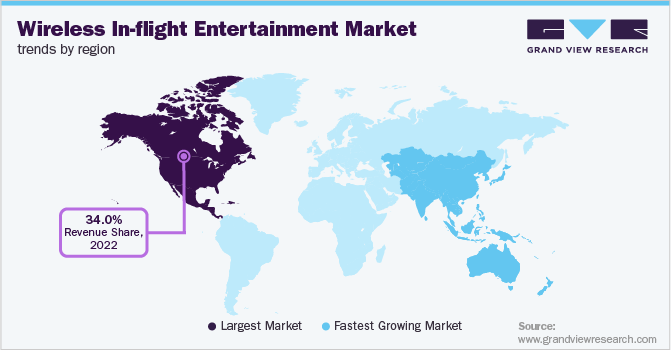

Regional Insights

North America accounted for the largest market share of more than 34% in 2022 and is expected to retain its dominance during the forecast period. Regional airlines in wealthy nations are anticipated to use W-IFE technologies more frequently, which is anticipated to propel the regional industry growth. Some well-known entertainment and communication companies, such as Viasat Inc. and Panasonic Avionics Corporation, always attempt to offer passengers innovative technologies in the region.

For instance, in August 2021, Panasonic Avionics Corporation launched the world’s first full cabin in-flight entertainment 4k ultra-HD system in association with Cathay Pacific Airways. Passengers on Cathay Pacific can use their own Bluetooth-enabled headphones to experience the latest Hollywood content in 4K on the screen, which supports Bluetooth audio streaming. This is expected to propel the regional growth over the forecast period.

The Asia Pacific region is expected to grow at a significant CAGR of around 21.0% during the forecast period. This can be attributed to the rising passenger traffic and demand for aircraft equipped with the region's next-generation communication and entertainment systems. For instance, in February 2022, Thai Airways partnered with Stellar Entertainment Group, an in-flight entertainment company, to work as a new content service partner for the airline group.

The company is expected to offer a range of in-flight entertainment services, including production services, television, and audio content, strategic curation and licensing of all film, account management, technical assistance, and content delivery. This, in turn, is expected to fuel the industry growth across the region.

Key Companies & Market Share Insights

Key players in the wireless in-flight entertainment market are offering and expanding their product portfolios by investing in product research & development and delivering competitive pricing, which furthers market rivalry. It is anticipated that these investments would eventually help airlines better meet passengers' demands for in-flight media and improve the connectivity experience by creating a digital environment, which is very similar to that at work or home.

The competition in this market is high. Moreover, technological advancements are allowing companies to save time and cost while increasing their efficiency and effectiveness, creating an incentive to gain a competitive edge. Constant research and development are leading to the industry becoming more common and standard even if it requires some investment. Due to globalization, the wireless in-flight entertainment trend is present in global markets over boundaries. Some prominent players in the global wireless in-flight entertainment market include:

-

BAE Systems plc

-

Bluebox Aviation Systems Ltd.

-

Gogo LLC

-

Inflight Dublin, Ltd.

-

Lufthansa Systems GmbH

-

Panasonic Avionics Corporation

-

Rockwell Collins Inc.

-

SITAONAIR

-

Thales Group SA

-

Zodiac Aerospace SA

Wireless In-flight Entertainment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,972.3 million

Revenue forecast in 2030

USD 6,011.6 million

Growth rate

CAGR of 17.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aircraft type, fitment type, hardware, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; Japan

Key companies profiled

BAE Systems plc; Bluebox Aviation Systems Ltd.; Gogo LLC; Inflight Dublin, Ltd.; Lufthansa Systems GmbH; Panasonic Avionics Corporation; Rockwell Collins Inc.; SITAONAIR; Thales Group SA; Zodiac Aerospace SA

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless In-Flight Entertainment Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wireless in-flight entertainment market report based on aircraft type, fitment type, hardware, technology, and region:

-

Aircraft Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Narrow-body

-

Wide-body

-

Regional Jet

-

-

Fitment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Retrofit

-

Line fit

-

-

Hardware Outlook (Revenue, USD Million, 2018 - 2030)

-

Antennas

-

WAPs

-

Modems

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

ATG

-

Ku-Band

-

L-Band

-

Ka-Band

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global wireless in-flight entertainment market size was estimated at USD 1,630.9 million in 2022 and is expected to reach USD 1,972.3 million in 2023.

b. The global wireless in-flight entertainment market is expected to grow at a compound annual growth rate of 17.3% from 2023 to 2030 to reach USD 6,011.6 million by 2030.

b. North America dominated the wireless in-flight entertainment market with a share of 35% in 2022. Consumers’ inclination towards spending more on air travel, especially for their continuous connectivity needs, has resulted in higher expenditure in North America.

b. Some key players operating in the wireless in-flight entertainment market include Gogo LLC, BAE Systems PLC, Panasonic Avionics Corporation, Rockwell Collins, Inc., SITAOnAir, and Thales Group SA.

b. Key factors that are driving the wireless in-flight entertainment market growth include the increasing prominence of wireless connectivity and the growing adoption of the Bring Your Own Device (BYOD) trend among the general public and growing inclination toward the use of personal electronic device onboard has supplemented the surging adoption of wireless in-flight entertainment and connectivity services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."