- Home

- »

- Clinical Diagnostics

- »

-

Women’s Health Diagnostics Market Size, Share Report 2030GVR Report cover

![Women’s Health Diagnostics Market Size, Share & Trends Report]()

Women’s Health Diagnostics Market Size, Share & Trends Analysis Report By End-use, By Application(Cancer, Infectious Disease, Osteoporosis, Pregnancy & Fertility, Prenatal), By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-581-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

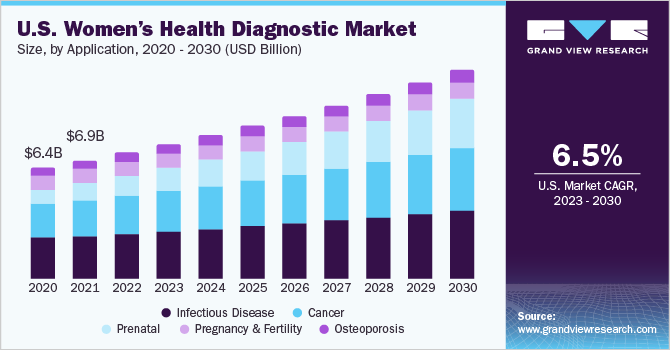

The global women’s health diagnostics market size was estimated at USD 17.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. The rising prevalence of infectious diseases, such as hepatitis and urinary tract infection, among women is anticipated to drive the growth during the forecast period.Early detection of any health issue with the help of digital and mobile mammography, such as breast MRI, ultrasound, and bone density testing, is critical. Advancements in medical science offer lucrative opportunities to keep a check on women-centric conditions that include infectious diseases, osteoporosis, and breast cancer.

According to data published by the National Center for Biotechnology Information (NCBI), women are 30.0% more prone to be infected with HIV compared to men. The COVID-19 pandemic had a significant impact on the women’s health diagnostic market. Many women postponed or canceled their routine checkups due to lockdown and government restrictions.

The market is witnessing exponential growth due to the rapid increase in chronic conditions in women globally. Chronic diseases are defined as health conditions that last more than a year. It may require ongoing medication and may result in limited daily activities. Chronic diseases in women majorly include cancer (lungs, breast, etc.), osteoporosis, and AIDS. According to the report published by the WHO in 2020, approximately 2.3 million women were diagnosed with breast cancer alone in 2020, which resulted in 685,000 deaths around the globe. This has led women to take preventive measures to mitigate the cancer risk by opting for early-stage check-ups for diagnosis of breast cancer, therefore aiding the growth of the market.

Osteoporosis is a medical illness where the bones lose tissue and become brittle and weak. This condition often occurs due to hormonal changes, a calcium or vitamin D shortage, or both. According to the National Centre of Health Sciences, in 2018, adults aged 50 and older had a 12.6% prevalence of osteoporosis at the femur neck, lumbar spine, or both; this incidence was higher in women (19.6%) than in males (4.4%).

Application Insights

The infectious diseases segment accounted for the largest revenue share of 52.8% in 2022. The global emergence of SARS, H1N1, Ebola, and COVID-19 have negatively impacted women, specifically their sexual and reproductive health. According to the National Centre for Biotechnology Information, STDs. was the cause of 50% of avoidable infertility in the U.S. Additionally, the majority of STDs can be transmitted to an unborn child or fetus, occasionally with catastrophic results. In addition, the findings indicate that women are more likely to develop active Mycobacterium TB illness.

The prenatal segment is expected to grow at the fastest rate of 11.7% during the forecast period. The infectious diseases that the mother has is transmitted to the unborn child or fetus, which is driving the growth of this segment. According to the National Centre for Biotechnology Information, 20,000 babies are born to hepatitis B virus (HBV) infected mothers in the U.S. 6,000 of these infants would develop chronic HBV infections without postexposure prophylaxis, and 1,500 would succumb to chronic liver disease before their time.

End-use Insights

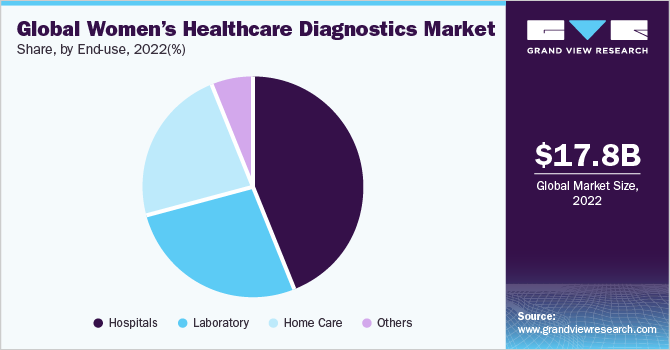

The hospitals segment accounted for the largest revenue share of 44.2% in 2022, as they are the first choice as the diagnostic center for women for the detection of cancer, infectious disease, osteoporosis, pregnancy & fertility tests. In March 2021, iCad announced The U.S. Food and Drug Administration (FDA) approval of ProFound A.I. Version 3.0 for Digital Breast Tomosynthesis (DBT). It is a deep learning, high-performance workflow solution that helps in detecting malignant soft tissue calcifications and densities.

The homecare segment is estimated to register the fastest CAGR of 9.0% over the forecast period owing to increasing investments by market players to commercialize portable and point-of-care devices. Furthermore, growing awareness about home diagnostic devices is estimated to spur the growth of the segment. Yeast infections of the vagina and urinary tract, menopause, colon cancer, breast cancer, and fertility are the diseases for which self-diagnosis devices/kits are used by women. In October 2018, the FDA approved the PicoAMH Elisa by Ansh Labs, a self-diagnosis menopause kit.

Regional Insights

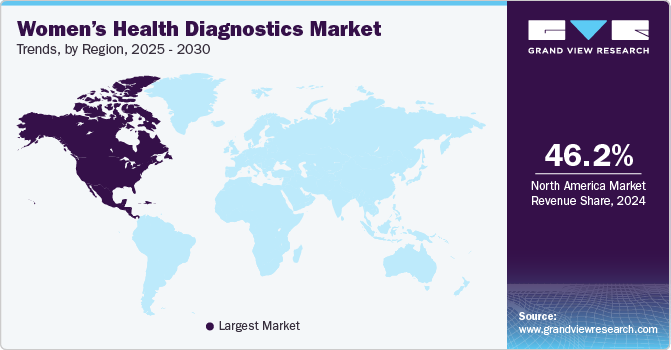

North America dominated the market and accounted for the largest revenue share of 44.87% in 2022. This can be attributed to the high adoption of technologically advanced products, product launches, and government initiatives.

National Women’s Health Week (NWHW) begins on 14th May - 20th May every year and The FDA Office of Women’s Health (OWH) theme for NWHW 2023 was to encourage women to #KNOWHmore About Your Health, Today and Every Day. In May 2019, Bayer launched a campaign “Test Your Cancer” to help cancer patients understand that genomic testing is a very important step in diagnosis thereby getting a real picture of individual cancer.

In May 2023 SOPHiA GENETICS announced that a private molecular laboratory, Natural State Laboratories, chose the former’s technology to expand their research capabilities and cancer testing. Natural State Laboratories is expected to start using SOPHiA DDM for in-house hereditary cancer testing.

Asia Pacific is expected to grow at the fastest CAGR of 8.3% during the forecast period. Improving healthcare infrastructure, awareness about women’s health disorders, government initiatives, and increased participation of women in the workforce are some of the factors poised to positively impact regional market growth. In November 2016, the Indian government launched the Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) scheme to provide free health checkups to pregnant women. Under this scheme, women would be tested for anemia, high blood sugar (gestational diabetes); blood pressure, and hormonal disorders, and have access to free ultrasounds to track the health and development of a fetus.

Brazil and Mexico are important markets in Latin America, with the former being the leading revenue contributor in the region. Declining maternal mortality rate, increasing life expectancy, aging women population, and growing prevalence of infectious & chronic diseases are primary growth stimulants for the regional market.

Key Companies & Market Share Insights

The market is highly competitive and launches, mergers & acquisitions, partnerships, and expansions of regional presence are among the key strategies undertaken by key players to remain competitive.

-

In March 2023, the U.S. FDA approved Visby Medical’s sexual health test. It is a second-generation PCR diagnostic that uses self-collected vaginal swabs to detect STIs namely trichomoniasis, chlamydia, and gonorrhea.

-

In October 2020, UK-based Diaceutics PLC announced that it launched The Diagnostic Network, DXRX. It is designed to expedite the development and launch of precision medicine diagnostics by reducing cancer testing biomarker test adoption time.

Some prominent players in the global women’s health diagnostics market include:

-

F. Hoffmann-la Roche Ltd.

-

Siemens Aktiengesellschaft

-

Quest Diagnostics Incorporated

-

Ge Healthcare

-

Koninklijke Philips N.V.

-

Abbott Laboratories

-

Becton, Dickinson, and Company,

-

Hologic, Inc.

Women’s Health Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.18 billion

Revenue forecast in 2030

USD 31.4 billion

Growth Rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

F. Hoffman-La Roche Ltd.; Siemens Aktiengesellschaft; Quest Diagnostics Incorporated; GE Healthcare; Koninklijke Philips N.V.; Abbott Laboratories; Becton; Dickinson; and Company; Hologic; Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Health Diagnostics Market Report Segmentation

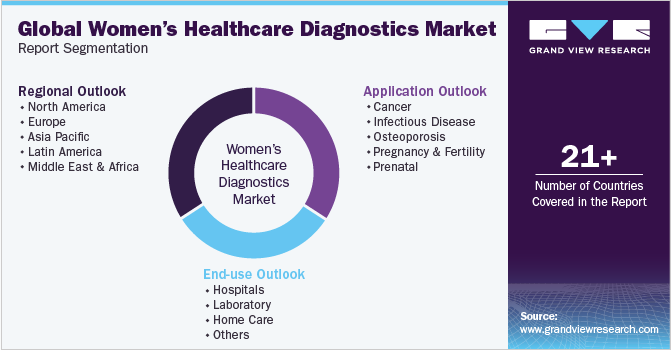

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s health diagnostics market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious disease

-

Osteoporosis

-

Pregnancy & fertility

-

Prenatal

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratory

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global women’s health diagnostics market size was estimated at USD 17.8 billion in 2022 and is expected to reach USD 19.18 billion in 2023.

b. The global women’s health diagnostics market is expected to grow at a compound annual growth rate of 7.32% from 2023 to 2030 to reach USD 31.46 billion by 2030.

b. Based on application, infectious diseases segment accounted for the largest revenue share of 52.86% in 2022, due to the continued importance of diagnosing and managing infectious diseases in women's health.

b. Some key players operating in the women’s health diagnostics market include F. Hoffmann-la Roche Ltd.; Siemens Aktiengesellschaft; Quest Diagnostics Incorporated; Ge Healthcare; Koninklijke Philips N.V.; Abbott Laboratories; Becton, Dickinson, and Company; and Hologic, Inc.

b. Key factors that are driving the market growth include the rising prevalence of infectious diseases, such as urinary tract infections, increasing awareness and healthcare access, growing aging female population, and advancements in diagnostic technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."