- Home

- »

- Medical Devices

- »

-

Wound Biologics Market Size, Share, Global Industry Report 2019-2026GVR Report cover

![Wound Biologics Market Size, Share & Trend Report]()

Wound Biologics Market Size, Share & Trend Analysis Report By Product (Biological Skin Substitutes, Topical Agents), By Wound Type (Chronic, Acute), and Regional Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-966-1

- Number of Pages: 108

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

The global wound biologics market size was valued at USD 3.13 billion in 2018 and is expected to grow at a CAGR of 9.4% over the forecast period. The demand for wound biologics is on a rise owing to the technological advancement, increasing prevalence of chronic diseases, rising cases of accidents & trauma, and rising geriatric population.

Rising prevalence of chronic & acute wounds and introduction of technologically advanced products are the major factors anticipated to drive the market growth. For instance, in February 2018, researchers at Uppsala University and Saint Louis University (SLU) developed a next generation biologic wound care product, which promotes rapid wound healing by altering the behavior of specific immune cells. Such technologically advanced products are expected to positively impact market growth over the forecast period.

Furthermore, as per data reported by the Centers for Disease Control and Prevention (CDC), in 2018, six out of ten Americans suffer from at least one chronic disease such as cancer, cardiovascular diseases or diabetes. Such high prevalence rate of chronic diseases in the U.S. is the major cause of the high disability and death rates in the country. Cancer is considered to be a healthcare burden in the U.S. as it is one of the leading causes of death in the country. According to the estimates of Cancer Organization, in 2018, cancer was the second leading cause of deaths and about 1,735,350 new cancer cases were registered in the U.S. In addition, nearly 4,700 new cases of cancer are diagnosed each day in the country.

Globally, the number of surgeries are also increasing owing to the rising prevalence of chronic conditions. Wound care products, thus, are increasingly being used to prevent surgical site infections. Most surgical wounds, post cancer surgery, are relatively large in size and are deep, releasing exudates that require regular management. The enzyme-based formulation products helps to manage large wounds, thereby significantly reducing the risk of infection. Thus, the rising incidence of chronic diseases is expected to boost the demand for wound biologics products, thereby propelling market growth globally.

The rising cases of traumatic events and road accidents are also one of the major reasons for the wound biologics market growth. For instance, as per the American Association for the Surgery of Trauma, in 2017, around 1.2 million people were killed globally, which around 3,242 people dying per day in road accidents. Such cases are expected to surge the demand for rapid wound healing products.

Key players are also adopting various strategies to strengthen their position in the Industry. For instance, in January 2018, Celularity Inc. entered into a definitive agreement to acquire biologic wound care business of Alliqua BioMedical, Inc. Such an initiative is anticipated to strengthen the biologic wound care business of Celularity Inc. The biologic wound care business of Alliqua BioMedical, Inc., includes Interfyl Human Connective Tissue Matrix, UltraMist Therapy System, Biovance amniotic membrane allograft, and therapeutic ultrasound platform products. Thus, such initiatives by key players are anticipated to propel the industry growth over the forecast period.

Wound Type Insights

Based on wound type, the wound biologics market is categorized into acute and chronic wounds. The acute segment dominated the market in 2018. The acute wounds, such as surgical & traumatic wounds and burns, has a high prevalence rate globally. For instance, as per the National Fire Chiefs Council (NFCC), in 2017, around 15,000 patients suffering from scalds and burns were treated by the NHS burn services in the UK.

The chronic wound segment is anticipated to witness the fastest growth over forecast period. The increasing cases of chronic diseases, especially diabetes across the globe is one of the major driving factors the segment’s growth. For instance, as per a report published by the WHO in 2019, chronic diseases are one of the leading causes of disability and death globally and the disease rate from the chronic conditions is also accelerating worldwide. In addition, as per the report published by the Australian Institute of Health and Welfare in 2019, more than 11.0 million Australians were suffering from at least one of eight chronic diseases from 2014 to 2015. Therefore, such instances are expected to drive this segment’s growth over the forecast period.

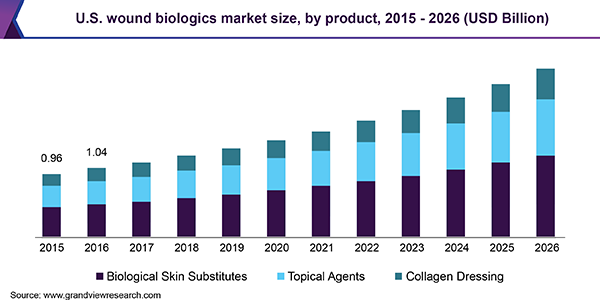

Product Insights

The biological skin substitutes segment of the wound biologics care market held the largest share in 2018 and is anticipated to witness the fastest growth over the forecast period. The biological skin substitutes are heterogeneous group of wound coverage materials that are used for wound closure. The biological skin substitutes are majorly used for acutely burned patients.. Furthermore, the biological skin substitutes also allows the construction of more natural new dermis which ensures rapid healing of wounds.

The biological skin substitutes segment is further sub segmented into allograft, xenograft, and biosynthetic products. The rising cases of burn wounds and chronic diseases are anticipated to majorly drive the segment growth. For instance, as per the American Burn Association in 2017, around 486,000 burn injuries were reported in between 2011 to 2015. In addition, as per the American Burn Association in 2017, the burn injuries is one of the leading cause of unintentional death and injury in the U.S.

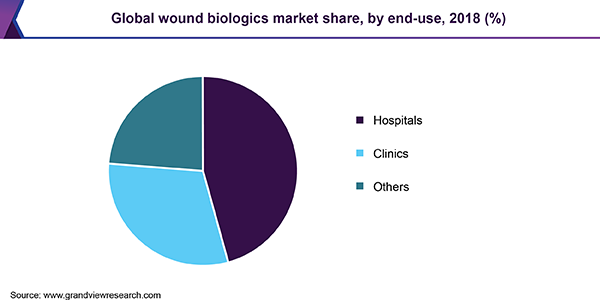

End-use Insights

On the basis of end-use, the market is segmented into hospitals, clinics, and others. Hospital segment held the largest share in 2018. The increasing demand for the treatment of acute and chronic wounds is one of the major driving factors for the segment. In addition, increasing incidence of diabetic foot ulcers and venous leg ulcers is also anticipated to drive the segment growth. The enzyme based formulations are majorly used for rapid healing of leg ulcers. Furthermore, increasing cases of surgical wounds due to rise in the number of surgeries is also driving the segment growth. The enzyme based formulations is also used for healing SSI wounds. Thus, these factors may fuel the segment growth over the forecast period.

Clinics segment is expected to witness the fastest growth over the forecast period. Increasing number of clinics and surgical procedures are the major factors contributing to the segment growth over the forecast period. Moreover, increasing cases of surgical wounds is one of the major driving factors for the segment growth. Wound dressings after surgeries requires constant monitoring owing to which demand for clinics are increasing among patients. Hence, such factors are expected to surge the segment growth over the forecast period.

Regional Insights

North America dominated the market in 2018. The increasing cases of road accidents, rising prevalence of chronic diseases, and the presence of several key players in the region is anticipated to drive the market in North America. In addition, the availability of skilled professionals and improvement in healthcare infrastructure are also expected to drive this market over the forecast period.

Asia Pacific is anticipated to witness the fastest growth over the forecast period. Presence of developing countries such as China, India, and Japan is anticipated to boost the market growth in Asia Pacific region. In addition, increasing cases of chronic diseases, especially diabetes is also expected to surge the Asia Pacific market growth over the forecast period.

Wound Biologics Market Share Insights

Few of the prominent market players in the market include Osiris Therapeutics, Integra Lifesciences, and Wright Medical and Smith & Nephew PLC. Key players are adopting various strategies such as merger & acquisitions, product launch, and partnerships to strengthen their position in the industry.

For instance, in April 2019, Smith & Nephew PLC acquired Osiris Therapeutics, Inc., with an aim to accelerate the development of its advanced wound management product portfolio. The initiative was anticipated to expand its customer base.

Wound Biologics Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.71 billion

Revenue forecast in 2026

USD 6.43 billion

Growth Rate

CAGR of 9.4% from 2019 to 2026

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, wound type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; China; Japan; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Mölnlycke Health Care AB; Osiris Therapeutics; Integra Lifesciences; Wright Medical; Smith & Nephew PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented wound biologics market on the basis of product, wound type, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2015 - 2026)

-

Biological Skin Substitutes

-

Allograft

-

Xenograft

-

Biosynthetic Products

-

-

Topical Agents

-

Collagen Dressings

-

-

Wound Type Outlook (Revenue, USD Million; 2015 - 2026)

-

Chronic Wounds

-

Acute Wounds

-

-

End-Use Outlook (Revenue, USD Million; 2015 - 2026)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."