- Home

- »

- Medical Devices

- »

-

Wound Debridement Market Size, Share & Trends Report, 2030GVR Report cover

![Wound Debridement Market Size, Share & Trends Report]()

Wound Debridement Market Size, Share & Trends Analysis Report By Product (Gels, Surgical Devices), By Method, By Wound Type (Pressure Ulcers, Diabetic Foot Ulcers), By End-use, By Mode of Purchase, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-462-8

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global wound debridement market size was valued at USD 4.45 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The high incidence of chronic conditions, such as pressure ulcers, diabetic foot ulcers, and other target wounds, the availability of reimbursement in developed economies, and changing lifestyles are anticipated to drive the market. Furthermore, the increased incidences of injuries such as accidents as road accidents, burns, and trauma events across the globe are also anticipated to drive the market. Additionally, the widening base of the geriatric population and increasing initiatives by governments and private organizations to raise awareness regarding wound care treatment are projected to work in favor of the market.

An increased number of people suffer from diabetes globally. This is anticipated to further impel the market growth. According to the International Diabetes Federation, diabetes is one of the most prevalent medical disorders in the world, affecting almost 537 million adults in 2021. It is expected to affect 643 million people by 2030 and 783 million people by 2045. In Europe, 19.3 million persons between the ages of 60 and 79, 11.3 million between the ages of 40 and 59, and 1.7 million between the ages of 20 and 39 had diabetes, in 2019.

The biggest percentage of diabetics (10.5%) in Europe was in Germany, followed by Portugal (9.5%) and Cyprus (9.0%). Such a high number of diabetics increase the risk of diabetic foot ulcers, and other wounds, which are difficult to treat & take longer duration to heal. These wounds require advanced wound debridement products, and thus the wound debridement industry is expected to grow over the forecast period.

Furthermore, tragic accidents have occurred more frequently worldwide. For instance, according to estimates provided by the WHO, vehicle accidents cause about 1.2 million fatalities each year while 20 to 50 million people suffer non-fatal injuries. Similarly, according to Economic Times, India witnessed 5,54,796 road accidents in 2020. These mishaps frequently cause serious bleeding and other injuries, prompting quick medical attention and occasionally requiring surgical operations to provide patients with immediate relief. As wound debridement products help in the debridement of such accidental wounds, the demand for wound debridement is expected to expand significantly over the forecast period.

The COVID-19 outbreak created large-scale opportunities for local manufacturers. Due to the restrictions on movement at international borders, the supply chain of major players remained disrupted. This created opportunity for local players to enter the market and meet the unmet demand of end users. The rising number of cases led to a shortage of medical supplies; thus, local players continue to manufacture products on a larger scale to meet the growing need. To further their foothold in the market, key companies adopt various strategies. Due to covid-19 change, partnering with relevant third-party vendors promises a strategic advantage for players in the wound debridement industry.

In addition, the increasing adoption of debridement products and techniques to heal wounds faster continues to propel the market growth. The micro-organisms and the presence of toxins on the wound inhibit healing and may lead to infection. Debridement removes the dead or infected tissues from the wound to promote healing.

Product Insights

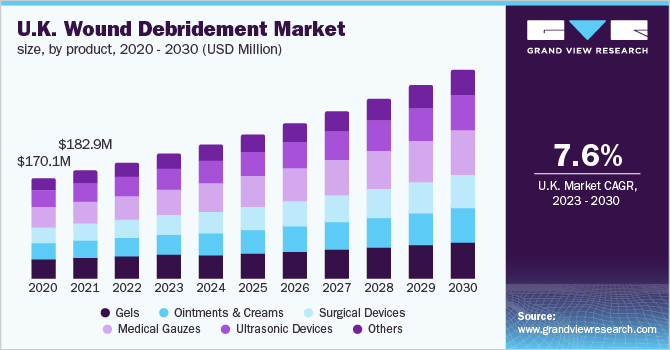

Based on products, the medical gauze segment held the largest share of 22.73% in 2022. Medical gauzes help in maintaining moisture surrounding the wound, which enables rapid healing. Since these wound care products enable faster healing, wound dressings are highly recommended for chronic wounds, such as diabetic ulcers, burn injuries, pressure ulcers, and other slow-healing wounds. Gauzes are majorly composed of substances such as collagen, hydrocolloids, hydrogels, foams, and alginates.

The gels segment is projected to impel at a growth rate of CAGR 5.2% during the forecast duration. Gels maintain a moist wound environment and have certain benefits as compared to other products. Gels are amorphous and clear hydrogel remains in prominent use for the treatment of sloughy and necrotic tissue in chronic wounds. Increasing cases of surgical wounds or Surgical Site Infection (SSI) among patients and rising incidence of chronic wounds, especially diabetic foot ulcers, are among the major factors contributing to the segment growth

Method Insights

Based on method, the market is segmented into autolytic, enzymatic, surgical, mechanical, and others. The surgical wound debridement segment dominated the market in 2022 with a share of 26.99%. It is the fastest way of wound debridement procedure to achieve a clean wound bed, thereby, contributing to the segment’s growth. The autolytic wound debridement segment is expected to expand at the highest CAGR of 6.8% during the forecast period.

Autolytic debridement is the removal of necrotic debris and damaged tissues from a wound site by the body’s endogenous enzymes that engulf specific components of body tissues/cells. This method is usually comfortable and effective, but it takes a longer time than other methods of debridement. However, if significant autolysis is not observed within 1-2 weeks, then another method of debridement is considered.

Wound Type Insights

Based on wound type, the wound debridement industry is segmented into pressure ulcers, diabetic foot ulcers, venous leg ulcers, burn wounds, and others. The diabetic foot ulcers segment is anticipated to capture the largest market share of 32.96% in 2022. This dominance can be accredited to the increased number of diabetic patients, coupled with several foot deformities, and trauma.

For instance, according to International Diabetes Federation, around 90 million people alone in South East Asia suffer from diabetes. This number rises further to 206 million in the Western Pacific region. As per NCBI, the risk of developing a diabetic foot ulcer in diabetic patients is around 2%, which increases to around 17%-60%, if the person suffered from a diabetic foot ulcer previously. Thus, with a dramatic rise in the diabetic population along with the risk of diabetic foot ulcers, the diabetic foot ulcers segment is projected to have a significant growth rate over the forecast period.

However, the pressure ulcers segment is expected to witness the fastest growth over the forecast duration. Pressure ulcers are also known as bed sores; it usually occurs due to prolonged intense pressure on the skin. Prolonged hospital stay is the most common cause of such ulcers and it mostly occurs among the geriatric population. Pressure ulcers generally occur at the bony areas of the body like ankles, hips, and tailbone. The rising geriatric population across the globe is the major driving factor for the segment’s growth. For instance, according to WHO, the number of the 60+ population in 2019 was expected to reach 254 million, whereas, it is anticipated to reach 24% by 2040.

End-use Insights

Based on end-use, the hospital segment dominated the wound debridement industry with a market share of 55.04% in 2022. This can be attributed to an increase in surgical procedures and the rising number of hospitals. For instance, a study by NCBI in 2020 predicted that 310 million surgical cases were performed annually over the world, of which 40 million to 50 million were done in the U.S. alone. Additionally, the number of hospitals and hospitalizations has increased globally.

For instance, the number of hospitalizations in Australia has grown, according to the Australian Institute of Health & Welfare. 11.1 million individuals in Australia were hospitalized in 2019-2020. As a result of the aforementioned considerations, it is anticipated that the hospital segment will dominate the end-use segment.

However, the homecare segment is projected to witness the fastest growth rate at a CAGR of 6.8% during the forecast period. Homecare settings remain on the rise in many countries. Moreover, many surgeries require a prolonged recovery period, leading to frequent debridement of wounds. Further, the geriatric population and bariatric population prefer homecare settings. Thus, the rising bariatric population & geriatric population is anticipated to boost the home healthcare segment.

For instance, as per WHO, world obesity has tripled since 1975. Additionally, as per a similar source, in 2020, 39 million children under the age of five were overweight or obese. Thereby, impelling the homecare segment over the forecast period.

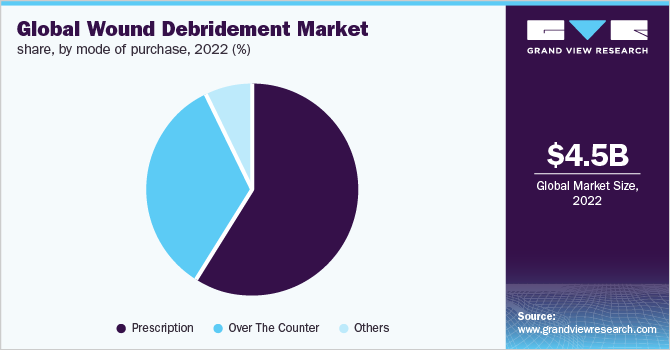

Mode Of Purchase Insights

Based on mode of purchase, the prescription segment dominated the wound debridement industry with a market share of 58.74% in 2022. The dominance can be attributed to the availability of reimbursement for wound debridement products if the products are prescribed by a certified medical practitioner. For instance, Medicare covers around 80% of the cost for medically necessary wound care supplies. This encourages people to visit physicians and receive prescribed wound debridement medication.

However, the over-the-counter segment is projected to witness the fastest growth rate of CAGR 6.5% over the forecast of 2023-2030. Several OTC wound debridement products are available for the treatment of various wounds, such as cuts, abrasions, scrapes, and scratches. In addition, easy access to wound debridement products, previous experience, and economic factors plays an important role in people opting for OTC wound debridement products. Further, e-commerce platforms, such as Amazon and Walmart’s online pharmacy, and the presence of several online key vendors, such as 1mg, Netmeds, and Apollo Pharmacy, have increased the availability of OTC wound debridement products. Thereby, boosting the segment growth.

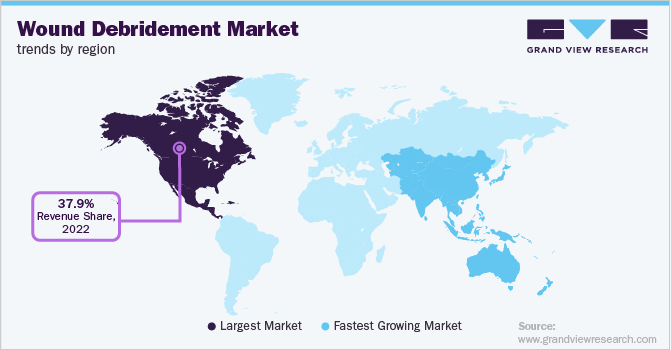

Regional Insights

Based on region, North America held the dominant market share of 37.87% in 2022. This supremacy can be attributed to the region's well-developed healthcare infrastructure, growing awareness, and the presence of significant important actors. Additionally, the market for wound debridement is anticipated to be driven by an increase in surgical procedures in the North American area.

For instance, the Life Span Organization estimates that about 500,000 open heart operations were carried out in the United States in 2018. Similarly, 40,000 children in the U.S. have congenital heart surgery, according to AHA Journals. Since these operations require wound debridement products, North America is expected to dominate the wound debridement products over the forecast period.

However, Asia Pacific is estimated to witness the fastest CAGR of 7.1% over the forecast period. This can be attributed to the region's growing diabetes population. For instance, the Down to Earth organization estimates that India had 74.2 million diabetics between the ages of 20 and 79 as of December 2021. Furthermore, it is expected that this figure would rise to 124.8 million by 2045. Similarly, the IDF estimates that 3,993,300 of the 63,265,700 individuals living in the Philippines had diabetes in 2019. Therefore, an increase in the diabetic population may help the wound debridement industry’s growth.

Key Companies & Market Share Insights

The wound debridement industry is extremely fragmented, with both major and local market competitors. As the current market players step up their efforts to seize the majority in the industry, a fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, to gain a competitive edge over rivals.

For instance, in November 2020, Gunze Limited launched an ultrasonic wound debridement device. Thus, with various strategies adopted by the market players, the wound debridement industry is predicted to impel during the forecast period. Some prominent players in the global wound debridement market include:

-

Coloplast Corp.

-

Medline Industries

-

Smith & Nephew

-

ConvaTec Group PLC

-

Integra LifeSciences

-

B. Braun SE

-

Molnlycke Health Care AB

-

Brightwake Ltd.

-

Lohmann & Rauscher

-

3M

Wound Debridement Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.72 billion

Revenue forecast in 2030

USD 7.17 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, wound type, end-use, mode of purchase, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Integra LifeSciences; Molnlycke Health Care AB, B. Braun SE; Brightwake Ltd., Lohmann & Rauscher; 3M.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Debridement Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound debridement market report based on product, method, wound type, end-use, mode of purchase, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Ointments & Creams

-

Surgical Devices

-

Medical Gauzes

-

Ultrasonic Devices

-

Others

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Autolytic

-

Enzymatic

-

Surgical

-

Mechanical

-

Others

-

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pressure Ulcers

-

Diabetic Foot Ulcers

-

Venous Leg Ulcers

-

Burn Wounds

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

Over The Counter

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wound debridement market size was estimated at USD 4.45 billion in 2022 and is expected to reach USD 4.72 billion in 2023.

b. The global wound debridement market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 7.17 billion by 2030.

b. North America dominated the wound debridement market with a share of 37.87% in 2022. This is attributable to rising healthcare awareness and constant research and development initiatives.

b. Some key players operating in the wound debridement market include Acelity L.P. Inc.; Smith & Nephew; B. Braun Melsungen AG; Coloplast A/S; ConvaTec Group; Paul Hartmann; Mölnlycke Health Care; Lohmann & Rauscher; Medline Industries; and Integra Lifesciences.

b. Key factors that are driving the wound debridement market growth include a growing number of accidents and fire outbreaks are leading to rising in the cases of injuries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."