- Home

- »

- Electronic Security

- »

-

X-ray Security Screening Market Size Analysis Report, 2030GVR Report cover

![X-ray Security Screening Market Size, Share, & Trends Report]()

X-ray Security Screening Market Size, Share, & Trends Analysis Report By End-use (Transit, Commercial), By Application (People Screening, Product Screening), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-400-0

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global X-ray security screening market size was valued at USD 3,208.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. The market growth can be attributed to the increasing threats such as criminal activities and the growing adoption of screening techniques for inspecting people and products for the detection of weapons. Furthermore, rising commercial construction activities, particularly the establishment of large shopping centers, also propel the demand for advanced security screenings. The industry witnessed a major upheaval due to the outbreak of COVID-19. Major countries across the globe scaled back airport and other shopping mall operations. Furthermore, after the reopening, security across the globe was revamped to implement non-contact methods to screen passengers and baggage.

The COVID-19 outbreak became a blessing in disguise for players in the security screening industry. Soon, as lockdowns were lifted in a staggered manner, several airports and shopping malls implemented X-ray screening, automated checkpoints, and baggage inspection to implement non-contact methods. These factors are expected to further propel the growth of the X-ray security screening industry during the forecast period.

Several organizations have implemented biometrics technology for physical and logistic access to mitigate the risks associated with data. These technologies are deployed to provide access control, prevent theft or leakage control, and register the attendance of employees. For biometrics, employees do not have to remember passwords or carry anything to validate their identity. This makes the deployment of biometrics technologies much easier and quicker as compared to other security solutions. These benefits are expected to further supplement the market growth.

The X-ray security screening industry has evolved rapidly, and the integration of new technologies has made X-ray security screening easy to use, fast, and safe. The aforementioned factors have broadened the scope of X-ray security screening systems beyond industrial applications. Technological advancements in hardware such as detectors, sources, and tubes as well as software upgrades have contributed significantly towards enhancing the efficiency of X-ray security systems. Presently, upgrading existing security screening installations provides avenues for the industry’s growth.

To improve security owing to several terrorism-related threats, X-ray security screening devices have been developed to complement existing manual searches and technologies such as metal detectors and X-ray security scanners. However, ionizing radiation is known to be carcinogenic and side effects such as skin cancers may hamper the market. Each time a passenger receives the backscatter scan, he or she may be exposed to a low dose of radiation. Such drawbacks could hinder the growth of the X-ray security screening industry during the forecast period.

The expansion of airports along with other commercial infrastructure and the growing threats such as terrorism are key factors driving the growth of the X-ray security scanning industry. Due to weak security systems at railway stations, seaports, hotels, and airports, illegal and terrorist activities continue to be on the rise. Body scanning and other end-use technologies are required to prevent terrorist attacks and other illegal activities. In March 2016, 30 citizens were killed in the departure hall of Maelbeek metro station and Brussels Zaventem International Airport. As a result, there will be a high demand for X-ray security screening systems during the forecast period.

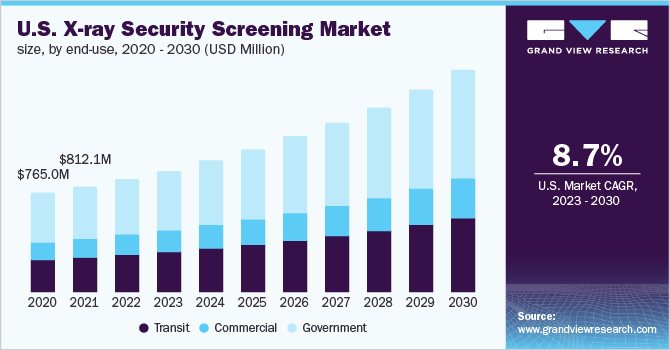

End-use Insights

The government segment accounted for a market share of 45.9% in 2022. The widespread use of security screenings by governments and law enforcement agencies to improve security drives the growth of the X-ray screening security industry. Governments and private organizations are aggressively investing in security solutions owing to rising incidences of terrorist activities.

Security checks and surveillance are major areas of government buildings, such as courthouses, parliament houses, and public banks, among others. Furthermore, government agencies continue to install several security devices, such as X-ray security scanner, handheld detectors, metal detectors, and biometrics systems. These factors have created robust demand for X-ray screening security systems in securing public infrastructure during the forecast period.

The transit segment is anticipated to expand at a CAGR of 8.9% during the forecast period. The segment growth can be attributed to an increase in the number of passengers worldwide and continuous efforts to adopt security measures to ensure complete safety for citizens and global travelers. This is expected to drive the demand for X-ray security screening in the transit sector over the next few years.

Technological advancements and the availability of diverse solutions have driven the growth of airport-related security solutions over the past few years. The capability of these systems to integrate with multiple platforms has widened the scope of the industry. Furthermore, real-time data intelligence and reduced time on screening procedures have greatly popularized automated screening equipment. Many large-capacity airports have adopted this trend. For instance, the self-service check-in machines installed at the London Heathrow Airport not only improve passenger experience but also expedite the screening process.

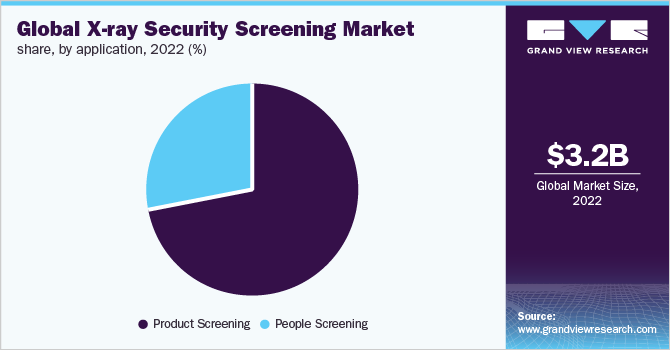

Application Insights

The product screening segment accounted for the largest market share of 71.6% in 2022. Easy availability of integrated screening systems due to technological advancements has enabled vendors to integrate traditional screening and emerging scanning end-uses, thereby driving segment growth. Furthermore, the risk of criminal activities such as drug trafficking at airports continues to be the key driver for the growth of the segment.

Training and maintenance promises could serve as critical selling points for future growth. Manufacturers are focused on the development of intelligent and integrated solutions that augment the requirement for efficiency and speed. Moreover, with the proliferation of smartphones and the Internet of Things (IoT), smart security solutions are expected to create a demand for security screening solutions during the forecast period.

The people screening segment is expected to register a significant growth rate of 8.8% from 2023 to 2030. Citizens and corporates are facing continuous threats of cyber-attacks, natural and man-made disasters, and dangers such as terrorism. Governments of several regions are emphasizing advanced solutions to improve and strengthen the existing information technology infrastructure and security systems.

Governments are aggressively focused on improving conventional public safety and security solutions by installing advanced biometric systems. These include authentication, Command, Control, Communications, & Computers, also known as the C2 framework and surveillance systems.

Furthermore, real-time data intelligence and reduced time on screening procedures have greatly popularized automated screening equipment. These factors are expected to create robust demand for X-ray security screening systems in the public screening segment during the forecast period.

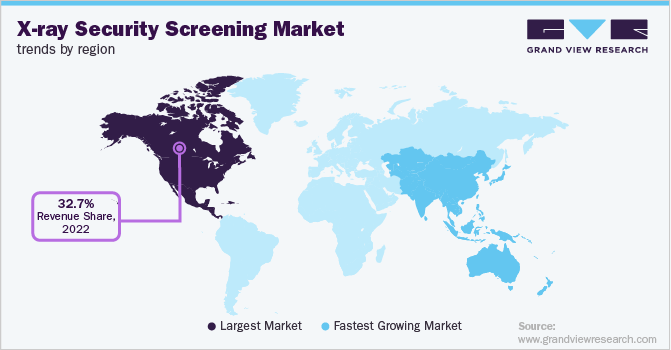

Regional Insights

North America held the major share of 32.7% of the revenue of the global X-ray security screening industry in 2022. Large public investments in improving existing public safety and security infrastructure to combat threats such as terrorism and illegal immigration are expected to drive market growth during the forecast period.

For instance, the U.S. Customs and Border Protection department scans all the containers during their entry into the U.S., irrespective of whether this cargo enters using land or sea. This inspection is carried out to detect radiation. The public agency also categorizes around 5% of all containers as ‘high risk’ and it scrutinizes these using X-ray or gamma-ray imaging systems. These factors are expected to drive the demand for X-ray security screening systems in the region during the forecast period.

The Asia Pacific is anticipated to emerge as the fastest-growing region over the forecast period at a CAGR of 9.6%. The regional growth can be attributed to the surge in the development of novel large-scale commercial projects, expansion of airport infrastructure, and aggressive investments in other public infrastructure development projects.

For instance, in December 2022, the Bureau of Civil Aviation Security (BACS) issued technical norms for Indian airports to implement current equipment to screen bags without the need to remove electronic devices. With the help of technologies such as neutron beam technology and computed tomography, security agencies can eliminate the need for passengers to remove electronic devices. These developments are expected to further drive the growth of the regional X-ray security screening industry during the forecast period.

Key Companies & Market Share Insights

The dominant players operating in the X-ray security screening industry include Thales; Smiths Detection; NEC Corporation; Teledyne FLIR LLC; and Bruker. Market players are keen to invest resources in research & development activities to support growth and enhance their internal business operations.

The report will include company analysis based on their financial performances, end-use benchmarking, key business strategies, and most recent strategic alliances. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their end-use cases and gain a competitive advantage in the market. They are effectively working on new end-use development, and enhancement of existing end-uses to acquire new customers and capture a higher market share.

For instance, in March 2021, NEC Corporation announced a new boarding technique for the departure of international flights using the facial recognition technology, Face Express. By registering their face, Face Express would allow passengers to enter and exit the airport without showing their passports or boarding pass. This technology is expected to reduce the risks of infection posed by person-to-person contact. Some prominent players in the global X-ray security screening market include:

-

Thales

-

Smiths Detection

-

NEC Corporation

-

Teledyne FLIR LLC

-

Burker

-

Analogic Corporation

-

OSI Systems

-

Leidos

-

Aware, Inc.

-

Kromek Group plc

X-ray Security Screening Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.45 billion

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

End-use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Thales; Smiths Detection; NEC Corporation; Teledyne FLIR LLC; Burker; Analogic Corporation.; OSI Systems; Leidos; Aware, Inc.; Kromek Group plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.Explore purchase options

Global X-ray Security Screening Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global X-ray security screening market report based on end-use, application, and region:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transit

-

Commercial

-

Government

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Screening

-

People Screening

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global x-ray security screening market size was estimated at USD 3,208.2 million in 2022 and is expected to reach USD 3.45 billion in 2023.

b. The global x-ray security screening market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 6.25 billion by 2030.

b. Transit industry dominated the x-ray security screening market with a share of 37.06% in 2022. This is attributable to the rise in number of passengers travelling via airplanes.

b. Some key players operating in the x-ray security screening market include OSI Systems (Rapiscan), Smith Detection, American Science and Engineering, Morpho Detection and Analogic Corporation.

b. Key factors that are driving the market growth include increasing adoption of x-ray scanners to screen people and baggage for detection of weapons, explosives, drugs, and chemicals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."