- Home

- »

- Reports

- »

-

Commercial Print Services Supplier Intelligence Report, 2030

![Commercial Print Services Supplier Intelligence Report, 2030]()

Commercial Print Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2020

- Report ID: GVR-P-10528

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Commercial Print Services Category Overview

“The commercial print services category’s growth is driven by the increasing use of printing technology for promotional activities.”

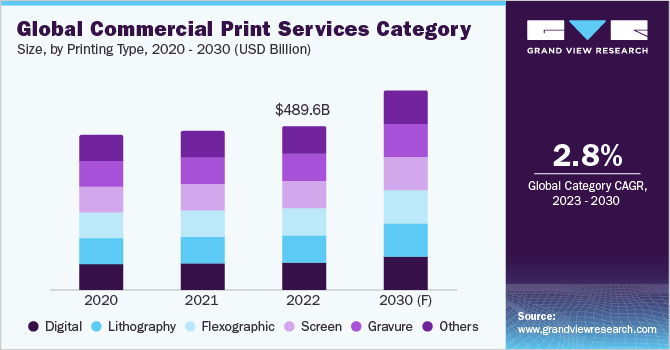

The global commercial print services category is expected to witness a CAGR of 2.8% from 2023 to 2030. APAC has the largest category share and it is the fastest growing region. Category growth is driven by the increasing use of printing technology for promotional activities, as well as the growing acceptance of digital printing. The different types of printing methods include digital printing, lithography printing, flexographic, gravure printing, and screen printing among others.

The global commercial print services market size was valued at USD 489.63 billion in 2022. The printing industry is undergoing a major transformation thanks to recent technological advancements. Artificial intelligence (AI), the Internet of Things (IoT), machine learning, and data analytics are all being used to create more personalized and tailored printing services. AI can be used to analyze customer data and preferences to create custom print designs. IoT can be used to track the printing process in real time, ensuring that orders are completed on time and to the customer's specifications. Machine learning can be used to improve the accuracy of print production, reducing errors and waste. And data analytics can be used to identify trends and patterns in customer behavior, helping businesses to better target their printing services. For instance,

-

In April 2022, Canon USA, Inc., a provider of digital imaging solutions, introduced Prismacolor Manager, a system that assists customers in evaluating and monitoring print quality. The system also displays to customers how their finished product looks in comparison to a commercial printing industry standard or to their own internal printing criteria. Customers can easily deploy Prismacolor Manager as a cloud-based service to track and compare outcomes over time.

The printing industry is expected to grow in the coming years due to the rise of IoT and AI technologies, as well as the increasing use of laser and inkjet printing solutions. Also, small and medium-sized businesses are adopting new printing technologies with a growing focus on environmentally friendly printing methods. LED UV printing is a new, eco-friendly printing technology that uses ultraviolet light to cure the ink on a substrate. This results in high-quality prints that are resistant to bleeding and fading. The printing industry is constantly evolving, with new technologies such as computerized imaging and specialized inks enabling companies to print items faster and more affordably. For example,

-

In October 2021, The Xeikon PX3300 and Xeikon PX2200 label presses have been unveiled by Xeikon, a major producer of digital printing solutions. These presses employ Panther DuraCure UV technology to generate high-gloss labels with great scuff resistance. This is said to provide a wide color spectrum and longevity for a number of applications, such as industrial, chemical, home, and high-end labels for the luxury beverage, health, and beauty industries.

Rising input material costs, like ink, paper, and toners, are expected to limit the category’s growth throughout the forecast period. Further, the category is expected to be hampered by consumers' increased use of digital media. However, the industry is expected to gain from the acceptance of commercial green printers among vendors. This technology employs eco-friendly papers, soy inks, and coatings that are likely to increase the scope for commercial green printers, consequently opening up new market potential.

Supplier Intelligence

“How can the nature of the commercial printing services category be best described? Who are some of the key players in this category?”

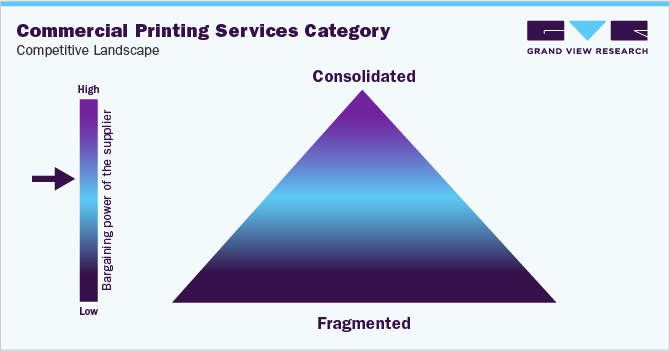

The commercial printing services category is fragmented and highly competitive, with several prominent players vying for market share. These players are constantly seeking ways to enhance their offerings, such as through strategic partnerships and regional expansion. Because the products are so similar, many participants are forced to compete on price. The commercial printing industry is also facing increasing competition from online printing companies. These companies offer a wide range of printing services at very competitive prices. However, commercial printers still have a number of advantages over online printing companies, such as the ability to offer more personalized service and the capacity to print on a wider range of materials. As a result of these circumstances, there is severe rivalry in the target market. Furthermore, businesses are under pressure to conserve cash flows while remaining as inventive as possible. For instance, in May 2022, RRD developed Helium, an editing solution that provides professionals with access to specialist copywriting, content optimization, and project management. This solution might give marketers a single point of contact for numerous content-generation subject matter experts.

Key suppliers covered in the category:

-

Quad/Graphics Inc.

-

Acme Printing

-

Cenveo

-

RR Donnelley

-

Transcontinental Inc.

-

LSC Communications US, LLC.

-

Gorham Printing, Inc.

-

Dai Nippon Printing

-

The Magazine Printing Company

-

Cimpress plc

-

Quebecor World Inc.

-

Duncan Print Group

Pricing and Cost Intelligence

“What is the total cost of ownership for a commercial print service provider? Which factors impact the price of the service?”

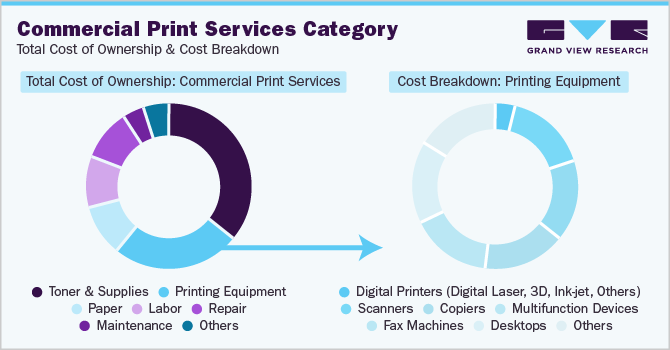

A company's printing costs include the overall costs incurred to acquire the printing equipment, as well as the technical staff and processes that support the printing operation. Typical costs associated with printing include:

-

All printing equipment, including desktop printers, scanners, copiers, multifunction devices, fax machines, and production printers

-

Paper, ink, cartridge, toner, and other printing supplies

-

Internal and external support desk, IT assistance, technical service, and maintenance

The cost of acquisition accounts for about only 25% of total printing expenditures over the life of a printer. Supplies, services, and maintenance account for more than 75% of total costs. Thus, the total cost can be divided into printing devices cost, toner & supplies, paper, repair costs, support, hardware, and maintenance cost. Hence, printing equipment (25%), toner & supplies (36%), and paper (11%) are the major cost components and account for roughly 70-75% of the total cost.

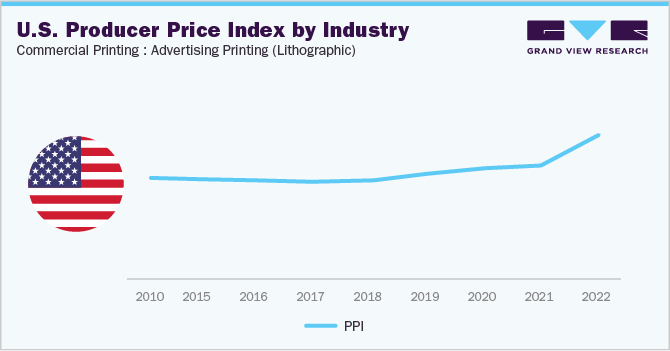

According to some reports, there were many rounds of price rises on all paper grades in the United States from 2021 and 2022. Paper prices increased by 12.8% in 2022 over 2021 prices. But, with consumer spending staying moderated in 2023 as a result of current concerns about an impending recession, paper prices are expected to rise at a more moderate 1.7% annual rate. According to PrintWeek UK, one paper manufacturer was reported to be charging a premium of up to GBP 170 per ton.

The chart below shows a breakdown of the cost structure connected with commercial print services along with major cost components:

There is a growing trend toward using a volume-based pricing strategy. To achieve better results, the performance-based pricing model is also linked to the project-based pricing model as a percentage of compensation.

The Commercial Print Services Procurement Intelligence Report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destination for Commercial Print Services? What is the type of engagement model?”

China, Germany, Japan, Netherlands, and Singapore are the top sourcing destinations for commercial print services. These countries were the leading exporters of printing machines worldwide in 2021. Combined, the top five countries exported machinery worth USD 48.8 billion which is 54.6% of the world’s total exports of printing machinery. In terms of money’s worth, Asian countries exported the most printing gear in 2021, accounting for USD 55.5 billion, or 62.2% of the global total. European exporters came in second at 31.5%, with North America accounting for another 5.6% of global shipments of printing machines.

In terms of value, the top 15 countries dispatched close to 90% of the worldwide exports of printing machinery in 2021. The fastest-developing printing machinery exporters since 2020 have been the Philippines (up 37.1%), Vietnam (up 35.8%), Malaysia (up 35.7%), and Singapore (up 34.6%). Whereas, Belgium was the only major supplier to report a drop in export printing machinery sales, with a decrease of 6.7%.

In terms of commercial print services sourcing intelligence, many vendors opt for an in-house service provider model to achieve greater control over processes and security. They can ensure service quality, align with specific needs, adapt to changing business needs, respond quickly to market changes, and maintain data security and compliance with industry regulations.

“In the in-house service provider model, the client retains the complete operations in-house.”

Commercial print service providers are investing in new technologies to offer better quality and personalized services to their customers. They are also partnering with other businesses and organizations to provide a wider range of services and reach a larger audience. This is helping them to grow their businesses and stay ahead of the competition.

The Commercial Print Services Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Commercial Print Services Procurement Intelligence Report Scope

Report Attribute

Details

Commercial Print Services Category Growth Rate

CAGR of 2.8% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 5% (Annually)

Pricing Models

Volume-based pricing model, Performance-based pricing model

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier Selection Criteria

Printing methods, print size, print quality, price, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Quad/Graphics Inc., Acme Printing, Cenveo, RR Donnelley, Transcontinental Inc., LSC Communications US, LLC., Gorham Printing, Inc., Dai Nippon Printing, The Magazine Printing Company, Cimpress plc, Quebecor World Inc., Duncan Print Group

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 598.06 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global commercial print services category size was valued at approximately USD 489.63 billion in 2022 and is estimated to witness a CAGR of 2.8% from 2023 to 2030.

b. Increasing use of printing technology for promotional activities, as well as the growing acceptance of digital printing is driving the growth of this category.

b. According to the LCC/BCC sourcing analysis, China, Germany, Japan, Netherlands, and Singapore are the ideal destinations for sourcing commercial print services.

b. This category is fragmented with the presence of many large players competing for the market share. Some of the key players are Quad/Graphics Inc., Acme Printing, Cenveo, RR Donnelley, Transcontinental Inc., LSC Communications US, LLC., Gorham Printing, Inc., Dai Nippon Printing, The Magazine Printing Company, Cimpress plc, Quebecor World Inc., Duncan Print Group.

b. Printing devices, toner & supplies, and paper are the major cost components of this category. Other key costs include repair, maintenance, and hardware.

b. Clearly defining needs, researching commercial print service providers, narrowing down suppliers, getting quotes from suppliers to compare prices and meeting with suppliers to gain better understanding are some of the best sourcing practices in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified