- Home

- »

- Next Generation Technologies

- »

-

U.S. Cloud Computing Market Size, Industry Report, 2030GVR Report cover

![U.S. Cloud Computing Market Size, Share & Trends Report]()

U.S. Cloud Computing Market Size, Share & Trends Analysis Report By Service (SaaS, IaaS), By Deployment (Public, Private, Hybrid), By Enterprise Size (Small & Medium-enterprise, Large Enterprise), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-214-0

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

U.S. Cloud Computing Market Size & Trends

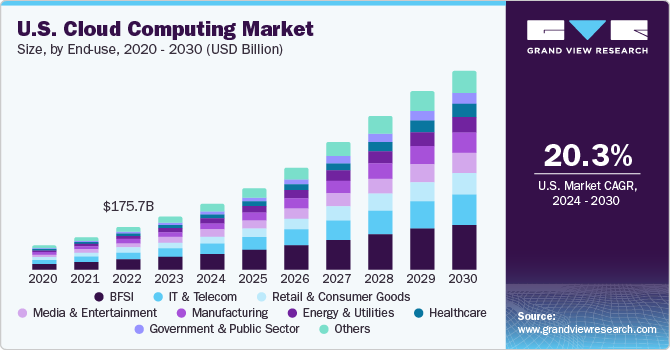

The U.S. cloud computing market size was valued at USD 216.91 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. The U.S. accounted for 36.0% of the global cloud computing market. Organizations in the U.S. are shifting their preference from legacy software to cloud-based software to overcome the losses caused by the COVID-19 pandemic and to support the growing adoption of new technologies such as Artificial Intelligence (AI), Machine Learning (ML), 5G, and Internet of Things (IoT). This paradigm shift is expected to play a crucial role in driving the growth of the U.S. cloud computing market.

The U.S. market is witnessing a constant digital transformation in various industry verticals, where emerging and established companies are incorporating new technologies to provide real-time user experiences to their consumers. In addition, the growing adoption of these latest technologies is helping organizations enhance data visualization and make complex data more accessible and usable. The extensive use of business solutions based on Big Data, AI, and ML also plays a decisive role in addressing the issues associated with data storage and accelerating data utilization. However, cloud solutions remain vital for implementing AI- and ML-based business solutions with minimum infrastructural investments.

U.S.-based companies increasingly use cloud migration strategy to reduce their budget allocations on IT infrastructure and allocate financial resources to other business operations. Cloud migration includes transferring data, business software, and other business-critical applications to the ecosystem. Migrating business applications to the cloud can help organizations simplify communication and streamline their business operations. Hence, several U.S. organizations are aggressively opting for cloud migration as part of their IT transformation strategy, thereby driving the market's growth.

Furthermore, companies strategically store data across multiple cloud platforms, requiring various cloud management services to avoid vendor lock-ins. Vendor lock-in in cloud computing refers to a condition whereby a business is unable to switch from the existing cloud service provider to a different cloud service provider. Vendor lock-ins can take a severe toll on corporate processes and organizational performance. To avoid any such situations, businesses prefer hiring multiple cloud platform providers rather than relying on a single vendor. As a result, the demand for effective multi-cloud management solutions among multi-cloud customers is increasing, thereby contributing to the growth of the cloud computing market.

Although, the adoption of cloud-based solutions has been on the rise in recent years, promising enhanced efficiency, cost savings, and scalability. Yet, some business entities are still skeptical due to the looming concerns over data security and privacy protection associated with cloud-based solutions. These concerns could challenge the market's growth, and businesses need to implement robust security measures to ensure their data remains secure on the cloud.

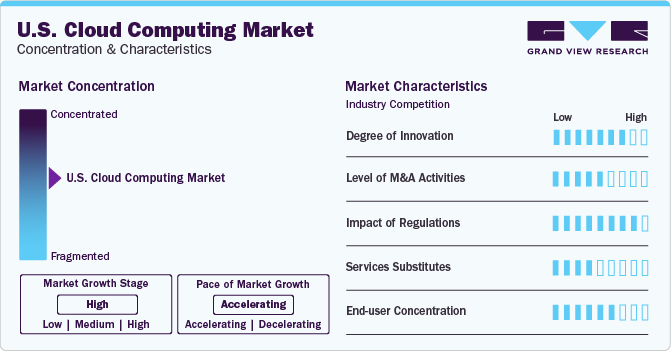

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The cloud computing market in the United States is poised for growth, driven by advancements in technologies such as big data analytics, Artificial Intelligence (AI), Machine Learning (ML), and cybersecurity by cloud management service providers. Additionally, many U.S. companies are increasingly moving their business operations to cloud platforms, which is likely to create ample opportunities for market growth.

The U.S. cloud computing solutions are adopted across various industries, especially IT, telecommunication, and healthcare, to ensure data storage facilities without investing in in-house infrastructure. The U.S. market has the presence of multiple cloud computing vendors, such as Adobe, Amazon.com, Inc., International Business Machine Corporation, Microsoft Corporation, and Oracle Corporation.

There is a significant potential for innovation in cloud computing to assist organizations with limited budgets. American companies always seek to enhance their end-user experience and outperform competitors by shifting their data to the cloud. Cloud migration benefits businesses by increasing agility and flexibility, enabling faster innovation, reducing the overall cost of ownership, and efficiently managing consumer demands.

However, data storage and privacy are the key challenges before cloud computing service-providing organizations. The growing complexity of U.S. regulations entails securing data. Therefore, changing regulatory standards may significantly impact cloud computing providers' market and service delivery models. Stringent regulations and compliance requirements often force U.S. companies to opt for secure cloud storage options to avoid data breach possibilities. Still, the market has opportunities in the long run, and it is anticipated to propel the U.S. market growth in the forecasted period.

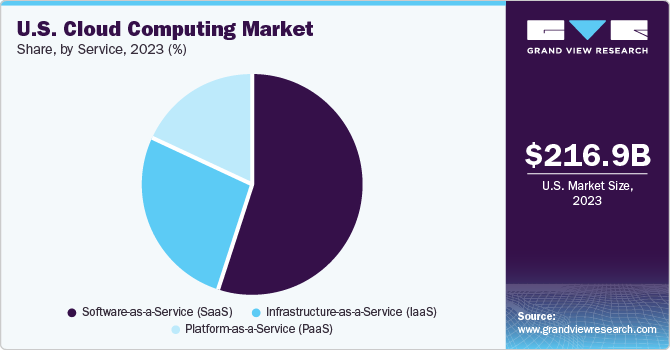

Service Insights

Software as a Service (SaaS) segment dominated the market and accounted for the highest revenue share of 55.08% in 2023. SaaS is gaining popularity due to the availability of diverse software with feature-rich solutions and remote accessibility. Remote working has triggered massive demand for SaaS services in the U.S. market, aiding collaborative working to access previously centralized data and intelligence. Moreover, SaaS offers a pay-as-you-go model, which provides businesses with more flexibility & options and web-based subscriptions to access the software remotely.

Infrastructure as a Service (IaaS) segment is anticipated to witness significant CAGR of 20.9% from 2024 to 2030 in the U.S. cloud computing market. The Infrastructure-as-a-service (IaaS) segment is witnessing significant growth and presents several opportunities across businesses. The increasing demands for reducing IT complexities, hiring a skilled workforce to manage IT infrastructures, and reducing deployment costs for data centers are factors attributed to driving the adoption of IaaS. Furthermore, the growing need to eliminate downtime errors in business operations, streamline IT operations, and enhance the flexibility of the technology ecosystem is observed as a key trend allowing businesses to adopt advanced IaaS cloud solutions.

Deployment Insights

Private segment led the market and accounted highest revenue of USD 116.12 billion in 2023. The private cloud segment is growing by providing end-user services such as complete control over hardware and software, client development and add-on customization of servers, increased visibility into security and access control, and completely enforced regulatory compliance. As a result, the private segment is anticipated to foster market share in the forecasted period.

Hybrid cloud segment is anticipated to witness a significant CAGR of 20.4% from 2024 to 2030 in the market. Hybrid deployment models combine public and private deployment models in an integrated environment. A hybrid model is popular, and many businesses in the U.S. emphasize developing hybrid cloud models to maximize benefits to improve business operations, resource consumption, cost efficiency, user experience, and application modernization. For instance, edge computing has become one of the most important factors anticipated to increase the adoption of hybrid cloud models among businesses in the United States.

Enterprise Size Insights

Large enterprises segment led the market and accounted for the highest global revenue of USD 109.03 billion in 2023. Large enterprises in the U.S. are increasingly adopting cloud solutions to enhance security compliance, increase efficiency, reduce operating expenses and downtime, and accelerate time-to-market. Moreover, cloud computing enables large businesses to outsource routine work to technology. As a result, major organizations are increasingly using cloud computing to streamline their business operations. Cloud computing services are expected to be in high demand over the forecast period due to the growing number of large firms in the United States.

Small and Medium Enterprises (SMEs) are anticipated to witness a significant CAGR of 21.4% from 2024 to 2030 in the U.S. cloud computing market. SMEs in the US are increasingly adopting cloud solutions to meet their business needs for IT infrastructure and data storage. Moreover, business entities are facing challenges and intense competition to ensure technical expertise and funding for secure on-premise IT infrastructure. Thus, SMEs are using the pay-as-you-go approach, which allows them to manage the IT infrastructure as fit to overcome these obstacles. As a result, widespread adoption of cloud computing services among SMEs is poised to grow significantly over the forecast period.

End-use Insights

IT & Telecom segment accounted for the largest market revenue share of 15.9% in 2023. Organizations in the U.S. functioning IT & telecom industry use several software-as-a-service products, infrastructure-as-a-service, and platform-as-a-service hosting services for various business applications. Various cloud vendors are a part of the IT ecosystem, and companies are opting for a hybrid or a multi-cloud approach, which enables organizations to obtain the ideal capabilities from distinct cloud vendors to run their workloads across multiple cloud environments. The adoption of cloud computing is poised to provide greater resilience and financial liquidity to the business operations of organizations. Thus, the segment is expected to grow significantly over the forecast period.

Manufacturing segment is expected to register the fastest CAGR of 22.4% during the forecast period.The manufacturing industry is observed to be making significant investments in advanced technologies, including cloud computing, to enhance its digital transformation journey and cover the losses experienced during the pandemic. Manufacturing enterprises in the U.S. are aggressively seeking hybrid, private-cloud, and multi-cloud solutions that provide agility, resiliency, and flexibility in business processes. Additionally, the growing need to gain complete visibility into the supply chain and improve business revenue forecasting accuracy is encouraging U.S. organizations to deploy cloud computing solutions.

Key U.S. Cloud Computing Company Insights

Some of the prominent participants operating in the market include Amazon.inc, Google LLC, and others.

-

Amazon.com Inc. is a technology company that focuses on cloud computing, e-commerce, Artificial Intelligence (AI), and digital streaming. In 2002, it launched Amazon Web Services (AWS), which delivers data on website status, internet traffic patterns, and other statistics for developers and marketers. In 2006, Amazon developed its AWS portfolio with Simple Storage Service (S3), which rents data storage and computer processing power via the Internet and Elastic Compute Cloud (EC2).

-

Google LLC, a subsidiary of Alphabet Inc., is a technology company specializing in internet-related products and services. The company focuses on business areas such as web-based search and internet-associated products and services. Google Cloud Platform is a suite of cloud computing services offered by Google, providing modular cloud services such as computing, data storage, analytics, and machine learning.

Workday Inc. and Broadcom (VMware) are emerging companies operating in the U.S. cloud computing market.

-

Broadcom provides a unified solution for automating private cloud releases and support for various release automation tools abstracted from diverse infrastructure services. Broadcom facilitates all VMware cloud computing services, such as cloud-based virtualization technology and services.

-

Workday, Inc. is engaged in offering cloud-based financial management and human capital management software services. Moreover, it caters to various industries and sectors, including communication, education, financial services, energy & resources, healthcare, hospitality, life sciences, manufacturing, media & entertainment, and the public. The company also offers its services and solutions to medium and small enterprises.

Key U.S. Cloud Computing Companies:

- Ace Cloud

- Adobe Inc.

- Alibaba Group Holding Limited

- Amazon.com Inc.

- Broadcom

- Digital Ocean

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Navisite

- Oracle Corporation

- Rackspace

- Salesforce.com Inc.

- SAP SE

- Verizon Cloud

- Workday, Inc.

Recent Developments

-

In June 2023, Oracle Corporation announced its plans to develop strong, generative AI services for businesses worldwide. Oracle Corporation partnered with Cohere, an enterprise AI platform, to develop native generative AI capabilities that can assist organizations in automating end-to-end business processes and improving decision-making and customer experiences. Oracle Corporation's generative AI services, which span applications and infrastructure as well as offer the highest standards of security, performance, and value in the market, are built on Oracle Cloud Infrastructure (OCI) and use Oracle's distinctive Supercluster capabilities.

-

In June 2023, EPAM Systems, Inc., a product engineering company, partnered with Google Cloud to enable enterprises to overcome operational challenges and drive transformational growth by developing and deploying AI-first Google Cloud solutions. As a result of this partnership, EPAM Systems, Inc. aims to expand its cloud-native engineering, integration and managed service offering around Google Cloud AI solutions, including Generative AI App Builder, Vertex AI, and Model Garden.

-

In June 2023, Adobe, Inc. announced new developments in Adobe Experience Cloud, the world's most prominent customer experience management tool. The new products allowed businesses to provide highly customized experiences at every point of contact while maximizing operational effectiveness. Along with important updates to Adobe Mix Modeller, Adobe Experience Manager, Adobe Real-Time Customer Data Platform, and Adobe Journey Optimizer, Adobe also announced the release of Adobe Product Analytics for enterprise customers.

-

In May 2023, International Business Machines Corporation launched IBM Hybrid Cloud Mesh, a SaaS solution to help businesses manage their hybrid multi-cloud architecture. Modern businesses can operate their IT systems across hybrid multi-cloud and heterogeneous environments using IBM Hybrid Cloud Mesh, powered by "Application-Centric Connectivity" and designed to automate the process, management, and accessibility of application connectivity among public and private clouds.

U.S. Cloud Computing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 268.81 billion

Revenue forecast in 2030

USD 813.01 billion

Growth Rate

CAGR of 20.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, deployment, enterprise size, end-use

Country scope

U.S.

Key companies profiled

Ace Cloud; Adobe Inc.; Alibaba Group Holding Limited; Amazon.com Inc.; Broadcom; Digital Ocean; Google LLC; International Business Machines Corporation; Microsoft Corporation; Navisite; Oracle Corporation; Rackspace; Salesforce.com Inc.; SAP SE; Verizon Cloud; Workday, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cloud Computing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cloud computing market report based on service, deployment, enterprise size, and end-use.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure-as-a-Service (IaaS)

-

Platform-as-a-Service (PaaS)

-

Software-as-a-Service (SaaS)

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium-enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Media & Entertainment

-

Government & Public Sector

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cloud computing market size was estimated at USD 216.91 billion in 2023 and is expected to reach USD 268.81 billion in 2024.

b. The U.S. cloud computing market is expected to grow at a compound annual growth rate of 20.3% from 2024 to 2030 to reach USD 813.01 billion by 2030.

b. Some key players operating in the U.S. cloud computing market include Ace Cloud; Adobe Inc.; Alibaba Group Holding Limited; Amazon.com Inc.; Broadcom; Digital Ocean; Google LLC; International Business Machines Corporation; Microsoft Corporation; Navisite; Oracle Corporation; Rackspace; Salesforce.com Inc.; SAP SE; Verizon Cloud; Workday, Inc.

b. The Software as a Service (SaaS) segment accounted for the largest revenue share of 55.08% in 2023. Remote working has triggered massive demand for SaaS services in the U.S. market, aiding collaborative working to access previously centralized data and intelligence.

b. Organizations in the U.S. are shifting their preference from legacy software to cloud-based software to support the growing adoption of new technologies such as Artificial Intelligence (AI), Machine Learning (ML), 5G, and Internet of Things (IoT).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."