- Home

- »

- Consumer F&B

- »

-

Canned Food Market Size, Share And Growth Report, 2030GVR Report cover

![Canned Food Market Size, Share & Trends Report]()

Canned Food Market Size, Share & Trends Analysis Report By Product (Canned Fruits & Vegetables, Canned Meat Products, Canned Fish/Seafood), By Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-260-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Consumer Goods

Canned Food Market Size & Trends

The global canned food market size was estimated at USD 118.53 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. Canned food products, known for their convenience and longer shelf life, are witnessing increased demand across various consumer segments and geographical regions.

The growing preference for convenient and long-lasting food options is driving the market growth. Consumers, including busy individuals and families, find canned food an attractive choice due to its easy preparation and extended shelf life. In addition, the demand for canned food is driven by its relevance in outdoor activities such as camping and hiking, where access to refrigeration and cooking facilities may be limited. The increasing global participation in hiking and camping is expected to drive market growth during the forecast period. For instance, the 2023 U.S. Outdoor Participation Report by the National Sporting Goods Association revealed that in 2022, 43.78 million individuals in the U.S. participated in camping, showing a 7% increase compared to 2021. Similarly, in hiking, 54.4 million individuals in the U.S. engaged in the activity, reflecting a notable 11.5% increase from 2021.

Changing consumer lifestyles, characterized by an increasing number of working individuals and families, have also led to a rise in the demand for ready-to-eat meal options, further fueling the market growth. Furthermore, the market is influenced by the growing emphasis on emergency preparedness, with canned food being an integral part of emergency kits and relief supplies during natural disasters and emergencies.

In addition, technological advancements in canning processes and packaging have contributed to the enhanced quality and safety of canned food products, appealing to health-conscious consumers. Manufacturers are also focusing on sustainable packaging and production practices to cater to environmentally conscious consumers.

Urbanization and globalization have also led to the wider availability and accessibility of canned food products, contributing to the expansion of the market globally. Moreover, the market is also witnessing a surge in the development of healthier canned food options, including organic, low-sodium, and preservative-free varieties, aligning with the preferences of health-conscious consumers. All the above-mentioned factors are expected to drive market growth during the forecast period.

Market Concentration & Characteristics

Manufacturers in the market are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The market shows a medium to high degree of innovation. In the global market the innovations includes a range of advancements, including improvements in canning processes, packaging, and product development. Companies are adopting advanced technologies in canning processes, such as heatization and vacuum sealing, which contribute to improving the preservation of food, thereby extending shelf life and maintaining nutritional value. Moreover, manufacturers are also incorporating vitamins, minerals, and dietary supplements in canned food products to provide healthier and more functional food offerings to consumers.

The mergers and acquisitions are in the range of low to medium in the market. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage on each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieve economies of scale in the global market.

Regulatory requirements, particularly those set by authorities such as the Food and Drug Administration (FDA) in the U.S. and the European Food Safety Authority (EFSA), influence product development, manufacturing processes, labeling, and marketing practices. Compliance with these regulations is mandatory for the market participants to ensure safety and quality of canned food products.

The global market faces limited competition from alternative food storage and preservation methods. However, its unique offering of extended shelf life, convenience, and preservation of nutritional value positions canned food as a distinct and preferred option for consumers, especially in scenarios where fresh produce is not readily available. The continuous innovations and improvements in canned food production serve as a hindrance to easy substitution by other food formats.

Product Insights

The canned fruits and vegetables segment led the market with the largest revenue share of 30.3% in 2023. Canned fruits and vegetables retain a high nutritional value due to the canning process, which involves preserving the produce at its peak ripeness. Consumers, increasingly health-conscious, recognize the value of canned fruits and vegetables as convenient sources of essential vitamins, minerals, and fiber.Canned fruits and vegetables are valued for their convenience and versatility. They can be quickly incorporated into various dishes, making meal preparation more efficient for busy consumers. In addition, the long shelf life of canned produce allows for extended storage without loss of quality, offering greater flexibility in meal planning driving its adoption among consumers during the forecast period.

The canned fish/seafood segment is expected to grow at the fastest CAGR of 3.2% from 2024 to 2030. The increasing popularity of ready-to-eat seafood products due to improvements in distribution infrastructure is anticipated to drive the growth of the canned seafood/ fish market. According to the Food and Agriculture Organization of the United Nations, Canned Tune imports in the U.S. increased by 15% in 2020. In addition, factors such as changing lifestyles coupled with increasing affordability are likely to drive the adoption of canned fish/ seafood during the forecast period.

Type Insights

Based on type, the conventional canned foods segment led the market with the largest revenue share of 88.10% in 2023. Conventional canned foods typically cost less to produce compared to organic varieties. Furthermore, conventional canned foods have a larger market presence and are more widely available in supermarkets and grocery stores. The distribution network for conventional canned foods is typically more extensive, ensuring that these products are easily accessible to consumers in various locations, thus, driving the sales of conventional canned foods during the forecast period.

On the other hand, the organic segment is expected to grow at the fastest CAGR of 7.4% from 2024 to 2030. A growing number of consumers are becoming health-conscious and are seeking food options perceived as healthier. Organic canned food, being free from synthetic pesticides and chemicals, aligns with this health-conscious trend, leading to increased demand. Furthermore, manufacturers are continuously innovating and introducing new organic canned food products with diverse flavors and ingredient combinations which are expected to drive the consumption of organic canned food during the forecast period.

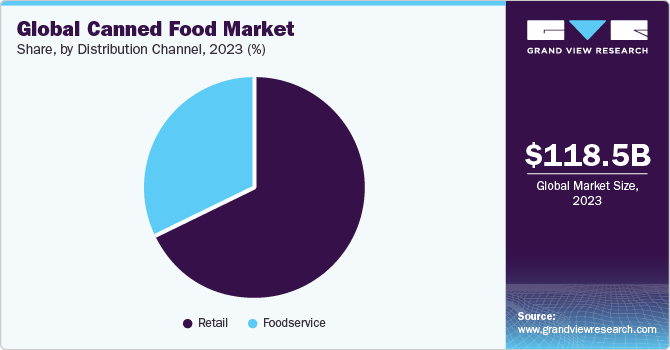

Distribution Channel Insights

Based on distribution channel, the retail segment led the market with the largest revenue share of 68.34% in 2023. Retail distribution channels, such as supermarkets, grocery stores, and convenience stores, offer a convenient and one-stop shopping experience for consumers. Canned foods are readily available, allowing consumers to quickly access a wide variety of options for their daily needs. Furthermore, retail outlets offer a diverse range of canned food products from various brands. This variety attracts consumers seeking different options, and the visibility of brands on store shelves further influence purchase decisions, driving the sales of canned food products through retail distribution channels globally.

The online channels segment is expected to grow at the fastest CAGR of 6.2% from 2024 to 2030. Online platforms play a crucial role in providing consumers with access to a diverse range of canned food, including seasonal and specialty produce that might not be readily available in their local physical stores. The significance of online canned food purchases became even more apparent in the wake of the viral outbreak of COVID-19, which resulted in temporary and permanent closures of physical distribution channels. In response to these challenges, the sale of canned food through e-commerce portals and online grocery stores experienced a notable surge in and after 2020.

Regional Insights

The canned food market in North America is expected to grow at the fastest CAGR of 3.8% from 2024 to 2030. Many companies have been rolling out canned foods in North America. For instance, Tyson Foods, Inc. offers canned foods under various brands such as Tyson, Jimmy Dean, Hillshire Farm, Ball Park, and SaraLee. Additionally, increasing product launches by key players in the region will complement the overall market growth. For instance, in May 2022, Siete Foods launched their first plant-based, a new line of canned refried beans, made with organic ingredients and avocado oil.

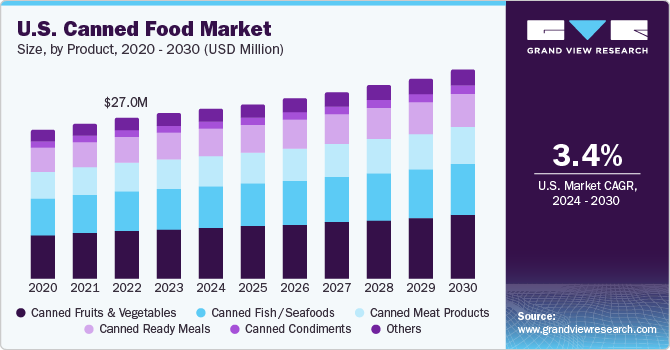

U.S. Canned Food Market Trends

The canned food market in U.S. is expected to grow at the fastest CAGR of 3.4% from 2024 to 2030. According to a study by USA Today in March 2022, approximately 98% of Americans keep canned foods in their kitchens. The study further mentioned that an average of 24 cans is consumed in a week. Such high consumption of canned food and the prevalence of a hectic, on-the-go lifestyle of Americans are expected to increase the demand for canned food in the U.S.

Europe Canned Food Market Trends

Europe dominated the canned food market with a revenue share of 37.7% in 2023. European consumers have a long-standing tradition of consuming canned foods as part of their diets. Canned foods are considered convenient, long-lasting, and versatile, making them a popular choice among European households. Furthermore, Europe has a well-established and efficient distribution network for canned foods, ensuring widespread availability of these products across various retail channels, including supermarkets, hypermarkets, specialty stores, and online platforms driving the market growth during the forecast period.

Asia Pacific Canned Food Market Trends

The canned food market in Asia Pacific is expected to grow at the fastest CAGR of 4.8% from 2024 to 2030. As lifestyles become busier and more urbanized in the Asia Pacific region, there is an increasing demand for convenient and ready-to-eat food options. Canned foods offer a quick and easy meal solution for consumers with hectic schedules, driving their growth in the market.The expansion of retail channels, including supermarkets, hypermarkets, convenience stores, and e-commerce platforms, has increased the accessibility of canned foods in the Asia Pacific region. This wider availability has made canned foods more accessible to a larger consumer base, driving market growth in the Asia Pacific region during the forecast period.

Key Canned Food Company Insights

The global market is characterized by the presence of numerous well-established players such Dole Food Company, Inc., Del Monte Produce, Inc., Campbell Soup Company, Hormel Foods Corporation, and Bumble Bee Foods, LLC, among others. The market players face intense competition from each other as some of them are among the top canned food manufacturers with diverse product portfolios for canned food. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key Canned Food Companies:

The following are the leading companies in the canned food market. These companies collectively hold the largest market share and dictate industry trends.

- Conagra Brands, Inc.

- Kraft Heinz Company

- Campbell Soup Company

- The Kraft Heinz Company

- Del Monte Foods, Inc.

- Hormel Foods Corporation

- Thai Union Group PCL

- Dole Food Company, Inc.

- Bonduelle SA

- Bumble Bee Foods

- LLC

Recent Developments

-

In January 2023, Dole Food Company, Inc. announced that some of its subsidiaries had entered into an agreement to sell Dole’s Fresh Vegetables Division to an affiliate of Fresh Express Incorporated, a wholly owned subsidiary of Chiquita Holdings. The division comprises operations related to the processing and sale of whole produce like iceberg, romaine, leaf lettuces, cauliflower, broccoli, celery, asparagus, artichokes, green onions, sprouts, radishes, and cabbage, as well as salads

-

In July 2022, Fresh Del Monte Produce, Inc. collaborated with Stord-a cloud supply chain company-to utilize the latter’s cloud supply chain solution and Del Monte’s cold storage infrastructure. This collaboration will satisfy the company’s requirement for temperature and humidity-controlled logistics in the market

-

In June 2022, Maldives Industrial Fisheries Company Limited (MIFCO) introduced a new canned tuna product called Drained Tuna Chunks with reduced amount of oil and cheaper than its Chunks in Oil tuna cans

Canned Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 122.68 billion

Revenue forecast in 2030

USD 154.72 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Conagra Brands, Inc.; Kraft Heinz Company; Campbell Soup Company; The Kraft Heinz Company; Del Monte Foods, Inc.; Hormel Foods Corporation; Thai Union Group PCL; Dole Food Company, Inc.; Bonduelle SA; Bumble Bee Foods; LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canned Food Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global canned food market report based on product, type, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Canned Fruits & Vegetables

-

Canned Meat Products

-

Canned Fish/Seafoods

-

Canned Ready Meals

-

Canned Condiments

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global canned food market size was estimated at USD 118.53 billion in 2023 and is expected to reach USD 122.68 billion in 2024.

b. The global canned food market is expected to grow at a compounded growth rate of 3.9% from 2024 to 2030 to reach USD 154.72 billion by 2030.

b. The canned fruits and vegetables accounted for a revenue share of 30.4% in 2023. Canned fruits and vegetables retain a high nutritional value due to the canning process, which involves preserving the produce at its peak ripeness. Consumers, increasingly health-conscious, recognize the value of canned fruits and vegetables as convenient sources of essential vitamins, minerals, and fiber. Canned fruits and vegetables are valued for their convenience and versatility.

b. Some key players operating in the canned food market include Conagra Brands, Inc.; Kraft Heinz Company; Campbell Soup Company; The Kraft Heinz Company; Del Monte Foods, Inc.; Hormel Foods Corporation; Thai Union Group PCL; Dole Food Company, Inc.; Bonduelle SA; Bumble Bee Foods, LLC

b. The growing preference for convenient and long-lasting food options is driving the growth of the canned food market. Consumers, including busy individuals and families, find canned food an attractive choice due to its easy preparation and extended shelf life. Additionally, the demand for canned food is driven by its relevance in outdoor activities such as camping and hiking, where access to refrigeration and cooking facilities may be limited.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."