- Home

- »

- Power Generation & Storage

- »

-

Coal-fired Power Generation Market Size, Share, Industry Report, 2020GVR Report cover

![Coal-fired Power Generation Market Size, Share & Trends Report]()

Coal-fired Power Generation Market Size, Share & Trends Analysis Report By Technology (Pulverized Coal Systems, Cyclone Furnaces), By Application (Residential, Commercial), And Segment Forecasts, 2014 - 2020

- Report ID: 978-1-68038-045-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Data: 2011-2013

- Industry: Energy & Power

Industry Insights

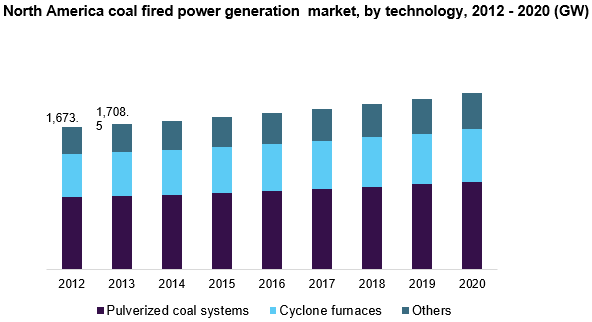

The global coal-fired power generation market size was 1,708.5 GW in 2013. Strong energy demand is expected to drive the overall market over the forecast period. There are several technologies that are used for coal-fired power generation, such as pulverized coal firing, cyclone furnace, coal gasification, and fluidized bed combustion. Coal is a major source of power generation owing to its abundant availability and lower cost compared to other power generation methods. Nearly half of the global electricity demand is met by generating power using coal.

Rapid industrialization and urbanization, particularly in the developing regions, such as the Asia Pacific and Latin America, have resulted in rapid electricity demand growth over the years for both commercial as well as residential applications. The advent of environmentally friendly technologies may hamper the market growth. Stringent regulations related to greenhouse gas emissions are anticipated to further curtail market growth and favor alternative electricity generation technologies.

Volatile price for other power generation fuel substitutes such as oil and natural gas is another factor that inclines electricity producing companies to adopt coal as a major power generating source.

Growing environmental concerns have resulted in multiple regulations being issued by governments and environmental protection agencies. Technological innovation has led to several alternative power generation technologies being developed that are cleaner and have lower emissions. Governments across the globe have taken several initiatives to encourage alternative cleaner electricity generation sources. Such stringent regulatory frameworks coupled with the advent of cleaner alternative methods are anticipated to hamper the global market.

Technology Insights

Pulverized coal firing technology dominated the global market accounting for nearly half of the market share followed by cyclone furnace technology. Pulverized coal-fired boilers use powdered coal to generate thermal energy in an attempt to efficiently use the entire boiler volume for combustion. Pulverized coal, as the rate of combustion can be controlled immediately and easily, gives a faster response to load changes. Cyclone furnace technology is the second most widely used method for power generation.

Other technologies, such as coal gasification and fluidized bed combustion, are expected to witness rapid growth due to their comparatively lower emission standards. Such novel technologies are projected to witness a CAGR of 3.9% over the forecast period. Stringent environmental regulations and environmental concerns have prompted electricity generating companies to shift their preference towards cleaner technologies such as coal gasification and fluidized bed combustion.

Application Insights

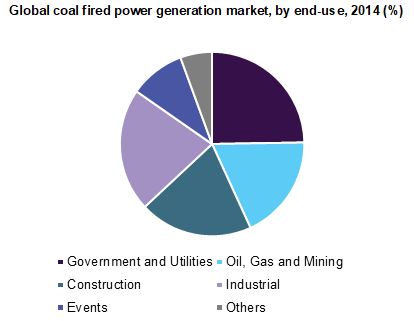

The commercial applications segment accounted for more than half of the coal-fired power generation market share in the recent past and is expected to continue this dominance in the future. Such a trend can be attributed to factors such as rapid industrialization, especially in developing regions. Commercial applications are presumed to experience a CAGR of 3% from 2014 to 2020. The residential application segment is expected to witness significant growth over the forecast period.

The commercial market is projected to reach over USD 1,163.0 GW by 2020. Increasing industrialization and urbanization particularly in the developing regions such as the Asia Pacific can be attributed to such robust commercial application growth in the near future. Moreover, R&D initiatives to increase efficiency, lower operating costs, and streamline logistical procedures offer ample opportunities for industry participants.

Regional Insights

Asia Pacific dominated the global coal-fired power generation market in the recent past with 5% of the market share and is expected to witness a CAGR of 3.2% from 2014 to 2020. Economies such as China and India are expected to aid the regional market over the forecast period. Growing industrialization and upcoming power projects in the region are the major factors propelling the growth of the coal-fired power market in the Asia Pacific region.

Western markets such as North America and Europe are anticipated to witness a slightly slower growth rate as compared to the Asia Pacific owing to stringent regulatory measures. Growing environmental concerns have resulted in increasing acceptance of alternative power generation sources, particularly in the European region. Such advent of alternative sources is anticipated to hamper growth in certain regional markets.

Coal-fired Power Generation Market Share Insights

China Huaneng Group emerged as the leading company operating in the global coal-fired power generation market. China Huaneng Group along with other prominent industry participants such as China Datang Corporation, Shenhua Group Corporation Limited, and Korea Electric Corporation accounted for one-fifth of the global market share in 2013.

Industry participants have taken several ardent steps and invested in R&D initiatives to reduce their operating costs, minimize emissions, and increase operating efficiencies. Other key industry participants include Duke Energy, E.ON SE, National Thermal Power Corporation Limited, and American Electric Power Company Inc.

Report Scope

Attribute

Details

Base year for estimation

2013

Actual estimates/Historical data

2011-2013

Forecast period

2014 - 2020

Market representation

Volume in GW and CAGR from 2014 to 2020

Regional scope

North America, Europe, Asia Pacific, Rest of World

Report coverage

Installed capacity forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts installed capacities and installed capacities growth at global, regional levels and provides an analysis of the industry trends in each of the sub-segments from 2012 to 2020. For this study, Grand View Research has segmented the global coal fired generation market on the basis of technology, application, and region.

-

Product Outlook (Volume, GW; 2012 - 2020)

-

Pulverized Coal Systems

-

Cyclone Furnace

-

Others

-

-

Application Outlook (Volume, GW; 2012 - 2020)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, GW; 2012 - 2020)

-

North America

-

Europe

-

Asia Pacific

-

ROW

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."