- Home

- »

- Catalysts & Enzymes

- »

-

Acrylic Adhesives Market Size, Share, Industry Trend Report 2018-2025GVR Report cover

![Acrylic Adhesives Market Size, Share & Trends Report]()

Acrylic Adhesives Market Size, Share & Trends Analysis Report By Technology (Water Based, Solvent Based, Reactive), By Application (Packaging, Construction, Wood & Furniture, Consumer Goods), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-505-2

- Number of Report Pages: 126

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Specialty & Chemicals

Industry Insights

The global acrylic adhesives market size was estimated at 3,864.40 kilotons in 2016. Extensive R&D activities and constant innovations are some of the key trends triggering market growth. The market is dynamic. Acrylic adhesives carry characteristic traits such as high performance and the ability to be used across diverse end-use industries, which include construction, packaging, and pharmaceutical.

Asia Pacific is anticipated to remain a vital destination for acrylic adhesive manufacturers. Economic performance is projected to rally in Europe and North America, ramping up investments in manufacturing & industrial activities. On the other hand, the market in China and Japan is expected to witness escalated expansion levels in the coming years.

The U.S. Food and Drug Administration (FDA) formulated policies in the food sector that incorporate functional barriers between food articles and their packaging materials, which help in enhancing safety, establishing a longer shelf life, and preserving the quality of food items. Companies in the field are now focused on developing food-grade packaging materials that comply with government regulations at each regional level.

The Center for Food Safety and Applied Nutrition declared the maximum permissible quantity of Alfa Hydroxy Acids contents in the cosmetics industry owing to skin irritation issues upon usage. Therefore, it has become mandatory now to mention AHA content on similar packs, providing precise information about skin sensitivity due to sunburn. This, in turn, is creating an upswing in the demand for acrylic adhesives in the labeling industry.

There is a strong demand for the product from emerging economies due to advancements in technology, increasing globalization, and surging usage of environment-friendly adhesives. Technologically advanced and cost-effective operations in the automotive, aerospace, and construction industries are likely to support the growth of the market.

There is an increasing demand for miniaturization and automation in the electronics industry, where acrylic adhesives are used majorly for hard disk drives and touchscreen displays. For hard disk drives, pressure-sensitive adhesives are used for permanent and cleanly removable labels, filters, and seals along with damping and component assembly purposes. They are also used in voice coil motor magnets assembly.

However, raw material price fluctuations and strict environmental and safety regulations are the bottlenecks in the upward climb of the market. Apart from these, R&D expense is comparatively higher than in other sectors and strict certifications by OEMs and component manufacturers are limiting the market from realizing its utmost potential.

Technology Insights

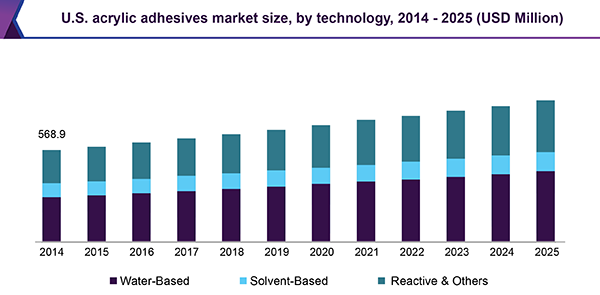

The water-based technology provides aggressive bond strength, high-temperature resistance, and low-temperature flexibility, thus making it suitable for sticking low-energy substrates. Acrylic adhesives are generally used in fastening tapes that are widely used regularly in clothing, shoes, furniture, housewares, stationery, automobiles, and packaging FMCG goods.

Water-based adhesives have widespread applications in the construction, packaging, rigid & non-rigid bonding, tapes, and transportation industries due to their properties such as viscosity, tack, set speed, bond strength, and lay-flat properties among others. Multinationals across the globe are trying to renovate their products, to cater to needs across a broader market base.

Solvent-based products are a mixture of polymers dissolved in a solvent. The hardening of adhesives depends largely on the evaporation rate of solvents. The choice of adhesives depends on certain conditions, which include temperature and oil & plasticizer resistance among others.

Poly-coatings are majorly used for a smooth durable finish that has superior resistance to corrosion, chemical exposure, and abrasion. They are widely utilized in hardwood, construction, and automotive applications to improve the appearance and durability of products. The rising demand for this coating is poised to augment the acrylic adhesives market.

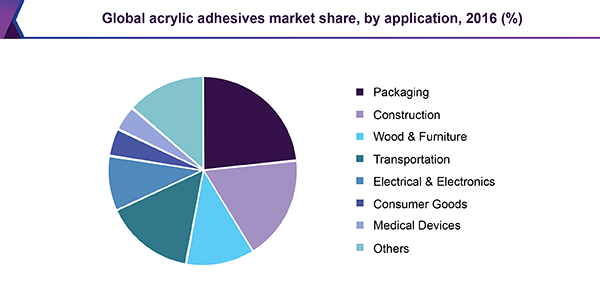

Application Insights

Pressure-sensitive adhesives have several advantages over conventional packaging materials in terms of excellent mechanical & biological filtration properties. From hardware, porcelain, and jewelry to tailor-made foam packaging materials, these adhesives are extensively used, making them easily available in the market.

Over the coming years, the market is anticipated to witness an upsurge in the product demand in flexible packaging applications. The booming packaged food industry in Asia Pacific coupled with strong demand for corrugated boxes is projected to fuel demand for acrylic adhesives in the packaging industry.

Acrylic adhesives are utilized in numerous construction & building applications owing to their excellent strength to weight ratio, insulation properties, durability, and versatility. A wide range of pipe materials and vacuum insulation panels are being used in buildings that operate on low energy requirements. They also help reduce energy costs, by lowering the amount of energy spent on temperature control within the building.

Building materials that use these adhesives, add design flexibility to a new home, offering a wide variety of colors and profiles. These coatings also find increasing application scope within the construction industry, owing to high mechanical strength and adhesion to numerous substrates. This factor along with constant technological improvements is stirring up the demand for the product in construction applications.

Acrylic adhesives are widely used in the wood and furniture industry owing to their excellent mechanical strength, adhesion, and hardness. With the introduction of the latest advanced technologies, they are immediate replacements for mechanical fasteners. These tapes stick better over time and are more durable & environmentally sensitive, which makes them popular in the industry. Most of all, they produce minimal fumes and off-gases as compared to asphaltic tapes used in the past.

The automotive industry is one of the largest users of reaction injection molded products. These products are utilized to maximize the shock absorption of a car’s fenders & bumpers. There is an increase in the consumption of rigid acrylic adhesive foam over the past few years. The primary reason is to reduce the gross vehicular weight, thereby increasing fuel efficiency and complying with regulatory norms set by the government in favor of a clean environmental drive. These factors are likely to trigger the growth of the segment during the forecast period.

Regional Insights

North America is poised to witness sluggish growth during the forecast period, as the market has attained maturity. The packaging and construction industries are responsible for the high demand for acrylic adhesives in the region. The packaging, automotive, non-woven/hygiene, and e-commerce industries have registered significant growth over the past couple of years. The U.S. represented a large share of product consumption in the region, followed by Canada.

Europe is home to several industrialized countries such as Germany, France, and the U.K. In other parts of the region, there is a strong demand from several major end-use industries such as furniture, construction, packaging, E-commerce, automotive, and FMCG. Increasing consumer disposable income, flourishing e-commerce, and growing uptake of corrugated packaging are supplementing the growth of the market.

Asia Pacific is an emerging economy with large open space available to facilitate new project infrastructures and is also rich in the availability of skilled laborers. The shift in production facilities to emerging economies, particularly China and India, is estimated to propel the regional market. The region comprises rapidly expanding industries such as automotive, electronics, e-commerce, packaging, and automotive, which are offering the phenomenal potential for the market to thrive.

Acrylic Adhesives Market Share Insights

Some of the key manufacturers across the globe are Bayer Corporation, Covestro LLC, BASF, 3M Corporation, Henkel, and Avery Dennison Corporation. These companies hold a strong supply chain network and have a sustainable product line that compliments governmental rules and regulations in the industry.

Bayer Corporation, 3M, Henkel, and BASF are the key players in the supplier’s arena globally. A high level of integration is held by Bayer and Henkel. While the U.S. is a major market for acrylic adhesives followed by European countries, there are significant acrylic adhesive imports in India, China, Mexico, and Canada.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Volume in kilo tons, revenue in USD Million, and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Canada, Germany, France, U.K., China, India, Japan, Brazil, Mexico, Saudi Arabia, U.A.E.

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global acrylic adhesives market report on the basis of technology, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Water-Based

-

Solvent Based

-

Reactive & Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Packaging

-

Construction

-

Wood & Furniture

-

Transportation

-

Electrical & Electronics

-

Consumer Goods

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

U.A.E

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."