- Home

- »

- Organic Chemicals

- »

-

Adipic Acid Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Adipic Acid Market Size, Share & Trends Report]()

Adipic Acid Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Nylon 6, 6 Fiber, Nylon 6, 6 Resin, Polyurethane, Adipate Esters), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-078-1

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Adipic Acid Market Summary

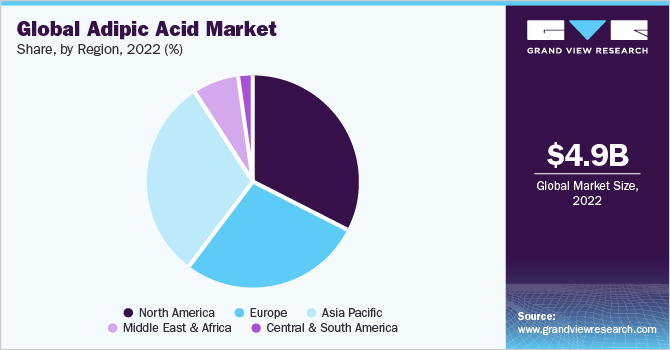

The global adipic acid market size was estimated at USD 4,887.6 million in 2022 and is projected to reach USD 6,567.3 million by 2030, growing at a CAGR of 3.8% from 2023 to 2030. The rising utilization of nylon 6, 6 for producing durable and lightweight plastic to be used in rapidly growing automotive and electrical & electronics industry across the globe is driving the demand for adipic acid.

Key Market Trends & Insights

- North America dominated the adipic acid market with the highest revenue share of 32.9% in 2022.

- Asia Pacific is expected to present lucrative growth opportunities.

- In terms of application, nylon 6, 6 fiber segment dominated the market with the highest revenue share of 53.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4,887.6 Million

- 2030 Projected Market Size: USD 6,567.3 Million

- CAGR (2023-2030): 3.8%

- North America: Largest market in 2022

Adipic acid is extensively used in various end-use industries such as electrical & electronics, automotive, building & construction, packaging & consumer goods, textile, and others. Growing demand for nylon 6, 6 fiber and polyurethane in a wide range of industries is likely to have a positive impact on the growth of the market over the coming years.Nylon 6, 6 is a vital element for the automotive industry. It is a lightweight material that is used as a replacement for metals in automobiles. Worldwide, the vehicle manufacturers are incorporating advanced plastics in their automobiles to reduce their weight and enhance their fuel economy while maintaining their performance and safety. The demand for automobiles surged during the COVID-19 owing to the safety concerns related to usage of public transportation. Shutdown of public transportation networks owing to the prolonged lockdowns during 2020-21 led the people to consider purchasing passenger cars for commuting to ensure their safety against the COVID-19 infection. An increase in demand for automobiles worldwide is anticipated to fuel the consumption of nylon 6, 6, thereby having a positive impact on the demand for adipic acid.

Nylon 6, 6 resin is also used in the electronics industry for developing mobile phone connectors, computer motherboards, terminal blocks for electronic devices, power tool housing, circuit breakers, etc. owing to its electrical and mechanical properties such as high dielectric strength, flame retardancy, and insulation resistance. The electronics industry offers a variety of products ranging from consumer electronics to aerospace. The ongoing digitalization and the increasing adoption of electronic devices such as smartphones, computers, and television sets are anticipated to contribute to the growth of the electrical & electronics industry worldwide in the coming years. This is expected to surge the consumption of nylon 6, 6, thereby positively impacting the demand for adipic acid, which is used as a feedstock to nylon 6, 6 production.

Adipic acid poses serious threats to the environment due to its toxicity. According to the New Jersey Department of Health and Senior Services, the direct exposure of humans to adipic acid can cause various health issues such as skin and eye irritation in them. Continuous contact of humans with this acid can also lead to severe health conditions such as reproduction disorders and cancer. In addition, releasing adipic acid into natural water sources such as rivers, lakes, and ponds can be fatal to marine life comprising fish, invertebrates, and aquatic plants. Therefore, the concerned government bodies of different countries have imposed several regulations regarding the production, sales, distribution, and usage of adipic acid. This is anticipated to restrain the growth of adipic acid market over the forecast period.

The after effects of coronavirus is expected to fuel the growth of the global pharmaceuticals industry. This, in turn, is anticipated to have a positive impact on the market growth due to rising demand for adipic acid from pharmaceutical industry. In addition, the surging adoption of electric vehicles across the globe is expected to fuel the growth of automotive industry thereby contributing to the demand for adipic acid for manufacturing nylon 6, 6. According to the International Energy Agency, the sales of electric cars doubled in 2021 to 6.6 million as compared to 2020.

Application Insights

Nylon 6, 6 fiber application segment dominated the market with the highest revenue share of 53.1% in 2022. Its high share is driven by growing application of nylon 6, 6 as a substitute to metal in automotive, electrical & electronic products, and others. Nylon 6,6 fiber is also widely used in engineering components such as gears, nuts, bolts, bearings, powder tool casings, rivets & wheels, and rocker box covers. Properties of nylon 6,6 fiber, such as moisture & mildew resistance, high-melting temperature, excellent durability, and increased strength, are expected to drive its use in various application in the coming years.

Polyurethane also hold a stable growth potential due to its application in various end-use industries. As polyurethane is lightweight with high abrasion resistance, it is used for developing hardwearing shoe soles. Sports and trekking shoes and boots are the largest application of polyurethane in footwear sector. Polyurethane is also used in sports shoe soles, as well as in high-quality safety shoes. It is widely used in building & construction industry as an insulating material. The increased use of polyurethane in a wide range of application is expected to fuel its global demand in the coming years.

Regional Insights

North America dominated the adipic acid market with the highest revenue share of 32.9% in 2022. The high demand in North America is propelled by rising utilization of nylon 6, 6 fiber from the automotive industry in the U.S. and Canada. Majority of North American population in the U.S. and Canada use their own vehicles to commute instead of using public transportation. In addition, strong economic stability in the U.S., Canada, and Mexico has elevated the individual purchasing power of the population in these countries. High individual disposable income is augmenting the demand for automobiles thereby propelling the growth for adipic acid in North America.

Asia Pacific is expected to present lucrative growth opportunities due to the growing consumption of polyurethane in industries including automotive, construction, and electronics in the region. Increasing construction spending owing to the developing sustainable infrastructure is expected to drive the market growth. According to the Oxford Economics, the U.S., India, and China account for around 58% of the total growth in construction industry worldwide with China accounting for around 26.1% of the global growth in 2020. Additionally, India is estimated to witness the highest growth rate of around 9.8% in infrastructure construction from 2020 to 2030.

Key Adipic Acid Company Insights

The key players in the acetone market include BASF SE, INVISTA, Lanxess AG, Solvay and others. Companies are engaged in adoption of strategic initiatives such as business expansion and mergers & acquisitions to broaden their geographical reach.Some prominent players in the global adipic acid market include:

-

Ascend Performance Materials

-

Asahi Kasei Corporation

-

BASF SE

-

INVISTA

-

LANXESS

-

Liaoyang Tianhua Chemical Co., Ltd

-

Radici Partecipazioni S.p.A.

-

Solvay

-

Sumitomo Chemical Co., Ltd.

-

DOMO Chemicals

Adipic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5,055.0 million

Revenue forecast in 2030

USD 6,567.3 million

Growth rate

CAGR of 3.8 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ascend Performance Materials; Asahi Kasei Corporation; BASF SE; INVISTA; LANXESS; Liaoyang Tianhua Chemical Co., Ltd; Radici Partecipazioni S.p.A.; Solvay; Sumitomo Chemical Co., Ltd.; DOMO Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adipic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global adipic acid market report based on application, and region:

-

Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Nylon 6, 6 Fiber

-

Nylon 6, 6 Resin

-

Polyurethane

-

Adipate Esters

-

Other Application

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global adipic acid market size was estimated at USD 4.89 billion in 2022 and is expected to reach USD 5.06 billion in 2023.

b. The global adipic acid market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 6.57 billion by 2030.

b. Asia Pacific dominated the adipic acid market with a share of 30.7% in 2019. This is attributable to growing automobile industry and high future potential for manufacturers due to inexpensive and abundant raw material availability in the region.

b. Some key players operating in the adipic acid market include Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, and Ascend Performance Materials LLC.

b. Key factors that are driving the market growth include the rising utilization of nylon 6, 6 for producing durable and lightweight plastic to be used in rapidly growing automotive and electrical & electronics industry across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.