- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Composite Panel Market Size, Share Report, 2030GVR Report cover

![Aluminum Composite Panel Market Size, Share & Trends Report]()

Aluminum Composite Panel Market Size, Share & Trends Analysis Report By Product (PVDF, Polyester, Laminating Coating, Oxide Film), By Application (Construction, Automotive, Railways), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-437-6

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Aluminum Composite Panel Market Trends

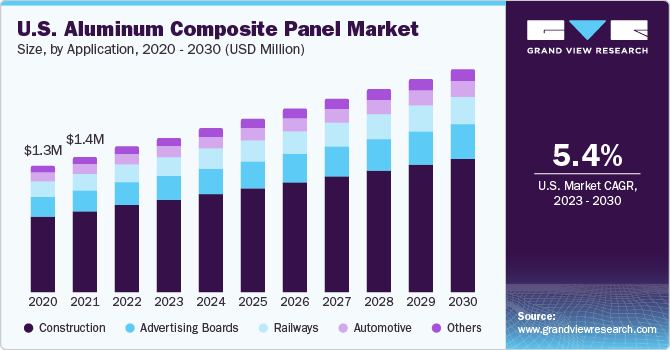

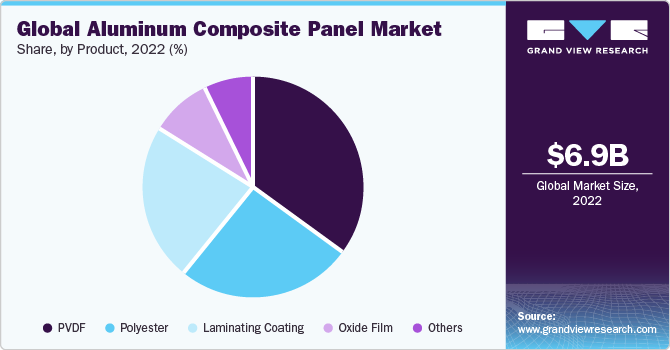

The global aluminum composite panel market size was valued at USD 6.98 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Increasing the application scope of lightweight aluminum composite panels in the construction industry for insulation is projected to drive the market over the forecast period. These composite panels provide features, such as lower thickness, high insulation, and superior sealing, which are crucial for building structures. Also, ACPs offer excellent air and water barrier, flexibility, high load performance, and durability, which is expected to positively impact market growth over the forecast period. The U.S. government has set regulations in which light-duty automobiles should achieve Corporate Average Fuel Efficiency (CAFE) standards of 54.5 mpg by 2025. The federal proposal to improve CAFE standards is thus expected to serve as a major impetus for the incorporation of lightweight materials, such as aluminum composites, into automobiles, thereby driving the market.

Sandwich panels are majorly used in the design and construction of transportation systems, such as aircraft, satellites, missiles, and high-speed trains, to reduce the structural weight. Aluminum composites are used for the manufacturing of sandwich panels, thereby propelling the market growth over the forecast period. Furthermore, technological advancements in the manufacturing process of ACP sheets and panels are expected to have a significant impact on the overall market.

The growing popularity of green buildings is also projected to fuel product demand on account of eco-friendly characteristics of these materials. Several regulations and safety standards, such as LEED and British Safety Standards, govern the building and structure and also favor the incorporation of ACPs. Also, ACPs provide high tensile strength and reduce the overall weight of the building structure, which makes them one of the potential materials for the modern construction industry.

Application Insights

The construction segment held the largest revenue share of 55.0% in 2022. Eco-friendly characteristics offered by the product are expected to increase its demand for green buildings, thereby propelling market growth. Benefits, such as thermal & acoustic insulation and corrosion resistance offered by the product are also expected to fuel their demand in the modern construction industry. Also, rising product use in decorative and cladding applications to meet transition energy and building standards is likely to augment the segment growth product over the next few years.

The advertising boards segment is expected to grow a CAGR of 4.6% over the forecast period. Rapidly expanding advertising, marketing, and mass media industry worldwide has resulted in increased expenditure on advertising boards. ACPs are broadly used for these boards as they are subjected to extreme environmental conditions, such as humidity, moisture, temperature fluctuations, and pollution. The railway application segment is also projected to witness considerable growth. Moreover, these composites help reduce the overall weight of trains resulting in improved speed and reduced power consumption.

Product Insights

The polyvinylidene fluoride (PVDF) segment accounted for the largest revenue share of 35.5% in 2022 owing to a wide range of applications including lightweight construction, high-speed trains, and advertisement boards. Also, their features, such as corrosion and wear resistance and durability, are expected to benefit the segment growth. PE panels are also among the majorly used products owing to properties, such as extreme rigidity, surface flatness, smoothness, and thermal as well as acoustical insulation. It is expected to register notable growth in the future due to benefits, such as easy fabrication and processing.

The laminating coating segment is expected to grow at a CAGR of 4.3% during the forecast period. Laminating coating ACPs are manufactured through multi-layer extrusion lamination and primarily used for lamination applications in the construction industry. The use of oxide film in the production of ACPs provides several advantages, such as fire protection and UV, corrosion, and acid resistance. These properties are crucial in the construction and automotive industries. Thus, this is also estimated to boost market development.

Regional Insights

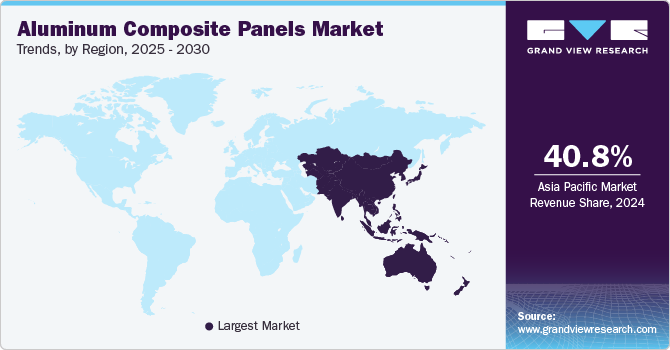

Asia Pacific dominated the market and accounted for the largest revenue share of 40.4% in 2022. The rapidly growing construction industry, especially in emerging economies like China, India, Indonesia, and Vietnam, is anticipated to have a positive impact on the regional market. The rising population coupled with government schemes promoting basic amenities and high demand for affordable housing are also among the major factors driving the region’s growth.

North America is expected to grow at a CAGR of 4.9% during the forecast period. The industry is expected to grow as a result of the region's growing number of green buildings. The expansion of North America is being aided by an increase in governmental programs and initiatives to foster better infrastructure. In addition, the increase is anticipated to be boosted by the increasing usage of panels in cladding and ornamental applications to meet evolving architectural and energy standards. Increased manufacturing of hybrid and electric cars in North America will also bode well for the market's expansion.

Key Companies & Market Share Insights

The global aluminum composite panels market is highly competitive as major companies focus on the development of advanced products with superior characteristics and also demonstrate their brand strength through well-known trademarked products. Production capacity expansion and product customizations are also expected to be among the key strategic initiatives adopted by these companies to gain competitive advantages. Global companies in developed regions like North America and Europe are facing strong price competition from Chinese manufacturers.

Key Aluminum Composite Panel Companies:

- Arconic

- Mitsubishi Engineering-Plastics Corporation

- Alcoa Corporation

- Fairfield Metal

- Shanghai Yaret Industrial Group Co., Ltd.

Recent Developments

-

In June of 2023, Alumaze, a company specializing in aluminum composite panels (ACP), unveiled a fresh lineup of offerings. This included ACP sheets that were produced within their recently established facility situated in the Vizianagaram district. The swift construction of this manufacturing plant, accomplished within a span of eight months, was underpinned by a significant investment totaling USD 6 million. This strategic expansion was prompted by the escalating market demand for aluminum panels, particularly for applications in interior design and signage.

-

In January 2021, Alucopanel, a UAE-based manufacturer of aluminum composite panels, announced the launch of the country’s first government-approved non-combustible grade aluminum composite panel recommended for building projects with high levels of fire protection. The launch makes Alucopanel the first civil A1-grade aluminum composite panel with defense certification in the world.

Aluminum Composite Panel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.40 billion

Revenue forecast in 2030

USD 10.33 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in million/billion units, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; India; Japan; South Korea; Thailand; Australia; Brazil; Saudi Arabia

Key companies profiled

Arconic; Mitsubishi Engineering-Plastics Corporation; Alcoa Corporation; Fairfield Metal; Shanghai Yaret Industrial Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Composite Panels Market Report Segmentation

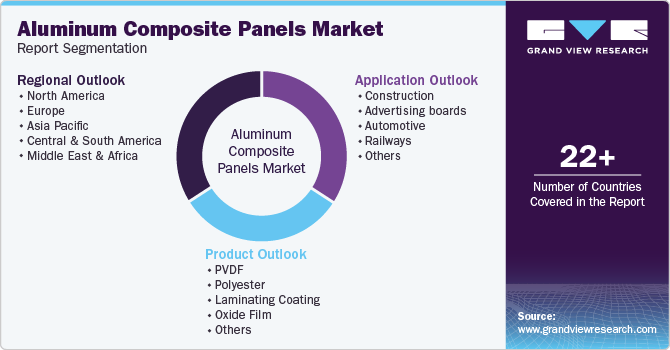

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum composite panel market based on product, application, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

PVDF

-

Polyester

-

Laminating Coating

-

Oxide Film

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Advertising Boards

-

Railways

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global aluminum composite panel market size was estimated at USD 6.98 billion in 2022 and is expected to reach USD 7.40 billion in 2023.

b. The aluminum composite panel market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 10.33 billion by 2030.

b. PVDF dominated the aluminum composite panel market with a share of 35.5% in 2022 owing to its lightweight material, high mechanical quality, and low cost.

b. Some of the key players operating in the aluminum composite panel market include 3M, ALUBOND U.S.A., ALUMAX COMPOSITE MATERIAL (JIANGYIN) CO., LTD., Mitsubishi Chemical Corporation., and Maxbond.

b. The key factors that are driving the aluminum composite panel market include rising popularity of antibacterial and anti-toxic panels in commercial and industrial construction activates around the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."