- Home

- »

- Network Security

- »

-

Anomaly Detection Market Size, Share, Growth Report, 2030GVR Report cover

![Anomaly Detection Market Size, Share & Trends Report]()

Anomaly Detection Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Component (Solution, Services), By Technology (Big Data Analytics, ML & AI), By End-use (BFSI, Retail), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-092-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Anomaly Detection Market Size & Trends

The global anomaly detection market size was valued at USD 4.33 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 16.5% from 2023 to 2030. The growing sophistication and complexity of cyber-attacks are one of the factors driving the growth of the market. With the growing frequency and intricate nature of threats, the traditional approaches to detecting and monitoring cyberattacks often need to be revised compared to modern approaches. Anomaly detection offers a proactive defense approach allowing the organization to identify and respond to unforeseen threats. The exponential growth of technology advancements and databases in Machine Learning (ML) has made it viable for organizations to analyze huge datasets in real-time.

By using ML algorithms to analyze enormous volumes of data, anomaly detection can find trends and anomalies that may be signs of online threats. The implementation of anomaly detection in cybersecurity has increased due to the availability of scalable and effective ML techniques. The overall security posture can be improved by integrating anomaly detection into Security Operations Centres (SOCs) and incident response procedures. Security analysts can efficiently prioritize and react to potential risks because of the real-time warnings and actionable insights it delivers. Furthermore, organizational security is significantly at risk from insider threats. An employee’s or authorized user’s unexpected behavior can be found using anomaly detection, including unauthorized access to sensitive information, strange file transfers, and unusual network traffic.

Organizations can reduce the risk of insider threats and safeguard their important assets by tracking user behavior and spotting irregularities. Organizations can comply with compliance requirements and stay out of trouble owing to anomaly detection, which assists them in monitoring and detecting security incidents or data breaches. It offers an extra layer of security to secure sensitive data and guarantee regulatory compliance. This is expected to propel the market demand across regions over the forecast period. Moreover, cyber threats and attacks significantly increased as a result of the pandemic as malicious players took advantage of the unstable and exposed environment.

Phishing attempts, ransomware assaults, and other cybercrimes increased dramatically, putting organizations throughout the world at risk. The need for anomaly detection solutions has increased as a result of the growing threat concerns as organizations are seeking advanced methods to identify and counteract developing cyber threats. However, effective implementation and management of anomaly detection systems can be challenging. It can be difficult to configure and optimize these systems so that they discover real anomalies while minimizing false positives (false alarms). High false positive rates might erode trust in the system’s accuracy and cause alert fatigue, which may hinder product adoption.

Component Insights

The solutions segment accounted for the largest market share of 69.0% in 2022. The cybersecurity threat landscape is constantly changing with more sophisticated and advanced threats. Through the detection of unusual trends or behaviors, anomaly detection solutions offer a proactive method for identifying new or evolving threats. Massive datasets can be processed and analyzed by anomaly detection tools, which can then be used to find hidden patterns and identify anomalies that could be signs of security vulnerabilities. The effectiveness and adoption of anomaly detection technologies have been strongly influenced by their ability to handle enormous amounts of data. The proliferation and complexity of cyber threats drive the need for efficient anomaly detection solutions, thereby driving industry growth.

The services segment is expected to grow at the fastest CAGR of 17.6% over the forecast period. Cloud computing and managed security services are now much more widely used across organizations. Anomaly detection services are frequently included in managed or cloud-based security service packages. These services offer businesses a hassle-free, cost-effective way to set up and maintain anomaly detection capabilities. Organizations can concentrate on their core operations while assuring reliable anomaly detection by leveraging the knowledge and infrastructure of service providers, thereby propelling the demand.

Deployment Insights

The on-premise segment accounted for the largest share of 54.9% in 2022. Organizations frequently need to have direct and auditable control over their data processing and security procedures to comply with industry-specific legislation. By ensuring that data stays on the premises while remaining under direct control, on-premise anomaly detection helps organizations comply with legal and regulatory requirements.Organizations can handle and analyze data locally using on-premise anomaly detection rather than relying on external networks or cloud infrastructure, which is further helping drive segmental growth.

The cloud segment is expected to grow at a CAGR of 17.8% from 2023 to 2030. The versatility and scalability of cloud-based anomaly detection technologies are unmatched. Anomaly detection capabilities may be readily scaled up or down by organizations based on their demands owing to cloud infrastructure. Organizations don’t need to make significant infrastructure expenditures or plan for capacity as data volumes and processing need to change over time; as a result, they may dynamically modify their resources. Because of its flexibility and scalability, cloud-based anomaly detection is a desirable choice for businesses with varied workloads or quickly shifting data environments.

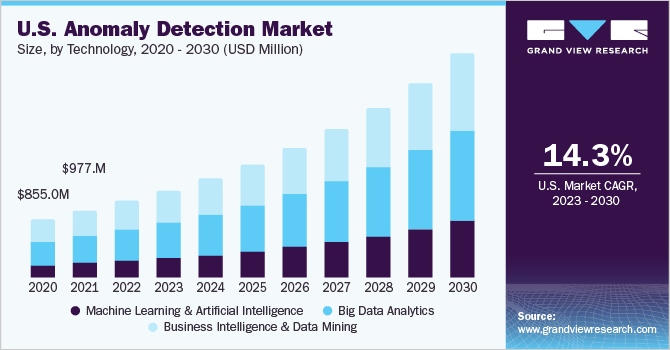

Technology Insights

The big data analytics segment accounted for the largest share of more than 40.9% in 2022. Organizations are producing and gathering enormous volumes of data from numerous sources due to the expansion of digital technology and connected devices. Since this data comes in both structured and unstructured as well as semi-structured formats, manually identifying abnormalities can be difficult. Big data analytics anomaly detection enables businesses to quickly scan and examine enormous amounts of data, discovering unexpected patterns or behaviors that might point to security issues or strange actions.

The machine learning & artificial intelligence segment is expected to witness significant growth at a CAGR of 18.7% from 2023 to 2030. Organizations can recognize and respond to abnormalities as they occur due to real-time ML and AI-based anomaly detection models. In time-sensitive situations like fraud detection, network security, or system monitoring, real-time anomaly detection is essential. ML and AI algorithms can handle streaming data or conduct analysis in close to real-time, enabling businesses to move quickly and lessen the effect of abnormalities.

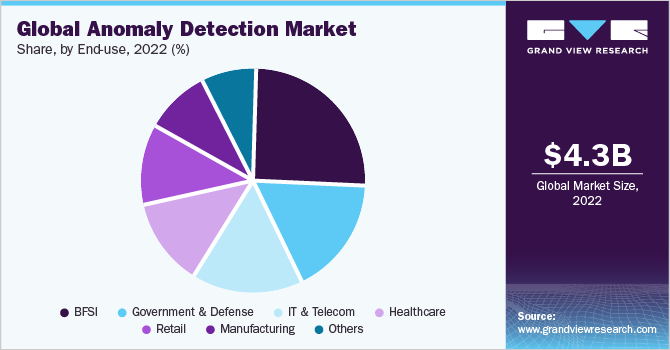

End-use Insights

The BFSI segment accounted for the largest share of 26.0% in 2022. The BFSI sector’s important component is risk management. Identification of potential hazards, such as credit risk, market risk, operational risk, and fraud risk, is made possible via anomaly detection. Organizations can assess and mitigate risks, make wise decisions, and reduce financial losses by spotting abnormalities in financial transactions, consumer behavior, or market patterns. Organizations in the BFSI sector can reduce financial risks, protect client assets, and uphold consumer trust and confidence by utilizing anomaly detection strategies. The IT & telecom segment is expected to grow at a CAGR of 18.7% over the forecast period. Various types of fraud, such as telecom fraud, identity theft, and financial fraud, are common in the IT and telecom industries.

Unusual call volumes, strange user behavior, or dubious financial transactions are just a few examples of patterns that anomaly detection algorithms can identify as being indicative of fraudulent activity. Employing anomaly detection solutions enables organizations to detect and prevent fraud attempts, protecting both their own interests and the data of their clients. Furthermore, by identifying unexpected network traffic patterns, network abnormalities, or unauthorized access attempts, anomaly detection systems help organizations spot potential network intrusions and take appropriate action. Organizations can prevent or lessen the effect of security breaches by seeing irregularities in real-time, thereby supporting the growth of the market.

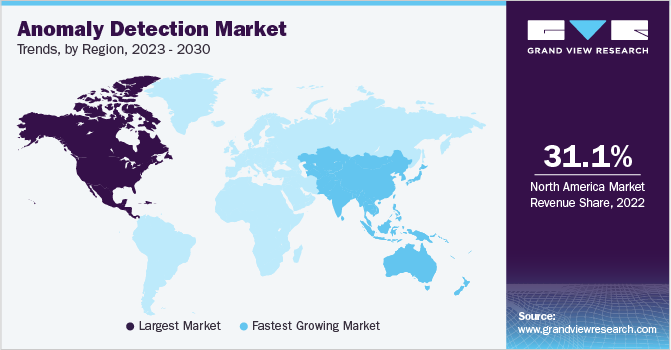

Regional Insights

The North America region dominated the global market in 2022 with a revenue share of 31.1%. A rapidly changing, unsafe environment, particularly in terms of cybersecurity, affects the North American continent. Furthermore, organizations are producing and gathering enormous volumes of data because of the spread of digital technology and the emergence of big data. Financial, insurance, e-commerce, and healthcare industries, among others, all depend on anomaly detection to identify fraudulent activity. Businesses can proactively identify and reduce fraud risks by looking for trends and abnormalities in transactional data or user behavior. Asia Pacific is anticipated to register the fastest CAGR of 18.0% over the forecast period.

With a sharp rise in online transactions, e-commerce activities, and digital services, the digital economy has rapidly expanded across the Asia Pacific region. The demand for anomaly detection to detect and address potential fraud, security breaches, and other irregularities in these digital transactions has increased as a result of this expansion. With the growing banking services, fintech developments, and an increase in digital payments, the Asia Pacific financial services industry is rising significantly. For Anti-Money Laundering (AML) initiatives, fraud detection, and regulatory compliance in this industry, anomaly detection is essential. Anomaly detection assists in identifying potential fraudulent actions and ensures compliance with financial legislation by examining transactional data and user behavior.

Key Companies & Market Share Insights

Companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions, to broaden their product offerings. For instance, in April 2022, HPE launched an HPE Swarm Learning solution, to enhance the accuracy and lessen biases in AI model training, without compromising any data security. The product is one of the advanced approaches to AI, which allows to detect global challenges, such as enhanced anomaly detection and improved patient healthcare, which aids in offering predictive maintenance and fraud detection. Prominent players operating in the global anomaly detection market include:

-

Amazon Web Services, Inc.

-

Anodot Ltd.

-

Broadcom, Inc.

-

Cisco Systems, Inc.

-

Dell Technologies, Inc.

-

Dynatrace, LLC

-

GURUCUL

-

Happiest Minds

-

Hewlett Packard Enterprise Company

-

International Business Machines Corp.

-

LogRhythm, Inc.

-

Microsoft Corp.

-

SAS Institute, Inc.

-

Splunk, Inc.

-

Trend Micro, Inc.

Anomaly Detection Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.02 billion

Revenue forecast in 2030

USD 14.59 billion

Growth Rate

CAGR of 16.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Anodot Ltd.; Broadcom, Inc.; Cisco Systems, Inc.; Dell Technologies, Inc.; Dynatrace, LLC; GURUCUL; Happiest Minds; Hewlett Packard Enterprise Company; International Business Machines Corp.; LogRhythm, Inc.; Microsoft Corp.; SAS Institute, Inc.; Splunk, Inc.; Trend Micro, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anomaly Detection Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the anomaly detection market based on component, deployment, technology, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Network Behavior Anomaly Detection

-

User Behavior Anomaly Detection

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Machine Learning & Artificial Intelligence

-

Big Data Analytics

-

Business Intelligence & Data Mining

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anomaly detection market size was estimated at USD 4.33 billion in 2022 and is expected to reach USD 5.02 billion by 2023.

b. The global anomaly detection market is expected to grow at a compound annual growth rate of 16.5% from 2023 to 2030 to reach USD 14.59 billion by 2030.

b. Solutions dominated the anomaly detection market with a share of 69.0% in 2022. This is attributable to the effectiveness and adoption of anomaly detection technologies owing to their ability to handle enormous amounts of data. The proliferation and complexity of cyber threats drive the need for efficient anomaly detection solutions, thereby driving the growth of the market.

b. he key players operating in the anomaly detection market include Amazon Web Services, Inc., Anodot Ltd., Broadcom, Inc., Cisco Systems, Inc., Dell Technologies, Inc., Dynatrace, LLC., GURUCUL, Happiest Minds, Hewlett Packard Enterprise Company, International Business Machines Corporation, LogRhythm, Inc., Microsoft Corporation, SAS Institute, Inc., Splunk, Inc., and Trend Micro, Inc.

b. The growing advancements in deep learning and machine learning technologies support the anomaly detection market growth. The traditional statistical approaches are being replaced with modern methods such as generative adversarial networks (GAN), variational autoencoders (Vaes), and recurrent neural networks (RNNs), thereby enhancing the identification of anomalies across various systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."