- Home

- »

- Clothing, Footwear & Accessories

- »

-

Anti-fatigue Mats Market Size, Share & Growth Report, 2030GVR Report cover

![Anti-fatigue Mats Market Size, Share & Trends Report]()

Anti-fatigue Mats Market Size, Share & Trends Analysis Report By Application (Industrial, Commercial, Residential), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-566-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global anti-fatigue mats market size was valued at USD 1,699.3 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. Hectic work hours and changing diet patterns among working-class professionals at the international level have led to foot problems and lower limb issues among personnel who stand for long periods. As a result, anti-fatigue mats have the capacity to absorb the shock during the walk and ease foot fatigue. It is largely used in commercial as well as industrial sectors. The rise in popularity of sit-stand desks in developed countries including the U.S., Germany, France, and the U.K. is driving companies to install anti-fatigue mats.

Time spent sitting or standing is considered to have negative effects on health outcomes. To avoid this, several businesses are using active workstations and standing desks that allow employees to seamlessly switch from sitting to standing. With the expansion of business, workplaces are changing industries and businesses are spending heavily on infrastructure development in order to provide safe working environments for their personnel. Globally, the manufacturing industry is growing. Long-term employment in the manufacturing industry causes a slew of health problems for workers, as well as a reduction in quality and output. One of the market's driving forces is the need for ergonomic items such as anti-fatigue mats. Owing to the introduction of portable workstations across the globe, the necessity to decrease slip and fall incidents has grown.

During the COVID-19 pandemic, the global anti-fatigue mats industry witnessed a slight decline. The consumer products business has suffered long-term damage as a result of the ongoing COVID-19 pandemic. Consumer buying habits have been fundamentally altered as a result of the crisis, and massive structural changes in the consumer products industry have been expedited. The anti-fatigue mats industry has been impacted by reduced real estate activity as a result of the COVID-19 pandemic. Due to the COVID-19 pandemic, the market in nations like China and Japan, among others, grew steadily in 2021 as travel and trade restrictions were lifted.

People began visiting commercial establishments such as hotels, schools, universities, and sports facilities as a result of continued vaccination programs and the removal of travel restrictions. As a result, the commercial sector witnessed strong demand for anti-fatigue mats in 2021. However, following the recovery from the pandemic, the market is expected to revitalize for future investments and possibilities and will resume a healthy development pattern from 2021 onwards. Over the forecast period, the global market is likely to be driven by the growth of online retail across the world, key player initiatives in product development and innovation, and work-from-home culture resulting in long working hours. The new work-from-home culture is predicted to provide major market participants with new opportunities to grow their footprints in the residential sector globally.

Safety bodies including the Occupational Safety and Health Administration (OSHA) have applied policies to stop the increasing number of workstation accidents by allocating the deployment of various types of facility safety equipment at the offices. Additionally, the manufacturing units are installed to prevent fall accidents and provide employee safety, which will promote the use of anti-fatigue mats in the upcoming years. The anti-fatigue mats should be composed of high-quality material to give a firm grip for the end-user and reduce foot discomfort. Anti-fatigue mats that are too soft or of poor quality might cause slipping or falling which in turn will hinder the global market and limit the adoption of anti-fatigue mats among consumers.

Physical issues carried out by a prolonged pervasiveness of occupation-related diseases have been growing on a daily basis. Anti-fatigue mats demand is growing due to the increasing number of foot and lower limb illness problems among laborers who stay in one position for a long time. Furthermore, an anti-fatigue mat is also used in restaurants as well as hotels where the kitchen workforce stands for longer times in the course of baking, washing dishes, and cooking. Moreover, anti-fatigue mats are used in laundry, bathrooms, home offices, and garages. The growing use of anti-fatigue mats in the above-mentioned spaces at the international level is likely to increase the market reach over the forecast period.

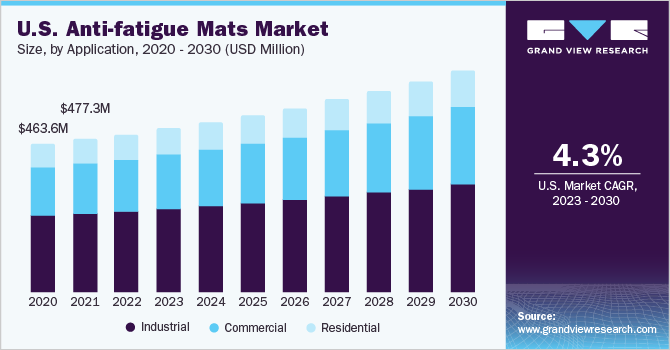

Application Insights

The industrial segment accounted for 51.7% share of the global market in 2022. Long-standing working hours on the shop floors of the manufacturing sector have increased the occurrences of various problems including foot problems, joint pains, and circulatory diseases. As a result, the industrial units have mounted anti-fatigue mats as a preventive mode of restraining the occurrence of these diseases among employees. Manufacturing companies and several other business venues have started using anti-fatigue mats on their premises to create pleasant workspaces and minimize worker tiredness. Anti-fatigue mats used in conjunction with sit-stand workstations give significant relief to individuals who work at these desks for lengthy periods of time. Thus, the industrial segment is expected to witness exponential demand for anti-fatigue mats in the coming years.

The commercial segment is likely to grow with a CAGR of 5.7% from 2023 to 2030. Key players are also launching new products in this segment to surge their market share. For instance, in July 2019, U.K.-based company “First Mats” launched a cater step red nitrile anti-fatigue mat with grease and oil-resistant features. The company particularly designed this anti-fatigue mat for the commercial kitchen, which is likely to open new avenues over the forecast period. Key players operating in the global market are heavily investing in product innovation and are involved in research and development to provide better-quality and novel products to encounter customer demand while competing with rivals’ products. Anti-fatigue mats of various forms and designs have been created by key companies for use in various sectors, such as rubber and PVC foamed mats for commercial purposes thus, driving the growth of the market.

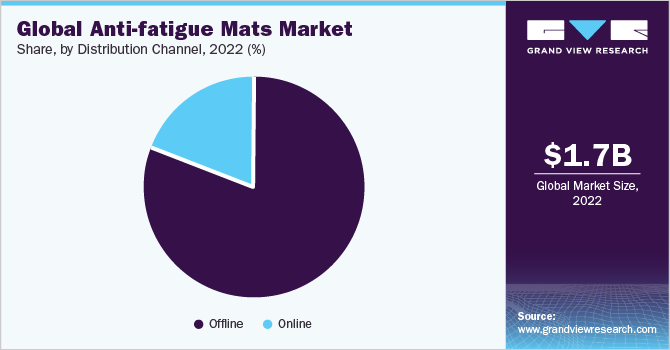

Distribution Channel Insights

Sales through offline channel held a share of 80.8% in 2022. Consumers select to buy anti-fatigue mats from local shops and also from supermarkets, which offer physical verification of the product. Thus, a buyer can understand and experience the product features and comfort in these stores. Additionally, these stores offer suitable discounts on bulk product buying from production units and corporate companies. Moreover, these stores also install anti-fatigue mats and offer after-sales services in case of any problems with the use of anti-fatigue mats.

The sales through online channel is expected to grow at a CAGR of 6.0% over the forecast period from 2023 to 2030. E-commerce retailers offer various types of promotional offers to buyers, which is driving the segment growth. Buyers get fascinated by online channels owing to member benefits, discounts, as well as cashback facilities. It has been witnessed that manufacturing units in advanced countries such as the U.S., the U.K., and Germany prefer to make their bulk buying through online channels owing to the ease of product selection. B2B online sellers such as Alibaba, eBay, Amazon, and IndiaMART are offering attractive discounts and money back to consumers for bulk buying. Furthermore, the increasing smartphone adoption rate among millennials is expected to have a profound impact on the global market in the upcoming years.

Regional Insights

North America accounted for a market share of 39.0% in 2022 and is anticipated to witness substantial development over the forecast period. The development of the market is credited to the existence of a large number of corporate as well as manufacturing units, along with the strong application of safety standards by government and industry associations. Large healthcare spending in the U.S. is driving people towards embracing a healthy lifestyle at home and in workplaces to avoid massive treatment costs. Also, a growing number of limb issues and joint soreness problems among employees owing to hectic work hours in companies will increase the demand for anti-fatigue mats over the forecast period.

The Asia Pacific is likely to grow with a CAGR of 5.9% from 2023 to 2030. The development of the manufacturing industries will lead to a rise in the sales of anti-fatigue mats to deliver safety for the workforce. Moreover, the growing disposable income of the young working population in emerging countries such as China, India, South Korea, and Bangladesh is likely to open up new market opportunities for market companies to develop their product portfolio and expand their consumer base.

Europe is expected to showcase significant growth, owing to the growing awareness of the health risks associated with extended hours standing on a rough and hard surface. Anti-Fatigue mats are most popular in the UK and France and are expected to become more popular as they are promoted as safe and productive accessories for the residential and commercial environment. During the forecast period, the regional industrial sector is likely to dominate the market, followed by the commercial sector.

Key Companies & Market Share Insights

Several players operating in the market are working on new product launches to increase their market revenue. For instance, in June 2020, Wearwell, LLC. launched ErgoDeck MAX anti-fatigue mat in their ErgoDeck product portfolio for dry environments. As most nations are still mostly undiscovered, several top anti-fatigue mat manufacturing companies are focusing their efforts on emerging regions. Furthermore, the growth of automation and the manufacturing industry is expected to offer companies with major expansion opportunities.

-

In November 2022, First Mats announced the launch of hygienic anti-fatigue mats. These newly launched mats are designed for sterile environments such as food production facilities and hospitals.

-

In October 2020, Antistat Inc. launched a new ESD Anti-fatigue Matting range. This new range of matting is constructed from a blend of PU, nitrile, and high-quality EPDM rubber, with durability and safety central to their design and construction

-

In February 2020, A new online survey commissioned by Cintas Corporation revealed that 91% of U.S. adults feel that employers should supply anti-fatigue floor mats as a benefit for their employees who work long hours on their feet

-

In July 2019, First Mats, introduced a new CaterStep Red Nitrile Anti-fatigue Mat. The specially designed mat has been created for use in commercial kitchens and is highly resistant to oil, grease, and many other chemicals present in that environment.

Some of the key players operating in the global anti-fatigue mats market include:

-

NoTrax

-

3M Corporation

-

Wearwell, LLC

-

Smart Step Flooring

-

Durable Corporation

-

Cintas Corporation

-

Euronics Industries Pvt Ltd.

-

M+A Matting

-

SmartCells USA

-

UniFirst Corporation

Anti-fatigue Mats Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,771.0 million

Revenue forecast in 2030

USD 2,503.0 million

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; South Africa; Brazil

Key companies profiled

NoTrax; 3M Corporation; Wearwell, LLC; Smart Step Flooring; Durable Corporation; Cintas Corporation; Euronics Industries Pvt Ltd.; M+A Matting; SmartCells USA; UniFirst Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-fatigue Mats Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the anti-fatigue mats market on the basis of application, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-fatigue mats market size was estimated at USD 1,699.3 million in 2022 and is expected to reach USD 1,771.0 million in 2023.

b. The global anti-fatigue mats market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 2,503.0 million by 2030.

b. North America dominated the anti-fatigue mats market with a share of 39.1% in 2022. This is attributable to the rising implementation of safety standards by government and industry associations in countries such as the U.S. and Canada.

b. Some key players operating in the anti-fatigue mats market include NoTrax; 3M; Unifirst; Wearwell, LLC; Smart Step Flooring; COBA Europe Ltd.; Mountville Mills, Inc.; Euronics Industries Pvt Ltd.; M+A Matting; and SmartCells USA.

b. Key factors that are driving the anti-fatigue mats market growth include the rising health-consciousness among consumers and the increasing popularity of e-commerce distribution channels.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."