- Home

- »

- Agrochemicals & Fertilizers

- »

-

Anticoagulant Rodenticides Market Size & Share Report, 2030GVR Report cover

![Anticoagulant Rodenticides Market Size, Share & Trends Report]()

Anticoagulant Rodenticides Market Size, Share & Trends Analysis Report By Product type (1st Generation, 2nd Generation), By Form (Pellets, Blocks, Powders), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-589-7

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

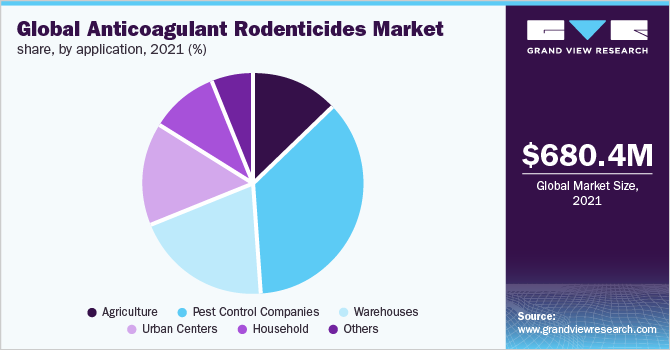

The global anticoagulant rodenticides market size was valued at USD 680.4 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.3% from 2022 to 2030. The growth of the market is expected to propel by a rising rodent population, increasing frequency of diseases related to rodents, and increased demand for rodent control. The market is extremely competitive in nature, due to the presence of multiple manufacturing companies coupled with rising demand for products that helps in rodent control, from key application industries including household, pest control, agriculture, and others.

Big manufacturers including Syngenta Crop Protection AG, BASF SE, and BAYER AG, among others manufacturers are intensifying their portfolio of products by developing powders, sprays, and baits with various concentrations of the active ingredients. Rodents consume anything, including waste, scraps, fruits, plants, seeds, grains, and grass. The majority of the rodent’s diet is based on seeds, and some of the rodents are carnivorous too. Spraying on anticoagulant rodenticides is not safer if compared to pellets, powdered, or any form, as it increases the incidents of secondary poisoning in birds and humans.

In addition to being employed by warehouses and pest control businesses, these products are also used in homes, urban areas, and for agricultural purposes. Throughout the forecast period, the market for anticoagulant rodenticides is anticipated to develop as a result of the rising need for rodenticides to reduce the rodent population. During the projection period, it is projected that factors such as rising rat populations, increased need for rodent control, and the availability of natural rodent control products will propel market expansion.

The growing need for effective farming techniques and increased agricultural yields with the use of advanced and new mechanisms are a result of growing worldwide worries about food security. As a result, the application of chemicals has increased to create efficient rodent control solutions. The creation of such goods has placed a strong emphasis on how competitive they are with current market-available traditional rodent control treatments.

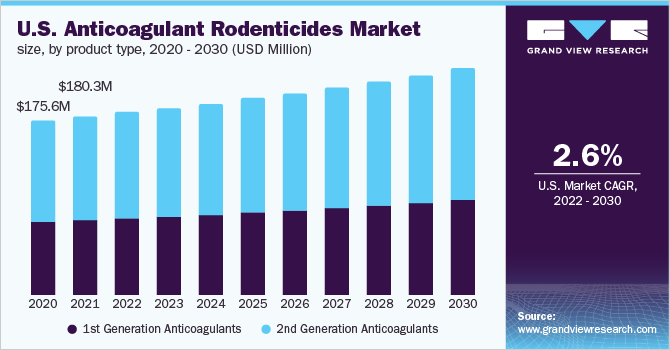

Product Type Insights

The 2nd generation anticoagulant product type dominated the market for anticoagulant rodenticides and accounted for a revenue share of 59.1% in 2021. This is attributed to the product's ability to be fed once, as opposed to several times with 1st generation anticoagulants. Single-dose anticoagulants are another name for second-generation anticoagulant rodenticides. The active ingredients of 2nd generation anticoagulant rodenticides that are currently registered are difethialone, difenacoum, bromadiolone, brodifacoum, and flocoumafen.

A larger danger of secondary poisoning exists with 2nd generation anticoagulant rodenticides, which are also longer to degrade than 1st generation anticoagulant rodenticides and to non-target species. Because they are less hazardous than 2nd generation anticoagulant rodenticides, the demand for 1st generation anticoagulant rodenticides is therefore anticipated to rise over the projected period.

Three of the first-generation anticoagulant rodenticides' active ingredients are currently approved for usage in Australia. The Australian Pesticides and Veterinary Medicines Authority has given the go-ahead for the use of diphacinone, coumatetralyl, and warfarin in and around industrial, agricultural, commercial, and residential structures.

Form Insights

The blocks segment dominated the market for anticoagulant rodenticides and accounted for a revenue share of 46.7% in 2021. This high share is attributed to the capacity to withstand the varying climatic circumstances that make them appropriate for outdoor utilization as well. Furthermore, the tendency of rodents to eat solid objects is additionally projected to fuel the need for a block form of anticoagulant rodenticides in the future.

When compared to sprays and powders, the pellet products are more appropriate, as they offer useful control against rats and mice, and are resilient to evolving nature. In the wake of fast urbanization and the spread of rodents in urban areas explicitly in business and private regions, the utilization of pellet anticoagulant rodenticides is expected to expand across the world over the forecast period.

Besides, the products that are available in powdered or crystalline form are somewhat dissolvable in water. These products are otherwise called tracking powder. Anticoagulant rodenticides in powdered form are not utilized in ducting systems as they can spread out in the particles form into the air, as a result, can lead to the contamination of food items.

Application Insights

The companies engaged in pest control dominated the market and accounted for a revenue share of 36.3% in 2021. Its high share is attributable to expanding rodent populace combined with the increasing mindfulness regarding high cleanliness norms. Pest control firms offer their services and products to various clients including agriculture, residential, and commercial offices. Additionally, numerous services in pest management, mainly include making preventive moves for limiting the increasing population of mice and rats.

Rodents can make serious harm to food products. In addition, they harm crops and are accountable for spreading more than 60 diseases to livestock, pets, and humans. Rodents contaminate crop yield and stored grains. The damage can lead to food scarcity and crop loss across the world. They can damage various crops by spoilage, contamination, and gnawing. These reasons are, thus, likely to drive the demand for anticoagulant rodenticides.

Increasing the disposable income of working-class families in the arising countries worldwide is one of the significant factors behind urbanization. With rapid urbanization, water transportation methods and their infrastructure face serious infiltration problems. Therefore, the rising mindfulness concerning controlling a large number of rodents in metropolitan areas is probably going to fuel the demand for anticoagulant rodenticides over the forecast period.

Regional Insights

North America dominated the global anticoagulant rodenticides market with a revenue share of 31.51% in 2021. This high share is attributed to the growing mindfulness concerning the increased rodent population along with growing concerns regarding security around warehouses, residential and commercial buildings, and farms and monitoring rodents in agricultural fields in countries like Canada, Mexico, and the U.S.

These products utilized in the U.S. are classified as first-generation, second generations, and acute rodenticides based on the mode of action and the harmfulness level. An expansion in the number of rodents across various cities including Washington DC, Los Angeles, San Francisco, New York, and Chicago combined with growing awareness regarding the diseases spread by rodents is expected to fuel the product demand.

New EU guidelines have limited the external usage of products that helps in rodent control. The usage of products is limited to some professionals due to the risk assessment; its execution differs from one country to another. These factors are probably going to expand the demand for multiple services offered by firms engaged in pest control. Rising demand for pest control services along with the existence of many pest control firms are likely to fuel the growth of the overall market in the region.

Key Companies & Market Share Insights

The rivalry in this market is highly dependent on the geographical spread, many sellers, and the product mix. The product manufacturers are involved in constant R&D to build numerous active ingredients to be used in the creation of anticoagulant-based rodent control products. For instance, in May 2021, BASF SE introduced an anticoagulant rodenticides product ‘Leo Miao’ to curb rodents in the livestock industry. Manufacturing companies are concentrating hugely on enhancing their portfolio of products along with the launch of nature-derived products, intended at keeping pace with future needs for viable development. Some of the prominent players in the anticoagulant rodenticides market include:

-

NEOGEN Corporation

-

Syngenta Crop Protection AG

-

BASF SE

-

PelGar International

-

Rentokil Initial plc

-

Bayer AG

-

Liphatech, Inc.

Anticoagulant Rodenticides Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 699.4 million

Revenue forecast in 2030

USD 913.6 million

Growth Rate

CAGR of 3.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Report updated

November 2023

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; South-East Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF SE; Bayer AG; Rentokil Initial plc; Liphatech, Inc.; PelGar International; Syngenta Crop Protection AG; NEOGEN Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anticoagulant rodenticides market report based on product type, form, application, and region:

-

Product Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

1st Generation Anticoagulants

-

2nd Generation Anticoagulants

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Pellets

-

Blocks

-

Powders & Sprays

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Pest Control Companies

-

Warehouses

-

Urban Centers

-

Household

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

South-east Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global anticoagulant rodenticides market size was valued at USD 680.42 million in 2021 and is expected to reach USD 699.40 million in 2022.

b. The global anticoagulant rodenticides market is anticipated to grow at a compound annual growth rate (CAGR) of 3.3% from 2022 to 2030 to reach USD 913.63 million by 2030.

b. Pest control companies dominated the anticoagulant rodenticides application with a share of 36.3% in 2021. Its high share is attributable to the increasing rodent population coupled with the rising awareness regarding high hygiene standards.

b. Some prominent players in the anticoagulant rodenticides market include BASF SE, Bayer AG, Rentokil Initial plc, Liphatech, Inc., PelGar International, Syngenta Crop Protection AG, NEOGEN Corporation

b. The demand for anticoagulant rodenticides is anticipated to be driven by increased demand for rodent control, the prevalence of rodent-related diseases, and rising rodent population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."