- Home

- »

- Automotive & Transportation

- »

-

Auto catalyst Market Size & Share, Global Industry Report, 2018-2025GVR Report cover

![Auto catalyst Market Size, Share & Trends Report]()

Auto catalyst Market Size, Share & Trends Analysis Report By Application (LDV-Diesel, LDV-Gasoline, HDV), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts, 2018 - 2025

- Report ID: 978-1-68038-834-3

- Number of Pages: 131

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Technology

Industry Insights

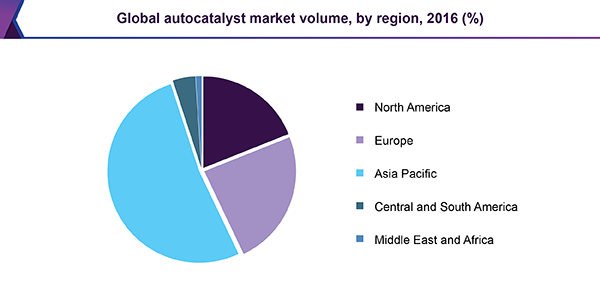

The global auto catalyst market size was estimated at 114,492.5 thousand units in 2016. Rising environmental concerns owing to the harmful emissions emitted from automobiles coupled with strict environmental regulations in this regard has led to the incorporation of technologically advanced autocatalysts in automobiles.

Autocatalysts help in converting harmful pollutants such as hydrocarbons, nitrogen oxides, carbon oxides, and other particulate matter into harmless gases such as carbon dioxide, nitrogen, and water. Therefore, the growing automobile sector and automobile aftermarket are expected to drive demand for autocatalysts across the world.

Countries such as China, Japan, Germany, and India, are witnessing a significant demand for autocatalysts and offering the scope for market growth in these regions. Furthermore, the implementation of stringent regulations, especially in North America and Europe and the execution of new rules & regulations governing vehicle emissions in the emerging countries of Asia Pacific are some of the factors projected to augment the auto catalyst market over the forecast period. The increase in per capita ownership of vehicles is another factor, which is expected to boost the demand for autocatalysts.

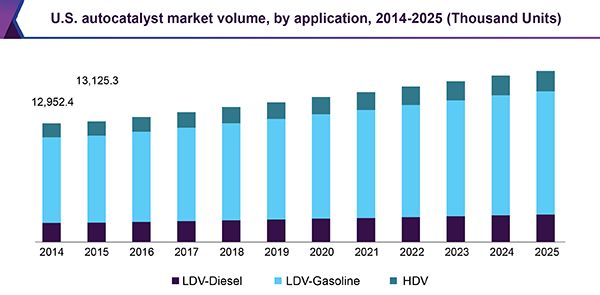

Application Insights

The auto catalyst market has been segmented on the basis of application as light-duty vehicles-diesel, light-duty vehicles-gasoline, and heavy-duty vehicles. LDVs include passenger cars or light-duty commercial vehicles that are fueled either by gasoline or diesel. The overall global market for light-duty vehicles is expected to progress on account of increasing population and the growing per-capita purchase of automobiles.

The demand for gasoline-powered light-duty vehicles is expected to arise from countries such as the U.S. and China. On the other hand, diesel-powered LDVs are preferred mainly in the European Union countries such as Germany, France, and Spain. Countries, such as India and South Korea, also contribute toward significant demand for diesel-powered LDVs.

Heavy-duty vehicles include trucks, tractors, tankers, buses, and coaches. These vehicles are mostly diesel-powered and require larger Platinum Group Metals (PGM) content to convert harmful exhaust gases into less noxious gases in comparison to other vehicles. Therefore, the price of autocatalysts used in this segment is much higher in contrast to that used in light-duty vehicles.

Regional Insights

In terms of volume, the auto catalyst market in Asia Pacific accounted for 51.95% of the global market share in 2016. The region is expected to register the highest CAGR of 3.6% from 2017 to 2025, on account of increasing automobile production in Asian countries such as India, Indonesia, South Korea, Pakistan, and China owing to the rising population and growing consumer disposable income.

Increasing regulations pertaining emission control limits implemented by China's State Environmental Protection Administration (SEPA) to curb vehicular pollution is anticipated to boost the demand for autocatalyst in this region. Moreover, these regulations will limit the use of increased PGMs in the coating of an autocatalyst substrate. This, in turn, is likely to make auto catalyst expensive in the coming years and, therefore, increase market revenue share.

Europe was the second-largest contributor to the production of automobiles in 2016. The country accounted for an output of 22 million motor vehicles in 2015. Europe's auto catalyst market is likely to register second-highest CAGR from 2017 to 2025. The implementation of Euro VI and VII guidelines is expected to boost the demand for autocatalyst in the region.

North America is expected to experience slow growth in terms of volume due to the increasing average life of vehicles. This can be attributed to the growing efficiency and durability of autocatalyst, which helps them last through the lifecycle of the vehicle. However, the prices of autocatalyst in North America are considerably high, which, in turn, is likely to contribute to the market value of autocatalyst in the region.

The demand for HDVs is expected to be growing in countries such as India, Brazil, China, South Korea, and Russia. Heavy-duty vehicles are mostly diesel-powered and emit harmful exhaust gases in comparison to light-duty vehicles. The higher content of platinum PGM used in autocatalyst for HDVs is expected to increase the price of autocatalyst catering to this segment. HDV segment is projected to register the highest CAGR of 3.6%, in terms of value, from 2017 to 2025.

Auto catalyst Market Share Insight

The dominant business players in the market have formed a high level of value chain integration and are involved in raw material production, product manufacturing, and supply activities. A large number of companies are investing in R&D activities for developing better and innovative products to withstand the growing competition.

Companies are also trying to expand their product portfolio by focusing on developing newer products with superior properties to meet the growing industry demands. Moreover, players in the market are focusing on increasing their product portfolio to suit customers needs to gain a competitive advantage in various regional markets.

Autocatalyst manufacturers are also product distributors and exporters across the globe. Some of the companies engaged in this part of the value chain are BASF SE; Umicore S.A.; Johnson Matthey PLC; Corning Incorporated; Cataler Corporation; DCL International, Inc.; Heraeus Holding GmbH; Tenneco, Inc.; Faurecia SA; Klarius UK Ltd.; and Bosal International N.V.

Companies such as AP Exhaust Products and Cummins Emission Solutions have adopted acquisition strategies to gain market share and enhance their market offerings. Expansions & investment strategies were undertaken by companies such as BASF SE; Johnson Matthey; Umicore S.A.; and DCL International, Inc. to increase their production capacities and expand into emerging markets.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in Thousand Units, Revenue in USD Million, and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, Spain, France, UK, Russia, Netherlands, China, Japan, South Korea, Australia, Malaysia, South Africa, Saudi Arabia, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global auto catalyst market on the basis of application and region:

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million; 2014 - 2025)

-

LDV-Diesel

-

LDV-Gasoline

-

HDV

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Spain

-

Netherlands

-

-

Asia Pacific

-

South Korea

-

China

-

Japan

-

Australia

-

Malaysia

-

Indonesia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Central & South America

-

Brazil

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."