- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Adhesives & Sealants Market Size Report, 2021GVR Report cover

![Automotive Adhesives And Sealants Market Report]()

Automotive Adhesives And Sealants Market Analysis By Product (Acrylic, PVA, Silicones, Polyurethanes), By Application (Exterior, Interior, Electronics), By Function (Bonding, NVH, Sealing), By Technology, By Vehicle Type, And Segment Forecasts, 2018 - 2021

- Report ID: GVR-1-68038-974-6

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2011 - 2016

- Forecast Period: 2017 - 2022

- Industry: Bulk Chemicals

Industry Insights

The global automotive adhesives & sealants market size was estimated at a combined total of 1,353.4 kilotons in 2016. Stringent environmental regulations formulated by authorities in order to reduce carbon emissions have driven the demand for lightweight bonding materials in place of conventional heavy metal fasteners.

Adhesives currently utilized in the automotive industry are mostly synthetic in nature, with raw materials such as vinyl acetate monomer, acrylics, polyester resins, epoxide resins, amine-based resins, ethylene, and propylene among others. However, major industry participants are increasingly formulating innovative products using bio-based & renewable feedstock.

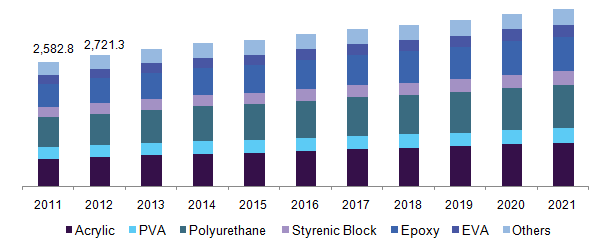

U.S. automotive adhesives market revenue by product, 2011 - 2021 (USD Million)

Innovations in the industry such as the introduction of a new silyl modified polymer (SMP) technology by Bostik, which is expected to heighten the efficiency and safety standards for automobile manufacturers. Manufacturers are thus increasingly shifting toward water-based adhesives, which are environment-friendly and contain a lower amount of VOCs

Sealants, which were conventionally silicone or acrylic-based, are also being developed with renewable feedstock and innovative technologies to foster enhanced product properties. New technologies such as anchoring & multipurpose sealants introduced by Sika AG possess waterproof properties designed specifically for automotive applications.

Hybrid sealants are being utilized for caulking and glazing applications in the construction sector. Such innovative products have also been developed to foster easier movement in pre-joined automotive components. Similarly, Henkel has also developed products that do not require any pre-treatment, eliminating the cost for substrate treatment.

Miniaturization & weight reduction are key factors influencing technology trends in the market. Companies are introducing specialized products with combined properties. New opportunities are available for manufacturers to produce environment-friendly and fast curing adhesives from biobased and renewable resources, which is likely to foster industry growth.

Product Insights

Products considered include acrylic, polyvinyl acetate (PVA), polyurethane, styrenic block, epoxy, EVA, and others (silicones & polyisobutylene). Acrylics are expected to emerge as the fastest expanding product segment, with the fastest CAGR of 4.4% owing to their excellent bonding strength along with humid and impact resistance. The segment is expected to witness rapid growth rate owing to increasing passenger car sales in emerging economies.

Polyurethane (PU) is another major segment, witnessing high growth in the highly lucrative Asia Pacific automotive industry. Rapidly expanding the auto industry driven by favorable government norms and increasing investments are some major factors spurring PU demand across the region.

Sealant products may be largely categorized into silicones, PVA, polyurethane, acrylic, and others (butyl & polysulfide). Silicones are anticipated to remain the largest product owing to their flexibility, good thermal & electrical conductivity, resistance to high temperatures, and other advantages including low cost. The product accounted for about 30% of the volume share in 2016 and is expected to increase at the highest CAGR of 3.2% from 2017 to 2021.

Application Insights

Body-in-white is expected to witness the highest growth rate of 4.1% over the forecast period owing to the rising popularity of high-performance adhesion solutions in vehicles, which helps in reducing overall weight, thereby saving fuel consumption. Adhesives are also widely used in exterior components of the vehicles for bonding composite hoods & roofs on sports cars.

Global automotive sealants market volume by application, 2016 (%)

Exterior applications are expected to remain an important component in the automotive market. Adhesives help to distribute stress loads more uniformly as compared to rivets which assist in enhanced rollover and impact test performance. Acrylics bond very well to a variety of substrates such as plastics, ceramics, steel, and glass. Epoxies are primarily used for UV curing in headlights.

Powertrains are expected to remain the dominant application, with a high number of protective sealants being utilized in the drivetrain, transmission box, and even engine. The segment is expected to account for over 32% of the revenue share by 2021, increasing at over 2% CAGR from 2017 to 2021.

Function Insights

Adhesives are widely utilized in the automotive industry for bonding applications, providing strong impact, corrosion, and heat resistance. High-performance adhesives are utilized in bonding a wide range of automotive components and assemblies such as wire harnesses, exterior trim, and windshields.

Automotive sealants play a significant role in providing vehicle durability, comfort, safety, and strength. They help to achieve consistency and integrity throughout the body shop, stamping, assembly processes, trim, and paint line. It provides noise-reducing solutions for various components as well as full vehicles. These aid in mass dampening and acts as vibration absorbers for efficient damping of noise and vibrations.

Technology Insights

Water-based technology held the dominant market share in 2016 owing to the substitution of conventional solvent-based adhesion products with more sustainable options. These products are formulated either from natural polymers including vegetable, protein, and animal sources or from soluble synthetic polymers, including polyvinyl alcohol, cellulose ethers, and methylcellulose among others.

Reactive are expected to grow at a modest pace, with over 5.5% CAGR. These high-performance adhesives are increasingly gaining popularity owing to their excellent durability under adverse environmental conditions as well as high bond strength.

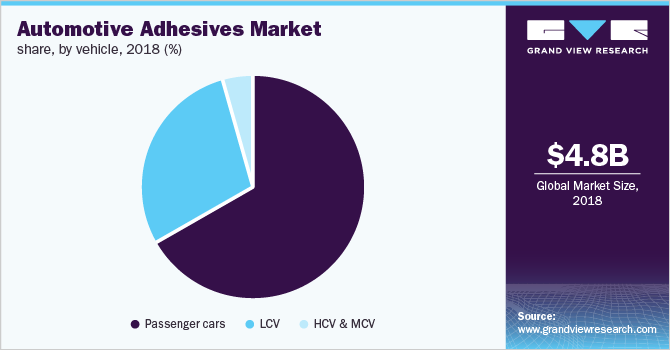

Vehicle Type Insights

Automotive adhesion products are increasingly being used in commercial vehicles since they are usually custom-designed in order to fulfill various requirements such as utility operations, emergency services, trash collection, and others, thereby requiring high-performance solutions. Sealants are used in medium and heavy commercial vehicles for preventing water intrusions and leaks. They are used for the bonding of trailer bed to frame, wall skin to frame, and interior bracket to frame.

Passenger cars dominated the overall industry, owing to high sales statistics in major economies across the globe. As per OICA statistics, passenger car unit sales grew by about 4.5% from 2015 to 2016; this rise may be attributed to rising disposable income in emerging economies, renewed production levels in recovering developed markets, and technological advancements at the OEM level, leading to higher, more efficient production.

Regional Insights

Greater China is expected to remain a lucrative region from 2017 to 2021, owing to a spurt in automobile production levels and encouraging conditions such as low labor costs, high population, and geographical proximity to emerging economies.

The rest of the world (RoW) is anticipated to emerge as the fastest-growing region on account of rapidly expanding automotive sector in India, Brazil, Colombia, Indonesia, The Philippines, and other emerging nations across the globe.

A rebounding automotive sector in the U.S., and expanding in Mexico is anticipated to drive demand in North America at a relatively higher pace than the aforementioned economies. The region also benefits from lower feedstock prices as a result of the recent shale gas boom, which impacted manufacturer profit margins positively.

Competitive Insights

The industry is highly fragmented among major multinationals with presence across several nations. Increasing entry of small & medium-sized players into the industry is expected to challenge multinational companies already competing in the industry. Increasing technological & product innovation is expected to drive industry growth as companies attempt to expand their existing portfolios and consolidate their positions in the industry.

Current players in the industry include BASF, Henkel, 3M Inc., Avery Dennison, Bostik, AkzoNobel N.V., Franklin Adhesives & Polymers, Evonik Industries, DSM Inc., H.B. Fuller & Co. among others.

Recent Developments

-

In May 2023, Henkel launched a new injectable adhesive Loctite TLB 9300 APSi for EV battery systems. This injectable adhesive provides structural and thermal conductivity in batteries and is beneficial for a smooth and simplified manufacturing process

-

In March 2022, Bostik’s parent company Arkema acquired Ashland’s performance adhesive business. This acquisition strengthened and accelerated the growth of Bostik’s adhesive solutions segment

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2011 - 2016

Forecast period

2017 - 2021

Market representation

Volume in kilo tons, revenue in USD Million and CAGR from 2017 to 2021

Regional & country level scope

North America, Europe, Greater China, Japan & Korea, Rest of the World

Report coverage

Volume & revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2011 to 2021. For the purpose of this study, Grand View Research has segmented the global automotive adhesives & sealants market on the basis of product, application, function, technology, vehicle type and region:

-

Adhesives Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Water-based

-

Solvent-based

-

Hot melt

-

Reactive & others

-

-

Adhesives Function Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Bonding

-

Noise, Vibration & Harshness (NVH)

-

Sealing/Protection

-

-

Adhesives Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Acrylic

-

PVA

-

Polyurethane

-

Styrenic Block

-

Epoxy

-

EVA

-

Others

-

-

Adhesives Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Exterior

-

Interior

-

Electronics

-

Powertrain

-

Body-in-white

-

Others

-

-

Adhesives Vehicle Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Passenger Cars

-

Light Commercial Vehicles (LCV)

-

Heavy & Medium Duty Commercial Vehicles (H/MCV)

-

-

Sealants Function Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Bonding

-

Noise, Vibration & Harshness (NVH)

-

Sealing/Protection

-

-

Sealants Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Silicones

-

PVA

-

Polyurethane

-

Acrylic

-

Others

-

-

Sealants Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Exterior

-

Interior

-

Electronics

-

Powertrains

-

Others

-

-

Sealants Vehicle Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2011 - 2021)

-

Passenger Cars

-

Light Commercial Vehicles (LCV)

-

Heavy & Medium Duty Commercial Vehicles (H/MCV)

-

-

Adhesives & Sealants Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

Europe

-

Greater China

-

Japan & South Korea

-

Rest of the World (RoW)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."