- Home

- »

- Agrochemicals & Fertilizers

- »

-

Biorationals Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Biorationals Market Size, Share & Trends Report]()

Biorationals Market Size, Share & Trends Analysis Report By Product (Botanical, Semiochemicals) By Crop (Fruits & Vegetables, Grains, Cereals, Corn), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-157-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global biorationals market size was valued at USD 946.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.32% from 2023 to 2030. This is attributed to the increasing usage of biorationals therapy in the crop production industry for boosting resistance against pests and insects due to their high effectiveness. The biorationals are low-toxic insecticides and pesticides which interrupt the normal destroying various insects and pests. Biorationalss is used to eliminate the normal lifecycle of pests and insects and preserve the useful bacteria and pests in soil and on leaves, which eventually increases the yield of agricultural products.

Demand for rationals is growing in agricultural practices as the product helps prevent seed- and leaf-borne infections and diseases, as well as minimizes amounts of hazardous residue on fruits and vegetables. In addition, it reduces germination time, promotes pollination enhances overall productivity and improves crop yield. Growing health concerns in crops and fruits regarding their yield and residue left due to synthetic insecticide spraying are increasing the use of Biorationals activities and have also been contributing to the growth of the global bio-rational industry.

Biorationals are used as an effective remedy against insects and pests due to naturally occurring pheromones. The development of organic treatment for biorationals provides zero residues of hazardous chemicals in grains and agricultural products, and growing consciousness for high agricultural yield has increased the demand for biorationals in the forthcoming years.

Increased usage of biorationals, especially in developing economies, for higher yields in fruits & vegetable crops has been observed recently. This has happened due to strict norms against the hazardous residues observed in synthetically treated plants. This trend is anticipated to continue further worldwide owing to the increasing demand for biorationals. The rising demand-supply gap is negatively impacting the industry’s growth, thereby increasing the prices of organic-based insecticides and pesticide products.

High demand for biorationals globally for protecting and increasing high-yield crops is increasing the product demand. Developed economies like the U.S. and developed economies of Europe garner major agriculture product markets and follow the policy of “Farm to Fork”. The consumer in U.S. and Europe are more concerned about the chemical residues in fruits and vegetables and are one of the major producers of high-quality agricultural products.

The increase in demand for integrated pest-management practices, pesticides, pest resistance, and organic farming practices, and to reduce post-harvest crop losses have increased the usage of biorationals foliar practices. A surge in the production and export of high-quality agricultural products in emerging economies of Asia Pacific is expected to contribute to the demand for biorationals. This, in turn, is anticipated to fuel the growth of the global industry during the forecast period.

The usage of biorationals helps tackle the issue of climate change and global warming. It replaces chemicals in various Products and ensures a clean environment. The growing usage of biorationals and bio-based pesticides and insecticides in agricultural practices is expected to fuel market growth in the coming years. The global demand for biorationals was not reduced completely during the pandemic considering their end-use, in the agricultural sector as a repellent against leaf-, soil-, and seed-borne diseases. The market witnessed substantial growth in 2022 and this trend is expected to continue in the coming years considering the ongoing research and development activities in the industry.

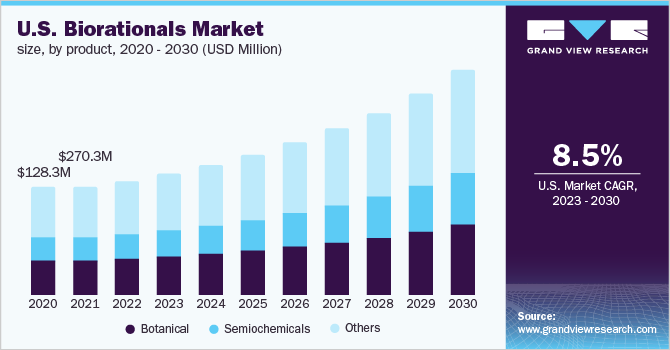

Product Insights

The botanical product segment dominated the global industry in 2022 and accounted for the maximum share of the overall revenue. The growth of the botanical product segment can be attributed to the increasing demand from emerging economies of Asia Pacific, such as India and China.

Over the past decade, the use of biorationals is increasing, due to the zero residue obtained in agricultural products. The products such as insecticides and pesticides promote the annihilation of pests and insects from the seeds and soils without forming any hazardous chemical residue in vegetables and fruits. Farmers from North America and Europe region are some of the early adopters of biorationals products, as the major consumers from this region prefer organic-based agricultural products.

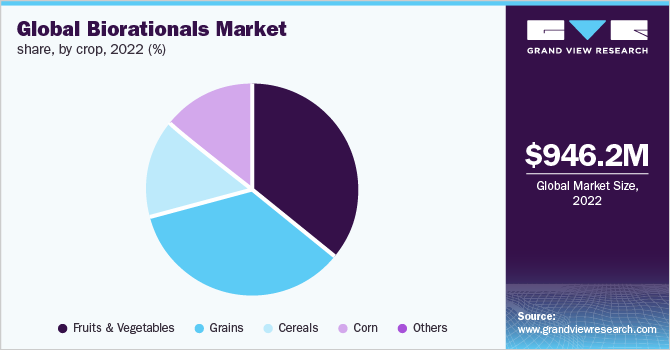

Crop Insights

The fruits & vegetable segment dominated the global industry in 2022 and accounted for the maximum revenue share. The growth can be attributed to the high product demand from crop protection activities, i.e. insecticides pesticides foliar application activities. Biorationals are less toxic organically derived pesticides and insecticides activity for crop protection. Biorationals affect the life cycle of living organisms that can interrupt the life cycle of insect pests in such a way that crop damage can be minimized in the future. The biorationals support the predators, parasites, and, disease-causing fungi bacteria, and viruses, which are the natural enemies of pests and insects.

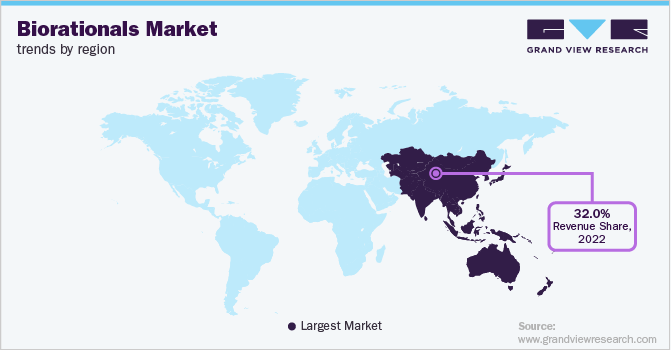

The global biorationals market is small compared to the overall pesticides and insecticides market. On the other hand, synthetic pesticides are largely used and are manufactured at a relatively cheaper cost than bio-based pesticides and insecticides. So, achieving that economy of scale is a tough challenge to overcome for the industry participants. However, the rapid adoption of biorationals is expected to help their cause. Asia Pacific led the overall market and accounted for more than one-third of the global market alone. However, owing to stringent regulations regarding the use of synthetic pesticides and insecticides make Europe the most attractive market in the near future.

Regional Insights

Asia Pacific dominated the industry in 2022 and accounted for the largest share of over 32% of the overall revenue. The region is likely to expand further at a steady CAGR maintaining its leading position throughout the forecast period. The growth is attributed to the increased agricultural activities in the region coupled with high crop demand from major countries, such as the U.S., and countries of the European region. In Europe, the major driver for the market growth is the product usage in vegetable & fruit plantations owing to the ongoing agricultural and fruit & vegetable plantation development projects across countries, such as Germany, France, the U.K., and Italy.

According to a study by the European Commission, the agriculture sector contributed revenue of EUR 178.4 billion in 2020. Asia Pacific, on the other hand, is projected to register the fastest growth rate during the forecast period. The region accounted for the second-largest revenue share in 2022. Organic agricultural practices in the Asia Pacific region are expected to witness substantial growth in the coming years. This is driven by the increasing demand for bio-based agricultural products, which is anticipated to boost regional market growth during the forecast period.

Key Companies & Market Share Insights

The presence of many multinational players has resulted in high competition in the industry. These companies look forward to expanding their operations in untapped markets to generate higher revenues. Major manufacturers undertake various initiatives, such as mergers & acquisitions, joint ventures, and expansion activities, to meet the rising product demand. Through these initiatives, companies also seek to increase their global footprints and expand their reach to potential customers at optimum distribution costs. Some prominent players in the global biorationals market include:

-

Koppert B.V.

-

Bayer AG

-

Isagro S.P.A

-

Gowan Company LLC

-

Summit Chemicals Company

-

Suterra

-

Russell IPM

-

Agralan Ltd

-

BASF SE

-

Syngenta

-

Monsanto

-

CropScience

-

Chemtura

-

Nufarm

-

DuPont

Biorationals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.04 billion

Revenue forecast in 2030

USD 1.87 billion

Growth rate

CAGR of 9.32% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand tons, and CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, crop, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Koppert B.V.; Bayer AG; Isagro S.P.A; Gowan Company LLC; Summit Chemicals Company; Suterra; Russell IPM; Agralan Ltd; BASF SE; Syngenta; Monsanto; CropScience; Chemtura; DuPont; Nufarm

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

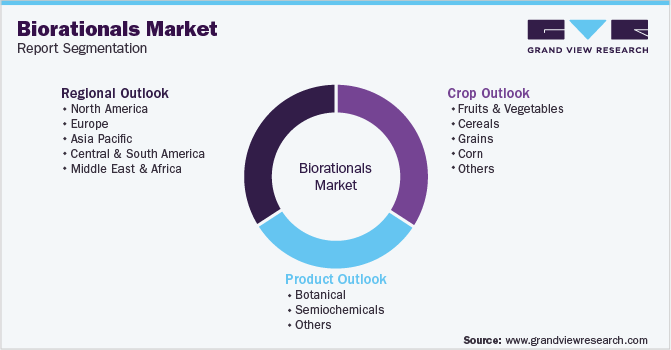

Global Biorationals Market Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biorationals market report based on product, crop, and region:

-

Product Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Botanical

-

Semiochemicals

-

Others

-

-

Crop Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Cereals

-

Grains

-

Corn

-

Others

-

-

Regional Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biorationals market size was estimated at USD 946.2 million in 2022 and is expected to reach USD 1,004.8 million in 2023.

b. The global biorationals market is expected to grow at a compound annual growth rate of 9.32% from 2023 to 2030 to reach USD 1,875.4 million by 2030.

b. Asia Pacific dominated the biorationals market with a share of 32 % in 2023. This is attributable to stringent regulatory framework against synthetic pesticides.

b. Some key players operating in the biorationals market include Suterra, LLC, Russell IPM Ltd., Agralan Ltd., Rentokil Initial Plc, McLaughlin Gormley King (MGK), Koppert BV, BASF SE, Bayer AG, Inora, Isagro Spa, Gowan Company, LLC, and Summit Chemical.

b. Key factors that are driving the market growth include increasing adoption of integrated pest management and growing awareness regarding adverse impacts of synthetic pesticides on beneficial organisms in farmland and terrestrial ecosystems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."