- Home

- »

- Food Safety & Processing

- »

-

Global Bulk Food Ingredients Market Size Report, 2028GVR Report cover

![Bulk Food Ingredients Market Size, Share & Trend Report]()

Bulk Food Ingredients Market Size, Share & Trend Analysis Report By Category (Primary Processed, Secondary Processed), By Application (Bakery & Confectionery, Snacks & Spreads) By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-933-2

- Number of Report Pages: 86

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

Report Overview

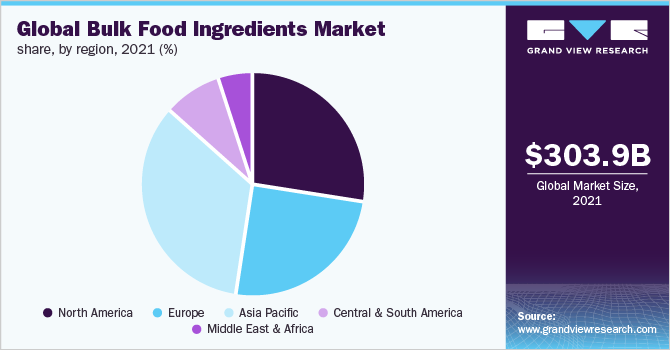

The global bulk food ingredients market size was valued at USD 303.88 billion in 2021 and is and is expected to expand at a compound annual growth rate (CAGR) of 4.4% from 2022 to 2028. The shift in consumer preference from artificial and pre-packaged foods to organic, natural, and simple ingredients, particularly in developed countries, is anticipated to influence market demand positively. Commodity/bulk ingredients are majorly final products such as flours and oils, wherein it is traded in high volumes with low-value addition to the final product. These products are procured in huge or bulk quantities from the wholesale supplier and brought into the convenience and retail stores.

The European bulk food ingredients market is anticipated to grow significantly in upcoming years owing to the increased penetration of packaged & processed food products and the inclination of consumers to try new preservatives, sweeteners, flavor enhancers, natural flavors, and spices. Robust growth in low-carbohydrate and low-fat foods & beverages is further estimated to propel market growth.

Growing consumer consciousness of eating healthy food has boosted natural, organic, and functional food demand. Increasing health complications such as cardiovascular problems, obesity, and diabetes, predominantly among the youth, have driven a shift in dietary trends towards a nutritional and healthy diet and away from alcohol, junk food, and meat consumption. The factors mentioned above are driving the demand in the bulk food ingredients market.

The COVID-19 pandemic certainly changed the consuming and buying pattern of consumers in the bulk food ingredients market. Wherein sale through the online distribution channel and convenience store is increasing.

Category Insights

Secondary processed food ingredients contributed the highest share of more than 60% of the global market revenue in 2021. Secondary processing is the conversion of bulk commodities into edible products. This process involves combining foods in a particular way to change their properties. Secondary processed ingredients are used in processed and packed food such as confectionery items, chocolate, beverages, biscuits, artificial sweeteners, flavors, and extracts.

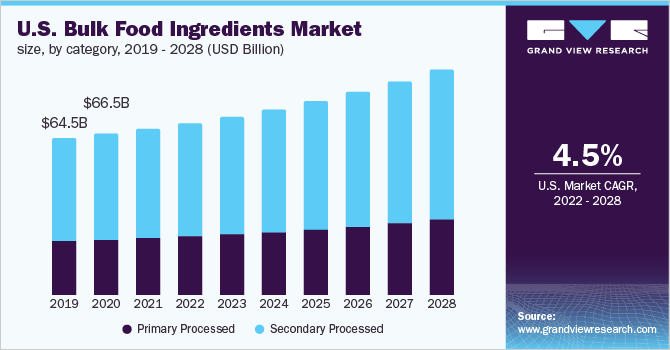

The primary processed ingredient is projected to register a CAGR of 4.0% from 2022 to 2028. Primary processing is the conversion of raw materials to bulk food ingredients. Milling is the key example for primary processing. Products such as grains, pulses, cereals, tea, coffee, cocoa, herbs, and spices are the majorly primary processed products.

Emerging economies are estimated to provide growth opportunities owing to the surging population and per-capita income levels. Furthermore, demand for grains, cereals, and pulses in Brazil, Mexico, Indonesia, Vietnam, China, and India will drive the market further.

Application Insights

Bakery & confectionary applications contributed to the highest share of more than 30% of the global market revenue in 2021. Rising consumer awareness about health and nutrition-related product has motivated the bakery and confectionery producers to include functional ingredients, such as probiotics, legumes, oats, fortified margarine, and cereals, in their products. Asia Pacific bakery & confectionary market is majorly driven by the increasing demand for processed bakery products, along with growing awareness among consumers for clean label and healthy products.

The beverage is the fastest-growing application and is expected to witness a CAGR of over 5% from 2022 to 2028. In 2018, soft drinks per capita consumption in the U.S. in 38.87 gallons per person. This is the primary factor driving the bulk food ingredients consumption in beverage applications in the North American region.

Regional Insights

Asia Pacific is the fastest-growing market and is expected to witness a CAGR of 4.8% from 2022 to 2028. In the Asia Pacific, especially in China, Indonesia, India, Australia, Vietnam, Malaysia, and Japan, the demand for the food & beverages industry has been increasing. The region is the primary market for consuming processed and packaged food due to its surging population, and increasing exposure to western lifestyles. Strong consumption growth in emerging economies driven by GDP growth and middle-class income expansion would boost the product demand in the region.

North America contributed a share of more than 25% of the global revenue in 2021. Healthy economic growth, changing lifestyle trends, rising living standards, and increasing per capita expenditure on health and nutrition products are expected to prompt demand. Increasing consumer health-consciousness and growing interest in healthy and nutritious products are positively influencing baked goods. Huge demand for baked products such as high-fiber, gluten-free, and Trans fat products is anticipated to boost the bulk food ingredients market.

Key Companies & Market Share Insights

The market is characterized by the presence of various well-established players and several small & medium scale players. However, the industry is dominated by top international players such as Cargill, Incorporated, Archer-Daniels-Midland Company, Bunge Limited, Associated British Foods plc, Tate & Lyle, and Olam International.

In April 2021, Olam Food Ingredients announced acquiring Olde Thompson for over USD 950 million. The company is engaged in producing sustainable, natural, and value-added food & beverage ingredients. In January 2020, Archer-Daniels-Midland Company announced to expand its product offering of plant-based ingredients and extract by acquiring Brazil-based Company Yerbalatina Phytoactives. Yerbalatina produces organic food colors, organic powdered fruits, and functional health and nutrition ingredients. Some of the key players operating in the global bulk food ingredients market include:

-

Cargill, Incorporated

-

Archer-Daniels-Midland Company

-

Bunge Limited

-

Associated British Foods plc

-

Olam International

-

Tate & Lyle

-

DUPONT DE NEMOURS, INC

-

Essex Food Ingredients

-

Ingredients Inc.

-

Corbion

-

Koninklijke DSM N.V

-

EHL Ingredients

-

McCormick & Company, Inc

-

GCL Food Ingredients

-

Dmh Ingredients, Inc.

Bulk Food Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 313.85 billion

Revenue forecast in 2028

USD 409.56 billion

Growth rate

CAGR of 4.4% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; China; India; Brazil; Saudi Arabia

Key companies profiled

Cargill, Incorporated; Archer-Daniels-Midland Company; Bunge Limited; Olam International, Associated British Foods plc; Tate & Lyle; Koninklijke DSM N.V; DUPONT DE NEMOURS, INC; Corbion; Essex Food Ingredients; McCormick & Company, Inc.; GCL Food Ingredients; Dmh Ingredients, Inc.; EHL Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global bulk food ingredients market on the basis of category, application, and region:

-

Category Outlook (Revenue, USD Billion, 2017 - 2028)

-

Primary Processed

-

Grains, Pulses and Cereals

-

Tea, Coffee and Cocoa

-

Herbs and Spices

-

Oilseeds

-

Sugar & Salt

-

Others

-

-

Secondary Processed

-

Processed Grains, Pulses and Cereals

-

Processed herbs and spices

-

Dry Fruit & nuts

-

Sugar & Sweetener

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2028)

-

Bakery & Confectionery

-

Snacks & Spreads

-

Ready Meals

-

Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bulk food ingredients market size was estimated at USD 303.8 billion in 2021 and is expected to reach USD 313.8 billion in 2022.

b. The global bulk food ingredients market is expected to grow at a compound annual growth rate of 4.4% from 2022 to 2028 to reach USD 409.5 billion by 2028.

b. Asia Pacific dominated the bulk food ingredients market with a share of 34.4% in 2021. This is attributable to the rising consuming processed and packaged food due to its surging population, and increasing exposure to western lifestyles.

b. Some key players operating in the bulk food ingredients market include Cargill; Incorporated; Archer-Daniels-Midland Company; Bunge Limited; Olam International; Associated British Foods plc; Tate & Lyle; Koninklijke DSM N.V; DUPONT DE NEMOURS, INC; Corbion; Essex Food Ingredients; McCormick & Company, Inc.; GCL Food Ingredients; Dmh Ingredients, Inc.; and EHL Ingredients.

b. Key factors that are driving the bulk food ingredients market growth include a shift in consumer preference from artificial and pre-packaged foods to organic, natural, and simple ingredients, particularly in developed countries, and growing consumer consciousness of eating healthy food has boosted natural, organic, and functional food demand across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."