- Home

- »

- Biotechnology

- »

-

Tumor Profiling Market Size & Share, Industry Report, 2030GVR Report cover

![Tumor Profiling Market Size, Share & Trends Report]()

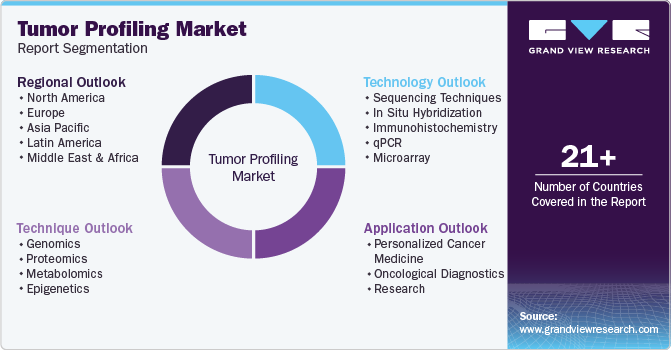

Tumor Profiling Market (2025 - 2030) Size, Share & Trends Analysis Report By Technique (Genomics, Proteomics), By Technology, By Application (Personalized Cancer Medicine), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-625-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tumor Profiling Market Summary

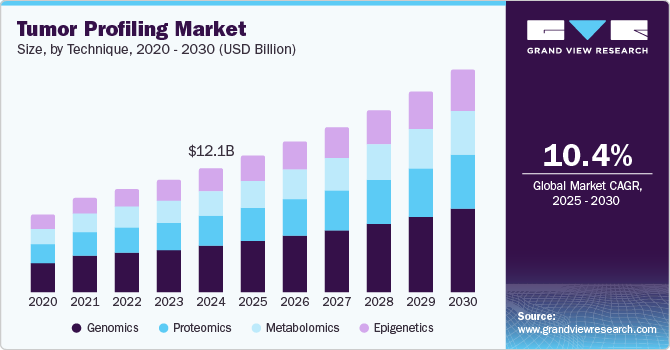

The global tumor profiling market size was estimated at USD 12.1 billion in 2024 and is projected to reach USD 21.7 billion by 2030, growing at a CAGR of 10.4% from 2025 to 2030. The rising number of cancer cases and the adoption of precision oncology, which tailors therapies based on a tumor’s unique genetic makeup, are key factors driving market growth.

Key Market Trends & Insights

- North America tumor profiling market dominated the tumor profiling industry, accounting for a revenue share of 36.7% in 2024.

- The Asia Pacific tumor profiling market is expected to register the fastest CAGR of 12.5% during the forecast period.

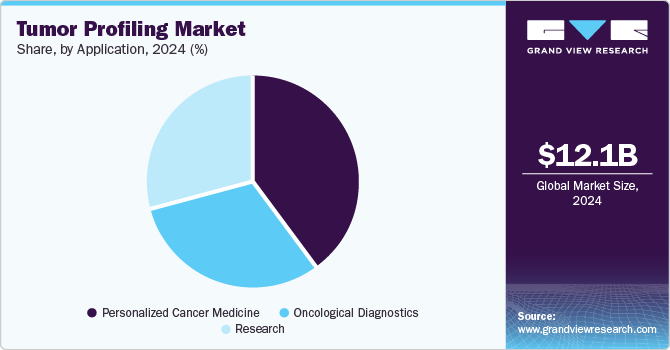

- Based on application, personalized cancer medicine dominated the market, accounting for a share of 40.4% in 2024.

- In terms of technology, sequencing techniques dominated the market, accounting for a share of 30.8% in 2024.

- Based on technique, genomics dominated the market, accounting for a share of 38.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.1 Billion

- 2030 Projected Market Size: USD 21.7 Billion

- CAGR (2025-2030): 10.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in technologies such as next-generation sequencing are enhancing the speed and accuracy of tumor profiling, further supporting its widespread adoption in oncology. The global incidence of cancer is increasing due to factors such as population aging, unhealthy lifestyles, and environmental exposure to carcinogens. The rising demand for cancer diagnosis and treatment is a major driver for the tumor profiling market.

According to the World Health Organization, in 2022, there were approximately 20 million new cancer cases and 9.7 million deaths. Precision oncology is a personalized approach to cancer treatment that considers the unique genetic characteristics of a patient’s tumor, improving treatment selection and patient outcomes.

Technological advancements are making tumor profiling more efficient, precise, and cost-effective. Next-Generation Sequencing (NGS) enables the sequencing of an entire tumor genome, providing a comprehensive understanding of its genetic structure. With awareness of tumor profiling’s benefits continuing to grow, including improved treatment efficacy and reduced side effects, the demand for this technology is expected to increase further.

Technique Insights

Genomics dominated the market, accounting for a share of 38.0% in 2024. Genomic profiling plays a critical role in identifying genetic alterations that drive tumor growth, enabling the development of targeted therapies. The widespread adoption of NGS in the tumor profiling industry has significantly improved the accuracy and efficiency of genomic analysis. With the increasing focus on precision oncology, healthcare providers are leveraging genomic profiling to tailor treatment strategies for individual patients. In addition, regulatory approvals and ongoing research initiatives further support this segment's expansion.

Epigenetics is expected to grow fastest at a CAGR of 13.2% over the forecast period. Epigenetic modifications, such as DNA methylation and histone modifications, provide critical insights into tumor development and progression. Profiling these changes alongside genomic alterations offers a comprehensive understanding of tumor biology, aiding early cancer detection and personalized treatment strategies. The expanding focus on biomarker-driven therapies and advancements in epigenetic sequencing technologies are driving the demand for this segment. With growing research investments and increasing clinical applications, epigenetics is becoming an essential tool in oncology, contributing to the evolving landscape of tumor profiling.

Technology Insights

Sequencing techniques dominated the market, accounting for a share of 30.8% in 2024. These techniques, particularly NGS, transform the tumor profiling industry by enabling rapid and comprehensive genetic analysis. NGS allows researchers and clinicians to identify mutations, gene fusions, and other genetic abnormalities, providing valuable insights for precision oncology. The increasing prevalence of cancer globally and the rising demand for personalized treatment approaches have accelerated the adoption of advanced sequencing technologies. In addition, improvements in sequencing efficiency, automation, and bioinformatics are enhancing the accuracy and accessibility of tumor profiling, further driving segment growth.

Immunohistochemistry (IHC) is expected to grow fastest at a CAGR of 16.3% over the forecast period. This technique enables the detection and localization of specific tumor markers through antigen-antibody interactions, playing a crucial role in cancer diagnosis and classification. Advancements in antibody development and staining technologies have improved the sensitivity and specificity of IHC assays, making them integral to modern oncology. The increasing use of IHC in companion diagnostics to identify patients most likely to benefit from targeted therapies further propels segment growth. With technology continuing to refine IHC applications, its role in tumor characterization and treatment selection is expected to expand.

Application Insights

Personalized cancer medicine dominated the market, accounting for a share of 40.4% in 2024. This approach tailors treatment strategies based on the patient's and the tumor's genetic composition, enabling more precise and effective therapies. By targeting specific mutations within tumors, personalized medicine minimizes damage to healthy cells, leading to fewer side effects and improved patient outcomes. The adoption of personalized cancer treatment is increasing with advancements in sequencing technologies and biomarker identification, which are enhancing the accuracy of tumor profiling. Growing awareness among oncologists and healthcare providers about the benefits of individualized therapy is further driving demand in this segment.

Research is expected to grow at the fastest CAGR of 12.2% over the forecast period. Increased funding from the public and private sectors is fueling advancements in profiling techniques and driving innovation in cancer diagnostics and treatment planning. Researchers are leveraging cutting-edge technologies to explore tumor heterogeneity, identify novel therapeutic targets, and refine precision oncology approaches. Expanding large-scale genomic databases and AI-driven analytics further strengthens research efforts, improving the ability to predict treatment responses. With the focus on translational cancer research continuing to grow, the integration of tumor profiling in experimental studies is expected to accelerate.

Regional Insights

North America tumor profiling market dominated the tumor profiling industry, accounting for a revenue share of 36.7% in 2024. This leadership is driven by the high incidence of cancer, substantial investments in research and development, and the adoption of advanced technologies in the region. The increasing prevalence of cancer has heightened the demand for precise diagnostic and therapeutic solutions, supporting market expansion. Public-private partnerships and significant funding have fostered advancements in proteomics and genomics research. Integrating next-generation sequencing and liquid biopsy technologies into clinical practice has transformed cancer care, enabling personalized treatment approaches and improving patient outcomes. With awareness and accessibility of these advanced profiling techniques continuing to rise, the market is expected to experience sustained growth.

U.S. Tumor Profiling Market Trends

The U.S. tumor profiling market dominated North America with the largest revenue share in 2024, driven by the rising incidence of cancer and advancements in bioinformatics and data analytics that enhance the accuracy and efficiency of tumor profiling tests. According to the American Cancer Society, over 2,041,910 new cancer cases are expected in the U.S. in 2025, contributing to the demand for advanced profiling solutions. The country's strong research infrastructure and ongoing investment in precision oncology further support market expansion.

Asia Pacific Tumor Profiling Market Trends

The Asia Pacific tumor profiling market is expected to register the fastest CAGR of 12.5% during the forecast period. Market expansion is driven by the growing adoption of precision medicine, increasing cancer prevalence, and advancements in genomic and molecular profiling technologies. Countries in the region are investing in healthcare infrastructure and research initiatives to improve early cancer detection and treatment strategies. The rising availability of targeted therapies and government initiatives supporting cancer research further contribute to market growth.

China tumor profiling market dominated the Asia Pacific tumor profiling industry with a revenue share of 31.3% in 2024. Market expansion is driven by the increasing incidence of cancer, rising demand for precision medicine, and advancements in sequencing technologies. Government initiatives supporting cancer research and the integration of artificial intelligence in genomic analysis are further contributing to market growth. In addition, the growing presence of biotechnology firms and research collaborations is enhancing the adoption of tumor profiling solutions in the country.

Middle East & Africa Tumor Profiling Market Trends

The Middle East & Africa tumor profiling market is experiencing growth, driven by the rising burden of cancer, improvements in molecular diagnostics, and increasing access to precision medicine. Efforts to expand genomic research and integrate advanced profiling technologies into clinical practice support market development. In addition, collaborations between healthcare institutions and global research organizations facilitate knowledge exchange and improve diagnostic capabilities. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are investing in healthcare infrastructure and training programs, further contributing to the adoption of tumor profiling solutions in the region.

Key Tumor Profiling Company Insights

Some of the key companies operating in Tumor Profiling are Illumina Inc., QIAGEN, and Exact Sciences Corporation. These companies are expanding their market presence by launching new products, collaborating, and adopting various other strategies.

-

Illumina Inc. provides advanced genomic sequencing solutions that enable precise tumor characterization. The company focuses on NGS technologies, supporting the development of targeted therapies and personalized cancer treatment. Through continuous research, product innovation, and strategic collaborations, Illumina strengthens its role in advancing oncology diagnostics and improving patient outcomes.

-

QIAGEN offers molecular diagnostics and bioinformatics solutions that facilitate precise tumor characterization. The company specializes in sample preparation, PCR, and NGS technologies, enabling comprehensive genomic insights for personalized cancer treatment. Through ongoing innovation, strategic collaborations, and a strong focus on precision medicine, QIAGEN continues to enhance oncology diagnostics and support advancements in cancer research.

Key Tumor Profiling Companies:

The following are the leading companies in the tumor profiling market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina Inc.

- QIAGEN

- Exact Sciences Corporation

- NeoGenomics Laboratories

- Oxford Gene Technology IP Limited

- Bruker Spatial Biology, Inc.

- GenomeDX

- Guardant Health

- Foundation Medicine, Inc.

Recent Developments

-

In August 2024, Illumina received FDA approval for its in vitro diagnostic test, TruSight Oncology Comprehensive. This comprehensive genomic profiling kit assesses over 500 genes and includes pan-cancer companion diagnostic claims, enabling rapid patient matching to targeted therapies.

-

In 2022, QIAGEN launched the therascreen EGFR Plus RGQ PCR Kit, designed to detect the C797S mutation and guide treatment decisions for non-small cell lung cancer (NSCLC). This molecular diagnostic test enhances precision medicine by providing comprehensive insights into EGFR mutation status, supporting targeted therapy selection. By leveraging real-time PCR technology, the kit aids in optimizing treatment strategies and advancing personalized oncology care.

Tumor Profiling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.2 billion

Revenue forecast in 2030

USD 21.7 billion

Growth rate

CAGR of 10.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technique, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Illumina Inc.; QIAGEN; Exact Sciences Corporation; NeoGenomics Laboratories; Oxford Gene Technology IP Limited; Bruker Spatial Biology, Inc.; GenomeDX; Guardant Health; Foundation Medicine, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tumor Profiling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tumor profiling market report based on technique, technology, application, and region:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomics

-

Proteomics

-

Metabolomics

-

Epigenetics

-

-

Technology (Revenue, USD Million, 2018 - 2030)

-

Sequencing Techniques

-

In Situ Hybridization

-

Immunohistochemistry

-

qPCR

-

Microarray

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Personalized Cancer Medicine

-

Oncological Diagnostics

-

Research

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.