- Home

- »

- Organic Chemicals

- »

-

Global Caprolactam Market Size, Analysis, Industry Report, 2012-2022GVR Report cover

![Caprolactam Market Size, Share & Trend Report]()

Caprolactam Market Size, Share & Trend Analysis Report By Application (Nylon 6 Fibers, Nylon 6 Resins), By End-Use (Textile Yarn, Industrial Yarn, Engineering Plastics) And Segment Forecast, 2015-2022

- Report ID: 978-1-68038-498-7

- Number of Pages: 101

- Format: Electronic (PDF)

- Historical Range: 2012 - 2014

- Industry: Bulk Chemicals

Industry Insights

The global caprolactam market size was valued at USD 10.53 billion in 2014. It is expected to expand with a CAGR of 5.2% from 2015 to 2022. The rising demand for plastics in the construction, automotive, and electrical & electronics sectors is projected to be a key driver for the industry over the forecast years.

Superior properties including high strength, elasticity, abrasion resistance, chemical & oil resistance, along with low moisture absorbency of nylon fibers and resins are expected to propel product demand. The growing textile industry, particularly in Asia Pacific, coupled with the upcoming automobile sector, is anticipated to fuel product demand over the forecast years.

Raw materials such cyclohexane, ammonia, and phenol are used in the manufacturing of caprolactam. Raw material production is concentrated in the U.S. and China owing to the presence of numerous oil refineries in the countries. Caprolactam is used in various end-use industries as textile yarn, industrial yarn, engineering plastics, carpet fibers, and staple fibers. Majority manufacturers of caprolactam are integrated across different stages of the value chain as the demand of the product is largely dependent on the need for nylon 6 fibers and resins in various end-use applications. 90% of caprolactam manufactured is used for the manufacturing of nylon 6.

Technological innovations aimed at improving the manufacturing process of caprolactam, in order to minimize the production of ammonium sulfate as it is hazardous to the environment, is likely to have a positive impact on the product demand. Increasing demand for engineering plastics and films in manufacturing various automotive parts including engine covers, gears, and bearings owing to their resistance to oils and greases is expected to drive product growth.

Numerous manufacturers aim to reduce the production of ammonium sulfate as it is hazardous to the environment. Caprolactam is widely used as a monomer for the production of polymers and as an intermediate for the synthesis of chemical substances or chemical intermediates. Caprolactam is registered under various agencies across the globe.

Caprolactam is used in the manufacture of nylon 6 fibers, which is further used in the production of textile fibers, industrial fibers, and carpets. Furthermore, the market is projected to witness significant growth over the forecast years on account of increasing demand for nylon 6 polymers in apparels, sportswear, swimwear, and fashion wear. However, product prices are expected to increase over the forecast period owing to highly volatile raw material prices.

Continuous R&D resulting in technological breakthroughs for cost-effective manufacturing have been key factors responsible for augmenting growth over the past few years. Rising disposable incomes, coupled with increasing penetration of players due to new product launches in China and India, is predicted to promote textile industry growth. Robust textile manufacturing bases in Germany, Italy, France and the UK is expected to augment product growth over the forecast period.

Application Insights

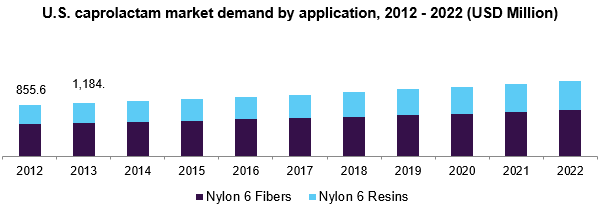

On the basis of application, the market is segmented into Nylon 6 and Nylon 6 resins. Caprolactam produced from ammonia and sulphuric acid and a few other compounds is used in the manufacturing of nylon 6 fibers. Nylon 6 fibers are employed in various applications, including toothbrushes, raincoats, sport wears, bedsheets, curtains, ropes, racket strings, threads, and sleeping bags. This is likely to drive product growth over the forecast years.

Caprolactam is used in the manufacture of nylon 6 fibers which is further used in the production of textile fibers, industrial fibers, and carpets. Furthermore, furthermore, the market is expected to witness significant growth over the next seven years on account of increasing demand for nylon 6 polymers in apparels, sportswear, swimwear, and fashion wear.

The nylon 6 resins segment has gained a significant share of the market over the past few years and is expected to continue this trend over the forecast period. Nylon 6 resins held a share of 55.6% of the global revenue in 2014. In the automotive industry, nylon resins are incorporated in louvers, wheel covers, and other exterior body components. In addition, it is used in the manufacturing of gears, fittings, bearings, fan blades, power steering fluids, and emission control canisters. In automotive application, nylon 6 resin is widely used for designing automotive components. This is projected to have a positive impact on product demand over the forecast period.

End-Use Insights

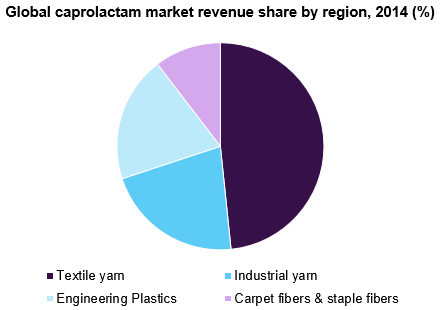

Textile yarn, industrial yarn, engineering plastics, carpet fibers & staple fibers are the key end users of the product. In 2014, the textile yarn segment dominated the market in the global market and held 48.3% of the overall revenue share.

Textile yarn is extensively used in numerous applications including apparel and house furnishing. Increasing demand for textile yarn coupled with the use of nylon 6 fibers in bedspreads, upholstery, curtains, and carpets is expected to have a positive impact on the industry over the next few years.

Nylon fabric in industrial yarn has increasing application scope in the manufacturing of conveyor belts, packaging clothes, ropes, cables, and mechanical rubber goods. Increasing nylon fabrics demand due to properties such as high tensile strength, elasticity, scrub resistance, and heat resistance is expected to have a positive impact on the industry over the forecast period. Increasing demand for nylon fabrics in the rapidly growing automotive industry, particularly in Europe and Asia Pacific, is likely to have a positive impact on the market, which in turn is projected to propel product growth over the forecast years.

Regional Insights

Asia Pacific led the market in 2014 and is expected to continue its dominance over the forecast period. Rapid industrialization leading to establishment of numerous automotive and appliance manufacturing plants, particularly in India and China, is likely to have a positive impact on industry growth over the forecast years. In addition, the increasing demand for passenger cars in India and China, owing to the rise in disposable incomes is expected to further boost product demand.

In addition, increasing demand for lightweight materials in developed regions, including North America and Europe, is expected to have a positive impact on the industry over the next seven years. In the automotive industry, metals are replaced with engineered plastics in lightweight vehicles on account of various properties such as low moisture absorption and high mechanical strength.

The robust manufacturing base of the textile & fabric industry coupled with growing domestic demand in Germany, Italy, France, and the U.K. is expected to augment caprolactam market growth over the forecast period. Increasing disposable income along with the rising penetration of market players through the introduction of new products in China and India is expected to promote textile industry growth. This in turn is expected to have a positive impact on the caprolactam market over the next seven years.

Caprolactam Market Share Insights

The global caprolactam value chain consists of raw material suppliers, manufacturers, distribution channels, and application industries. The market is characterized by integration through raw material supply and through membrane manufacturing stages. The players in the market captively consume these raw materials to manufacture the product.

Companies including Ube Industries, Honeywell, and Toray Industries are engaged in the manufacturing of caprolactam followed by the production of nylon 6 fibers and resins. These companies procure raw materials from suppliers and manufacture caprolactam after which they utilize the product for the manufacturing of nylon 6 which is then sold to end-use industries

Some of the other key companies present in the industry include Sumitomo Chemical Co., Ltd., UBE Industries, Ltd., DSM, Capro Co., China Petrochemical Development Corporation, and LANXESS AG.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."