- Home

- »

- Healthcare IT

- »

-

Clinical Trials Matching Software Market Size Report, 2030GVR Report cover

![Clinical Trials Matching Software Market Size, Share & Trends Report]()

Clinical Trials Matching Software Market Size, Share & Trends Analysis Report By Deployment Mode (Web & Cloud-based, On-premise), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-921-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global clinical trials matching software market size was estimated at USD 148.5 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.2% from 2023 to 2030. Clinical trials are regularly carried out by pharmaceutical producers, biotechnology businesses, clinical research organizations (CROs), and medical device producers to evaluate the safety and effectiveness of innovative drugs, diagnostics, and therapies. The rising prevalence of chronic diseases and the growing need for clinical trials are expected to contribute to the market growth. Clinical trials are increasingly conducted in developing regions as the availability of patient recruitment and matching is a crucial part of clinical trials.

The digitization of research is also opening the door for market expansion. Incorporating sophisticated technology such as Electronic Data Capture (EDC), and clinical trials management systems assist market players in maintaining patient data and lowering monitoring expenses. Hence, clinical trial matching software can be crucial in conducting trials and improving the efficiency of the process. Regulatory authorities such as the European Medicines Agency (EMA), U.S. FDA, China’s National Medical Products Administration, and the National Institutes of Health (NIH) have released a framework for the conduct of clinical studies during the pandemic, which fully supports virtual trials. This acceptance by regulatory authorities and pharmaceutical companies is anticipated to fuel the growth of the patient matching software market.

The COVID-19 pandemic had a significant impact, particularly on the hospitals, due to the patient load and the danger of viral propagation. To counteract the virus's transmission among doctors, hospital workers, and patients, healthcare facilities have altered the execution of clinical trials. The restrictions and limitations impacted a number of ongoing clinical studies in various therapeutic areas. To overcome the adverse situation, researchers created novel COVID-19 vaccines. The growing demand for services from the CROs to perform clinical trials in the pharmaceutical industry is driving the growth of the market.

In clinical trials, patient matching is an essential factor as trials are performed on humans and the right candidate match can save the time of the sponsors, thereby leading to optimal results. A lot of pharmaceutical companies, research organizations, and hospitals are shifting towards virtual or remote trials. These trials do not require traveling to sites and the process is conducted online. Hence, the future of clinical trials lies in clinical trial management systems and patient matching software. These automated systems eliminate the need for human intervention, hence contributing to the growing demand for patient matching software.

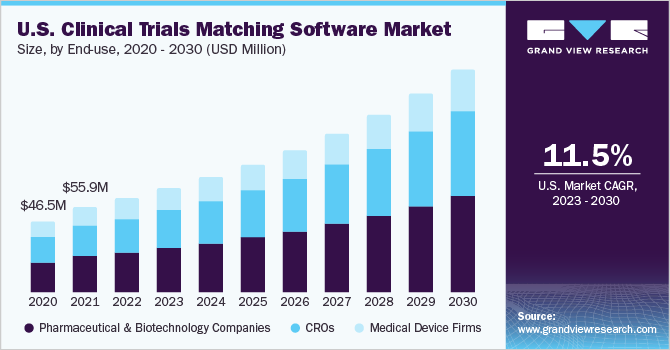

End-use Insights

Based on end-use, the market is segmented into pharmaceutical & biotechnology, CROs, and medical device firms. The pharmaceutical and biotechnology companies segment accounted for the largest revenue share in 2022 because of the enormous number of clinical trials required for product introductions. For instance, in the U.S., the FDA’s Center for Evaluation and Research (CDER) requires drug companies to test their drug for safety and effectiveness and send evidence to the center before selling it in the country. The evaluation helps in assessing the benefits and risks associated with the drugs.

The CRO segment is expected to register the fastest CAGR over the forecast period. CROs offer drug development through commercialization, pharmacovigilance, and post-approval services to manufacturing organizations with low R&D budgets. A sponsor (the entity wishing to research the safety and efficacy of the products) contracts a CRO, a project-by-project basis for clinical trials. Organizations that are unable to afford to conduct extensive clinical trials prefer to outsource these services. Hence, the demand for CROs is growing rapidly.

Finding the proper match for patients can be challenging and time-consuming during clinical studies. Patients are recruited after screening or locating potential participants who meet the requirements, taking into account all aspects of the studies, confirming awareness, and obtaining informed consent to participate.It is vital to recruit people who meet the eligibility standards, which is why trial matching technology has been shown to be helpful. The program not only helps to identify the correct match but also helps to reduce R&D-related costs, enabling smoother operations without human interference. To improve their market position, software suppliers are developing new, cutting-edge methods. For instance, the CTMA increased the availability of CT-SCOUT technology in rheumatology in February 2022.

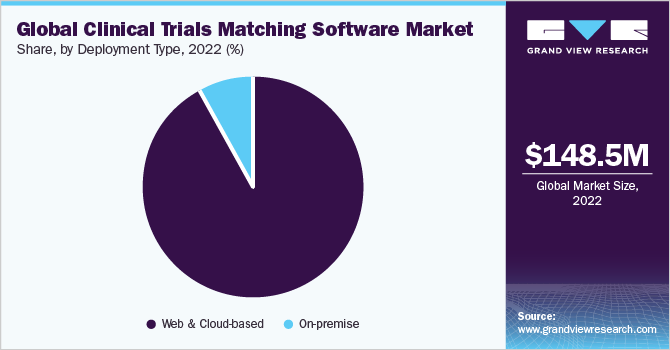

Deployment Mode Insights

Based on deployment mode, the market is segmented into web & cloud-based and on-premises software. The web & cloud segment accounted for the largest revenue share of 92.3% in 2022 and is expected to grow at the fastest CAGR of 13.4% over the forecast period owing to the cloud computing model, which is easy to maintain with no upkeep expenditures. As in-house server infrastructure is not required, development costs are reduced. The integration time is significantly reduced, and it may be accessed from any location. Data sharing is convenient and allows collaboration on different projects.

The on-premises model requires in-house infrastructure, software licensing, IT support, and lengthier integration times. Therefore, this model is costlier and less preferred. On the other hand, organizations with highly confidential data, including government and financial institutions, require an on-premises environment's security and privacy.

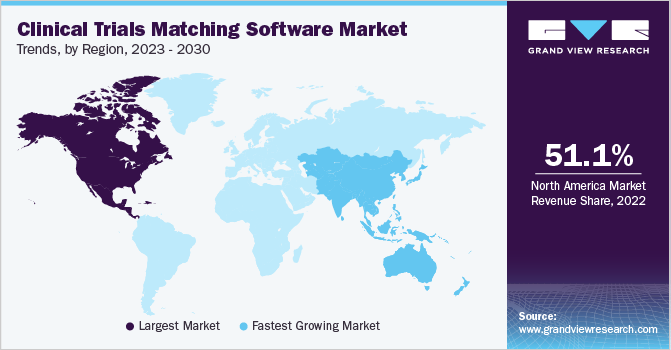

Regional Insights

North America dominated the market and accounted for the largest revenue share of 51.08% in 2022 owing to the growth in the adoption of clinical trials matching software by pharmaceutical and biotechnology companies in the U.S. Moreover, the region has a strong and well-established pharmaceutical industry and many companies are investing in the development of clinical trials matching software, which is driving the growth of the market. In addition, the regulatory environment is favorable to the development and commercialization of clinical trial matching software. Various initiatives relating to IT and AI-based solutions and the higher adoption of CTMS, and patient matching software are contributing to the market growth in the region.

Asia Pacific is expected to grow at the fastest CAGR of 17.3% over the forecast period owing to the availability of a large patient pool in the region, enabling easier patient recruitment procedures. A large number of organizations are aiming to set up their R&D activities in the Asia Pacific, contributing to the market growth in the region. This growth can be attributed to the increase in the number of IT healthcare projects, the booming economy, and overall improving healthcare infrastructure, especially in developing Asian countries, such as China and India.

Key Companies & Market Share Insights

The supportive government initiatives and rapidly evolving technology are further encouraging the market players to focus significantly on the new features and develop innovative products. In addition, rapid growth in the number of companies offering updated features, which can be customized, is contributing to the growth of the market in healthcare.

In the coming years, manufacturers and software providers are most likely to rely on mergers, collaborations, partnerships, and acquisitions to strengthen their market positions. For instance, in December 2021, Optimapharm, a leading European clinical research organization, acquired SSS International. This acquisition helped the company in widening its portfolio of clinical research studies. Some prominent players in the global clinical trials matching software market include:

-

IBM Clinical development

-

Antidote Technologies, Inc.

-

Clinical Trials Mobile Application

-

SSS International Clinical Research

-

Advarra

-

Aris Global

Clinical Trials Matching Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 166.5 million

Revenue forecast in 2030

USD 396.1 million

Growth rate

CAGR of 13.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

IBM Clinical development; Antidote Technologies, Inc.; Clinical Trials Mobile Application; SSS International Clinical Research; Advarra; Aris Global

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

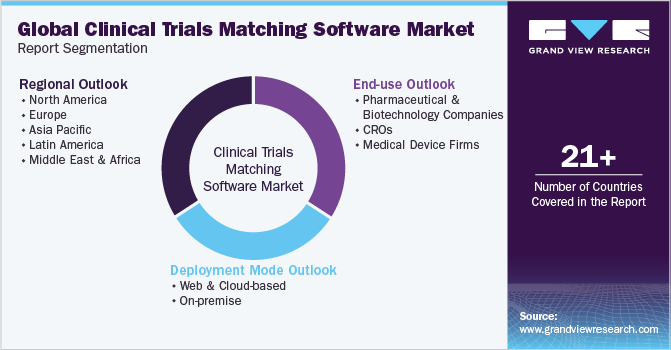

Global Clinical Trials Matching Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trials matching software market report based on deployment mode, end-use, and region:

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web & Cloud-based

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs

-

Medical Device Firms

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials matching software market size was estimated at USD 148.5 million in 2022 and is expected to reach USD 166.5 million in 2023.

b. The global clinical trials matching software market is expected to grow at a compound annual growth rate of 13.2% from 2023 to 2030 to reach USD 396.1 million by 2030.

b. North America dominated the clinical trials matching software market with a share of over 51.0% in 2022. This is attributable to the adoption of clinical trial matching software by pharmaceutical and biotechnology companies in the U.S. In addition, the supportive government initiatives toward IT and AI-based solutions along with the higher adoption of CTMS and patient matching software are contributing to the market growth in the region.

b. Some key players operating in the clinical trials matching software market include IBM Clinical development, Antidote Technologies, Inc., Clinical Trials Mobile Application, SSS International Clinical Research, Advarra, and Aris Global, among others.

b. Key factors that are driving the clinical trials matching software market growth include the rising prevalence of chronic diseases and the growing need for clinical trials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."