- Home

- »

- Homecare & Decor

- »

-

Coin-operated Laundries Market Size & Share Report, 2030GVR Report cover

![Coin-operated Laundries Market Size, Share & Trends Report]()

Coin-operated Laundries Market Size, Share & Trends Analysis Report By End-user (Residential, Commercial), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-914-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

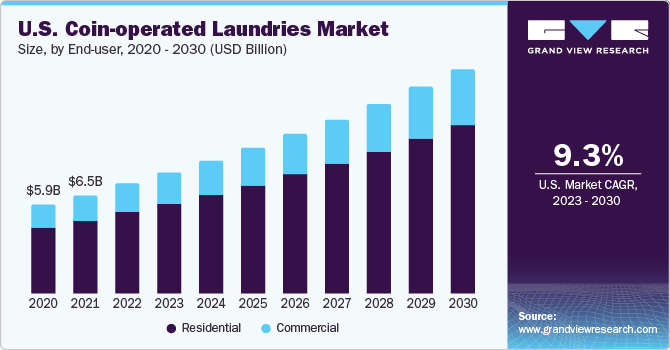

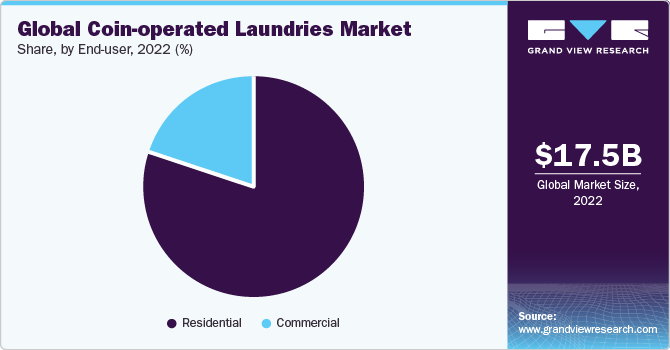

The global coin-operated laundries market size was valued at USD 17.55 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. Laundry is time-consuming and has become a burden for people, especially the working-class population. Time constraints due to increasing work pressure and hours restrict people from often doing their laundry. The working-class population has significantly increased over the past few years, contributing to the rising demand for coin-operated laundries due to their convenience. The rapidly increasing working women population worldwide mainly drives market expansion.

Key consumers of these services include millennials, college graduates, and working professionals. Additionally, boarding schools, colleges, and hostels are some of the other potential customers for online service providers. Laundry services in developing countries, such as India and South Africa, are primarily catered by the unorganized sector. Improvements in the standard of living and rising disposable income levels in such economies are expected to drive the market during the forecast period.

Moreover, increasing internet penetration in developing countries, such as India and China, has driven the market for online services. With the rising number of double-income households, the purchase of expensive and delicate fabric apparel has increased. Thus, the abovementioned factors are expected to drive industry expansion over the coming years.

With improving living standards globally, millennials and the working class are becoming more health-conscious. Selectiveness with regards to apparel, household linen, and furniture has increased greatly. Customers prefer buying and wearing more expensive, clean, and well-ironed apparel. Over the past few years, spending on clothes has significantly increased, raising the demand for laundry services. Although conventional coin-operated laundries are available globally, they have limited applications, which has created new avenues for coin-operated laundries.

The younger population, millennials, and the working class are attracted to these coin-operated laundries owing to their highly convenient features, such as round-the-clock service, doorstep pickup and delivery, and complete service within 24 hrs. Moreover, service providers offer heavy discounts to customers, especially during the first service. These benefits are increasing the adoption of coin-operated laundries.

End-user Insights

The residential segment dominated the market with the largest revenue share of 80.1% in 2022 and is further expected to register the fastest CAGR of 9.5% over the forecast period. This high share is attributable to the increasing consumer preference for professional cleaning due to rising health concerns about personal hygiene and cleanliness. In addition, the rising number of nuclear families is an advantage for the global market, as there are fewer family members, and online laundry services are more economical than buying and using washing machines at home.

An increasing percentage of the millennial population has started availing online laundry services owing to a rise in their disposable income levels and convenience associated with the use of online services. The rapidly rising demand can be attributed to the steadily growing electricity costs, time constraints in the case of working couples, and the increasing trend of apartment-style living.

The commercial segment is expected to grow significantly over the forecast period. An increase in the number of hotels and hospitals is expected to provide growth opportunities to the commercial segment in the coming years. Service providers offer free pickup and doorstep delivery, positively influencing the segment. Doorstep delivery of clothes not only saves time but also additional costs, if any. Moreover, such services save the cost required to maintain washing machines. It reduces human efforts, thus driving the coin-operated laundries market demand over the forecast period.

Regional Insights

North America accounted for the largest market share of 45.1% in 2022. This is attributable to the region's growing population of health-conscious consumers, which has significantly increased the utilization of laundry services. The increasing preference for fragrantly laundered clothes, particularly in developed economies, has increased the demand for fragrant cleaning products.

The increasing number of commercial facilities that use online laundry services, especially in the U.S. and Canada, contributes to the region's market growth. Moreover, the local presence of key global players related to coin-operated laundries and increasing collaborations and partnerships between companies and hotels is expected to favor the market in the coming years.

On the other hand, Asia Pacific is projected to witness the fastest CAGR of 10.6% over the forecast period, owing to improving economic stability and living standards in developing economies such as India, China, and Indonesia. These factors are expected to propel the demand for online laundry services over the forecast period. Asia Pacific is one of the most lucrative regions for online laundry services, owing to the rapidly growing middle-class and millennial demographics.

Key Companies & Market Share Insights

The market is highly competitive and players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, Cintas Corporation is the creator of the "Total Clean Program," a comprehensive service offering that encompasses three essential components: the provision of necessary cleaning supplies, hygienic laundering services, and on-site ultraclean solutions. This program aims to provide customers with a holistic approach to cleaning and maintaining cleanliness in their facilities.

Key Coin-Operated Laundries Companies:

- Elis

- Aramark

- Cintas Corporation

- UniFirst Corporation

- Johnson Service Group PLC

- Franz Haniel & Cie. GmbH

- Spotless

- Bel & Blanc

- Champion Cleaners

- Easylifelaundry.com

Recent Developments

-

In May 2023, Dinobi Detergent, a Chicago-based plant-based laundry product manufacturer, launched Dirty Laundry, an innovative pop-up laundromat project. The new laundromat, which has 37 coin-operated washers and dryers, will provide wash and fold services every day from 9 a.m. to 7 p.m. Dirty Laundry also intends to offer a varied selection of arts and entertainment activities weekly, such as podcast recordings, live music performances, and creative maker workshops

-

In March 2023, HappyNest, a tech-enabled laundry pickup and delivery service, announced the availability of its services in new locations across five U.S. states, including New York, California, Arizona, Florida, and Texas. HappyNest's extensive expansion throughout the country and its industry expertise have made it a preferred partner for many firms, allowing them to offer communities the convenience of pickup and delivery laundry services

-

In January 2023, dobiQueen, an innovative self-service laundry provider in Malaysia, launched an unprecedented "6-Hour Laundry Pick-Up." This offering is the first of its kind in the country, enabling customers to conveniently schedule their laundry to be collected, cleaned, and promptly returned to them within a short six-hour timeframe

-

In October 2022, DBA Tumble, a smart laundry technology platform, secured USD 7 million in seed funding that was led by Hivers & Strivers Capital to revolutionize the shared laundry experience and convert traditional machines into profitable assets. The funding will support the expansion of its proprietary software platform, enabling a fully digital laundry experience encompassing cashless payment, cycle tracking, and enhanced machine security. Tumble aims to extend its services nationwide, catering to rental properties and residents, with plans to introduce a new pickup and delivery service for consumers in the near future

Coin-operated Laundries Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.20 billion

Revenue forecast in 2030

USD 35.84 billion

Growth Rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Elis; Aramark; Cintas Corporation; UniFirst Corporation; Johnson Service Group PLC; Franz Haniel & Cie. GmbH; Spotless; Bel & Blanc; Champion Cleaners; Easylifelaundry.com

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coin-operated Laundries Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global coin-operated laundries market report on the basis of end-user and region:

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global coin-operated laundries market size was estimated at USD 17.55 billion in 2022 and is expected to reach USD 19.20 billion in 2023.

b. The global coin-operated laundries market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 35.84 billion by 2030.

b. North America region dominated the coin-operated laundries market with a share of over 45.0% in 2022. This is attributable to the high demand of consumers to avail of convenient services, especially among the working professionals.

b. Some key players operating in the coin-operated laundries market include Elis SA, Aramark, Cintas Corp., UniFirst Corp., Johnson Service Group, Franz Haniel & Cie. GmbH., Spotless Group Holdings Limited., and others.

b. Key factors that are driving the market growth include high demand from a wide range of hotels, hospitals, restaurants, and other such businesses and the availability of new product development and outlets for convenient laundry for the consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."