- Home

- »

- Communications Infrastructure

- »

-

Data Center Transfer Switches And Switchgears Market Size Report, 2030GVR Report cover

![Data Center Transfer Switches and Switchgears Market Size, Share & Trends Report]()

Data Center Transfer Switches and Switchgears Market Size, Share & Trends Analysis Report By Transfer Switch, By Switchgear (Low Voltage, Medium Voltage), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-712-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

The global data center transfer switches and switchgears market size was valued at USD 3.01 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. The rapid expansion of data centers, the growing need for uninterrupted power supply, and the rising emphasis on energy efficiency and sustainability drive market growth. As data centers continue to increase globally, fueled by the surging demand for cloud computing, big data analytics, and digital services, there is an increasing need for reliable and resilient power infrastructure.

The growing complexity of data center operations is another significant factor. As data centers diversify their services, integrating various IT workloads such as artificial intelligence (AI), machine learning, and high-performance computing (HPC), the power requirements become more intricate. Managing this complexity demands advanced transfer switches and switchgears capable of handling varying loads, offering redundancy, and supporting flexible power distribution strategies.

Cybersecurity concerns also influence the demand for transfer switches and switchgears in data centers. As the risk of cyberattacks on critical infrastructure increases, data center operators invest in more secure and resilient power management systems. Modern switchgear solutions often incorporate features such as real-time monitoring, automated fault detection, and enhanced protection against power surges and disturbances, all essential for safeguarding sensitive data and maintaining uptime in the face of potential cyber threats.

The growing focus on energy efficiency and sustainability within the data center industry further drives the market. As data centers are major consumers of electricity, operators are seeking to implement technologies that optimize power usage and reduce carbon footprints. Modern transfer switches and switchgears are designed to enhance power distribution efficiency and reduce energy losses, aligning with the broader industry trend toward greener operations. Additionally, many data centers are integrating renewable energy sources into their power systems, necessitating advanced switchgear solutions that manage diverse and fluctuating power inputs.

Transfer Switch Insights

The static transfer switches segment held the largest market revenue share of 38.3% in 2023. Static transfer switches offer rapid and seamless transfer of electrical loads between power sources without interruption, which is critical for maintaining data center uptime. As data centers expand and handle more critical applications, minimizing downtime becomes more pressing, and static transfer switches provide an efficient solution. Additionally, the growing adoption of cloud computing, big data analytics, and edge computing further fuels the demand for static transfer switches, as these technologies require uninterrupted power supply to maintain operational continuity.

The service entrance transfer switches segment is projected to grow at the fastest CAGR during the forecast period. The demand for service entrance transfer switches is rising due to the need for reliable power continuity and enhanced safety measures. As data centers expand to accommodate the growing volume of digital data and services, minimizing downtime during power disruptions has become paramount. Service entrance transfer switches play a crucial role in ensuring a seamless transition between power sources, from the grid to backup generators, while protecting against electrical faults. The growing emphasis on energy efficiency and compliance with regulatory standards further drives the adoption of these switches in data centers, as they help maintain operational integrity and reduce the risk of costly outages.

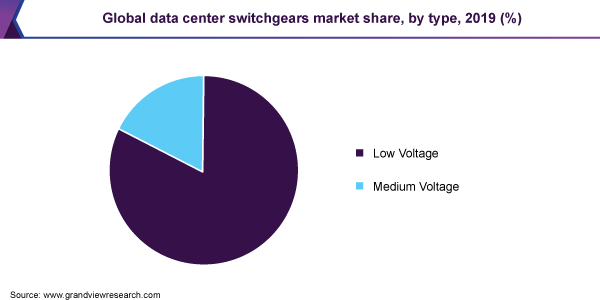

Switchgear Insights

The low-voltage power control system segment held the largest market revenue share in 2023. The demand for the low-voltage power control system segment is increasing due to the growing need for energy efficiency and reliability in data centers. As data centers expand to handle larger volumes of data and more complex computing tasks, they require more sophisticated power control systems to manage and distribute electricity efficiently. Low-voltage power control systems ensure data centers operate with minimal energy loss and maximum uptime. Additionally, the trend towards green data centers, which focus on reducing environmental impact through energy-efficient solutions, further drives the adoption of low-voltage systems.

The medium-voltage power control system segment is projected to grow at the fastest CAGR over the forecast period. The increasing demand for medium voltage power control systems can be attributed to modern data centers' rising complexity and scale. As data centers expand to accommodate growing data processing and storage needs, they require more robust and efficient power distribution systems to ensure operational reliability. Medium voltage systems offer higher power control and distribution efficiency, which is essential for managing large-scale data center operations. Additionally, these systems support the integration of renewable energy sources and provide better fault tolerance, reducing downtime risks and making them a preferred choice in data center infrastructure.

Regional Insights

North America dominated the market accounting for a market revenue share of 36.5% in 2023. The rapid growth of data centers drives the increasing demand due to the rise in cloud computing, the proliferation of internet services, and the expansion of IoT devices. As businesses and consumers require more data storage and processing capabilities, reliable power infrastructure becomes critical to prevent downtime and ensure continuous operations. Additionally, the region's focus on energy efficiency and adopting renewable energy sources further fuels the demand for advanced switchgear technologies that manage diverse power inputs. Regulatory requirements for power reliability and safety also contribute to this growth, encouraging data center operators to invest in high-quality transfer switches and switchgears.

U.S. Data Center Transfer Switches and Switchgears Market Insights

The U.S. held the largest market revenue share regionally in 2023. The growing emphasis on data security and regulatory compliance in finance, healthcare, and government sectors pushes organizations to invest in more reliable power infrastructure to avoid data breaches and downtime. Additionally, the trend toward energy efficiency and sustainability in data center operations leads to the adoption of advanced switchgear solutions that reduce energy consumption and improve operational efficiency. Lastly, the increasing frequency of extreme weather events in the U.S. is prompting data centers to enhance their resilience through better power protection, contributing to the demand for these critical components.

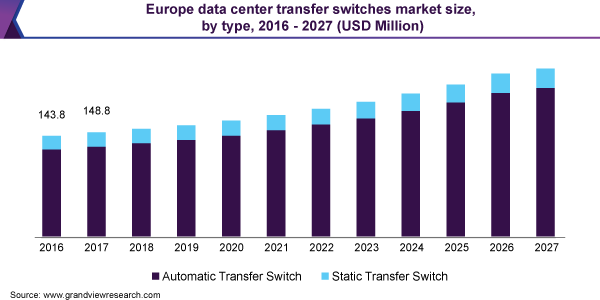

Europe Data Center Transfer Switches and Switchgears Market Insights

Europe market is anticipated to grow significantly in the forecast period. The region's expanding data center infrastructure and the push towards energy efficiency and reliability drive market growth. With the rise of digital services, cloud computing, and data-intensive applications, European data centers are under pressure to maintain uninterrupted operations. Additionally, the European Union's stringent regulations on energy efficiency and carbon emissions encourage data centers to upgrade their power distribution systems, further boosting the demand for advanced transfer switches and switchgears in the region.

The UK market is projected to grow significantly over the forecast period. The rise in cloud computing, digital transformation initiatives, and the growing need for data storage and processing capabilities drive market growth. The UK's strategic focus on becoming a digital hub and government initiatives to support digital infrastructure has accelerated the construction of regional data centers. Additionally, the push for sustainable energy solutions and the need for reliable power supply in data centers have emphasized the importance of efficient power management systems, including transfer switches and switchgears.

Asia Pacific Data Center Transfer Switches and Switchgears Market Insights

The Asia Pacific market is expected to grow at the fastest CAGR over the forecast period. The rapid expansion of data centers is driven by increasing digitalization, cloud adoption, and the growth of the IT and telecom sectors, which fuels the market demand. Countries such as China and India are witnessing a surge in internet usage and data consumption, leading to the construction of more data centers. Additionally, the region's focus on industrial automation and the rising adoption of 5G technology further necessitate reliable power management solutions, such as transfer switches and switchgears, to ensure uninterrupted operations and enhance energy efficiency in these data centers.

India market is projected to grow rapidly over the forecast period. The rapid growth of the country's digital economy and the ongoing expansion of data center infrastructure drive the market growth. With the rise of cloud computing, e-commerce, and digital services, companies are investing in robust data centers to handle the surge in data traffic. Additionally, government initiatives such as "Digital India" and the growing emphasis on data localization have spurred the establishment of new data centers nationwide. Furthermore, the increasing frequency of power outages and fluctuations in various regions of India necessitates reliable power management solutions, further driving the demand for these technologies.

Key Companies and Market Share Insights

Some key companies in the data center transfer switches and switchgears market include Legrand; Siemens; GE Grid Solutions, LLC; Titan Power, Inc.; Schneider Electric.

-

Caterpillar's power solutions assist data centers in meeting uptime goals at numerous facilities globally. Caterpillar provides diesel and gas generator sets that are efficient and have high power densities. These sets are equipped with automatic transfer switches (ATS) and switchgear that are customized for data centers' continuous, standby, and temporary power needs.

-

GE Grid Solutions, LLC provides Zenith STS-3 and STS-1 series which are transfer switches that ensure smooth power transfer between sources, increasing the dependability of essential infrastructure. Furthermore, GE provides a wide range of solutions such as UPS systems, power distribution units, and busway systems to facilitate the effective functioning of data centers.

Key Data Center Transfer Switches and Switchgears Companies:

The following are the leading companies in the data center transfer switches and switchgears market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Caterpillar

- Cummins Inc

- Eaton

- Emerson Electric Co.

- Legrand

- Siemens

- GE Grid Solutions, LLC

- Titan Power, Inc.

- Schneider Electric

Recent Developments

- In March 2023, Cummins announced the launch of a new line of UL1008-listed transfer switches designed to enhance reliability and safety in power transfer applications. These switches aim to ensure a seamless transition between power sources in critical operations, such as hospitals and data centers.

Data Center Transfer Switches and Switchgears Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.20 billion

Revenue forecast in 2030

USD 5.42 billion

Growth Rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transfer Switch, Switchgear, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB; Caterpillar; Cummins Inc; Eaton; Emerson Electric Co.; Legrand; Siemens; GE Grid Solutions, LLC; Titan Power, Inc.; Schneider Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Transfer Switches and Switchgears Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center transfer switches and switchgears market report based on transfer switch, switchgear, and region.

-

Data Center Transfer Switches and Switchgears Market Transfer Switch Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Transfer Switches

-

Automatic Transfer Switches

-

Bypass Isolation Transfer Switches

-

Service Entrance Transfer Switches

-

-

Data Center Transfer Switches and Switchgears Market Switchgear Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage Power Control System

-

Medium Voltage Power Control System

-

-

Data Center Transfer Switches and Switchgears Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."