- Home

- »

- Consumer F&B

- »

-

Fast Food & Quick Service Restaurant Market Report, 2027GVR Report cover

![Fast Food & Quick Service Restaurant Market Size, Share & Trends Report]()

Fast Food & Quick Service Restaurant Market Size, Share & Trends Analysis Report By Type (Chain, Independent), By Cuisine (American, Turkish & Lebanese), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-523-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global fast food and quick service restaurant market size was valued at USD 257.19 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2020 to 2027. The market growth is assisted by increasing preference for fast food among generation X, Y, and Z across the globe. The fast food industry size was valued at over USD 500 billion in 2019. Quick service restaurants and fast food restaurants have evolved as a major provider of this mass-produced food, which has been attracting an increasing number of people towards experiencing and enjoying their services. Convenience, good taste, and economical in terms of both time and money are some of the crucial factors acting in favor of the market for fast food and quick service restaurant.

The fast food and quick service restaurant industry has evolved to encompass the changing needs of its customers in its business model. Most of the quick service restaurants, along with offering sit and dine also offer numerous other services, including take-out, drive-thru, and home delivery, which are well suited to the modern lifestyle. This has also helped the restaurant business in maximizing benefits. The delivery trend has been further propelled by third party delivery services, such as DoorDash, Foodler and Grubhub, which have extended the courtesy of distributing food at odd hours too. Thus, customers who prefer dining at home contribute a major chunk of revenue for the fast food and quick service restaurant industry.

Health-related concerns over increasing fast food consumption have obligated most fast food producers to create healthier fast food products. Most restaurants have been updating their menus and recipes to create healthier fast food options. A large number of fast-food items show dominance of fruits and vegetables over processed meat, which is considered to be unhealthy. Along with healthy eating habits, vegetarianism and veganism are also influencing the changes in the menu. Rising inclusion of plant-based products in the menu is a major trend, which along with catering to niche customer demands also helps in creating a sustainability-focused image.

Technology has also played a crucial role in supporting the market growth. Touchscreen point of sales terminals, self-order kiosks, and kitchen-display screens are among many other technologies that are helping in restructuring the industry operations. Deployment of self-order kiosks has been increasing in number in various restaurants. These help in meeting diners’ expectations through top-notch digital experience and easy-to-use interfaces. Furthermore, these give customers a quick and easy opportunity to be selective about their orders by allowing multiple reviews and customizations. Besides assisting the customers, the kiosks also help in increasing the average check size and order volume and shortening the queue.

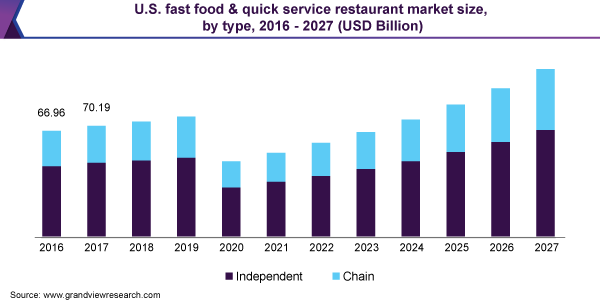

Type Insights

Independent fast food and quick service restaurant dominated the market and accounted for more than 65.0% share of the global revenue in 2019. The category includes restaurants with four or fewer branches or subsidiaries with the same name and of the same type. The growth is attributed to the fact these restaurants serve fast food that is more inclined to the local taste and cuisine. The local flavors are much more familiar among local people, and thus standalone quick service restaurants enjoy a wider penetration among the common mass. Dish Society is a Houston-based fast food restaurant that operates through two units. The restaurant offers toasts, tacos, sandwiches, salads, crackers, cakes, cookies, and biscuits and is focused on offering meals for half the cost.

Chain fast food and quick service restaurant is expected to register the fastest CAGR of 5.9% from 2020 to 2027. The segment includes restaurants with five or more branches or subsidiaries with the same name and of the same type. Some of the most popular restaurant chains operating globally are Subway, McDonald's, Starbucks, KFC, Burger King, Pizza Hut, Domino’s, Dunkin’, Baskin-Robbins, Hunt Brothers Pizza, Wendy’s, and Taco Bells. Adaptation of menu based on the countries that these restaurants have been entering has been a crucial strategy motivating the global success of these restaurant chains.

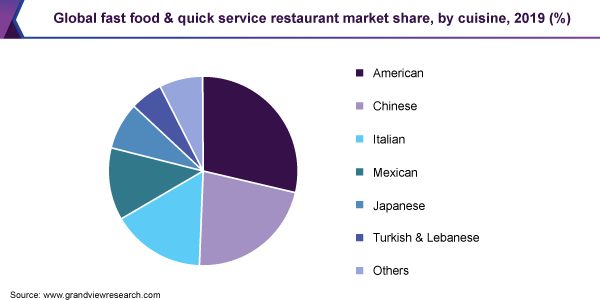

Cuisine Insights

American cuisine led the market and accounted for more than 25.0% share of the global revenue in 2019. The category includes restaurants serving a variety of burgers, pop-corns, fries, frozen dairy desserts, wraps, doughnuts, toasts, nuggets, sandwiches, sliders, coleslaw, potato wedges, chicken fries, corn dogs, chicken fingers, cinnamon rolls, biscuits, cakes, muffins, and sweet flavored drinks. The industrial process, fast-paced lifestyle, development of franchises, and efficiency in production are some of the factors playing a vital role in widening the scope of American cuisine.

Turkish and Lebanese cuisine is expected to register the fastest CAGR of 6.4% from 2020 to 2027. The category includes restaurants serving açma, ayvalik tostu, balik ekmek, börek, döner, dürüm, gözleme, kebap, kestane, kokoreç, kol böregi, kumpir, kürt böregi, lahmacun, midye dolma, misir, pide, pogaca, simit, sosisli, taksim hamburger, tantuni, tavuk pilav, tost, and shawarma. Growing popularity of the cuisine has given opportunities to various restaurant companies offering Turkish and Lebanese fast food to open new branches across borders.

Regional Insights

North America held the largest share of over 40.0% in 2019. Different types of fast food have been popular in the U.S., Canada, and Mexico. According to a report released by the Center for Disease Control & Prevention, from 2013 to 2016, 36.6% of adults consumed fast food on any given day. 44.9% of the fast-food consumers are aged between 20 and 39, 37.7% are aged between 40 and 59, and 24.1% are aged 60 and above. It was concluded that the consumption of fast food reduced with age. It was also noticed that a greater number of men consumed fast food in comparison to women.

Asia Pacific is the fastest growing regional market with a CAGR of 6.2% from 2020 to 2027. The region has a wide penetration of both local as well as foreign fast food restaurant chains. McDonald’s, Burger King, and KFC are some of the most popular American restaurant chains in the region. Some of the domestic fast-food restaurants in the region are Trung Nguyen Coffee in Vietnam; Kebab Turki Baba Raffi in Indonesia; Café Amazon in Thailand; and Jollibee Foods in the Philippines.

Key Companies & Market Share Insights

Some of the key market players are Quality Is Our Recipe, LLC; Carrols Restaurant Group, Inc.; Yum! Brands; Darden Concepts, Inc.; McDonald's; Ark Restaurant Corp.; DEL TACO RESTAURANT, INC.; Restaurant Brands International Inc.; Kotipizza Group Oyj; Chipotle Mexican Grill; DD IP Holder LLC; and JACK IN THE BOX INC.

Fast foods have evolved as cuisine for all occasions. For instance, in March 2019, White House hosted a lunch meal for the North Dakota State Bison football team where the food was from McDonald's and Chick-Fil-A. Items like Big Macs and fried chicken sandwiches and sauce were on the menu.

Recent Development

- In September 2021, Yum! Brands, Inc. acquired Dragontail Systems Limited (Dragontail) to widen its global order management and delivery capability, and integrate the latest technology talent within its organization

Fast Food & Quick Service Restaurant Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 163.16 billion

Revenue forecast in 2027

USD 383.81 billion

Growth Rate

CAGR of 5.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Cuisine, and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., U.K., Germany, China, Japan, Brazil, Saudi Arabia

Key companies profiled

Quality Is Our Recipe, LLC; Carrols Restaurant Group, Inc.; Yum! Brands; Darden Concepts, Inc.; McDonald's; Ark Restaurant Corp.; DEL TACO RESTAURANT, INC.; Restaurant Brands International Inc.; Kotipizza Group Oyj; Chipotle Mexican Grill; DD IP Holder LLC; and JACK IN THE BOX INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global fast food and quick service restaurant market report on the basis of type, cuisine, and region:

-

Type Outlook (Revenue, USD Billion, 2016 - 2027)

-

Chain

-

Independent

-

-

Cuisine Outlook (Revenue, USD Billion, 2016 - 2027)

-

American

-

Chinese

-

Italian

-

Mexican

-

Japanese

-

Turkish & Lebanese

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fast food and quick service restaurant market size was estimated at USD 257.19 billion in 2019 and is expected to reach USD 163.16 billion in 2020.

b. The global fast food and quick service restaurant market is expected to grow at a compound annual growth rate of 5.1% from 2020 to 2027 to reach USD 383.81 billion by 2027.

b. North America dominated the fast food and quick service restaurant market with a share of 44.3% in 2019. This is attributed to the presence of large number of fast food restaurants in the U.S. and Canada.

b. Some key players operating in the fast food and quick service restaurant market include AM.D.Q. CORP, CKE Restaurants Holdings, Inc., DD IP Holder LLC, Del Taco Holdings, Inc., Doctor's Associates, Inc., Hunt Brothers Pizza, LLC., Jubilant FoodWorks Ltd., McDonald's, Papa John's International, Inc., Quality Is Our Recipe, LLC, Restaurant Brands International Inc., Sonic Corp., Starbucks Coffee Company and Yum! Brands.

b. Key factors driving the fast food and quick service restaurant market growth include the increasing preference for fast food among generation X, Y & Z across the globe along with the increasing spending by restaurants on new food items in breakfast menu.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."