- Home

- »

- Renewable Chemicals

- »

-

Global Fatty Alcohol Market Trends Report, Industry Analysis, 2022GVR Report cover

![Fatty Alcohol Market Size, Share & Trends Report]()

Fatty Alcohol Market Size, Share & Trends Analysis By Product (C6-C10, C11-C14, C15-C22), By Application (Soaps & Detergents, Personal Care, Lubricants, Amines), By Region, And Segment Forecasts, 2015 - 2022

- Report ID: 978-1-68038-436-9

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2012-2013

- Industry: Specialty & Chemicals

Industry Insights

The global fatty alcohol market demand was 2,345.8 kilotons in 2014. It is projected to expand at a CAGR of 4.3% from 2015 to 2022. Growing demand for biodegradable and sustainable products on account of reducing petrochemical dependence is expected to remain a key driving factor for global fatty alcohol industry. Volatile price of petrochemical derived products on account of supply-demand imbalances raise concerns for global chemical industry which has prompted this shift towards bio-based chemicals industries.

Increasing concerns regarding the effect of petrochemicals on environment has prompted the use of bio-based, sustainable chemicals. In order to reduce reliance on petrochemicals and to decrease carbon footprint, industry has shifted their focus towards development of biodegradable products and base chemicals through bio-based raw materials. Regulations from agencies such as REACH regarding the environmental hazards associated with petrochemical-based products are expected to support the trend.

Fatty alcohols are biodegradable in nature and cater to the same application as petrochemicals. Moreover, they are a cost-effective alternative to petrochemicals. Increasing supply of sustainable raw materials in the form of oilseed is expected to positively impact fatty alcohols production. This, in turn, is expected to provide wide horizons for downstream applications and thus increase market penetration. Major sources of fatty alcohols include soybean oil, sunflower oil, safflower oil, rapeseed oil, tall oil, palm oil, and beef tallow.

Global increase in hygiene product demand coupled with increasing consumer awareness is expected to drive personal care industry over the forecasts period. Shift in consumer preference towards bio-ingredient based products demand owing to growing awareness regarding potential toxicity caused by petrochemical products is expected to drive personal care products demand. These factors are in turn responsible for positively impacting fatty alcohols demand in personal care industry.

Product Insights

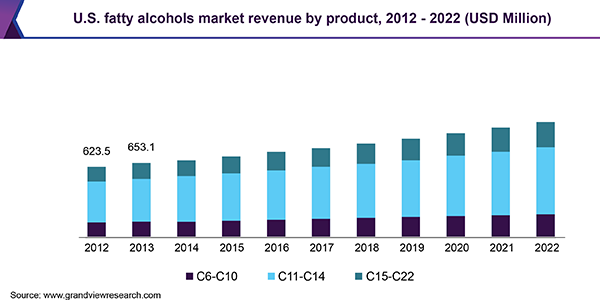

C11-C14 fatty alcohols emerged as the leading product segment and accounted for over 58% of the overall market in 2014. Rising C11-C14 alcohol demand, especially in Asia Pacific, is expected to drive the product segment market over the forecast period. C11-C14 fatty alcohols are used for sodium laureth ether sulphate (SLES), a major foaming agent found in shampoo and body wash formulation. C15-C22 fatty alcohols are anticipated to be the fastest growing product segment over the forecasts period. Increasing application scope of the particular product segment is anticipated to be the major driving factor for the market over the forecast period.

Global C6-C10 based fatty alcohol market was 448.8 kilo tons in 2014 and is expected to reach 593.0 kilo tons in 2022, growing at an estimated CAGR of 3.7% from 2015 to 2022. Growing demand for C6-C10 fatty alcohol as a raw material in personal care and detergents industry is expected to drive its demand over the forecast period. Increasing soaps & detergents and personal care products demand in the Asia Pacific region is anticipated to drive the market over the forecast period.

Application Insights

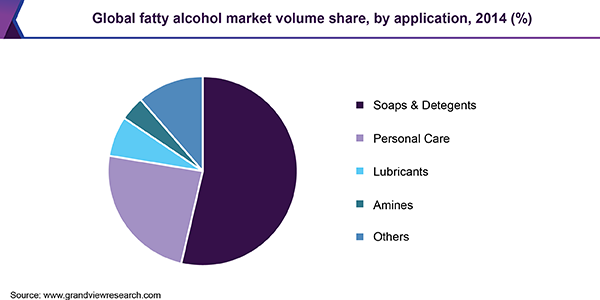

Soaps & detergents emerged as the largest application segment and accounted for over 54% of market share in 2014. Rising population in Asia Pacific is anticipated to augment soaps & detergents demand over the forecast period. The soap & detergent industry is characterized by various differentiated products that cater to various consumer needs and is anticipated to grow over the forecasts period.

This in turn is anticipated to drive the fatty alcohol industry in near future. Personal care is anticipated to be the fastest growing application segment for fatty alcohols over the forecast period on account of rising personal care products demand especially in Asia Pacific over the foreseeable future. Rising awareness towards personal hygiene and care is anticipated to drive the product market over the foreseeable future.

Fatty alcohols are used in personal care products such as creams, lotions, shampoos and bath oils with the application market high in product differentiation that caters to the consumer needs. Growing personal care industry in the region is expected to drive the market over the forecast period due to rising population and increasing disposable income.

Regional Insights

Asia Pacific was the largest regional fatty alcohol market and accounted for over 30% of the total market volume in 2014. Increasing soaps & detergents demand on account of population growth and increased disposable income in the region is expected to drive fatty alcohols demand in this region. Apart from being the largest, Asia Pacific is expected to be the fastest growing regional market. Europe followed Asia Pacific to emerge as the second major regional market.

The regional market is expected to lose share to high growth regions such as Asia Pacific and Central & South America. Uncertain economic situation in the Asia Pacific region along with deteriorating growth in the key downstream industries is anticipated to have an adverse influence on Europe fatty alcohols market. North America is anticipated to witness average growth over the forecast period owing to increasing demand for bio-based product owing to growing consumer awareness coupled with stringent regulations is predicted to fuel fatty alcohols demand.

Fatty Alcohol Market Share Insights

Major players operating in global fatty alcohols market include BASF SE, Croda International, Eastman Chemical Company, Ecogreen Oleochemical and Emery Oleochemicals. Increased availability of raw materials such as soy, rapeseed and corn in China, Malaysia and Indonesia and has forced numerous chemical manufactures to shift base from Europe and North America to invest in Asia Pacific.

Asia Pacific, along with being largest consumer, is also the largest producer of fatty alcohols and accounts for over half of the global production. Large Asian plantation companies are investing in downstream feedstock capacities to win over reduced profitability and to restrict capacity overhang of fatty alcohols. For strengthening Asia Pacific as a largest hub for base fatty alcohols and downstream products, these companies teamed up with chemical manufacturers in the last few years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."