- Home

- »

- Food Safety & Processing

- »

-

Food Processing Blades Market Size Report, 2020-2027GVR Report cover

![Food Processing Blades Market Size, Share & Trends Report]()

Food Processing Blades Market Size, Share & Trends Analysis Report By Product (Straight, Curved, Circular), By Application (Grinding, Cutting/Portioning), By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-176-6

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global food processing blades market size was valued at USD 821.7 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2020 to 2027. Macroeconomic factors such as rising disposable income, increasing spending power of the middle-class population, and the adoption of processed food products, including meat and poultry, are augmenting the market growth. The increasing consumption of food and beverage products due to the expansion of the retail network, the launch of new products, and the growing population is expected to promote market growth. Moreover, increasing demand for packaged food owing to its convenience and longer shelf life is anticipated to drive the product demand over the forecast period.

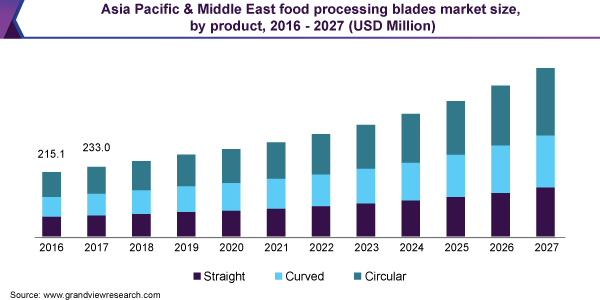

Asia Pacific is one of the fastest-growing economies and a prominent player in the food processing blades market, majorly driven by economies, including China, India, Malaysia, Indonesia, and Thailand. The rising spending capacity among the consumers is projected to increase the demand for packaged and processed foods, thereby fueling the demand for blades.

Regulatory framework enacted by various governments facilitated the equipment manufacturers to offer the desired quality of the blades and other food processing equipment with hygiene and a standardized production process. The need to accommodate a rapidly burgeoning population is anticipated to drive the product consumption in the food and beverage industry, thus significantly contributing to the growth of the market.

The demand for processed meat is on the rise on account of changing consumer preferences and eating habits. Growth in the population of meat-eating consumers across the world is expected to result in increased demand for processed meat, which, in turn, is expected to drive the product demand.

Key players in the market are focusing on maintaining or strengthening their position through innovation, product development, acquisition, and geographic expansion. Major players from developed regions, like North America and Europe, are increasingly investing in India and China owing to favorable market conditions, untapped customer base, and the presence of potential opportunities.

Product Insights

The circular blade segment led the market and accounted for more than 39.0% share of the global revenue in 2019. The segment is projected to witness significant growth in the years to come on account of its production process optimization and improved workflow efficiency.

The market is bifurcated based on product into straight, curved, and circular. The blades are designed to perform operations in minimum time with accuracy. Thus, these blades are increasingly used in the food industry to minimize processing time and ensure process efficiency. However, blades are exposed to both freshwater and saltwater, and hence require timely maintenance and protection from corrosion and other conditions.

The circular blades are available in various types, including flat edge, beveled edge, toothed, notched, scalloped, semi-circular, and involute, to serve the food processing industry. The straight blade segment is further bifurcated into single edge, double edge, and serrated blades. The serrated blades are projected to witness significant growth over the forecast period on account of their suitability for slicing applications.

The curved blades are used in the food industry to ensure sharp cuts and efficiency in cutting, slicing, or skinning. The product is used in meat processing, cutting, slicing, and dicing vegetables, fruits, and nuts. The product is available in two forms, including single-edged and serrated curved blades.

End-use Insights

The proteins segment led the market and accounted for more than 60.0% share of the global revenue in 2019. The segment is projected to witness significant growth in the forecast period owing to the rise in demand and the need for rigorous processing of fish, poultry, bovine, and pork. The poultry protein segment dominated the market in 2019 and is projected to maintain its lead in the forthcoming years.

The global market is bifurcated into protein and other foods based on end-use. The protein segment includes fish, poultry, bovine, and pork, whereas the other foods segment includes vegetables, fruits, and nuts. The food processing blades are widely used for these end uses by hotels, restaurants, homes, and various other areas.

The demand for other foods, such as vegetables, nuts, and fruits, is increasing owing to the rising demand for nutritional food. In addition, the changing lifestyle, coupled with the growing working population, is projected to boost the demand for diced or cut vegetables and fruits in order to save time.

The consumption and production of poultry, meat, fish, beef, pork, and bovine are projected to increase over the forecast period. This is attributed to the rising demand for meat and seafood, lower prices of meat and poultry, and their increased shelf life, quality, and safety, thereby promoting the use of blades for applications, like slicing.

Application Insights

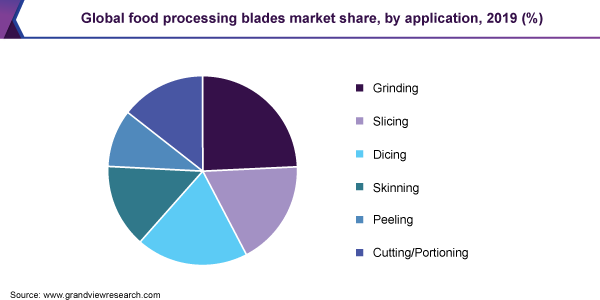

The grinding application segment led the market and accounted for more than 24.0% share of the global revenue in 2019. The segment is projected to witness significant growth in the coming years owing to its efficiency in reducing the particle size of the foodstuffs. In the grinding equipment, meat, vegetables, fruits, or other foods are forced through a grinding plate, which is preceded by a rotating blade.

The market is categorized based on application into grinding, slicing, dicing, skinning, peeling, and cutting/portioning. The cutting/portioning application segment is projected to gain traction over the forecast period owing to its efficiency and extensive use in hotels, restaurants, frozen food suppliers, and others.

The slicing blades are used to cut the cubes, slices, or muscle strips and to slice frozen or tempered meat. Slicing blades can be fitted with add-ons, such as tray feeders and weighing machines, which reduces the manual weighing and arrangement of sliced products, resulting in improved hygiene of products.

Dicing equipment is used to produce controlled size small cubes, slices, flakes, and strips of meat, vegetables, fruits, and nuts, whereas the skinning process involves removing the hide in cattle, skinning in goat and sheep, de-hairing in swine, and removing feathers in poultry. Peeling involves removing off the outer layer or skin of vegetables, including potatoes, radish, cucumber, and fruits such as apples.

Companies such as Marel and JBT Corporation offer a wide range of blades and other food processing equipment. Companies are focusing on reducing their reliance on manpower by using automated systems for process lines in an attempt to lessen the rising labor costs.

Growth in the spending ability of consumers, coupled with the burgeoning food expenditure, is likely to propel the demand for processed meat and other foods. The growth is expected to have a direct impact on market growth over the forecast period. However, the impact of the COVID-19 pandemic can be seen in the overall food and associated industry, which is restraining the market growth.

Regional Insights

Asia Pacific accounted for the largest revenue share of over 33.0% in 2019 and is anticipated to emerge as the fastest-growing regional market over the forecast period. This is attributed to the rising demand for meat, seafood, and allied products. The rise in the income level and spending power of consumers proved to be a boon to the spending on animal protein, thus favoring the regional market growth.

The improvement in living standards stimulates people to shift to eating seafood and allied products. High disposable income allows the customer to choose the best value option available in the market and enhances their food habits. Thus, the changing food trend in the region is projected to propel the growth of the market over the forecast period.

The demand for fast food across the economies such as the U.S., Canada, and Mexico is expected to witness rapid growth, leading to a rise in the demand for processing machines. The demand for processed meat and changing lifestyles in middle-class families are likely to result in the heightened demand for protein-rich convenience food.

The increasing adoption of processed and packaged food, growing health awareness among the youth, and the upper echelons of society all together favor European meat and seafood consumption. The market is majorly driven by macroeconomic factors, such as increasing spending power, growing population, and rising healthy eating habits.

Key Companies & Market Share Insights

The market is competitive due to the existence of major companies involved in product manufacturing. The market is characterized by the presence of a significant consumer base across the globe with the companies operating their businesses through dedicated distribution networks. The market has witnessed intensive competition on account of acquisitions, technological innovations, and growing demand for packaged and processed food products.

Many market players such as GEA Group Aktiengesellschaft and JBT Corporation offer a varied range of food processing equipment. The upward trend in the adoption of advanced food processing technology is set to witness an upswing in the near future due to the wide range of health benefits derived from it, which are effectively communicated to potential customers. Some prominent players in the global food processing blades market include:

-

Minerva Omega Group s.r.l.

-

Biro Manufacturing Company

-

GEA Group Aktiengesellschaft

-

JBT Corporation

-

Nemco Food Equipment, LTD.

-

Marel

-

BAADER

-

Bettcher Industries, Inc.

-

Zigma Machinery & Equipment Solutions

-

Jarvis India

-

Hallde

-

Talsabell S.A.

Food Processing Blades Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 855.1 million

Revenue forecast in 2027

USD 1,475.6 million

Growth Rate

CAGR of 7.6% from 2020 to 2027

Market demand in 2020

80.5 million units

Volume forecast in 2027

122.7 million units

Growth Rate

CAGR of 5.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in million units, revenue in USD million, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Minerva Omega Group s.r.l.; Biro Manufacturing Company; GEA Group Aktiengesellschaft; JBT Corporation; Nemco Food Equipment, LTD.; Marel; BAADER

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global food processing blades market report on the basis of product, application, end-use, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Straight

-

Single Edge

-

Double Edge

-

Serrated

-

-

Curved

-

Single Edge

-

Serrated

-

-

Circular

-

Flat Edge

-

Beveled Edge

-

Scalloped Edge

-

Toothed

-

Notched

-

Semi-circular

-

Involute

-

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Grinding

-

Slicing

-

Dicing

-

Skinning

-

Peeling

-

Cutting/Portioning

-

-

End-use Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Proteins

-

Fish

-

Poultry

-

Bovine

-

Pork

-

-

Other Foods

-

Fruits

-

Vegetables

-

Nuts

-

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global food processing blades market size was estimated at USD 821.7 million in 2019 and is expected to reach USD 855.1 million in 2020.

b. The food processing blades market is expected to grow at a compound annual growth rate of 7.6% in terms of revenue from 2020 to 2027 to reach USD 1,475.6 million by 2027.

b. The circular blade segment dominated the food processing blades market with a share of 39.5% in 2019, on account of workflow efficiency, automation, and optimization of the production process.

b. Some of the key players operating in the food processing blades market include Minerva Omega group s.r.l., Biro Manufacturing Company, GEA Group Aktiengesellschaft, JBT Corporation, Marel, Nemco Food Equipment, LTD, and others.

b. The food processing blades market is expected to grow at a significant rate over the estimated time frame owing to rising demand for poultry, meat, seafood, and bakery products along with packaged and convenience food items and healthy and nutritious food products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."